Question

Can you advise which in the dropdown is the debit and which is the credit? Nature Gnome Company is a service based company that rents

Can you advise which in the dropdown is the debit and which is the credit?

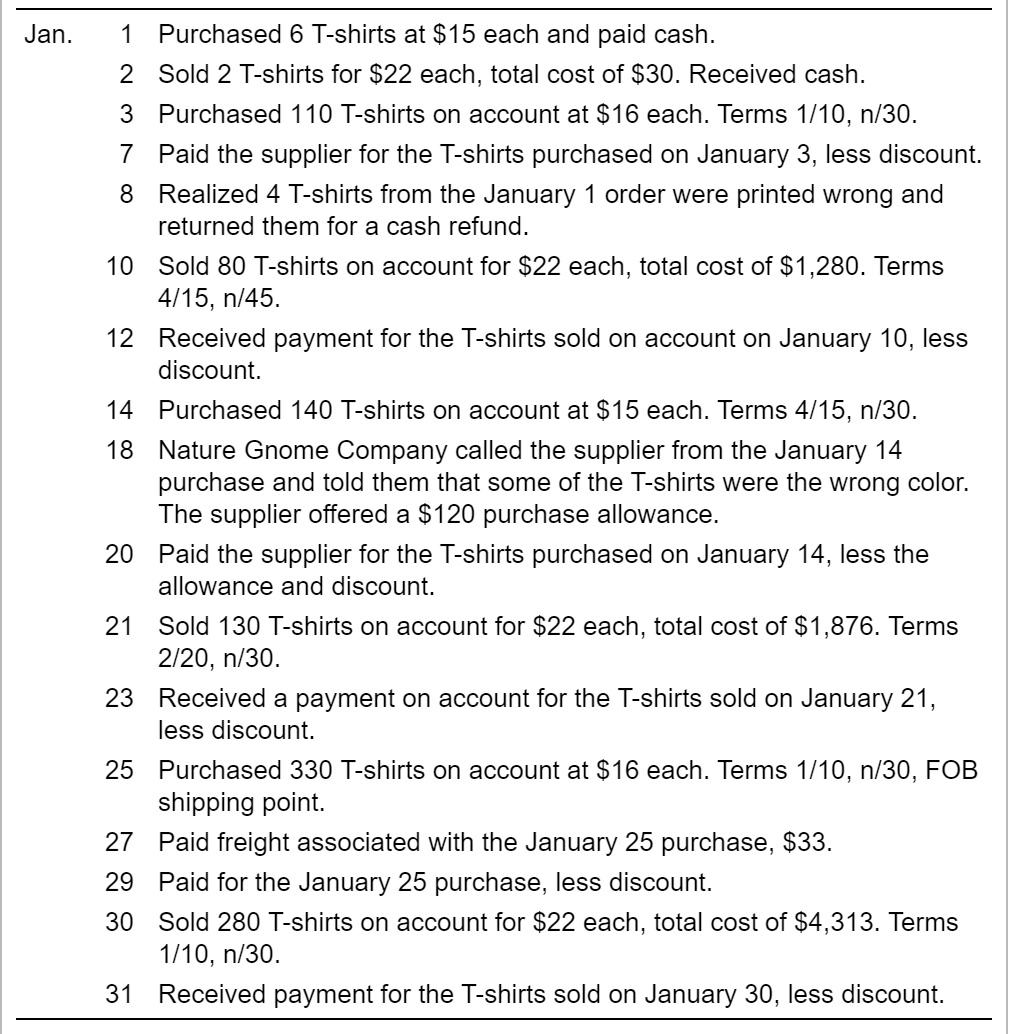

Nature Gnome Company is a service based company that rents for use on local lakes and rivers. At the beginning of the new year, NGC decided to carry and sell T-shirts with its logo printed on them. NGC uses the perpetual inventory system to account for the inventory. During January 2019, NGC completed the following merchandise transactions:

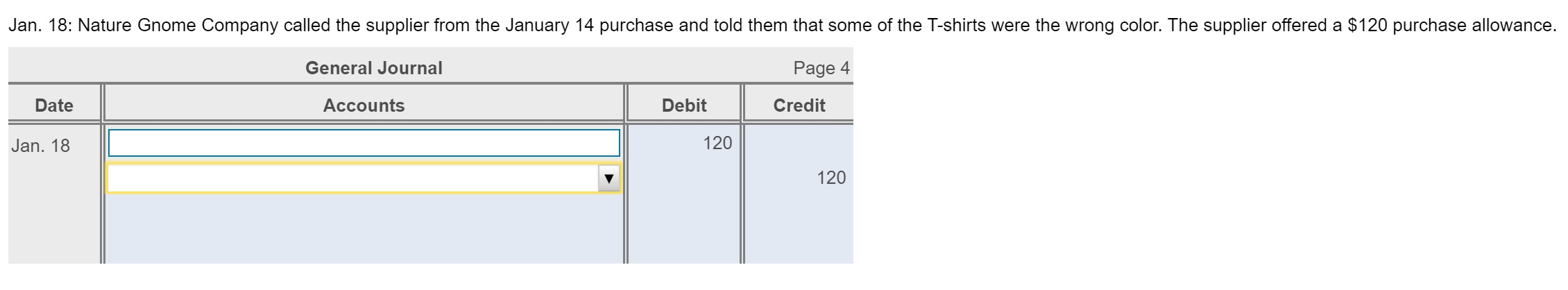

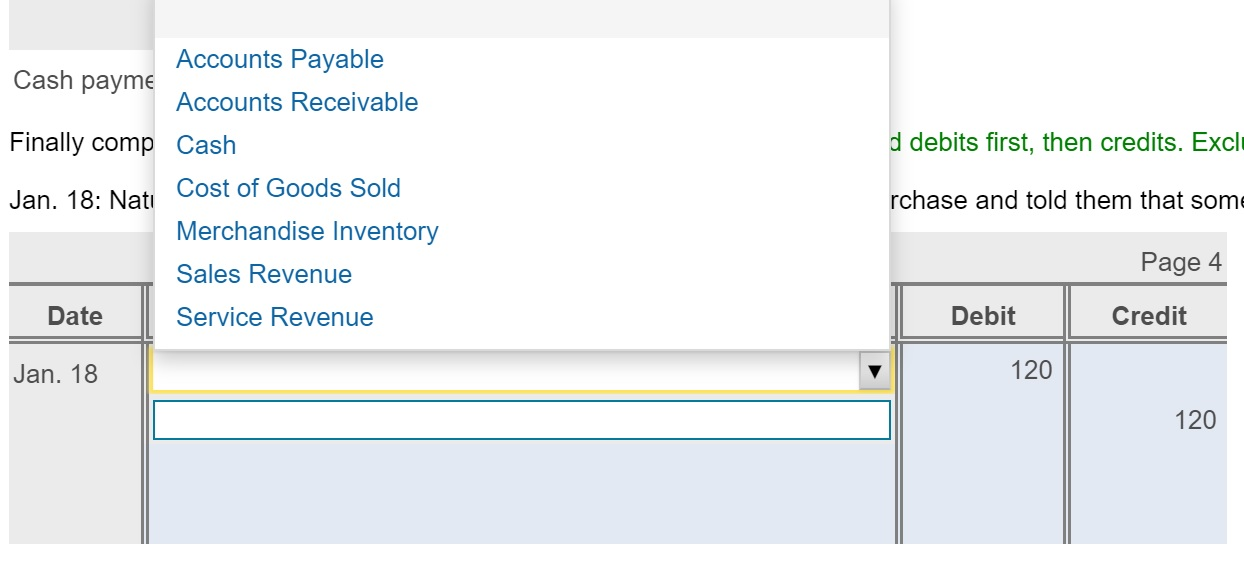

To confirm, I only need the answer to which of the dropdowns is the debit for $120 and which of the dropdowns is the credit for $120 based on the January 18th transaction.

Jan. 18: Nature Gnome Company called the supplier from the January 14 purchase and told them that some of the T-shirts were the wrong color. The supplier offered a $120 purchase allowance. General Journal Page 4 Date Accounts Debit Credit Jan. 18 120 120 Cash payme Accounts Payable Accounts Receivable d debits first, then credits. Excl rchase and told them that some Finally comp Cash Cost of Goods Sold Jan. 18: Nati Merchandise Inventory Sales Revenue Date Service Revenue Page 4 Debit Credit Jan. 18 120 120 Jan. 1 Purchased 6 T-shirts at $15 each and paid cash. 2 Sold 2 T-shirts for $22 each, total cost of $30. Received cash. 3 Purchased 110 T-shirts on account at $16 each. Terms 1/10, n/30. 7 Paid the supplier for the T-shirts purchased on January 3, less discount. 8 Realized 4 T-shirts from the January 1 order were printed wrong and returned them for a cash refund. 10 Sold 80 T-shirts on account for $22 each, total cost of $1,280. Terms 4/15, n/45. 12 Received payment for the T-shirts sold on account on January 10, less discount. 14 Purchased 140 T-shirts on account at $15 each. Terms 4/15, n/30. 18 Nature Gnome Company called the supplier from the January 14 purchase and told them that some of the T-shirts were the wrong color. The supplier offered a $120 purchase allowance. 20 Paid the supplier for the T-shirts purchased on January 14, less the allowance and discount. 21 Sold 130 T-shirts on account for $22 each, total cost of $1,876. Terms 2/20, n/30. 23 Received a payment on account for the T-shirts sold on January 21, less discount. 25 Purchased 330 T-shirts on account at $16 each. Terms 1/10, n/30, FOB shipping point. 27 Paid freight associated with the January 25 purchase, $33. 29 Paid for the January 25 purchase, less discount. 30 Sold 280 T-shirts on account for $22 each, total cost of $4,313. Terms 1/10, n/30. 31 Received payment for the T-shirts sold on January 30, less discountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started