can this be completed on a computer not by hand please.

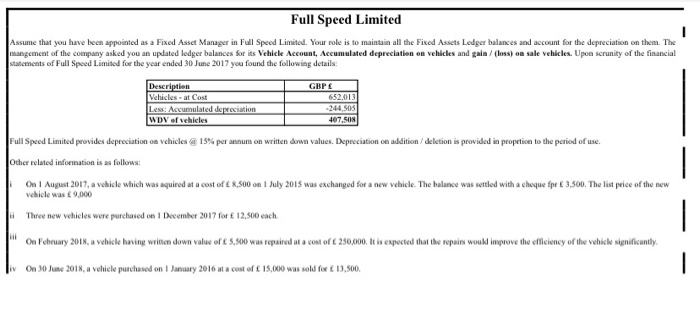

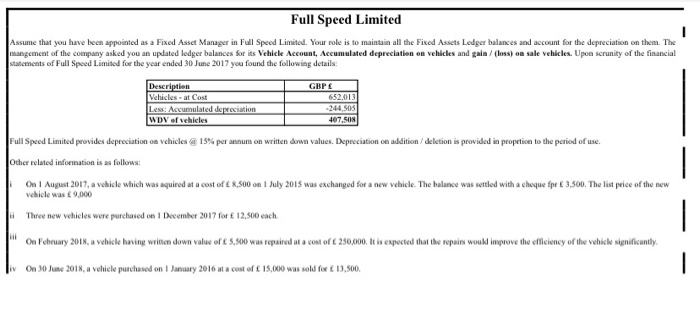

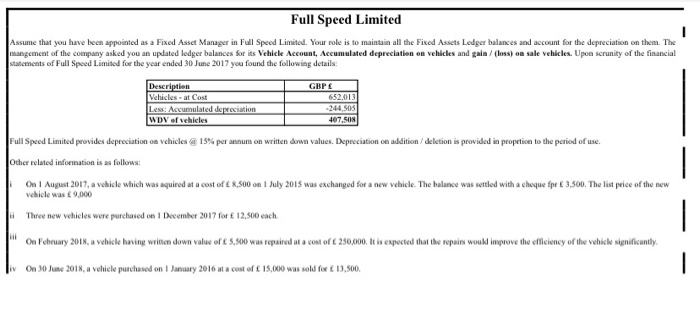

Full Speed Limited Assume that you have been appointed as a Fixed Asset Manager in Full Speed Limited. Your role is to maintain all the Fixed Assets Ledger balances and account for the depreciation on them. The Mangement of the company asked you an updated ledger balances for its Vehicle Account, Accumulated depreciation on vehicles and gain / (loss) on sale vehicles. Upon scrunity of the financial statements of Full Speed Limited for the year ended 30 June 2017 you found the following details: Description Vehicles-at Cost Less: Accumulated desiation WDV of vehicles GBP 652,013 -244,505 407,508 Full Speed Limited provides depreciation oa vehicles @ 15% per annum on writen down values. Depreciation des addition/deletion is provided in propetice to the period of use. Other related information is as follows: On August 2017, a vehicle which was aquired at a cost of 8,500 on 1 July 2015 was exchanged for a new vehicle. The balance was settled with a choque fpe3.500. The list price of the new vehicle was 9,000 Three new vehicles were purchased on December 2017 for 12,500 each. On February 2018, a vehicle having write down value of 5,500 was repaired at a cost of 250,000. It is expected that the repairs would improve the efficiency of the vehicle significantly On 30 June 2018, a vehicle purchased on 1 January 2016 at a cost of 15,000 was sold fox 13,500. - Full Speed Limited Assume that you have been appointed as a Fixed Asset Manager in Full Speed Limited. Your role is to maintain all the Fixed Assets Ledger balances and account for the depreciation on them. The Mangement of the company asked you an updated ledger balances for its Vehicle Account, Accumulated depreciation on vehicles and gain / (loss) on sale vehicles. Upon scrunity of the financial statements of Full Speed Limited for the year ended 30 June 2017 you found the following details: Description Vehicles-at Cost Less: Accumulated desiation WDV of vehicles GBP 652,013 -244,505 407,508 Full Speed Limited provides depreciation oa vehicles @ 15% per annum on writen down values. Depreciation des addition/deletion is provided in propetice to the period of use. Other related information is as follows: On August 2017, a vehicle which was aquired at a cost of 8,500 on 1 July 2015 was exchanged for a new vehicle. The balance was settled with a choque fpe3.500. The list price of the new vehicle was 9,000 Three new vehicles were purchased on December 2017 for 12,500 each. On February 2018, a vehicle having write down value of 5,500 was repaired at a cost of 250,000. It is expected that the repairs would improve the efficiency of the vehicle significantly On 30 June 2018, a vehicle purchased on 1 January 2016 at a cost of 15,000 was sold fox 13,500