Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can u show formula Consolidated Industries' preferred stock currently sells for 100.75 per share and pays an annual dividend of $8.20 per share. What is

can u show formula

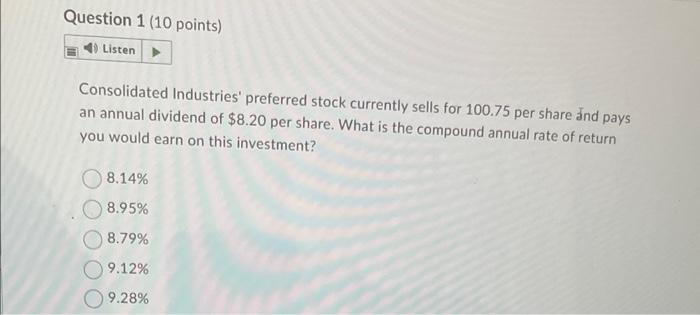

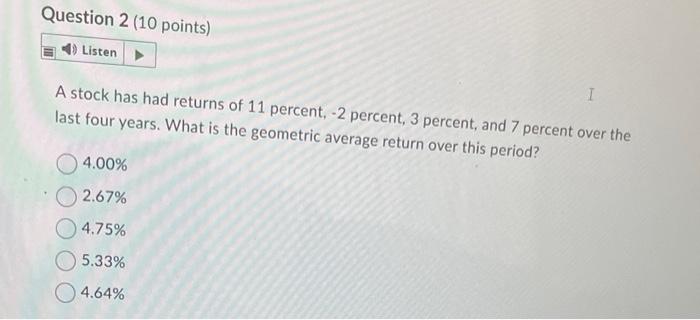

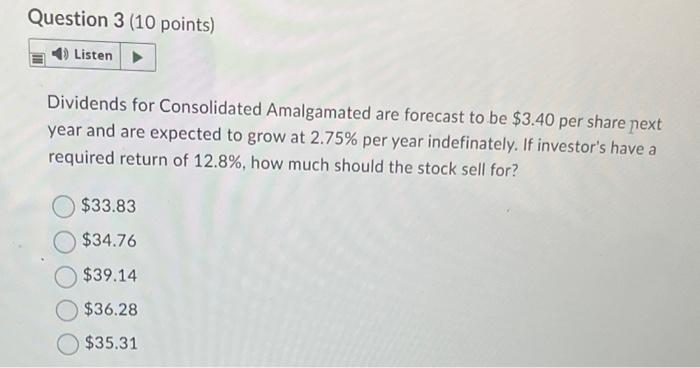

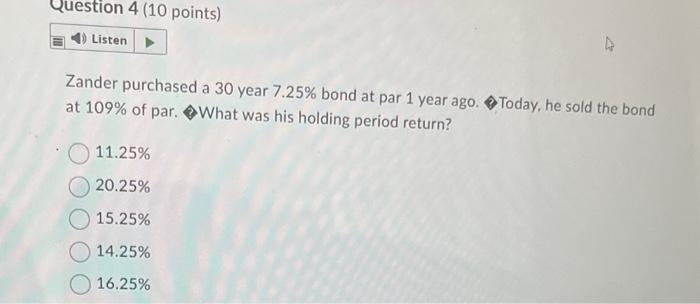

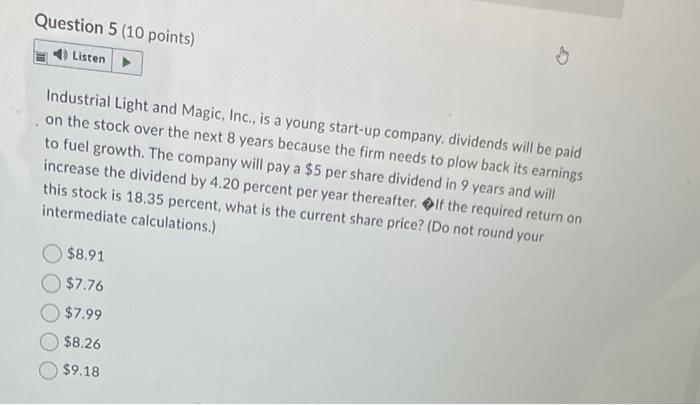

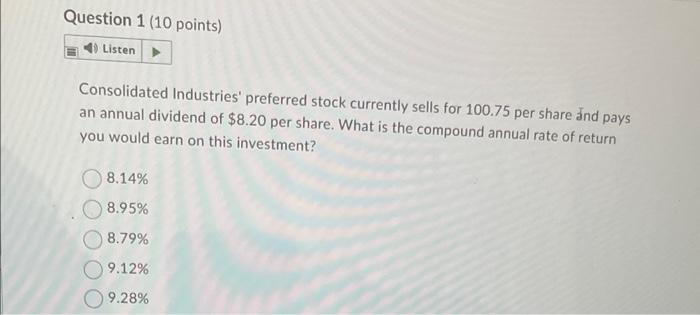

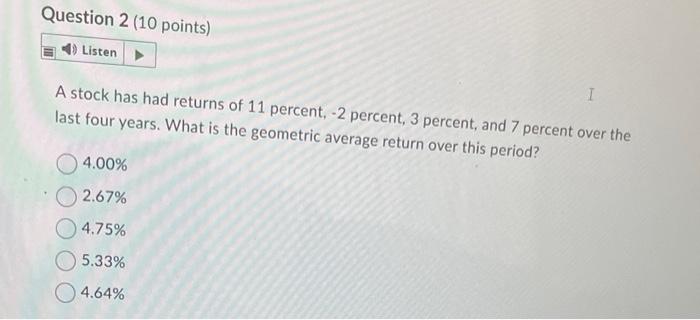

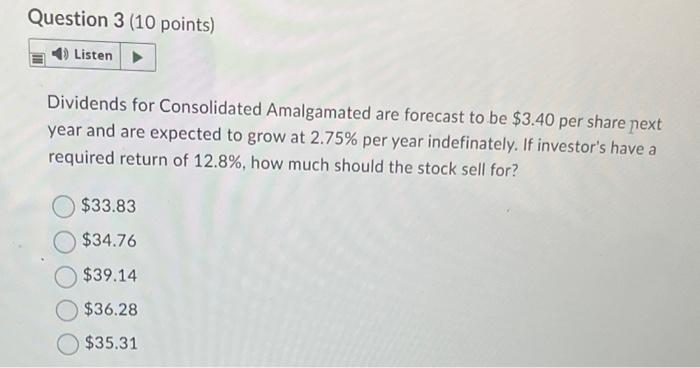

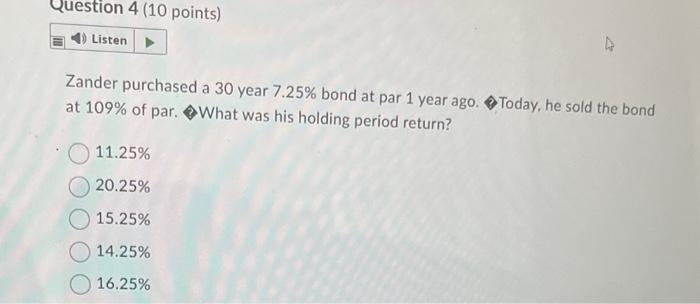

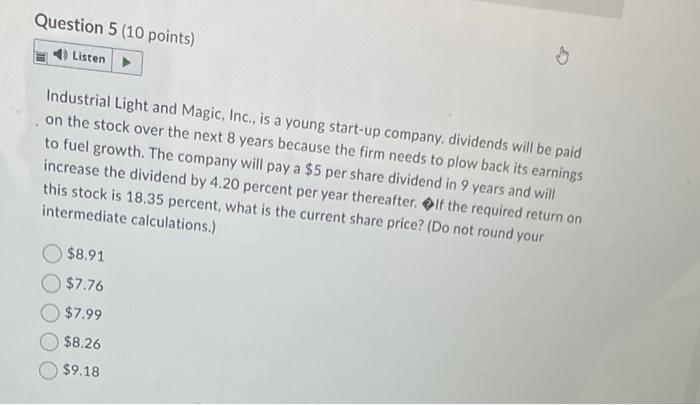

Consolidated Industries' preferred stock currently sells for 100.75 per share and pays an annual dividend of $8.20 per share. What is the compound annual rate of return you would earn on this investment? 8.14% 8.95% 8.79% 9.12\% 9.28% A stock has had returns of 11 percent, 2 percent, 3 percent, and 7 percent over the last four years. What is the geometric average return over this period? 4.00% 2.67% 4.75% 5.33\% 4.64% Dividends for Consolidated Amalgamated are forecast to be $3.40 per share pext year and are expected to grow at 2.75% per year indefinately. If investor's have a required return of 12.8%, how much should the stock sell for? $33.83$34.76$39.14$36.28$35.31 Zander purchased a 30 year 7.25% bond at par 1 year ago. (1Today, he sold the bond at 109% of par. \&What was his holding period return? 11.25%20.25%15.25%14.25%16.25% Industrial Light and Magic, Inc., is a young start-up company. dividends will be paid on the stock over the next 8 years because the firm needs to plow back its earnings to fuel growth. The company will pay a $5 per share dividend in 9 years and will increase the dividend by 4.20 percent per year thereafter. \$If the required return on this stock is 18.35 percent, what is the current share price? (Do not round your intermediate calculations.) $8.91 $7.76 $7.99 $8.26 $9.18

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started