Can someone verify they are right?

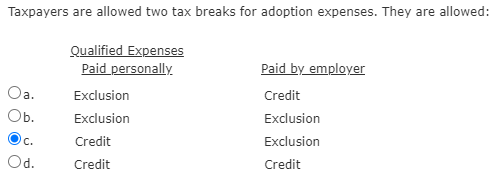

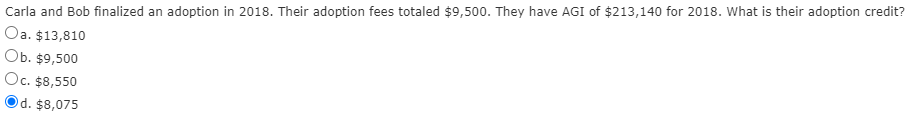

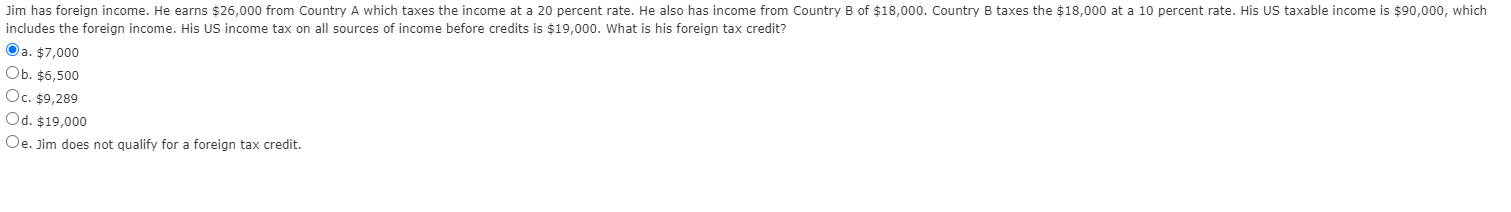

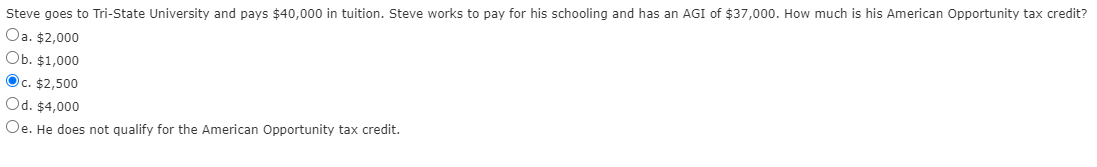

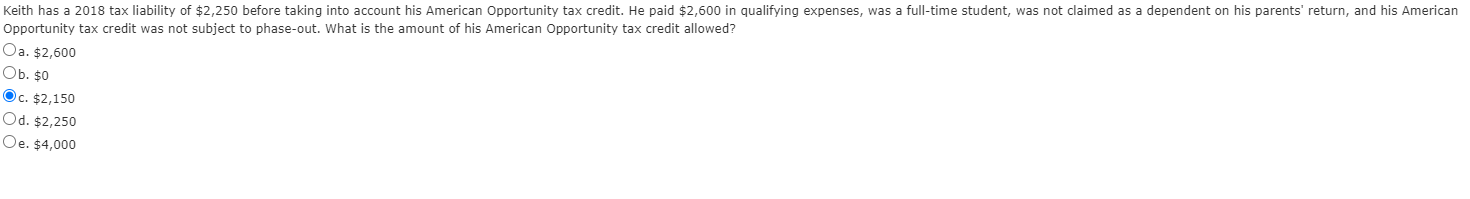

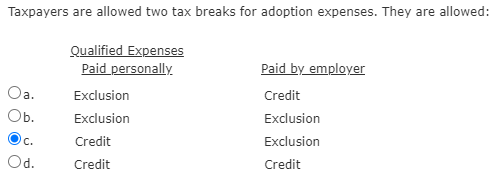

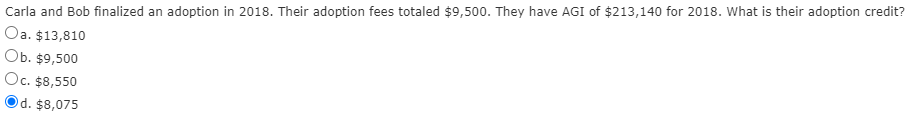

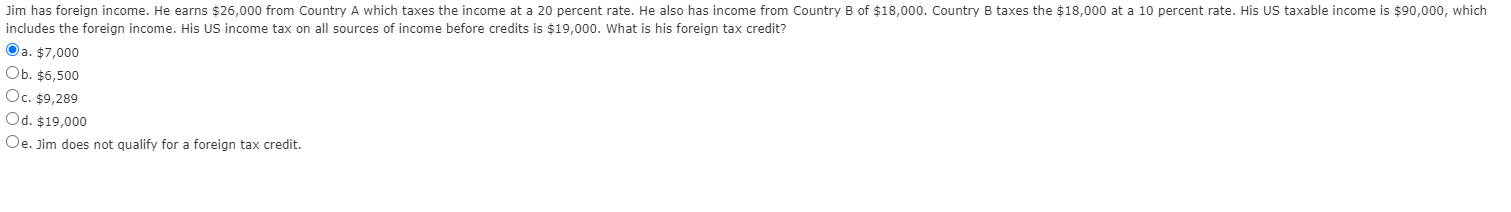

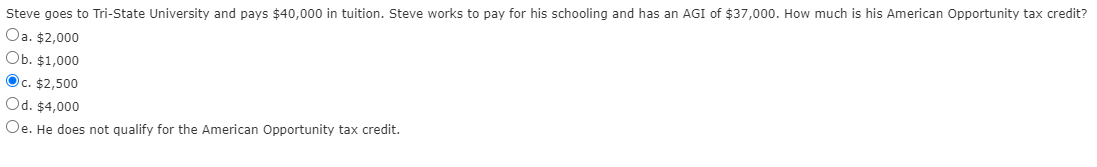

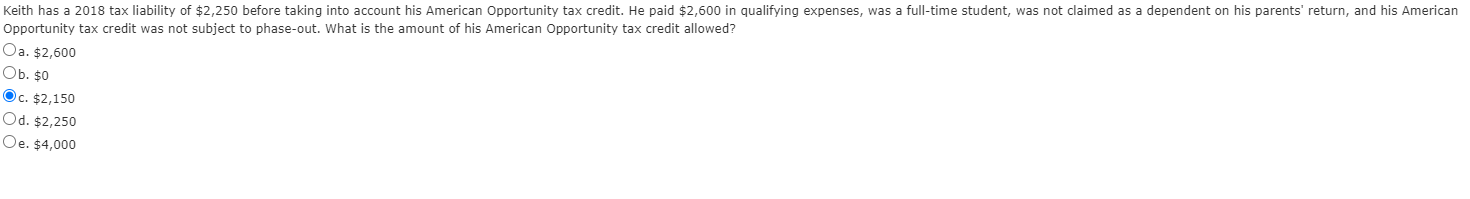

Taxpayers are allowed two tax breaks for adoption expenses. They are allowed: Oa. Qualified Expenses Paid personally Exclusion Exclusion Credit Credit b. Paid by employer Credit Exclusion Exclusion Credit C. Od. Carla and Bob finalized an adoption in 2018. Their adoption fees totaled $9,500. They have AGI of $213,140 for 2018. What is their adoption credit? Oa. $13,810 Ob. $9,500 Oc. $8,550 d. $8,075 Jim has foreign income. He earns $26,000 from Country A which taxes the income at a 20 percent rate. He also has income from Country B of $18,000. Country B taxes the $18,000 at a 10 percent rate. His US taxable income is $90,000, which includes the foreign income. His US income tax on all sources of income before credits is $19,000. What is his foreign tax credit? Oa. $7,000 Ob. $6,500 Oc. $9,289 Od. $19,000 Oe. Jim does not qualify for a foreign tax credit. American Opportunity tax credit? Steve goes to Tri-State University and pays $40,000 in tuition. Steve works to pay for his schooling and has an AGI of $37,000. How much is Oa. $2,000 Ob. $1,000 Oc. $2,500 Od. $4,000 Oe. He does not qualify for the American Opportunity tax credit. Keith has a 2018 tax liability of $2,250 before taking into account his American Opportunity tax credit. He paid $2,600 in qualifying expenses, was a full-time student, was not claimed as a dependent on his parents' return, and his American Opportunity tax credit was not subject to phase-out. What is the amount of his American Opportunity tax credit allowed? Oa. $2,600 Ob. $0 Oc. $2,150 Od. $2,250 Oe. $4,000 Taxpayers are allowed two tax breaks for adoption expenses. They are allowed: Oa. Qualified Expenses Paid personally Exclusion Exclusion Credit Credit b. Paid by employer Credit Exclusion Exclusion Credit C. Od. Carla and Bob finalized an adoption in 2018. Their adoption fees totaled $9,500. They have AGI of $213,140 for 2018. What is their adoption credit? Oa. $13,810 Ob. $9,500 Oc. $8,550 d. $8,075 Jim has foreign income. He earns $26,000 from Country A which taxes the income at a 20 percent rate. He also has income from Country B of $18,000. Country B taxes the $18,000 at a 10 percent rate. His US taxable income is $90,000, which includes the foreign income. His US income tax on all sources of income before credits is $19,000. What is his foreign tax credit? Oa. $7,000 Ob. $6,500 Oc. $9,289 Od. $19,000 Oe. Jim does not qualify for a foreign tax credit. American Opportunity tax credit? Steve goes to Tri-State University and pays $40,000 in tuition. Steve works to pay for his schooling and has an AGI of $37,000. How much is Oa. $2,000 Ob. $1,000 Oc. $2,500 Od. $4,000 Oe. He does not qualify for the American Opportunity tax credit. Keith has a 2018 tax liability of $2,250 before taking into account his American Opportunity tax credit. He paid $2,600 in qualifying expenses, was a full-time student, was not claimed as a dependent on his parents' return, and his American Opportunity tax credit was not subject to phase-out. What is the amount of his American Opportunity tax credit allowed? Oa. $2,600 Ob. $0 Oc. $2,150 Od. $2,250 Oe. $4,000