Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone tell me how to calculate the above question? Calculate the value of your firm using your most recent financials. Balance Sheet At the

Can someone tell me how to calculate the above question?

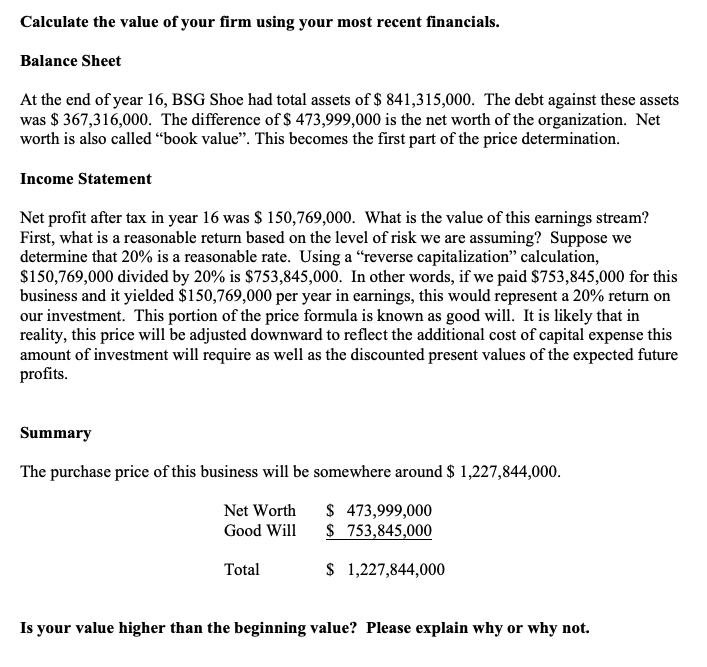

Calculate the value of your firm using your most recent financials. Balance Sheet At the end of year 16, BSG Shoe had total assets of $ 841,315,000. The debt against these assets was $ 367,316,000. The difference of $ 473,999,000 is the net worth of the organization. Net worth is also called book value. This becomes the first part of the price determination. Income Statement Net profit after tax in year 16 was $ 150,769,000. What is the value of this earnings stream? First, what is a reasonable return based on the level of risk we are assuming? Suppose we determine that 20% is a reasonable rate. Using a reverse capitalization calculation, $150,769,000 divided by 20% is $753,845,000. In other words, if we paid $753,845,000 for this business and it yielded $150,769,000 per year in earnings, this would represent a 20% return on our investment. This portion of the price formula is known as good will. It is likely that in reality, this price will be adjusted downward to reflect the additional cost of capital expense this amount of investment will require as well as the discounted present values of the expected future profits. Summary The purchase price of this business will be somewhere around $ 1,227,844,000. Net Worth Good Will $ 473,999,000 $ 753,845,000 Total $ 1,227,844,000 Is your value higher than the beginning value? Please explain why or why not. Calculate the value of your firm using your most recent financials. Balance Sheet At the end of year 16, BSG Shoe had total assets of $ 841,315,000. The debt against these assets was $ 367,316,000. The difference of $ 473,999,000 is the net worth of the organization. Net worth is also called book value. This becomes the first part of the price determination. Income Statement Net profit after tax in year 16 was $ 150,769,000. What is the value of this earnings stream? First, what is a reasonable return based on the level of risk we are assuming? Suppose we determine that 20% is a reasonable rate. Using a reverse capitalization calculation, $150,769,000 divided by 20% is $753,845,000. In other words, if we paid $753,845,000 for this business and it yielded $150,769,000 per year in earnings, this would represent a 20% return on our investment. This portion of the price formula is known as good will. It is likely that in reality, this price will be adjusted downward to reflect the additional cost of capital expense this amount of investment will require as well as the discounted present values of the expected future profits. Summary The purchase price of this business will be somewhere around $ 1,227,844,000. Net Worth Good Will $ 473,999,000 $ 753,845,000 Total $ 1,227,844,000 Is your value higher than the beginning value? Please explain why or why notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started