Can someone tell me how you get these NPV answers with a calculator?

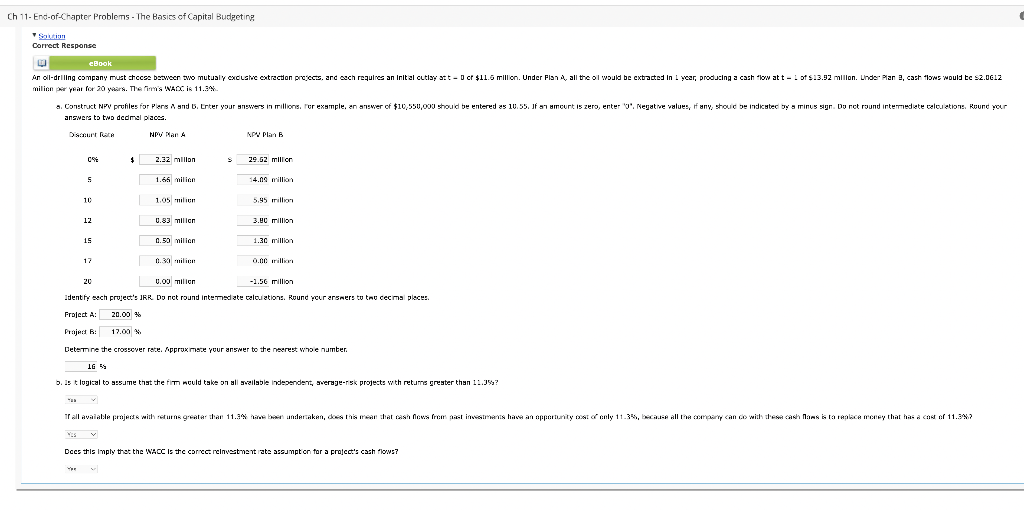

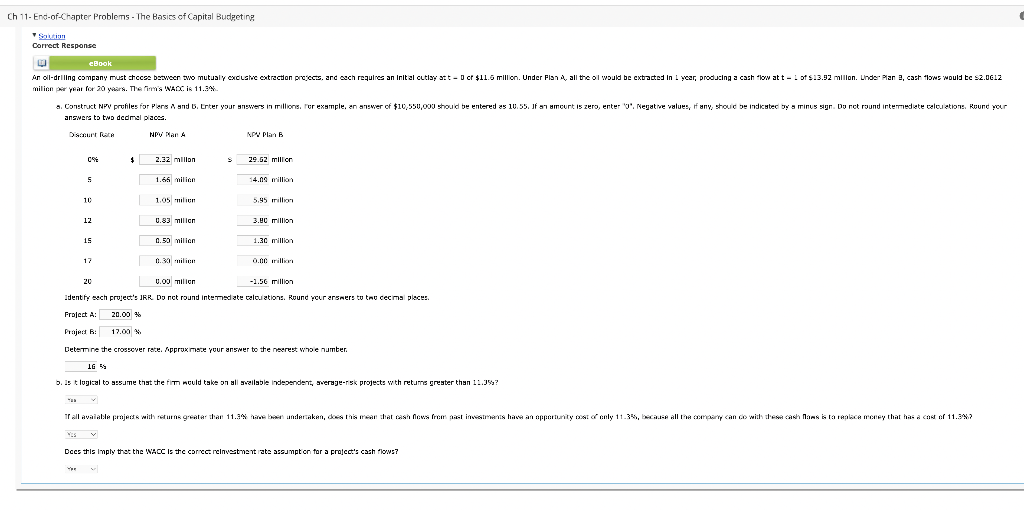

Ch 11- End-of-Chapter Problems - The Basics of Capital Budgeting Correct Response eBook on oll-driling company must tccse between two mutualy excushc extraction proces, and esch requires an Init al cutlast - cr $11.6 million. Under Plan all the ol would be exbacted in I year, producing a cash low at t - 1 of $.3.92 millon. Under Plan 2, cash ons would te s2.06.2 milion year for 20 years. The WACC IS 11.3%. a. Construct NPV profiles for Penis A and B. Enter your swers in millions. For example, an awer of $10,550,000 should be entered as 10.55. Jf numcurt is zero, enter ". Negatre values, if any, should be indicated by a minus sign. Do not round intermediate celoutions. Round your answers to to dedmal places NP and NP Plan 5 2.32 millon 29.52 millor 5 1.66 milion 14.09 million 10 1.05 milion 5.95 million 12 0.83 milion 3.90 million 15 0.50 milion 1.30 million 17 0.30 milieu 0.00 illi 20 0.00 milion -1.56 million Identity wach project's RR. Do nct round intermedate calculations. Round your answers to the cecmai plece. Froject A 20.00 % Praject : 17.00 % Determne te crossover rate. opproximate your answer to the neerest we number IG 5.25 tlogical to me that the fim nould take on allzilable independent, average-risk projects with retums greater than 1..39 It all available projets with cure greater than 11.34 Wundertaken, dessearthat ran los Premstimers have an opportunity to only 11.3%, war all may can do with the cash Mans is a realoca irery that has a cow of 11.397 Does it is imply that the WACC is to corice reinvestment ate assumpt on for a projcct's cash flows? We Ch 11- End-of-Chapter Problems - The Basics of Capital Budgeting Correct Response eBook on oll-driling company must tccse between two mutualy excushc extraction proces, and esch requires an Init al cutlast - cr $11.6 million. Under Plan all the ol would be exbacted in I year, producing a cash low at t - 1 of $.3.92 millon. Under Plan 2, cash ons would te s2.06.2 milion year for 20 years. The WACC IS 11.3%. a. Construct NPV profiles for Penis A and B. Enter your swers in millions. For example, an awer of $10,550,000 should be entered as 10.55. Jf numcurt is zero, enter ". Negatre values, if any, should be indicated by a minus sign. Do not round intermediate celoutions. Round your answers to to dedmal places NP and NP Plan 5 2.32 millon 29.52 millor 5 1.66 milion 14.09 million 10 1.05 milion 5.95 million 12 0.83 milion 3.90 million 15 0.50 milion 1.30 million 17 0.30 milieu 0.00 illi 20 0.00 milion -1.56 million Identity wach project's RR. Do nct round intermedate calculations. Round your answers to the cecmai plece. Froject A 20.00 % Praject : 17.00 % Determne te crossover rate. opproximate your answer to the neerest we number IG 5.25 tlogical to me that the fim nould take on allzilable independent, average-risk projects with retums greater than 1..39 It all available projets with cure greater than 11.34 Wundertaken, dessearthat ran los Premstimers have an opportunity to only 11.3%, war all may can do with the cash Mans is a realoca irery that has a cow of 11.397 Does it is imply that the WACC is to corice reinvestment ate assumpt on for a projcct's cash flows? We