Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you answer C,D and E please QUESTION 1 Winter Company uses a job costing system at its plant. The plant has two production departments

can you answer C,D and E please

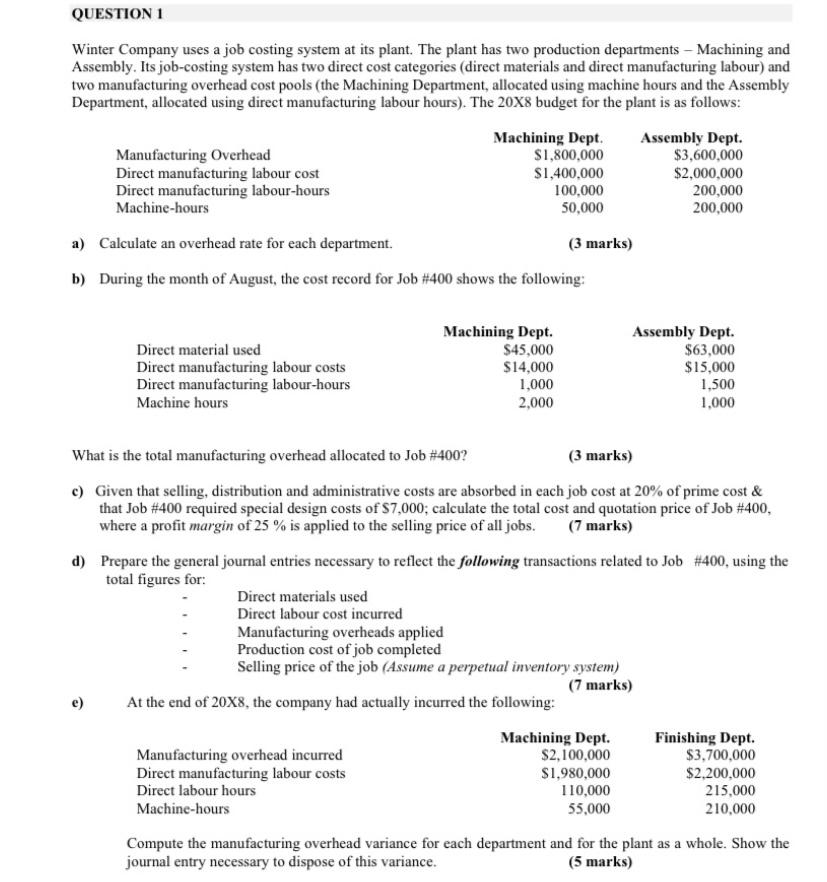

QUESTION 1 Winter Company uses a job costing system at its plant. The plant has two production departments - Machining and Assembly. Its job-costing system has two direct cost categories (direct materials and direct manufacturing labour) and two manufacturing overhead cost pools (the Machining Department, allocated using machine hours and the Assembly Department, allocated using direct manufacturing labour hours). The 20X8 budget for the plant is as follows: Machining Dept. Assembly Dept. Manufacturing Overhead $1,800,000 $3,600,000 Direct manufacturing labour cost $1,400.000 $2,000,000 Direct manufacturing labour-hours 100.000 200,000 Machine-hours 50,000 200,000 a) Calculate an overhead rate for each department. (3 marks) b) During the month of August, the cost record for Job #400 shows the following: Direct material used Direct manufacturing labour costs Direct manufacturing labour-hours Machine hours Machining Dept. $45,000 $14,000 1,000 2,000 Assembly Dept. $63,000 $15,000 1,500 1,000 What is the total manufacturing overhead allocated to Job #400? (3 marks) c) Given that selling, distribution and administrative costs are absorbed in each job cost at 20% of prime cost & that Job #400 required special design costs of $7,000, calculate the total cost and quotation price of Job #400, where a profit margin of 25 % is applied to the selling price of all jobs. (7 marks) d) Prepare the general journal entries necessary to reflect the following transactions related to Job #400, using the total figures for: Direct materials used Direct labour cost incurred Manufacturing overheads applied Production cost of job completed Selling price of the job (Assume a perpetual inventory system) (7 marks) e) At the end of 20X8, the company had actually incurred the following: Machining Dept. Finishing Dept. Manufacturing overhead incurred $2,100,000 $3,700,000 Direct manufacturing labour costs $1,980,000 $2,200,000 Direct labour hours 110,000 215,000 Machine-hours 55,000 210,000 Compute the manufacturing overhead variance for each department and for the plant as a whole. Show the journal entry necessary to dispose of this varianceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started