Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can this 4 parts be solved by using the same formula but interchanging the currencies ? Question 4: Firefly Digitronics Ltd. (Moderately hard question) A

can this 4 parts be solved by using the same formula but interchanging the currencies ?

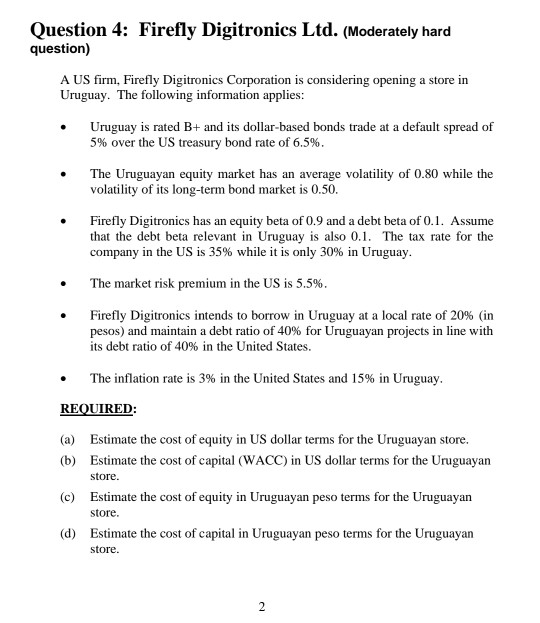

Question 4: Firefly Digitronics Ltd. (Moderately hard question) A US firm, Firefly Digitronics Corporation is considering opening a store in Uruguay. The following information applies: Uruguay is rated B+ and its dollar-based bonds trade at a default spread of 5% over the US treasury bond rate of 6.5%. The Uruguayan equity market has an average volatility of 0.80 while the volatility of its long-term bond market is 0.50. Firefly Digitronics has an equity beta of 0.9 and a debt beta of 0.1. Assume that the debt beta relevant in Uruguay is also 0.1. The tax rate for the company in the US is 35% while it is only 30% in Uruguay. The market risk premium in the US is 5.5%. Firefly Digitronics intends to borrow in Uruguay at a local rate of 20% (in pesos) and maintain a debt ratio of 40% for Uruguayan projects in line with its debt ratio of 40% in the United States. The inflation rate is 3% in the United States and 15% in Uruguay. REQUIRED: (a) Estimate the cost of equity in US dollar terms for the Uruguayan store. (b) Estimate the cost of capital (WACC) in US dollar terms for the Uruguayan store. (c) Estimate the cost of equity in Uruguayan peso terms for the Uruguayan store. (d) Estimate the cost of capital in Uruguayan peso terms for the Uruguayan store. 2 Question 4: Firefly Digitronics Ltd. (Moderately hard question) A US firm, Firefly Digitronics Corporation is considering opening a store in Uruguay. The following information applies: Uruguay is rated B+ and its dollar-based bonds trade at a default spread of 5% over the US treasury bond rate of 6.5%. The Uruguayan equity market has an average volatility of 0.80 while the volatility of its long-term bond market is 0.50. Firefly Digitronics has an equity beta of 0.9 and a debt beta of 0.1. Assume that the debt beta relevant in Uruguay is also 0.1. The tax rate for the company in the US is 35% while it is only 30% in Uruguay. The market risk premium in the US is 5.5%. Firefly Digitronics intends to borrow in Uruguay at a local rate of 20% (in pesos) and maintain a debt ratio of 40% for Uruguayan projects in line with its debt ratio of 40% in the United States. The inflation rate is 3% in the United States and 15% in Uruguay. REQUIRED: (a) Estimate the cost of equity in US dollar terms for the Uruguayan store. (b) Estimate the cost of capital (WACC) in US dollar terms for the Uruguayan store. (c) Estimate the cost of equity in Uruguayan peso terms for the Uruguayan store. (d) Estimate the cost of capital in Uruguayan peso terms for the Uruguayan store. 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started