Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you answer number 7 please 6) Ima Better just won $1.4 billion in the lottery. She can choose to take a) $775 million today,

Can you answer number 7 please

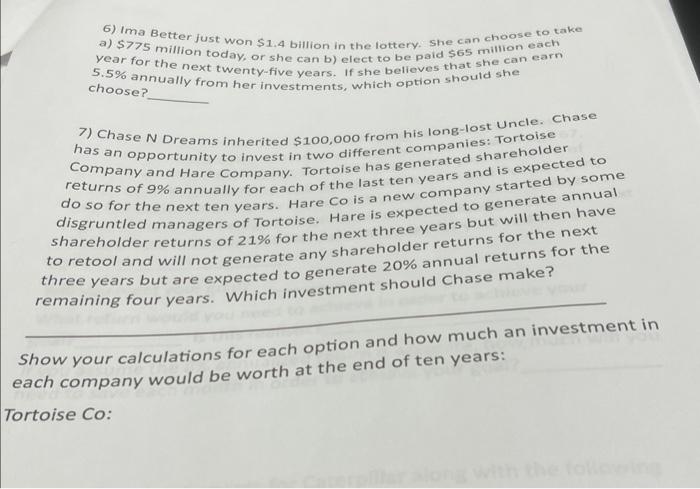

6) Ima Better just won $1.4 billion in the lottery. She can choose to take a) $775 million today, or she can b) elect to be paid $65 million each year for the next twenty-five years. If she belleves that she can earn 5.5% annually from her investments, which option should she choose? 7) Chase N Dreams inherited $100,000 from his long-lost Uncle. Chase has an opportunity to invest in two different companies: Tortoise Company and Hare Company. Tortoise has generated shareholder returns of 9% annually for each of the last ten years and is expected to do so for the next ten years. Hare co is a new company started by some disgruntled managers of Tortoise. Hare is expected to generate annual shareholder returns of 21% for the next three years but will then have to retool and will not generate any shareholder returns for the next three years but are expected to generate 20% annual returns for the remaining four years. Which investment should chase make? Show your calculations for each option and how much an investment in each company would be worth at the end of ten years: ortoise CoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started