Can someone walk me through these problems?

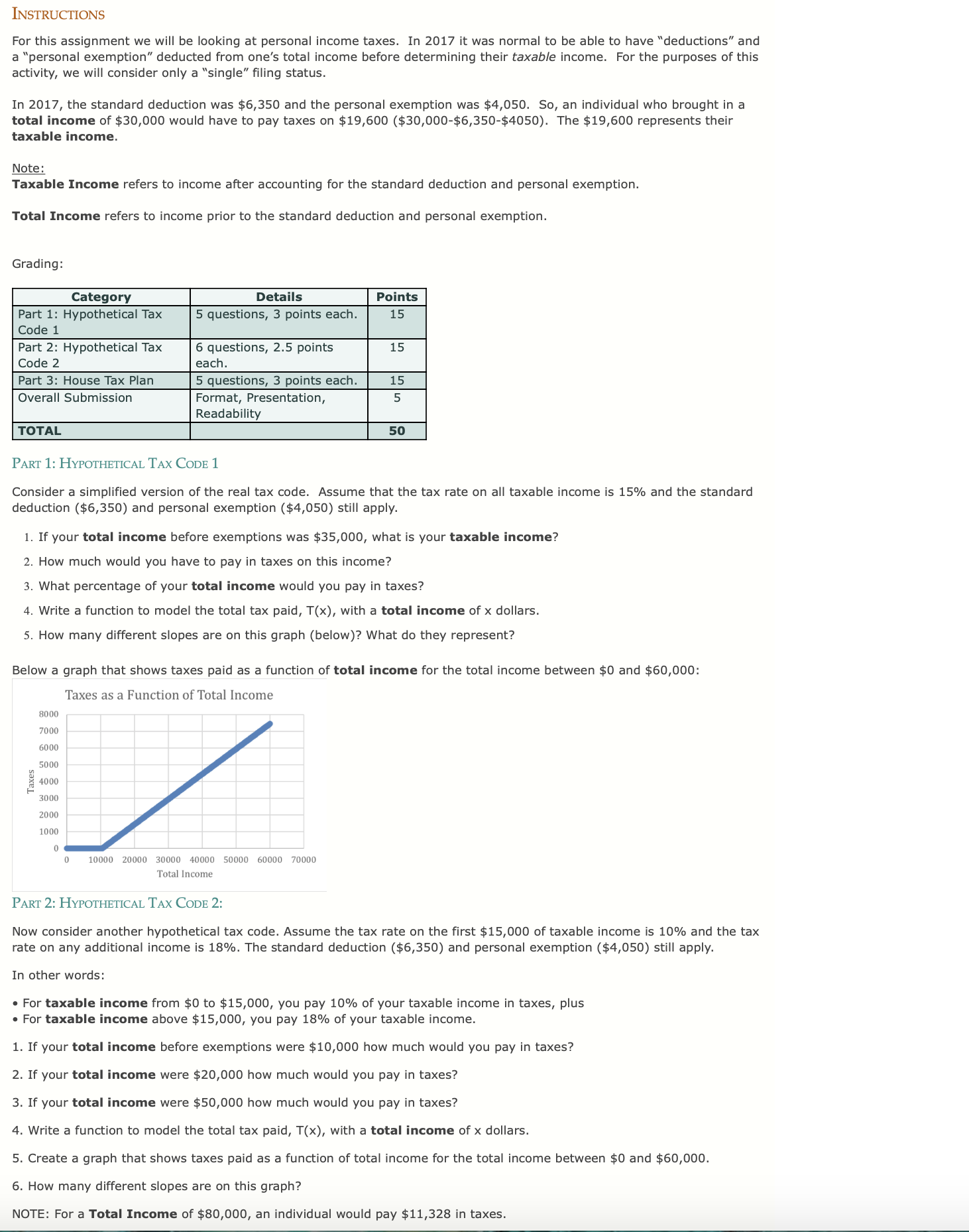

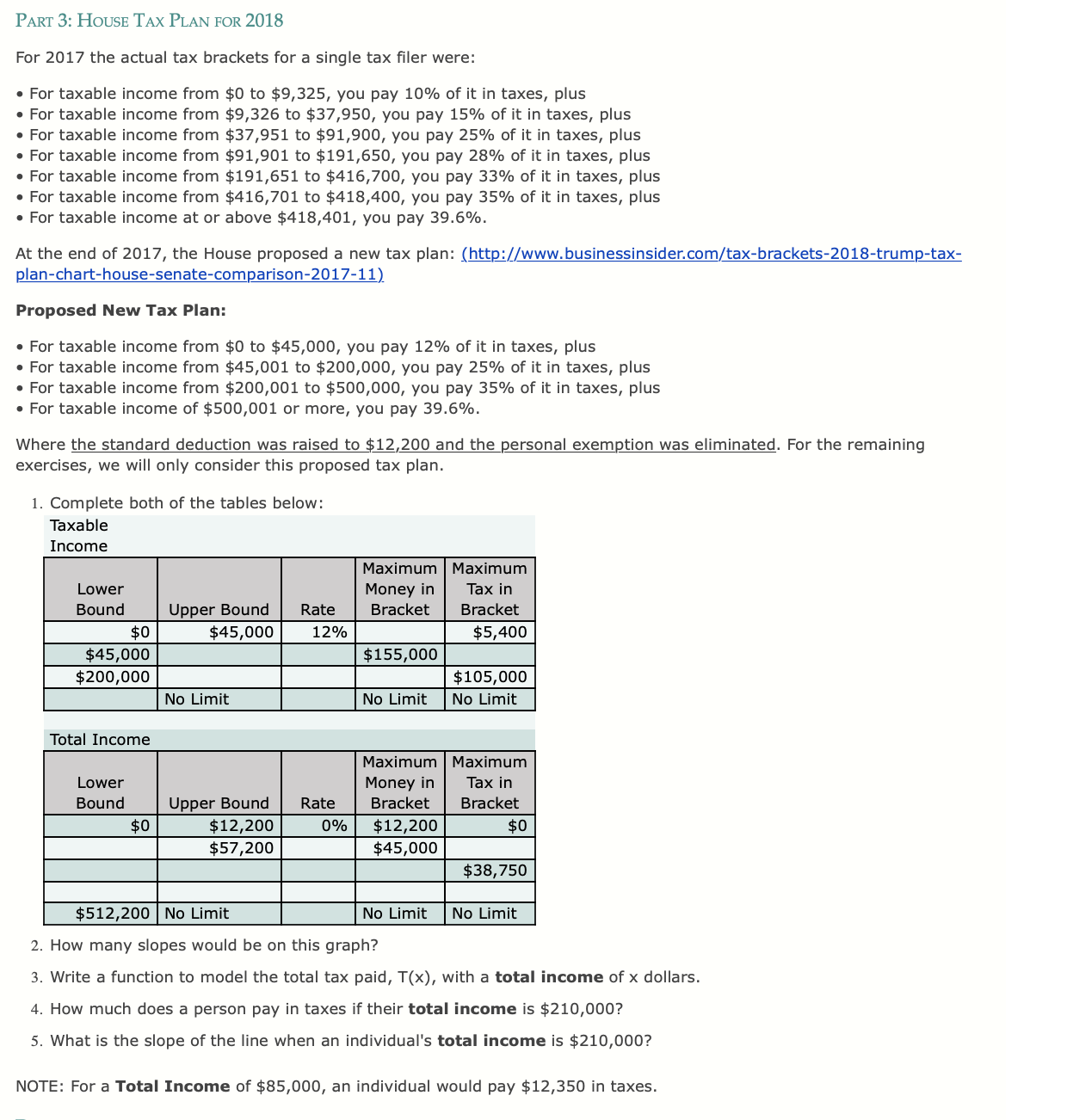

INSTRUCTIONS For this assignment we will be looking at personal income taxes. In 2017 it was normal to be able to have \"deductions" and a \"personal exemption" deducted from one's total income before determining their taxable income. For the purposes of this activity, we will consider only a \"single" ling status. In 2017, the standard deduction was $6,350 and the personal exemption was $4,050. So, an individual who brought in a total income of $30,000 would have to pay taxes on $19,600 ($30,000-$6,350-$4050). The $19,600 represents their taxable income. Note: Taxable Income refers to income after accounting for the standard deduction and personal exemption. Total Income refers to income prior to the standard deduction and personal exemption. Grading: Category m Code 1 Part 2: Hypothetical Tax 6 questions, 2.5 points Code 2 each. Part 3: House Tax Plan 5 questions, 3 points each. Overall Submission Format, Presentation, Readability PART 1: HYPOTl-[ETJCAL TAX CODE 1 Consider a simplified version of the real tax code. Assume that the tax rate on all taxable income is 15% and the standard deduction ($6,350) and personal exemption ($4,050) still apply. 1. If your total income before exemptions was $35,000, what is your taxable income? 2. How much would you have to pay in taxes on this income? 3. What percentage of your total income would you pay in taxes? 4. Write a function to model the total tax paid, T(x), with a total income of x dollars. 5. How many different slopes are on this graph (below)? What do they represent? Below a graph that shows taxes paid as a function of total income for the total income between $0 and $60,000: Taxes as a Function of Total Income 3000 7000 0000 5000 0 g 4000 0 3000 2000 1000 0 D 10000 20000 30000 40000 50000 60000 70000 Total Income PART 2: HYPOTHZEI'ICAL TAX CODE 2: Now consider another hypothetical tax code. Assume the tax rate on the first $15,000 of taxable income is 10% and the tax rate on any additional income is 13%. The standard deduction ($6,350) and personal exemption ($4,050) still apply. In other words: 0 For taxable income from $0 to $15,000, you pay 10% of your taxable income in taxes, plus 0 For taxable income above $15,000, you pay 18% of your taxable income. 1. If your total income before exemptions were $10,000 how much would you pay in taxes? 2. If your total income were $20,000 how much would you pay in taxes? 3. If your total income were $50,000 how much would you pay in taxes? 4. Write a function to model the total tax paid, T(x), with a total income of x dollars. 5. Create a graph that shows taxes paid as a function of total income for the total income between $0 and $60,000. 6. How many different slopes are on this graph? NOTE: For a Total Income of $80,000, an individual would pay $11,328 in taxes. PART 3: HOUSE TAX PLAN FOR 2018 For 2017 the actual tax brackets for a single tax ler were: a For taxable income from $0 to $9,325, you pay 10% of it in taxes, plus a For taxable income from $9,326 to $37,950, you pay 15% of it in taxes, plus - For taxable income from $37,951 to $91,900, you pay 25% of it in taxes, plus a For taxable income from $91,901 to $191,650, you pay 28% of it in taxes, plus - For taxable income from $191,651 to $416,700, you pay 33% of it in taxes, plus a For taxable income from $416,701 to $418,400, you pay 35% of it in taxes, plus - For taxable income at or above $413,401, you pay 39.6%. At the end of 2017, the House proposed a new tax plan: (http:www.businessinsider.com/tax-brackets-2018-trump-tax- plan-charthouse-senate-comparison-2017-11)_ Proposed New Tax Plan: a For taxable income from $0 to $45,000, you pay 12% of it in taxes, plus a For taxable income from $45,001 to $200,000, you pay 25% of it in taxes, plus - For taxable income from $200,001 to $500,000, you pay 35% of it in taxes, plus a For taxable income of $500,001 or more, you pay 39.6%. Where the standard deduction was raised to $12,200 and the personal exemption was eliminated. For the remaining exercises, we will only consider this proposed tax plan. 1. Complete both of the tables below: Taxable Income Maximum Maximum Lower Money in Bound Upper Bound Bracket n 5.00:: mono $155,000 $200300 $105,000 Total Income Maximum Maximum Lower Money in Bound Upper Bound Bracket -m $45,000 $38,750 2. How many slopes would be on this graph? 3. Write a function to model the total tax paid, T(x), with a total income ofx dollars. 4. How much does a person pay in taxes if their total income is $210,000? 5. What is the slope of the line when an individual's total income is $210,000? NOTE: For a Total Income of $85,000, an individual would pay $12,350 in taxes