can someone solve this please

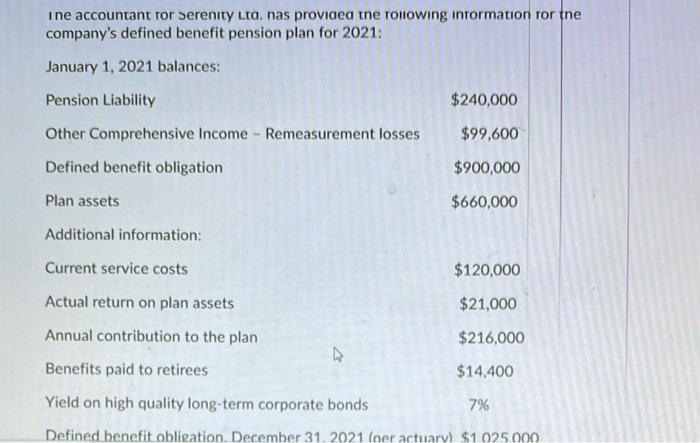

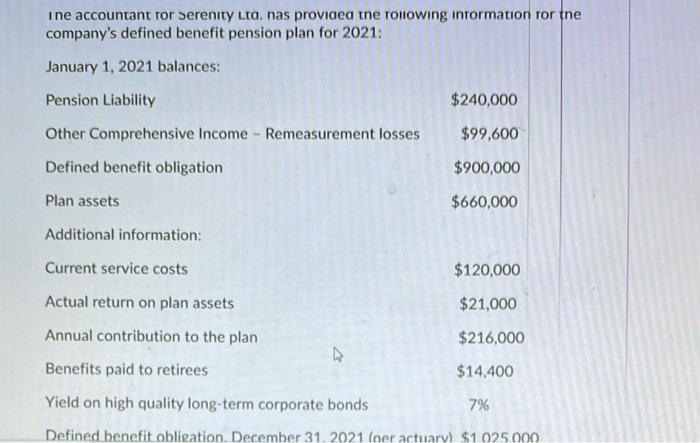

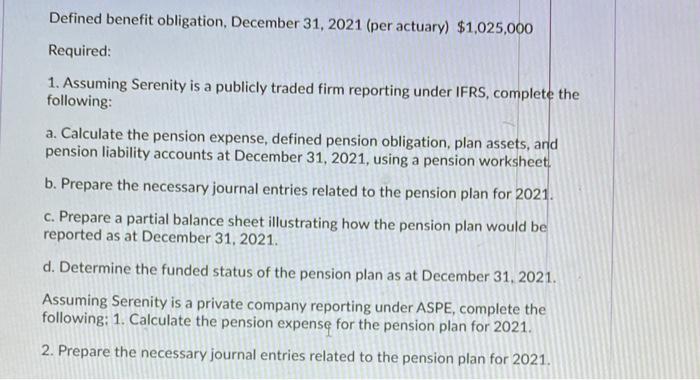

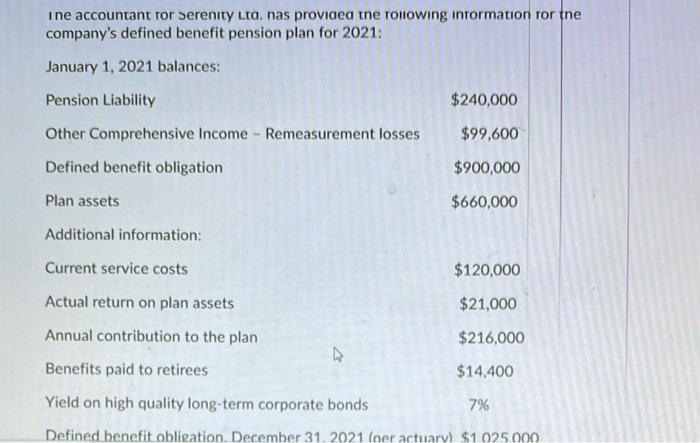

i ne accountant for Serenity Ltd, nas providea the following information for the company's defined benefit pension plan for 2021: January 1, 2021 balances: Pension Liability $240,000 Other Comprehensive Income - Remeasurement losses $99,600 Defined benefit obligation $900,000 Plan assets $660,000 Additional information: Current service costs $120,000 Actual return on plan assets $21,000 $216,000 Annual contribution to the plan Benefits paid to retirees Yield on high quality long-term corporate bonds $14,400 7% Defined benefit obligation. December 31, 2021 (ner actuarv) $1.025.000 Defined benefit obligation. December 31, 2021 (per actuary) $1,025,000 Required: 1. Assuming Serenity is a publicly traded firm reporting under IFRS, complete the following: a. Calculate the pension expense, defined pension obligation, plan assets, and pension liability accounts at December 31, 2021, using a pension worksheet b. Prepare the necessary journal entries related to the pension plan for 2021. c. Prepare a partial balance sheet illustrating how the pension plan would be reported as at December 31, 2021. d. Determine the funded status of the pension plan as at December 31, 2021. Assuming Serenity is a private company reporting under ASPE, complete the following: 1. Calculate the pension expense for the pension plan for 2021. 2. Prepare the necessary journal entries related to the pension plan for 2021. i ne accountant for Serenity Ltd, nas providea the following information for the company's defined benefit pension plan for 2021: January 1, 2021 balances: Pension Liability $240,000 Other Comprehensive Income - Remeasurement losses $99,600 Defined benefit obligation $900,000 Plan assets $660,000 Additional information: Current service costs $120,000 Actual return on plan assets $21,000 $216,000 Annual contribution to the plan Benefits paid to retirees Yield on high quality long-term corporate bonds $14,400 7% Defined benefit obligation. December 31, 2021 (ner actuarv) $1.025.000 Defined benefit obligation. December 31, 2021 (per actuary) $1,025,000 Required: 1. Assuming Serenity is a publicly traded firm reporting under IFRS, complete the following: a. Calculate the pension expense, defined pension obligation, plan assets, and pension liability accounts at December 31, 2021, using a pension worksheet b. Prepare the necessary journal entries related to the pension plan for 2021. c. Prepare a partial balance sheet illustrating how the pension plan would be reported as at December 31, 2021. d. Determine the funded status of the pension plan as at December 31, 2021. Assuming Serenity is a private company reporting under ASPE, complete the following: 1. Calculate the pension expense for the pension plan for 2021. 2. Prepare the necessary journal entries related to the pension plan for 2021