can u pls help me with 4 of these requirements?

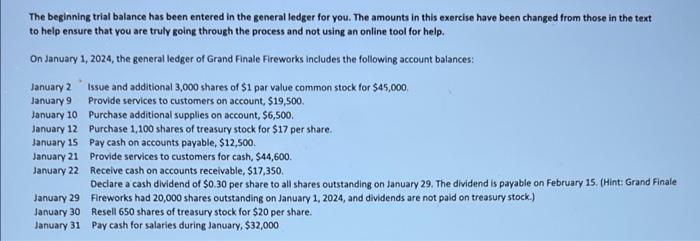

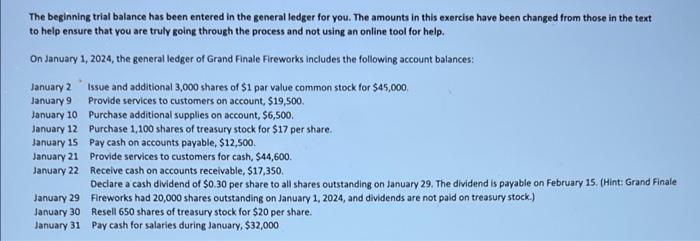

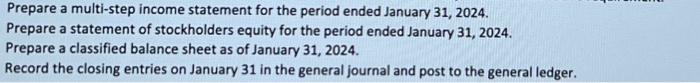

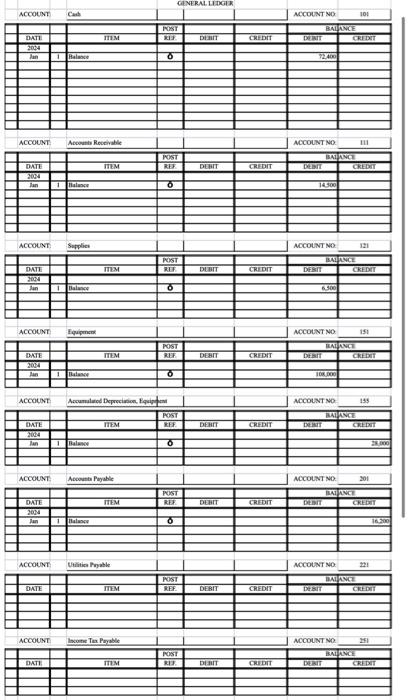

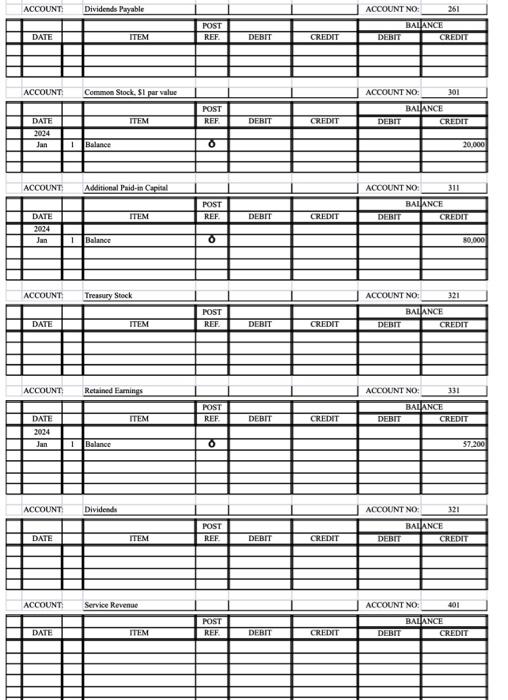

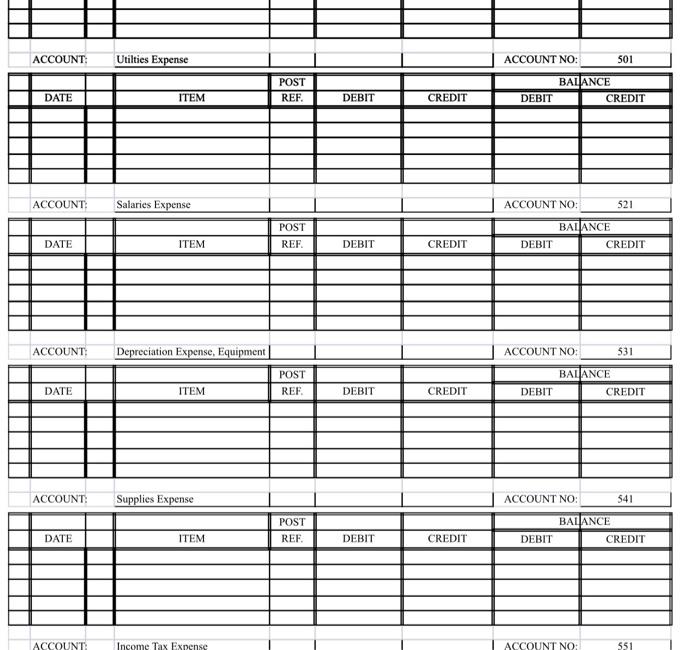

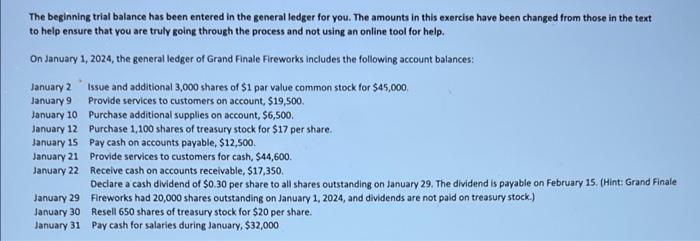

The beginning trial balance has been entered in the general ledger for you, The amounts in this exercise have been changed from those in the text to help ensure that you are truly going through the process and not using an online tool for help. On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: January 2 Issue and additional 3,000 shares of $1 par value common stock for $45,000. January 9 Provide services to customers on account, $19,500. January 10 Purchase additional supplies on account, $6,500. January 12 Purchase 1,100 shares of treasury stock for $17 per share. January 15 Pay cash on accounts payable, $12,500. January 21 Provide services to customers for cash, $44,600. January 22 Recelve cash on accounts receivable, $17,350. Declare a cash dividend of $0.30 per share to all shares outstanding on January 29 . The dividend is payable on February 15 . (Hint: Grand Finale January 29 Fireworks had 20,000 shares outstanding on January 1, 2024, and dividends are not paid on treasury stock.) January 30 Resell 650 shares of treasury stock for $20 per share. January 31 Pay cash for salaries during January, $32,000 Prepare a multi-step income statement for the period ended January 31,2024. Prepare a statement of stockholders equity for the period ended January 31, 2024. Prepare a classified balance sheet as of January 31, 2024. Record the closing entries on January 31 in the general journal and post to the general ledger. \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline & & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular} The beginning trial balance has been entered in the general ledger for you, The amounts in this exercise have been changed from those in the text to help ensure that you are truly going through the process and not using an online tool for help. On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances: January 2 Issue and additional 3,000 shares of $1 par value common stock for $45,000. January 9 Provide services to customers on account, $19,500. January 10 Purchase additional supplies on account, $6,500. January 12 Purchase 1,100 shares of treasury stock for $17 per share. January 15 Pay cash on accounts payable, $12,500. January 21 Provide services to customers for cash, $44,600. January 22 Recelve cash on accounts receivable, $17,350. Declare a cash dividend of $0.30 per share to all shares outstanding on January 29 . The dividend is payable on February 15 . (Hint: Grand Finale January 29 Fireworks had 20,000 shares outstanding on January 1, 2024, and dividends are not paid on treasury stock.) January 30 Resell 650 shares of treasury stock for $20 per share. January 31 Pay cash for salaries during January, $32,000 Prepare a multi-step income statement for the period ended January 31,2024. Prepare a statement of stockholders equity for the period ended January 31, 2024. Prepare a classified balance sheet as of January 31, 2024. Record the closing entries on January 31 in the general journal and post to the general ledger. \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline & & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular}