Answered step by step

Verified Expert Solution

Question

1 Approved Answer

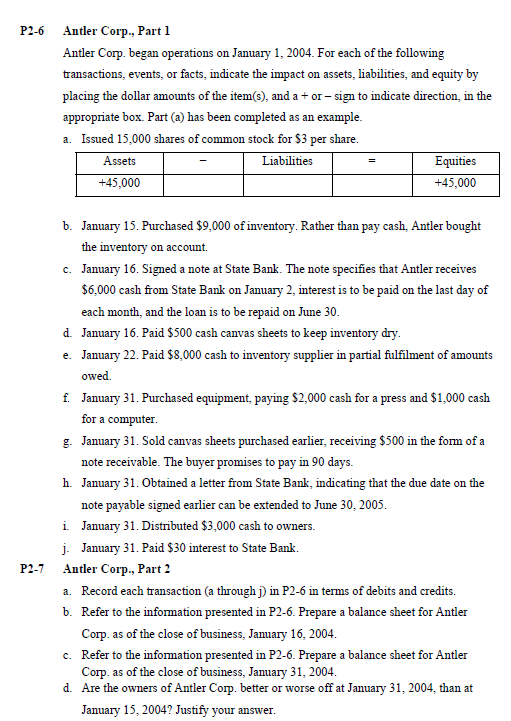

Can someone teach me how to answer all the questions as mentioned above? P2-6 Antler Corp., Part 1 Antler Corp. began operations on January 1,

Can someone teach me how to answer all the questions as mentioned above?

P2-6 Antler Corp., Part 1 Antler Corp. began operations on January 1, 2004. For each of the following transactions, events, or facts, indicate the impact on assets, liabilities, and equity by placing the dollar amounts of the item(s), and a or-sign to indicate direction, in the appropriate box. Part (a) has been completed as an example a. Issued 15,000 shares of common stock for $3 per share Assets Liabilities Equities +45,000 +45,000 b. January 15. Purchased $9,000 of inventory. Rather than pay cash, Antler bought the inventory on account. January 16. Signed a note at State Bank. The note specifies that Antler receives $6,000 cash from State Bank on January 2, interest is to be paid on the last day of each month, and the loan is to be repaid on June 30 January 16. Paid $500 cash canvas sheets to keep inventory dry January 22. Paid $8.000 cash to inventory supplier in partial fulfilment of amounts owed. January 31. Purchased equipment, paying $2,000 cash for a press and $1,000 cash for a computer January 31. Sold canvas sheets purchased earlier, receiving $500 in the form of a note receivable. The buyer promises to pay in 90 days. January 31. Obtained a letter from State Bank, indicating that the due date on the note payable signed earlier can be extended to June 30, 2005 c. d. e. f. g. h. i. January 31. Distributed $3,000 cash to owners. j. January 31. Paid $30 interest to State Bank. Antler Corp., Part 2 a. Record each transaction (a through j) in P2-6 in terms of debits and credits. b. Refer to the information presented in P2-6. Prepare a balance sheet for Antler P2-7 Corp. as of the close of business, January 16, 2004 Refer to the information presented in P2-6. Prepare a balance sheet for Antler Corp. as of the close of business, January 31, 2004 Are the owners of Antler Corp. better or worse off at January 31, 2004, than at January 15, 2004? Justify your answer. c. dStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started