Can sumone help me wid solving this peoblem

Can sumone help me wid solving this peoblem

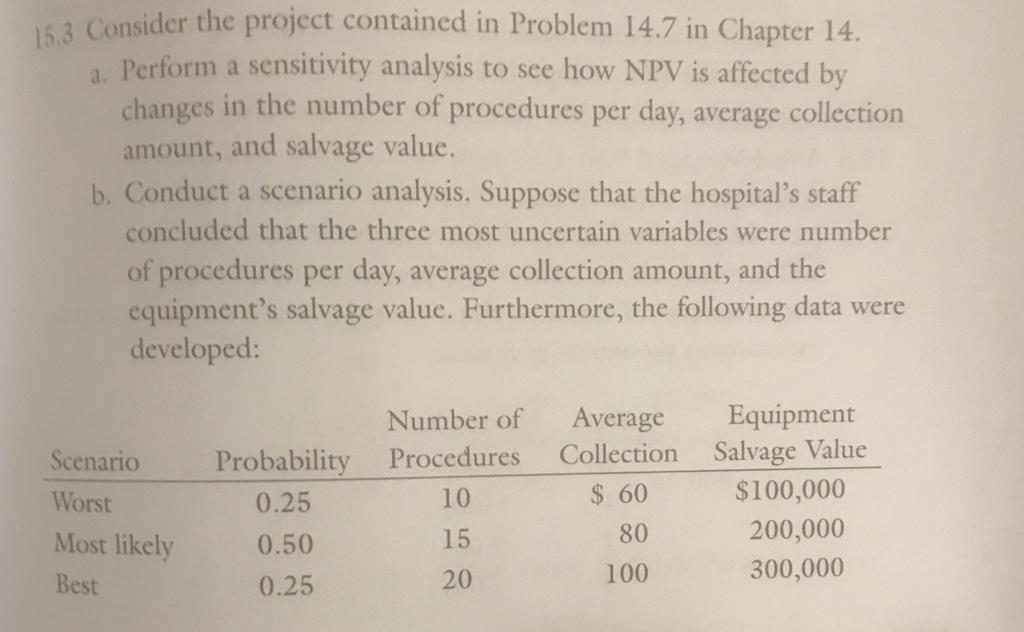

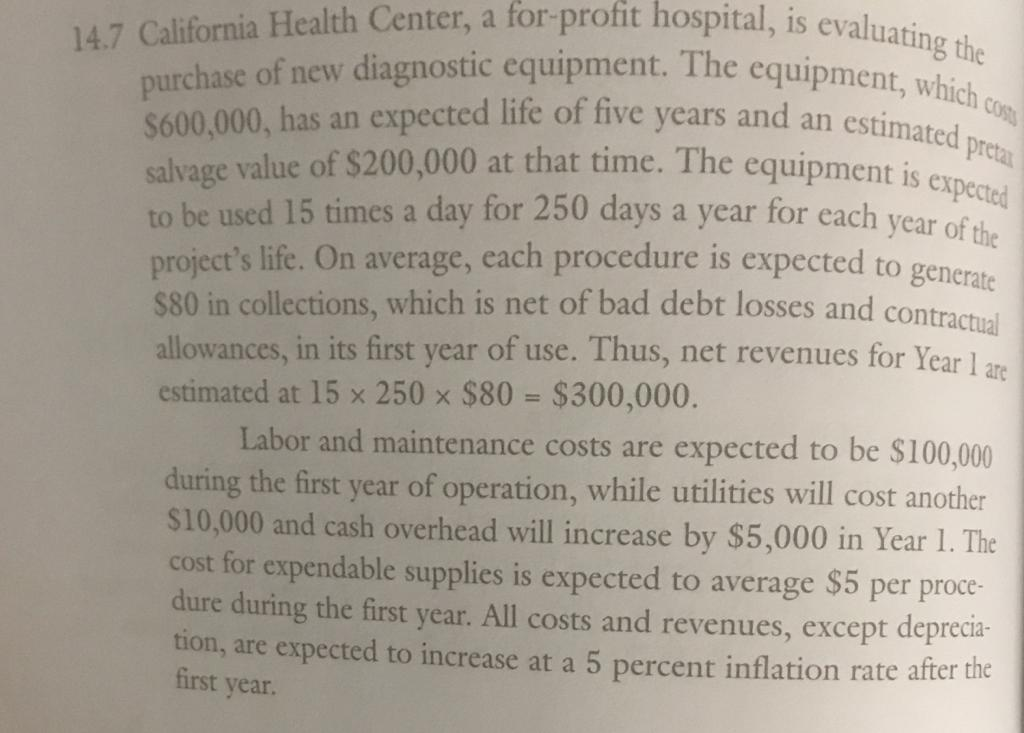

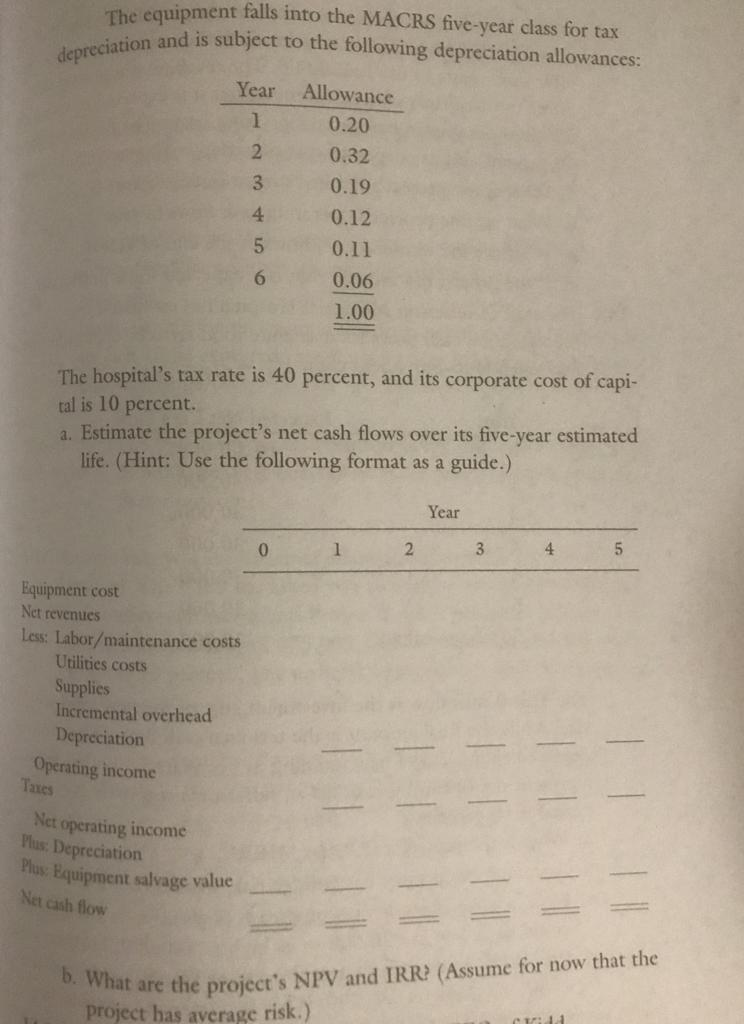

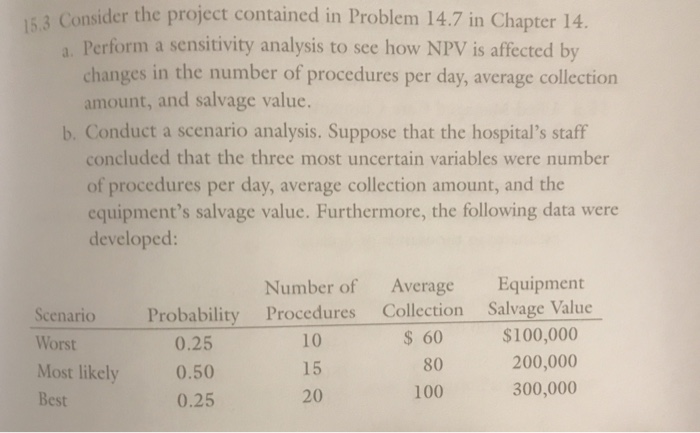

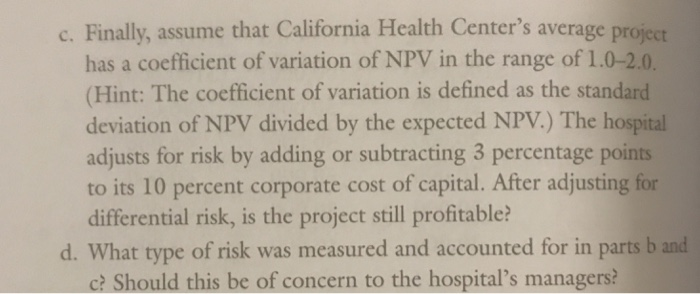

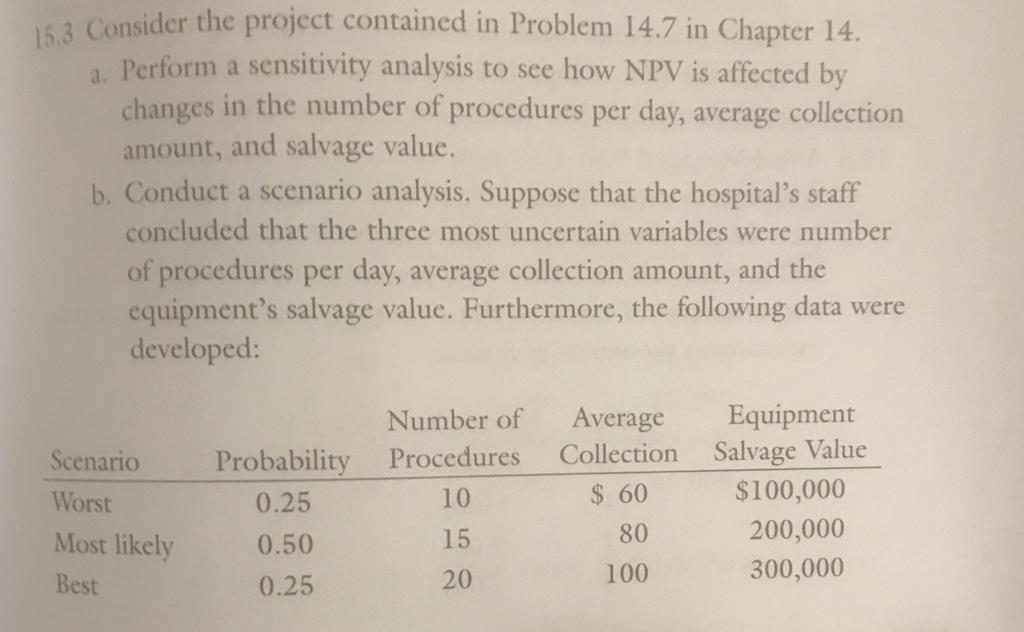

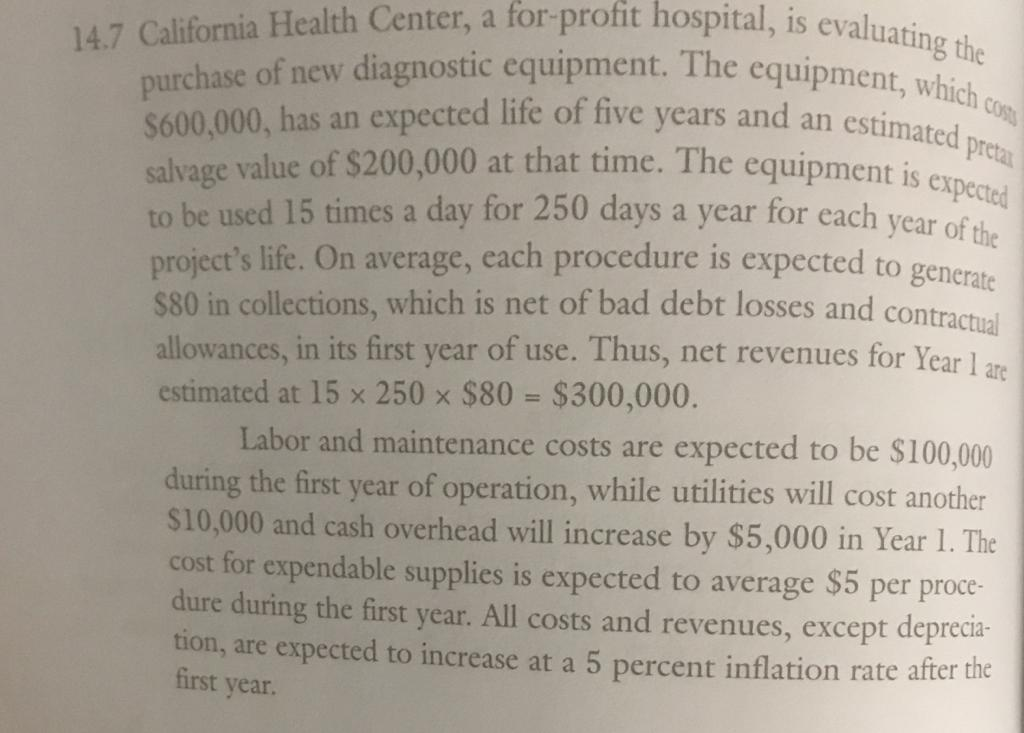

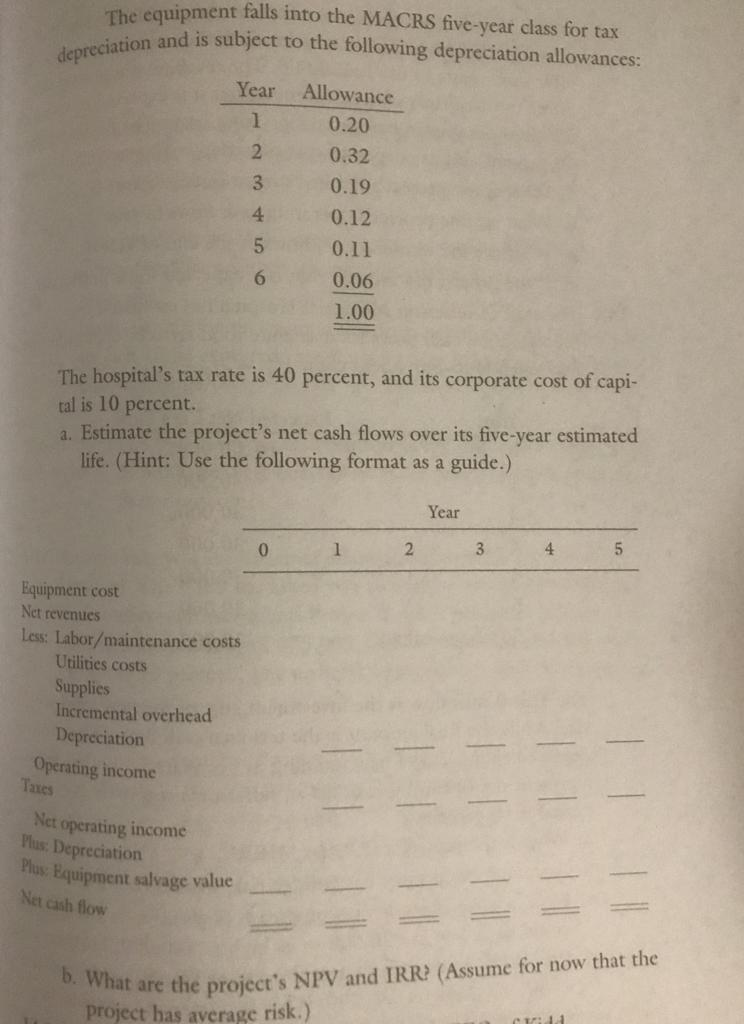

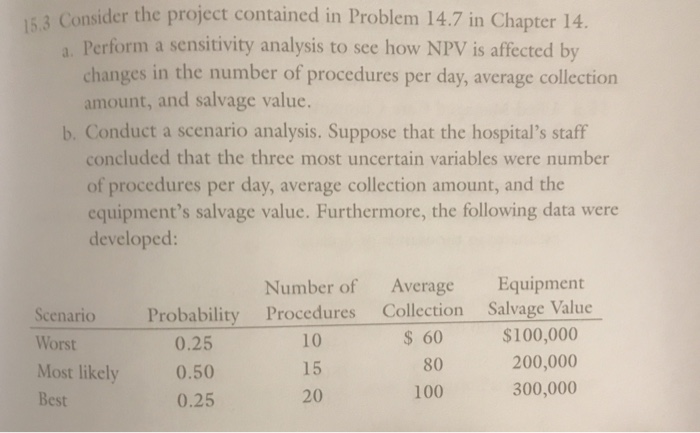

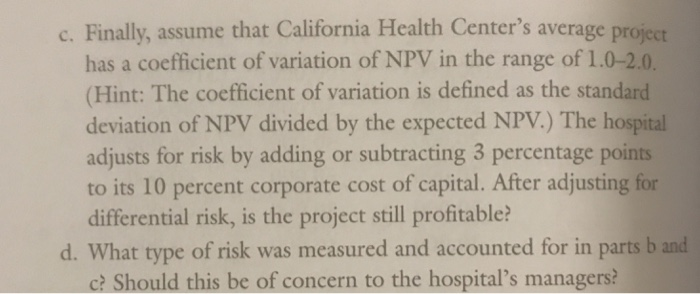

53 Consider the project contained in Problem 14.7 in Chapter 14. a. Perform a sensitivity analysis to see how NPV is affected by changes in the number of procedures per day, average collection amount, and salvage value. b. Conduct a scenario analysis. Suppose that the hospital's staff concluded that the three most uncertain variables were number of procedures per day, average collection amount, and the equipment's salvage value. Furthermore, the following data were developed: Number of Average Equipment Scenario Probability Procedures Collection Salvage Value Worst Most likely Best 0.25 0.50 0.25 10 15 20 60 80 100 $100,000 200,000 300,000 for-profit hospital, is evalu 14.7 California Health Center, a for profit hospital, is ev purchase of new diagnostic equipment. The equipment 5600,000, has an expected life of five years and an estimat salvage value of $200,000 at that time. The equipment is , which cc ed p expected to be used 15 times a day for 250 days a year for each year of tho project's life. On average, each procedure is expected to generate $80 in collections, which is net of bad debt losses and contractuai r 1 a allowances, in its first year of use. Thus, net revenues for Yea estimated at 15 x 250 x $80 = $300,000. Labor and maintenance costs are expected to be $100,000 during the first year of operation, while utilities will cost another $10,000 and cash overhead will increase by $5,000 in Year 1. The cost for expendable supplies is expected to average $5 per proce- dure during the first year. All costs and revenues, except deprecia- tion, are expected to increase at a 5 percent inflation rate after the first vear the equipment falls into the MACRS five-year class for tax uepreciation and is satbject to the folloving deprecation allowances Year Allowance 0.20 2 0.32 3 0.19 4 0.12 5 0.11 0.06 1.00 6 The hospital's tax rate is 40 percent, and its corporate cost of capi- tal is 10 percent. a. Estimate the project's net cash flows over its five-year estimated life. (Hint: Use the following format as a guide.) Year 4 0 quipment cost Net revenues Les: Labor/maintenance costs Utilities costs Supplies Incremental overhead Depreciation Operating income Net operating income Plus: Depreciation Equipment salvage value Net cash ow D. What are the projecr's NPV and IRR2 (Assume for now that the project has average risk.) 153 Consider the project contained in Problem 14.7 in Chapter 14. a. Perform a sensitivity analysis to see how NPV is affected by changes in the number of procedures per day, average collection amount, and salvage value. b. Conduct a scenario analysis. Suppose that the hospital's staff concluded that the three most uncertain variables were number of procedures per day, average collection amount, and the equipment's salvage value. Furthermore, the following data were developed: Scenario Probability Procedures Collection Salvage Value Worst Most likely Best 0.25 0.50 0.25 Number of Average Equipment S 60 100 10 15 20 $100,000 200,000 300,000 80 c. Finally, assume that California Health Center's average project has a coefficient of variation of NPV in the range of 1.0-2.0 (Hint: The coefficient of variation is defined as the standard deviation of NPV divided by the expected NPV.) The hospital adjusts for risk by adding or subtracting 3 percentage points to its 10 percent corporate cost of capital. After adjusting for differential risk, is the project still profitable? d. What type of risk was measured and accounted for in parts b and c? Should this be of concern to the hospital's managers

Can sumone help me wid solving this peoblem

Can sumone help me wid solving this peoblem