can u show me the whole solutions how to calculate these questions? plz

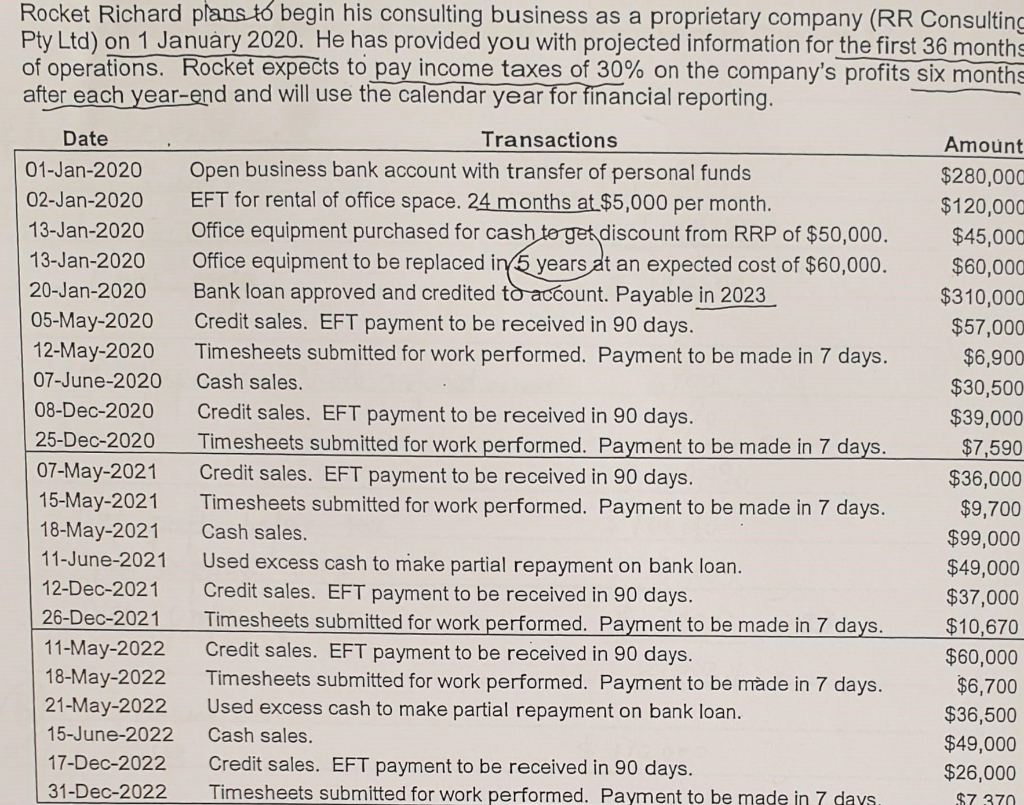

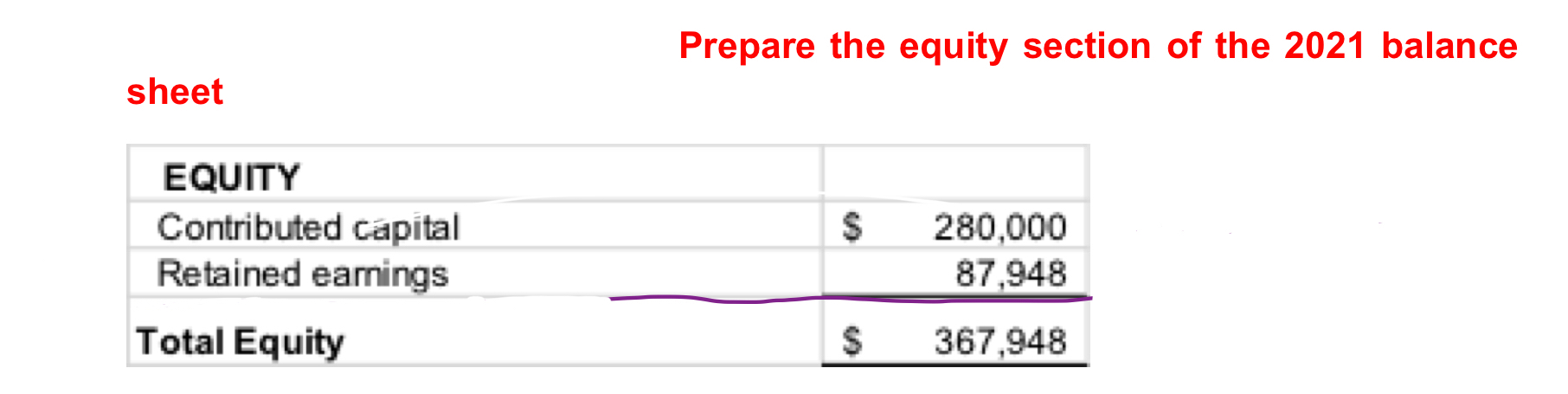

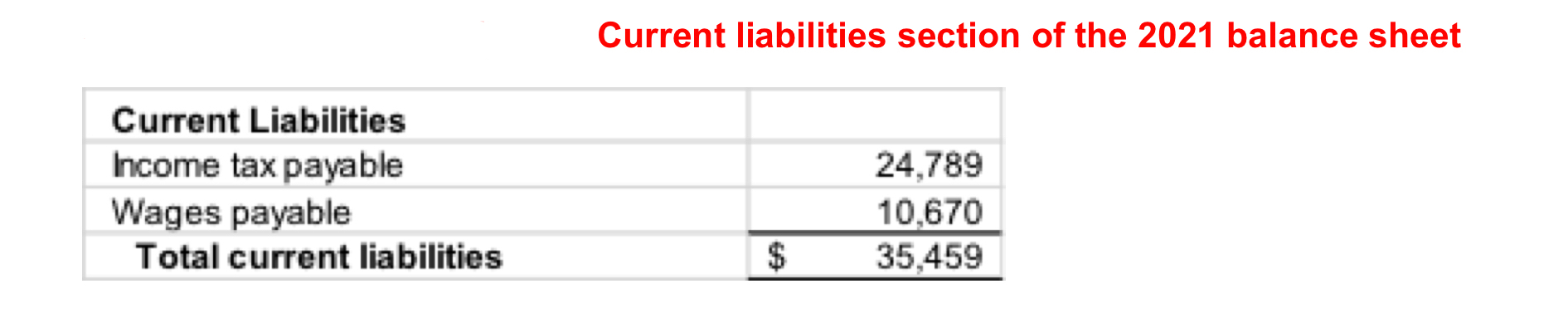

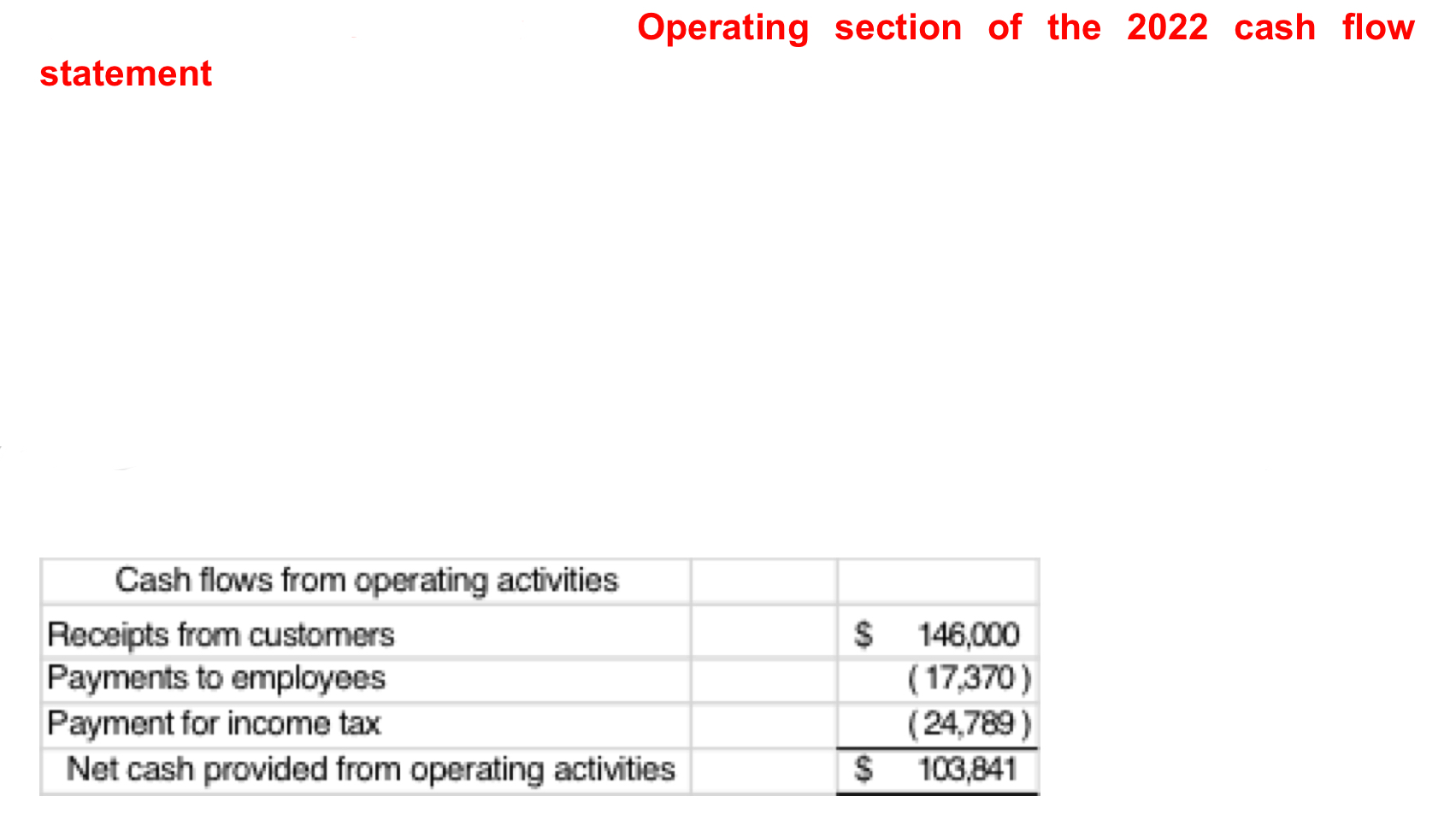

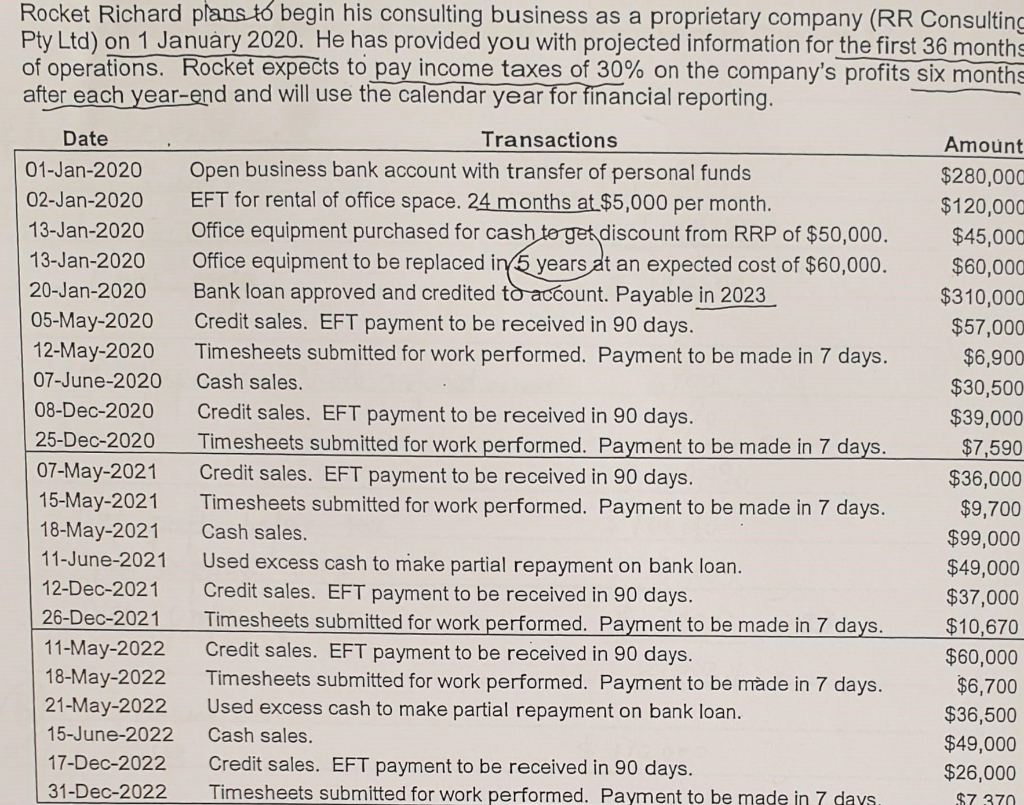

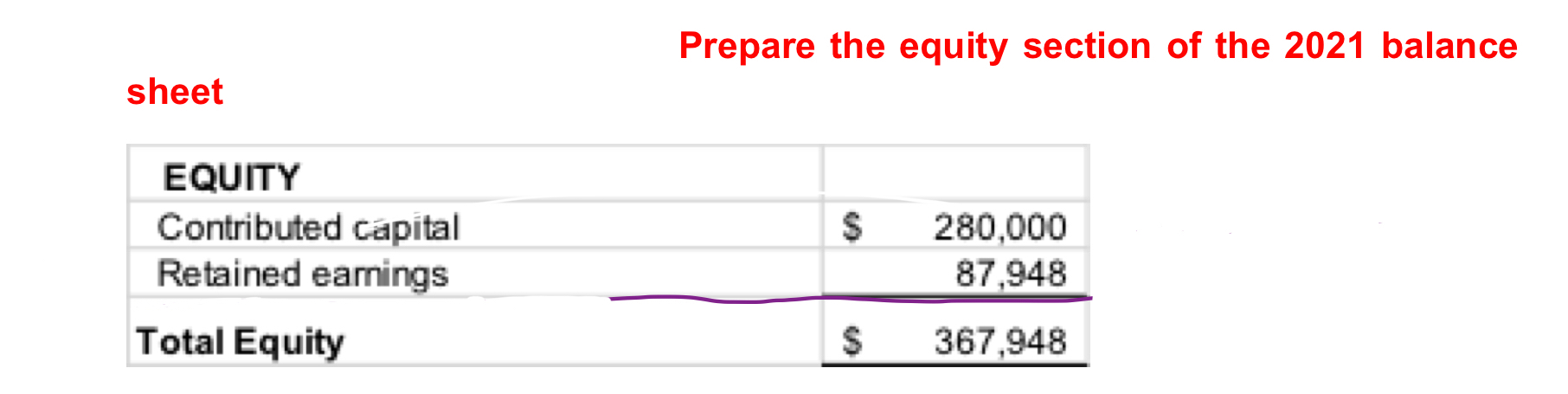

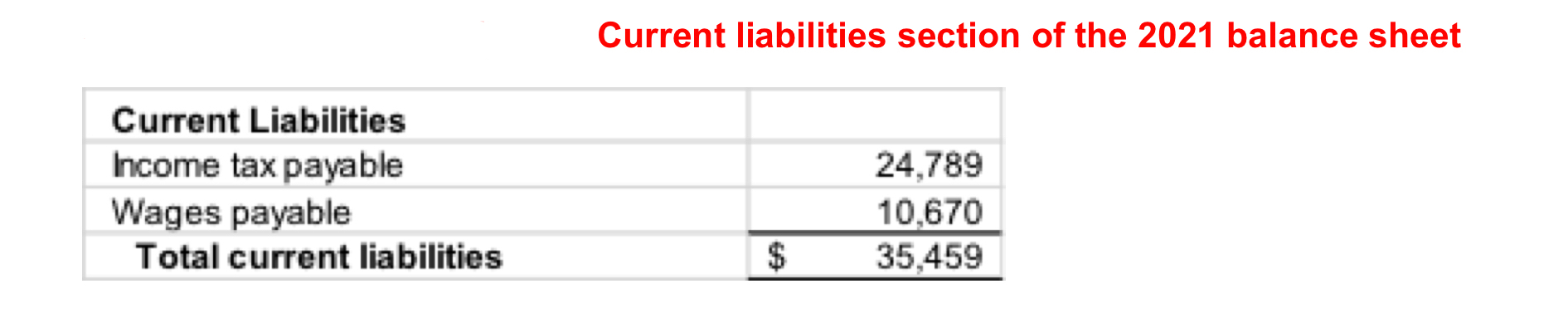

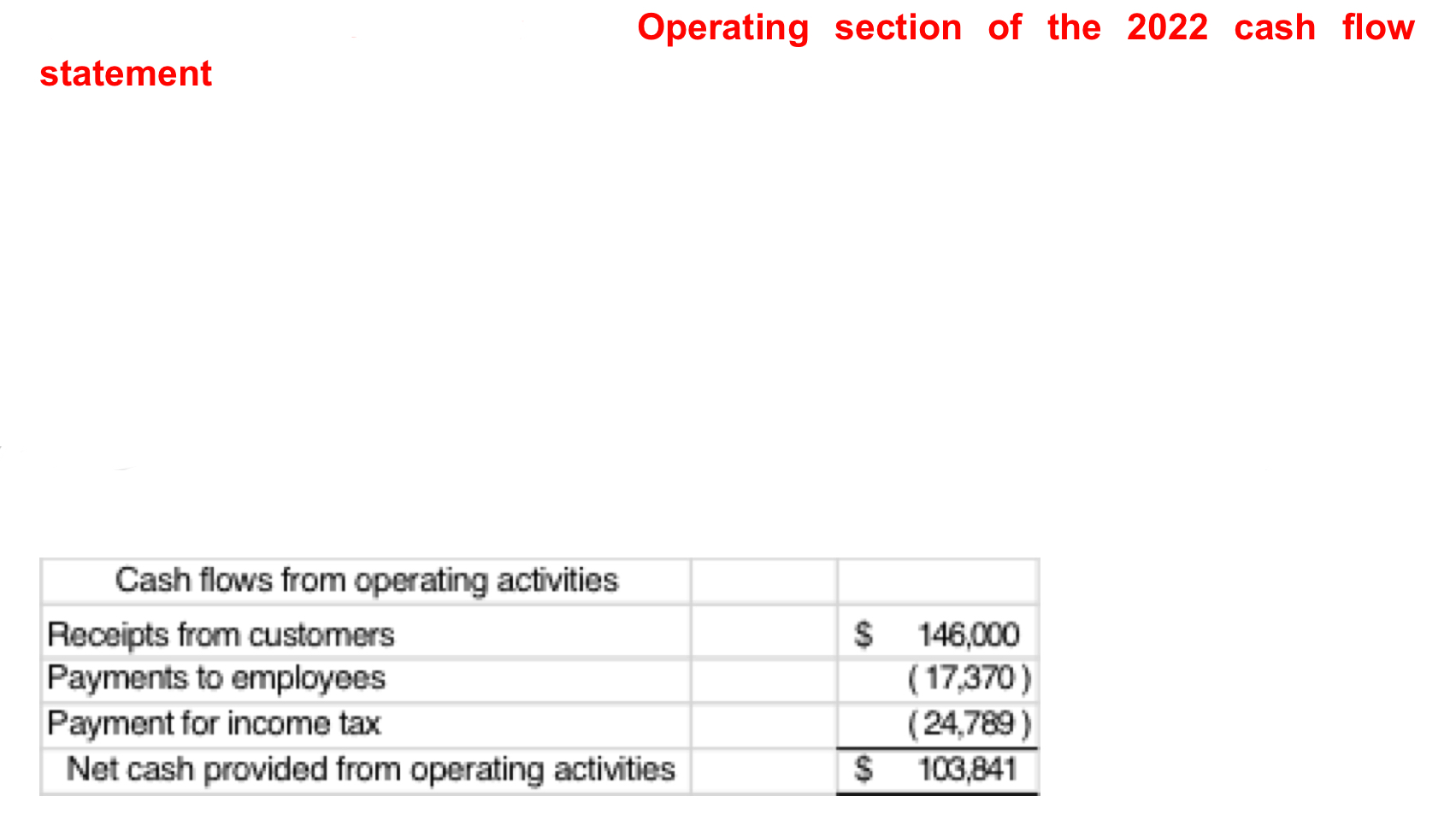

Rocket Richard plans to begin his consulting business as a proprietary company (RR Consulting Pty Ltd) on 1 January 2020. He has provided you with projected information for the first 36 months of operations. Rocket expects to pay income taxes of 30% on the company's profits six months after each year-end and will use the calendar year for financial reporting. Date Transactions Amount 01-Jan-2020 Open business bank account with transfer of personal funds $280,000 02-Jan-2020 EFT for rental of office space. 24 months at $5,000 per month. $120,000 13-Jan-2020 Office equipment purchased for cash to get discount from RRP of $50,000. $45,000 13-Jan-2020 Office equipment to be replaced in 5 years at an expected cost of $60,000. $60,000 20-Jan-2020 Bank loan approved and credited to account. Payable in 2023 $310,000 05-May-2020 Credit sales. EFT payment to be received in 90 days. $57,000 12-May-2020 Timesheets submitted for work performed. Payment to be made in 7 days. $6,900 07-June-2020 Cash sales. $30,500 08-Dec-2020 Credit sales. EFT payment to be received in 90 days. $39,000 25-Dec-2020 Timesheets submitted for work performed. Payment to be made in 7 days. $7,590 07-May-2021 Credit sales. EFT payment to be received in 90 days. $36,000 15-May-2021 Timesheets submitted for work performed. Payment to be made in 7 days. $9,700 18-May-2021 Cash sales. $99,000 11-June-2021 Used excess cash to make partial repayment on bank loan. $49,000 12-Dec-2021 Credit sales. EFT payment to be received in 90 days. $37,000 26-Dec-2021 Timesheets submitted for work performed. Payment to be made in 7 days. $10,670 11-May-2022 Credit sales. EFT payment to be received in 90 days. $60,000 18-May-2022 Timesheets submitted for work performed. Payment to be made in 7 days. $6,700 21-May-2022 Used excess cash to make partial repayment on bank loan. $36,500 15-June-2022 Cash sales. $49,000 17-Dec-2022 Credit sales. EFT payment to be received in 90 days. $26,000 31-Dec-2022 Timesheets submitted for work performed. Payment to be made in 7 days. $7370 Prepare the equity section of the 2021 balance sheet EQUITY Contributed capital Retained earnings $ 280,000 87,948 Total Equity S 367,948 Current liabilities section of the 2021 balance sheet Current Liabilities Income tax payable Wages payable Total current liabilities 24,789 10,670 35,459 $ Operating section of the 2022 cash flow statement Cash flows from operating activities Receipts from customers Payments to employees Payment for income tax Net cash provided from operating activities $ 146,000 (17,370) (24,789) $ 103,841