Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can we analyze this annual report financially using the financial ratios , such as current ratio , quick ratio , average collection period , total

can we analyze this annual report financially using the financial ratios , such as current ratio , quick ratio , average collection period , total assets turnover , dept ratio , net profit margin , return on total asset , return on total equity , net profit margin , operating profit margin , earnings per share , market ratio , and

decide if it is good to invest in this bank , the bank is TNB Bank the analuze is for 1 year 2022

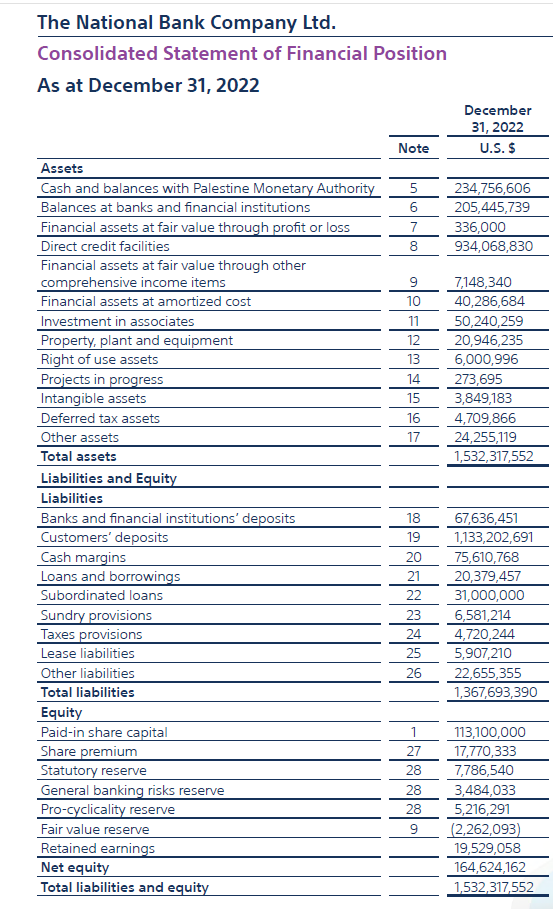

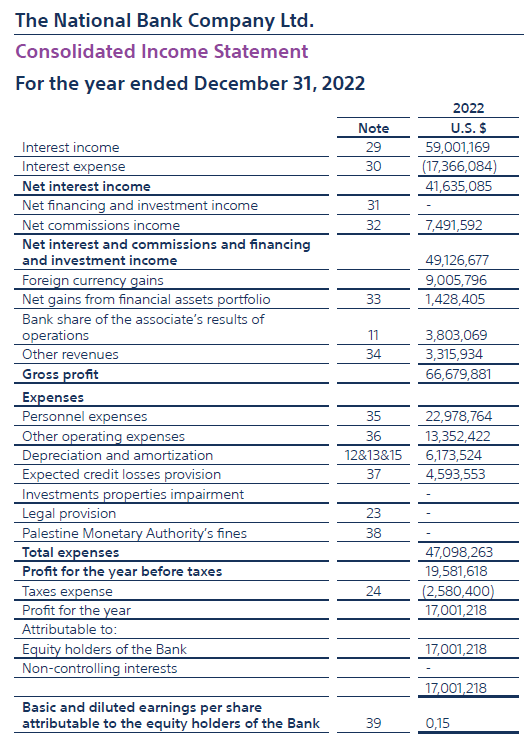

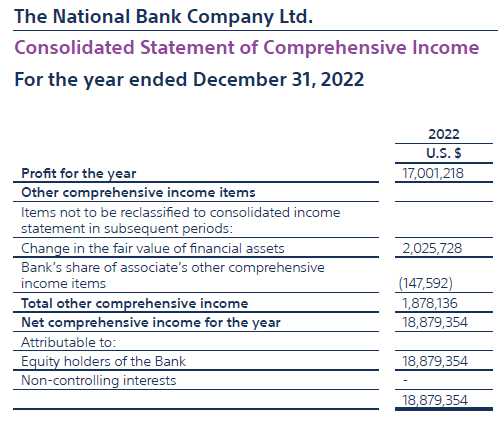

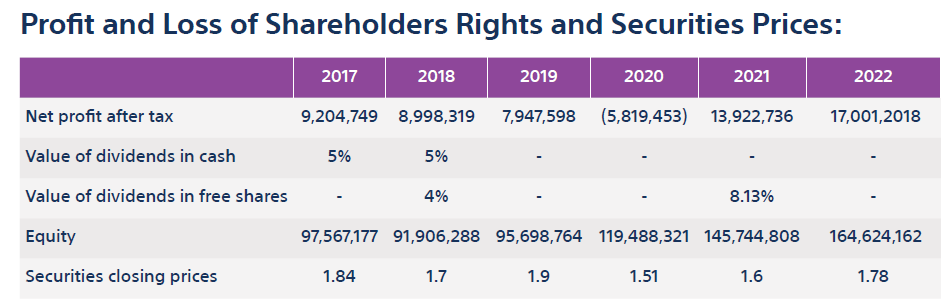

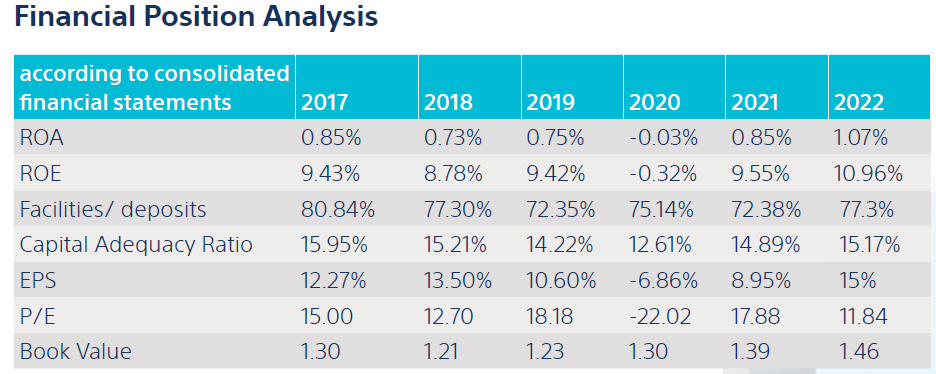

Total Assets \\[ 1,532 \\] Total Deposits \\[ 1,209 \\] Total Liabilities \\[ 934 \\] The National Bank Company Ltd. Consolidated Statement of Financial Position As at December 31, 2022 Profit and Loss of Shareholders Rights and Securities Prices: Financial Position Analysis The National Bank Company Ltd. Consolidated Statement of Comprehensive Income For the year ended December 31, 2022 The National Bank Company Ltd. Consolidated Income Statement For the year ended December 31, 2022 Net Profit 17 million \\$ Growth rate \100 * Profits attributable to TNB shareholders* The National Bank achieved historical results. By the end of 2022, it achieved a net profit of \\( \\$ 17 \\) million, bringing the profits attributable to TNB shareholders to \100 growth rate. The positive growth indicators of TNB continued in 2022, thus continuing the bank's progress and success. TNB achieved excellent financial outcomes and remarkable progress in its performance, growth, operation and profitability. This reflects the successful implementation of its development plans and strategy. TNB managed to maintain its competitiveness among Palestinian banks, with an \\( \\$ 8.5 \\) million capital increase in 2022, thereby increasing the paid-up capital from \\( \\$ 104.6 \\) million to \\$113.1 million. TNB therefore became the second largest Palestinian bank in terms of paid-up capital and market value, which increased by more than \20 to \\( \\$ 201.3 \\) million at the end of 2022. Capital Adequacy Ratio \15.17 Higher than local and global requirement Paid-Up Capital 113.1 million \\$ second largest Palestinian bank in terms of paid-up capital

Total Assets \\[ 1,532 \\] Total Deposits \\[ 1,209 \\] Total Liabilities \\[ 934 \\] The National Bank Company Ltd. Consolidated Statement of Financial Position As at December 31, 2022 Profit and Loss of Shareholders Rights and Securities Prices: Financial Position Analysis The National Bank Company Ltd. Consolidated Statement of Comprehensive Income For the year ended December 31, 2022 The National Bank Company Ltd. Consolidated Income Statement For the year ended December 31, 2022 Net Profit 17 million \\$ Growth rate \100 * Profits attributable to TNB shareholders* The National Bank achieved historical results. By the end of 2022, it achieved a net profit of \\( \\$ 17 \\) million, bringing the profits attributable to TNB shareholders to \100 growth rate. The positive growth indicators of TNB continued in 2022, thus continuing the bank's progress and success. TNB achieved excellent financial outcomes and remarkable progress in its performance, growth, operation and profitability. This reflects the successful implementation of its development plans and strategy. TNB managed to maintain its competitiveness among Palestinian banks, with an \\( \\$ 8.5 \\) million capital increase in 2022, thereby increasing the paid-up capital from \\( \\$ 104.6 \\) million to \\$113.1 million. TNB therefore became the second largest Palestinian bank in terms of paid-up capital and market value, which increased by more than \20 to \\( \\$ 201.3 \\) million at the end of 2022. Capital Adequacy Ratio \15.17 Higher than local and global requirement Paid-Up Capital 113.1 million \\$ second largest Palestinian bank in terms of paid-up capital Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started