Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can u please answer this in less than 30 minutes its really urgent thank you so much in advance Question 1 Fred's Fries is a

can u please answer this in less than 30 minutes its really urgent thank you so much in advance

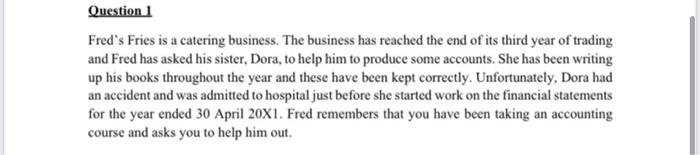

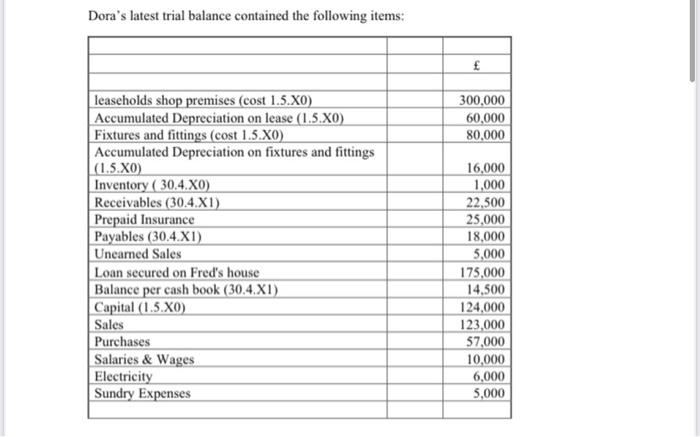

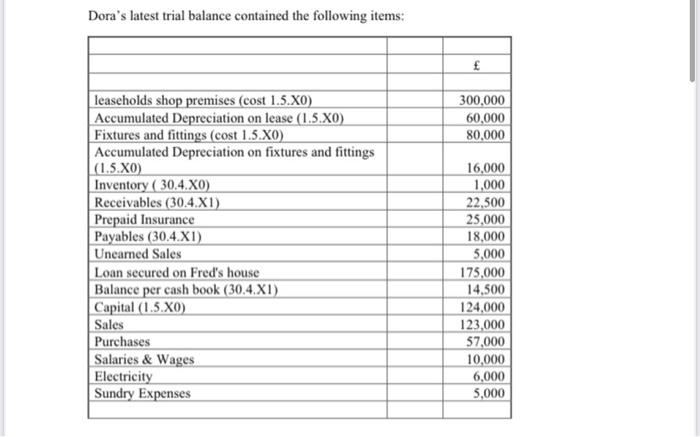

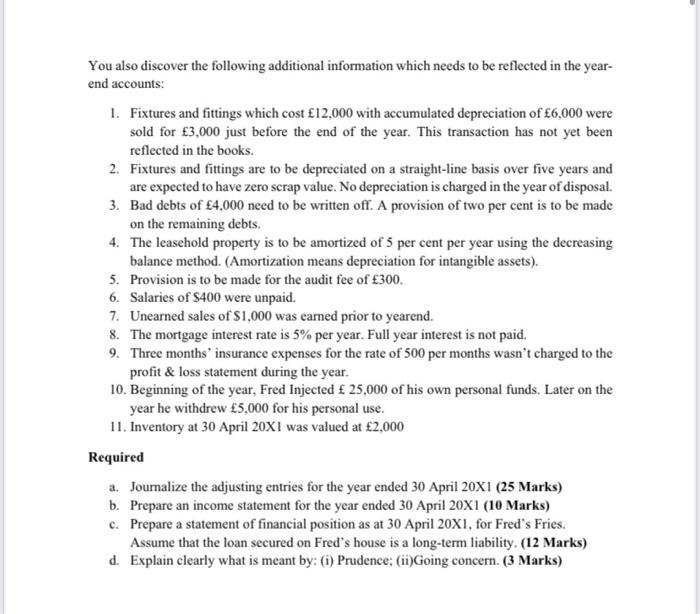

Question 1 Fred's Fries is a catering business. The business has reached the end of its third year of trading and Fred has asked his sister, Dora, to help him to produce some accounts. She has been writing up his books throughout the year and these have been kept correctly. Unfortunately, Dora had an accident and was admitted to hospital just before she started work on the financial statements for the year ended 30 April 20X1. Fred remembers that you have been taking an accounting course and asks you to help him out. Dora's latest trial balance contained the following items: 300.000 60,000 80.000 leaseholds shop premises (cost 1.5.XO) Accumulated Depreciation on lease (1.5.XO) Fixtures and fittings (cost 1.5.80) Accumulated Depreciation on fixtures and fittings (1,5.10) Inventory ( 30.4.XO) Receivables (30.4.XI) Prepaid Insurance Payables (30.4.XI) Uncamed Sales Loan secured on Fred's house Balance per cash book (30.4.XI) Capital (1.5.XO) Sales Purchases Salaries & Wages Electricity Sundry Expenses 16,000 1,000 22.500 25,000 18,000 5,000 175,000 14,500 124,000 123,000 57,000 10,000 6,000 5.000 You also discover the following additional information which needs to be reflected in the year- end accounts: 1. Fixtures and fittings which cost 12,000 with accumulated depreciation of 6,000 were sold for 3,000 just before the end of the year. This transaction has not yet been reflected in the books. 2. Fixtures and fittings are to be depreciated on a straight-line basis over five years and are expected to have zero scrap value. No depreciation is charged in the year of disposal. 3. Bad debts of 4,000 need to be written off. A provision of two per cent is to be made on the remaining debts. 4. The leasehold property is to be amortized of 5 per cent per year using the decreasing balance method. (Amortization means depreciation for intangible assets). 5. Provision is to be made for the audit fee of 300. 6. Salaries of $400 were unpaid. 7. Unearned sales of $1,000 was earned prior to yearend. 8. The mortgage interest rate is 5% per year. Full year interest is not paid. 9. Three months' insurance expenses for the rate of 500 per months wasn't charged to the profit & loss statement during the year. 10. Beginning of the year, Fred Injected 25,000 of his own personal funds. Later on the year he withdrew 5,000 for his personal use. 11. Inventory at 30 April 20X1 was valued at 2,000 Required a. Journalize the adjusting entries for the year ended 30 April 20X1 (25 Marks) b. Prepare an income statement for the year ended 30 April 20X1 (10 Marks) c. Prepare a statement of financial position as at 30 April 20X1, for Fred's Fries. Assume that the loan secured on Fred's house is a long-term liability. (12 Marks) d. Explain clearly what is meant by: (i) Prudence; (ii)Going concern

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started