can u answer these pls..select any one correct statement for circled statement

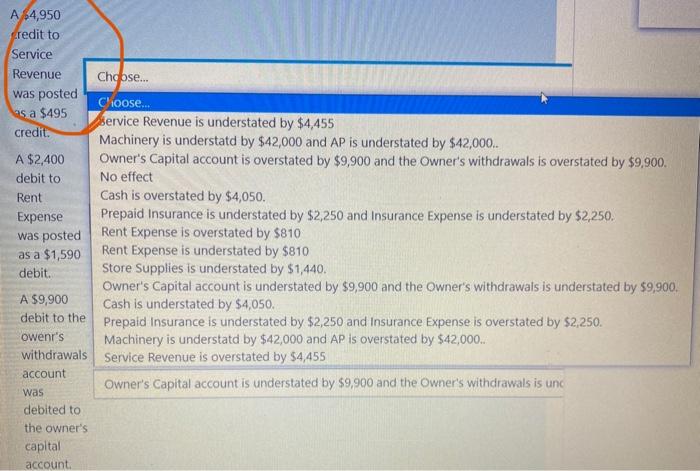

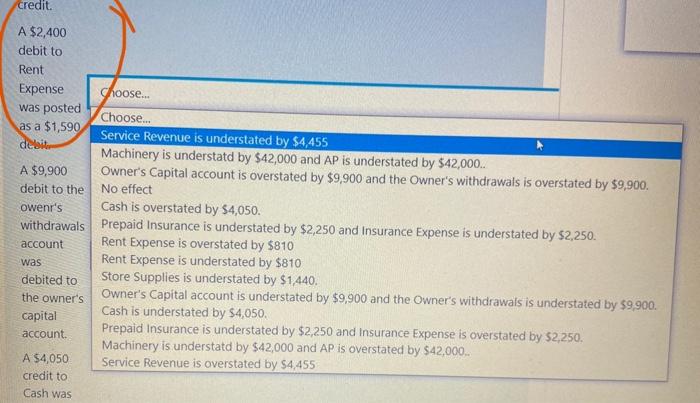

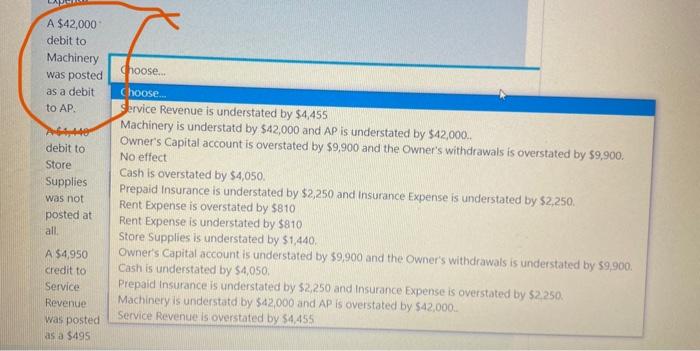

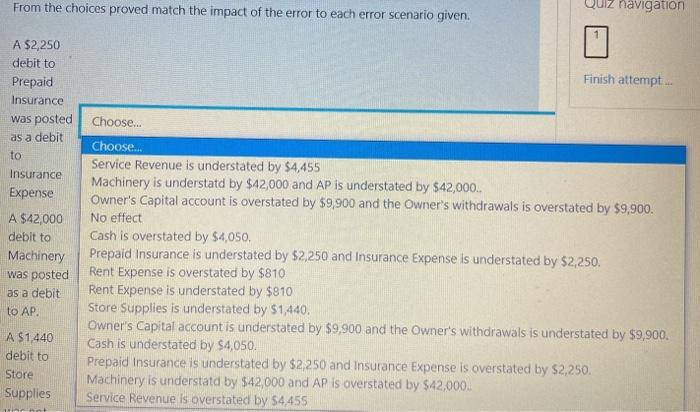

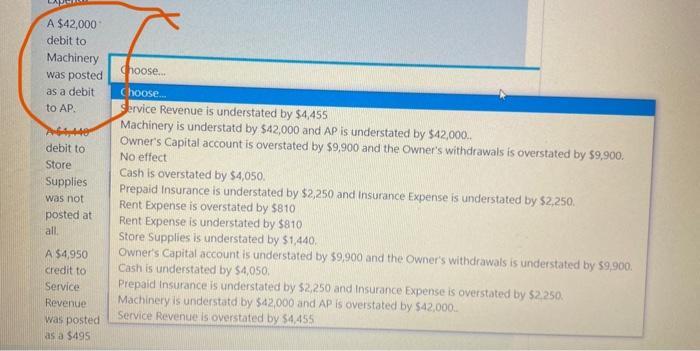

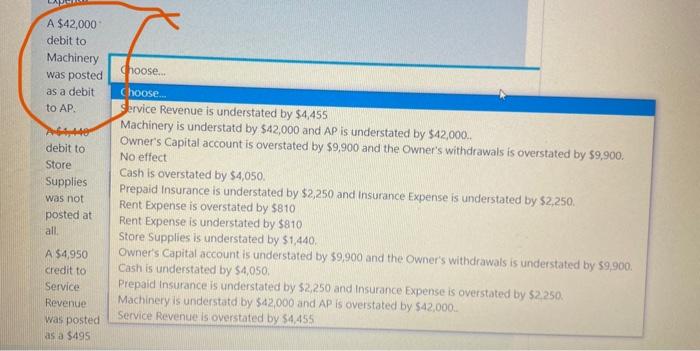

From the choices proved match the impact of the error to each error scenario given. navigation Finish attempt A $2,250 debit to Prepaid Insurance was posted as a debit to Insurance Expense A $42,000 debit to Machinery was posted as a debit to AP Choose... Choose... Service Revenue is understated by $4,455 Machinery is understatd by $42,000 and AP is understated by $42,000. Owner's Capital account is overstated by $9,900 and the Owner's withdrawals is overstated by $9,900. No effect Cash is overstated by $4,050, Prepaid Insurance is understated by $2,250 and Insurance Expense is understated by $2,250. Rent Expense is overstated by $810 Rent Expense is understated by $810 Store Supplies is understated by $1,440. Owner's Capital account is understated by $9,900 and the Owner's withdrawals is understated by $9,900. Cash is understated by $4,050. Prepaid Insurance is understated by $2,250 and Insurance Expense is overstated by $2,250. Machinery is understatd by $42,000 and AP is overstated by $42,000 Service Revenue is overstated by 54,455 A $1,440 debit to Store Supplies A $42,000 debit to Machinery was posted as a debit to AP Choose... debit to Store Supplies was not posted at all Choose. Service Revenue is understated by $4,455 Machinery is understatd by $42,000 and AP is understated by $42,000. Owner's Capital account is overstated by $9,900 and the Owner's withdrawals is overstated by $9,900. No effect Cash is overstated by 54,050. Prepaid Insurance is understated by $2,250 and insurance Expense is understated by $2,250. Rent Expense is overstated by 5810 Rent Expense is understated by $810 Store Supplies is understated by $1,440. Owner's Capital account is understated by 59,900 and the Owner's withdrawals is understated by 59,900 Cash is understated by $4,050, Prepaid Insurance is understated by $2,250 and Insurance Expense is overstated by $2250 Machinery is understatd by 542,000 and AP is overstated by $42,000 Service Revenue is overstated by $4,455 A $4,950 credit to Service Revenue was posted as a $495 A $42,000 debit to Machinery was posted as a debit to AP Choose... debit to Store Supplies was not posted at all Choose. Service Revenue is understated by $4,455 Machinery is understatd by $42,000 and AP is understated by $42,000. Owner's Capital account is overstated by $9,900 and the Owner's withdrawals is overstated by $9,900. No effect Cash is overstated by 54,050. Prepaid Insurance is understated by $2,250 and insurance Expense is understated by $2,250. Rent Expense is overstated by 5810 Rent Expense is understated by $810 Store Supplies is understated by $1,440. Owner's Capital account is understated by 59,900 and the Owner's withdrawals is understated by 59,900 Cash is understated by $4,050, Prepaid Insurance is understated by $2,250 and Insurance Expense is overstated by $2250 Machinery is understatd by 542,000 and AP is overstated by $42,000 Service Revenue is overstated by $4,455 A $4,950 credit to Service Revenue was posted as a $495 A 64,950 credit to Service Revenue Choose... was posted Choose... as a $495 service Revenue is understated by $4,455 credit. Machinery is understatd by $42,000 and AP is understated by $42,000.. A $2,400 Owner's Capital account is overstated by $9,900 and the Owner's withdrawals is overstated by $9,900. debit to No effect Rent Cash is overstated by $4,050. Expense Prepaid Insurance is understated by $2,250 and Insurance Expense is understated by $2,250. was posted Rent Expense is overstated by $810 as a $1,590 Rent Expense is understated by $810 debit. Store Supplies is understated by $1,440. Owner's Capital account is understated by $9,900 and the Owner's withdrawals is understated by $9,900. A $9,900 Cash is understated by $4,050. debit to the Prepaid Insurance is understated by $2,250 and Insurance Expense is overstated by $2,250. Owenr's Machinery is understatd by $42,000 and AP is overstated by $42,000. withdrawals Service Revenue is overstated by $4,455 account Owner's Capital account is understated by $9,900 and the Owner's withdrawals is und debited to the owner's capital account was credit. Choose... A $2,400 debit to Rent Expense was posted Choose... as a $1,590 Service Revenue is understated by $4,455 debit Machinery is understatd by $42,000 and AP is understated by $42,000... A $9,900 Owner's Capital account is overstated by $9,900 and the Owner's withdrawals is overstated by $9,900 debit to the No effect owenr's Cash is overstated by $4,050. withdrawals Prepaid Insurance is understated by $2,250 and Insurance Expense is understated by $2,250. Rent Expense is overstated by $810 was Rent Expense is understated by $810 debited to Store Supplies is understated by $1,440. the owner's Owner's Capital account is understated by $9,900 and the Owner's withdrawals is understated by $9,900. capital Cash is understated by $4,050, Prepaid Insurance is understated by $2,250 and Insurance Expense is overstated by 52,250. account Machinery is understatd by $42,000 and AP is overstated by $42,000 A $4,050 Service Revenue is overstated by $4,455 credit to Cash was account

can u answer these pls..select any one correct statement for circled statement

can u answer these pls..select any one correct statement for circled statement