Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can use excel function 1 MULTIPLE-CHOICE PROBLEMS Ample of wiple choice problems is provided below Additional multiple choice pri are anailable at money-education.com by accessing

can use excel function

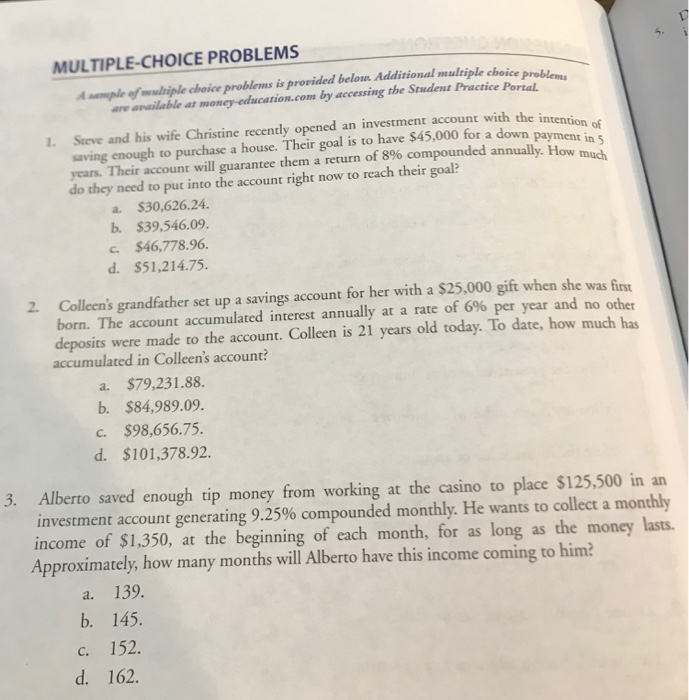

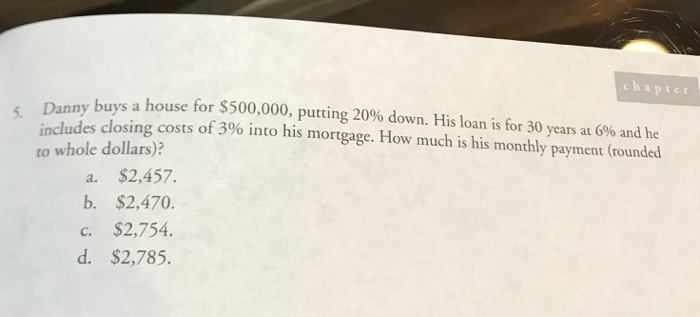

1 MULTIPLE-CHOICE PROBLEMS Ample of wiple choice problems is provided below Additional multiple choice pri are anailable at money-education.com by accessing the Student Practice Portal with the intention of o for a down payment in 5 1. Steve and his wife Christine recently opened an investment account with the inte saving enough to purchase a house. Their goal is to have $45,000 for a down pay years. Their account will guarantee them a return of 8% compounded annually. How do they need to put into the account right now to reach their goal? a $30,626.24. b. $39,546.09. c. $46,778.96. d. $51,214.75. 2. Colleen's grandfather set up a savings account for her with a $25,000 gift when she was first born. The account accumulated interest annually at a rate of 6% per year and no other deposits were made to the account. Colleen is 21 years old today. To date, how much has accumulated in Colleen's account? a $79,231.88. b. $84,989.09. C. $98,656.75. d. $101,378.92. 3. Alberto saved enough tip money from working at the casino to place $125,500 in an investment account generating 9.25% compounded monthly. He wants to collect a monthly income of $1,350, at the beginning of each month, for as long as the money lasts. Approximately, how many months will Alberto have this income coming to him? a. 139. b. 145. C. 152. d. 162. chapter 5. Danny buys a house for $500.0 buys a house for $500,000, putting 20% down. His loan is for 30 years at 6% and he dudes closing costs of 3% into his mortgage. How much is his monthly payment (rounded to whole dollars)? a. $2,457. b. $2,470. C. $2,754. d. $2,785 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started