Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can use as a down paym chasing a house that costs $185,000. You have $9,000 in cash that you offering a 30-year mont, but you

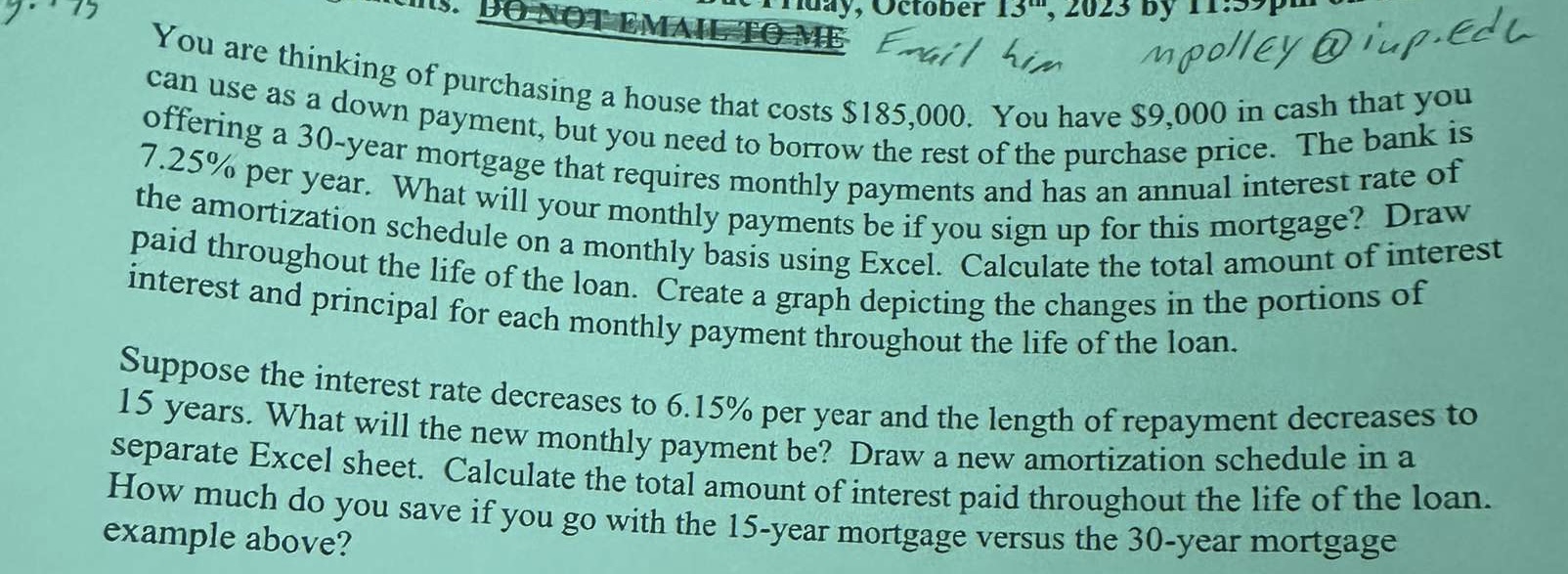

can use as a down paym chasing a house that costs $185,000. You have $9,000 in cash that you offering a 30-year mont, but you need to borrow the rest of the purchase price. The bank is 7.25% per year. Whortgage that requires monthly payments and has an annual interest rate of the amortization schat will your monthly payments be if you sign up for this mortgage? Draw paid throughout thedule on a monthly basis using Excel. Calculate the total amount of interest interest and princip life of the loan. Create a graph depicting the changes in the portions of monthly payment throughout the life of the loan. Suppose the interest rate decreases to 6.15% per year and the length of repayment decreases to 15 years. What will the new monthly payment be? Draw a new amortization schedule in a separate Excel sheet. Calculate the total amount of interest paid throughout the life of the loan. How much do you save if you go with the 15 -year mortgage versus the 30 -year mortgage example above

can use as a down paym chasing a house that costs $185,000. You have $9,000 in cash that you offering a 30-year mont, but you need to borrow the rest of the purchase price. The bank is 7.25% per year. Whortgage that requires monthly payments and has an annual interest rate of the amortization schat will your monthly payments be if you sign up for this mortgage? Draw paid throughout thedule on a monthly basis using Excel. Calculate the total amount of interest interest and princip life of the loan. Create a graph depicting the changes in the portions of monthly payment throughout the life of the loan. Suppose the interest rate decreases to 6.15% per year and the length of repayment decreases to 15 years. What will the new monthly payment be? Draw a new amortization schedule in a separate Excel sheet. Calculate the total amount of interest paid throughout the life of the loan. How much do you save if you go with the 15 -year mortgage versus the 30 -year mortgage example above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started