Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you answer only 3 to 9 thanks 1. Explain the concept of a di-liquidating loan. Indicare how the time patterns of earnings for our-

Can you answer only 3 to 9 thanks

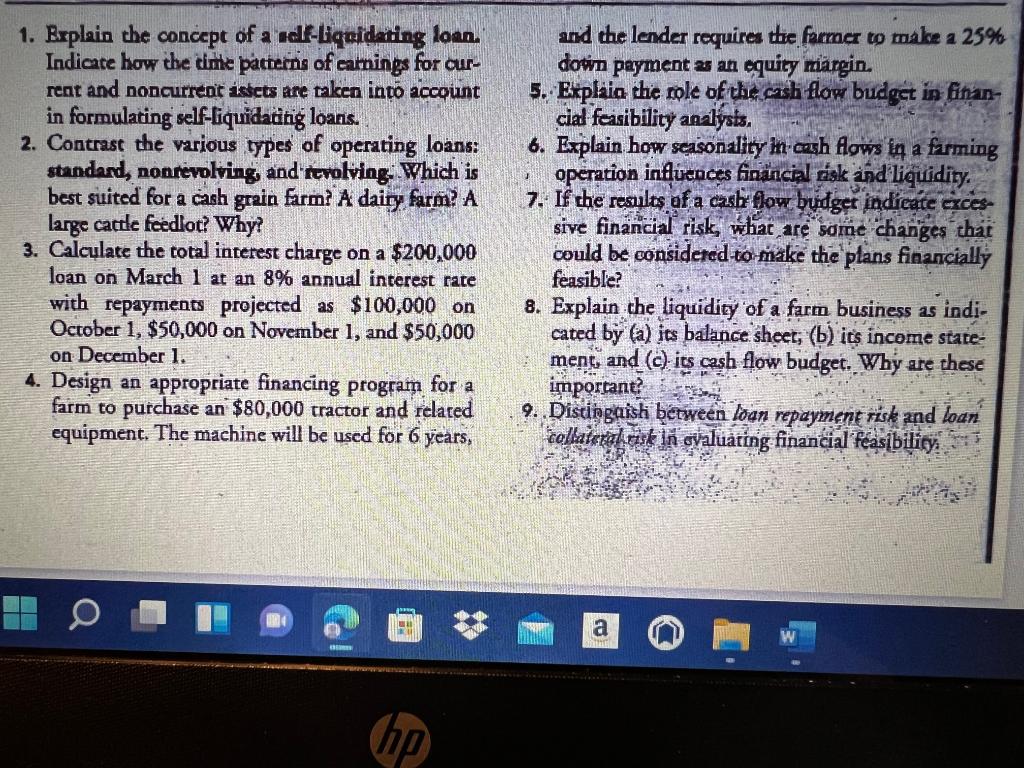

1. Explain the concept of a di-liquidating loan. Indicare how the time patterns of earnings for our- rent and noncurrent issets are taken into account in formulating self-liquidating loans. 2. Contrast the various types of operating loans: standard, nontevolving, and ttvolving. Which is best suited for a cash grain farm? A dairy farm? A large cattle feedlot? Why? 3. Calculate the total interest charge on a $200,000 loan on March 1 at an 8% annual interest rate with repayments projected as $100,000 on October 1, $50,000 on November 1, and $50,000 on December 1. 4. Design an appropriate financing program for a farm to purchase an $80,000 tractor and related equipment. The machine will be used for 6 years, and the lender requires the farmer to make a 25% down payment an equity margin. 5. Explain the role of the cash flow budget in finan- cial feasibility analysts. 6. Explain how seasonality in cash flows in a farming operation influences financial isk ind liquidity. 7. If the results of a cash flow budget indicate exces- sive financial risk, what are some changes that could be considered to make the plans financially feasible? 8. Explain the liquidity of a farm business as indi- cated by (a) its balance sheet, (b) its income state- ment, and (c) its cash flow budget. Why are these important? 9. Distingaish between loan repayment risk and loan collateral risk in evaluating financial feasibility a hp 1. Explain the concept of a di-liquidating loan. Indicare how the time patterns of earnings for our- rent and noncurrent issets are taken into account in formulating self-liquidating loans. 2. Contrast the various types of operating loans: standard, nontevolving, and ttvolving. Which is best suited for a cash grain farm? A dairy farm? A large cattle feedlot? Why? 3. Calculate the total interest charge on a $200,000 loan on March 1 at an 8% annual interest rate with repayments projected as $100,000 on October 1, $50,000 on November 1, and $50,000 on December 1. 4. Design an appropriate financing program for a farm to purchase an $80,000 tractor and related equipment. The machine will be used for 6 years, and the lender requires the farmer to make a 25% down payment an equity margin. 5. Explain the role of the cash flow budget in finan- cial feasibility analysts. 6. Explain how seasonality in cash flows in a farming operation influences financial isk ind liquidity. 7. If the results of a cash flow budget indicate exces- sive financial risk, what are some changes that could be considered to make the plans financially feasible? 8. Explain the liquidity of a farm business as indi- cated by (a) its balance sheet, (b) its income state- ment, and (c) its cash flow budget. Why are these important? 9. Distingaish between loan repayment risk and loan collateral risk in evaluating financial feasibility a hpStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started