Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can uli please be assisted with this question thank you 4. Assume that the price of shares in the stock market is described by the

can uli please be assisted with this question

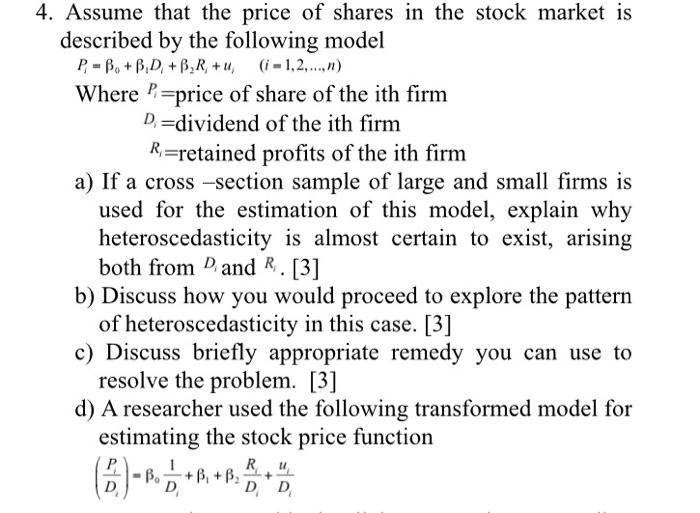

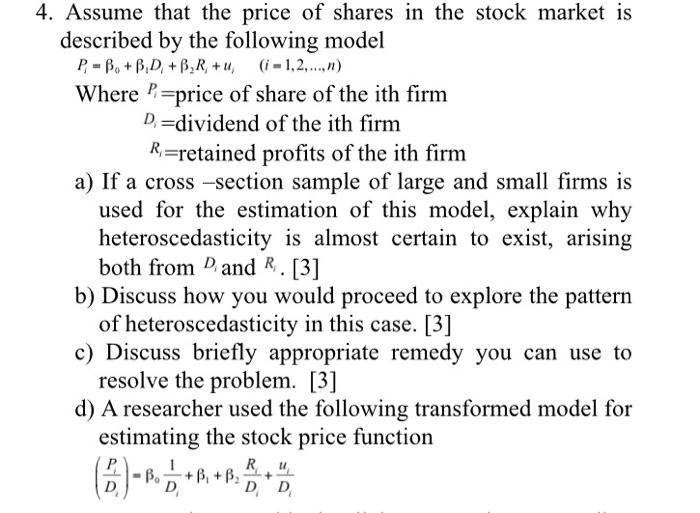

4. Assume that the price of shares in the stock market is described by the following model P - B + B, D + B,R+u, (i=1,2,...) Where P=price of share of the ith firm D=dividend of the ith firm R=retained profits of the ith firm a) If a cross section sample of large and small firms is used for the estimation of this model, explain why heteroscedasticity is almost certain to exist, arising both from and R. [3] b) Discuss how you would proceed to explore the pattern of heteroscedasticity in this case. [3] c) Discuss briefly appropriate remedy you can use to resolve the problem. [3] d) A researcher used the following transformed model for estimating the stock price function Bob +B+B. B. + D D R. " (6) - BOB + 4. Assume that the price of shares in the stock market is described by the following model P - B + B, D + B,R+u, (i=1,2,...) Where P=price of share of the ith firm D=dividend of the ith firm R=retained profits of the ith firm a) If a cross section sample of large and small firms is used for the estimation of this model, explain why heteroscedasticity is almost certain to exist, arising both from and R. [3] b) Discuss how you would proceed to explore the pattern of heteroscedasticity in this case. [3] c) Discuss briefly appropriate remedy you can use to resolve the problem. [3] d) A researcher used the following transformed model for estimating the stock price function Bob +B+B. B. + D D R. " (6) - BOB + thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started