Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can Teresa and Sam afford this home using the monthly income loan criterion? Next week, your friends Teresa and Sam want to apply to the

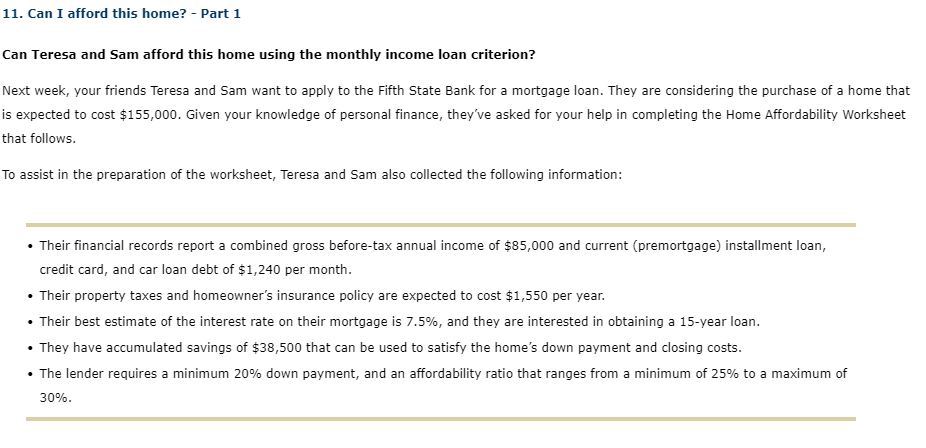

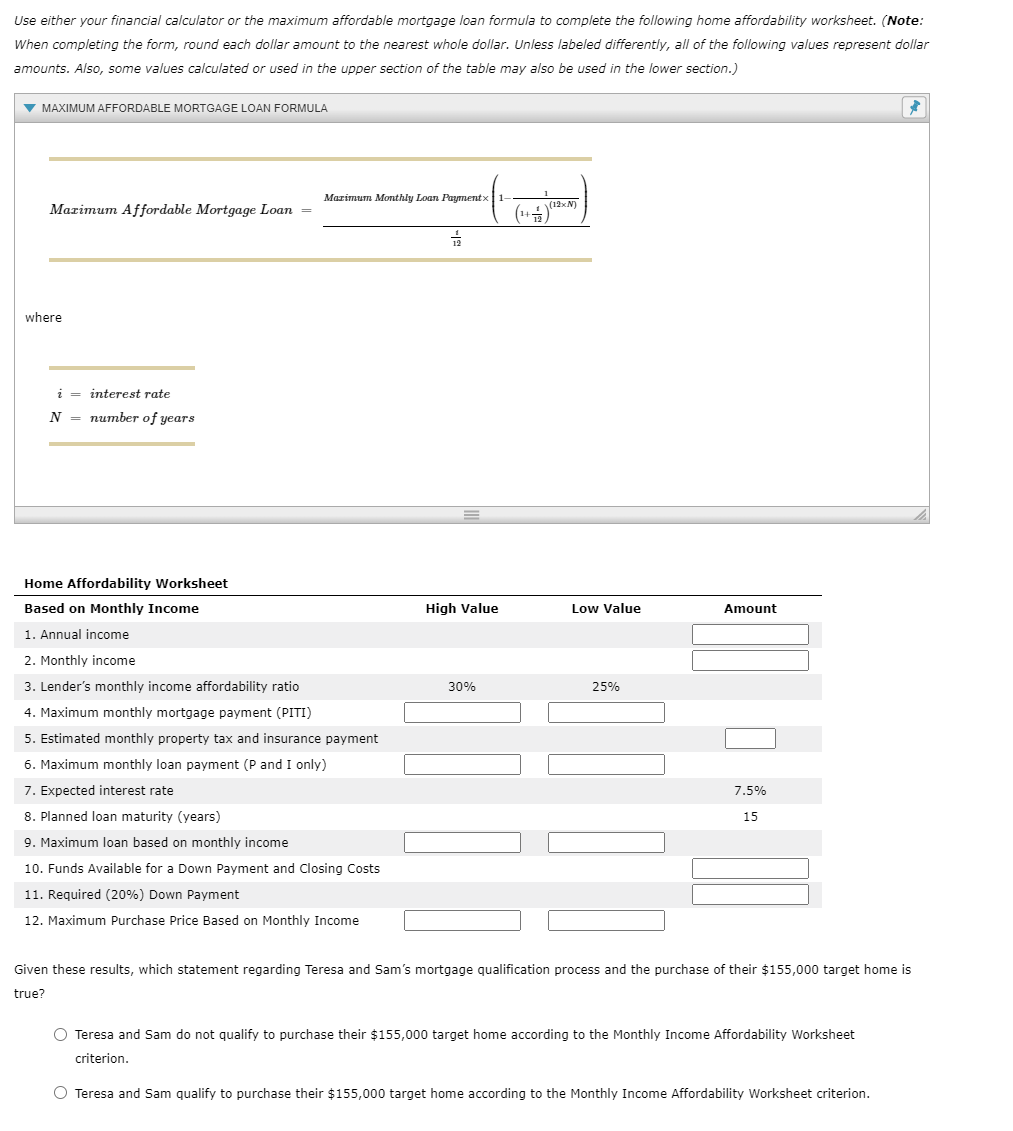

Can Teresa and Sam afford this home using the monthly income loan criterion? Next week, your friends Teresa and Sam want to apply to the Fifth State Bank for a mortgage loan. They are considering the purchase of a home that s expected to cost $155,000. Given your knowledge of personal finance, they've asked for your help in completing the Home Affordability Worksheet hat follows. To assist in the preparation of the worksheet, Teresa and Sam also collected the following information: - Their financial records report a combined gross before-tax annual income of $85,000 and current (premortgage) installment loan, credit card, and car loan debt of $1,240 per month. - Their property taxes and homeowner's insurance policy are expected to cost $1,550 per year. - Their best estimate of the interest rate on their mortgage is 7.5%, and they are interested in obtaining a 15 -year loan. - They have accumulated savings of $38,500 that can be used to satisfy the home's down payment and closing costs. - The lender requires a minimum 20% down payment, and an affordability ratio that ranges from a minimum of 25% to a maximum of 30%. Use either your financial calculator or the maximum affordable mortgage loan formula to complete the following home affordability worksheet. (Note: When completing the form, round each dollar amount to the nearest whole dollar. Unless labeled differently, all of the following values represent dollar amounts. Also, some values calculated or used in the upper section of the table may also be used in the lower section.) MAXIMUM AFFORDABLE MORTGAGE LOAN FORMULA Maximum Affordable Mortgage Loan =12tMaximumMonthlyLaanPayment(1(1+121)(12N)1) where iN=interestrate=numberofyears Given these results, which statement regarding Teresa and Sam's mortgage qualification process and the purchase of their $155,000 target home is true? Teresa and Sam do not qualify to purchase their $155,000 target home according to the Monthly Income Affordability Worksheet criterion. Teresa and Sam qualify to purchase their $155,000 target home according to the Monthly Income Affordability Worksheet criterion

Can Teresa and Sam afford this home using the monthly income loan criterion? Next week, your friends Teresa and Sam want to apply to the Fifth State Bank for a mortgage loan. They are considering the purchase of a home that s expected to cost $155,000. Given your knowledge of personal finance, they've asked for your help in completing the Home Affordability Worksheet hat follows. To assist in the preparation of the worksheet, Teresa and Sam also collected the following information: - Their financial records report a combined gross before-tax annual income of $85,000 and current (premortgage) installment loan, credit card, and car loan debt of $1,240 per month. - Their property taxes and homeowner's insurance policy are expected to cost $1,550 per year. - Their best estimate of the interest rate on their mortgage is 7.5%, and they are interested in obtaining a 15 -year loan. - They have accumulated savings of $38,500 that can be used to satisfy the home's down payment and closing costs. - The lender requires a minimum 20% down payment, and an affordability ratio that ranges from a minimum of 25% to a maximum of 30%. Use either your financial calculator or the maximum affordable mortgage loan formula to complete the following home affordability worksheet. (Note: When completing the form, round each dollar amount to the nearest whole dollar. Unless labeled differently, all of the following values represent dollar amounts. Also, some values calculated or used in the upper section of the table may also be used in the lower section.) MAXIMUM AFFORDABLE MORTGAGE LOAN FORMULA Maximum Affordable Mortgage Loan =12tMaximumMonthlyLaanPayment(1(1+121)(12N)1) where iN=interestrate=numberofyears Given these results, which statement regarding Teresa and Sam's mortgage qualification process and the purchase of their $155,000 target home is true? Teresa and Sam do not qualify to purchase their $155,000 target home according to the Monthly Income Affordability Worksheet criterion. Teresa and Sam qualify to purchase their $155,000 target home according to the Monthly Income Affordability Worksheet criterion Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started