Answered step by step

Verified Expert Solution

Question

1 Approved Answer

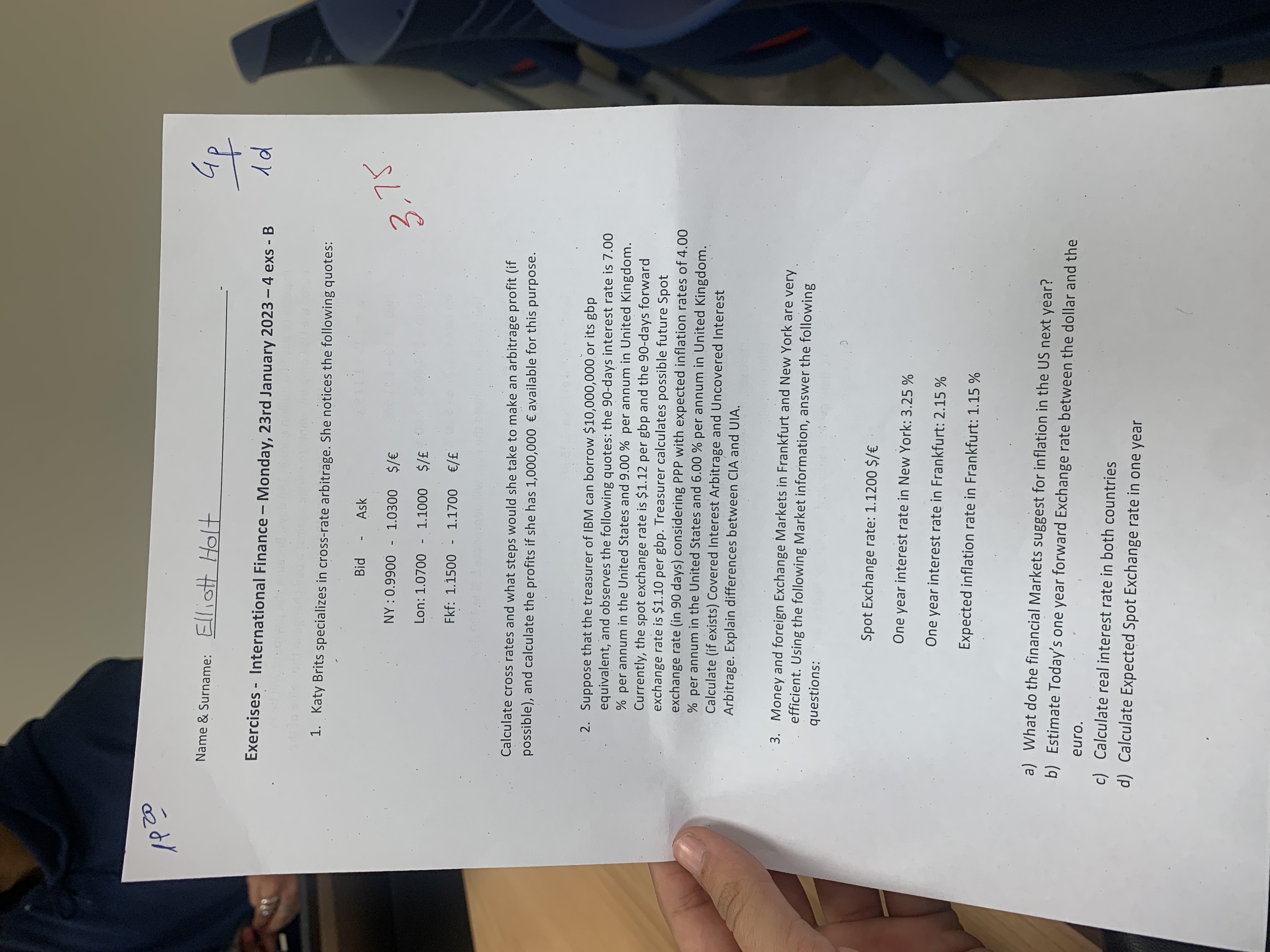

Can you answer question 3 please Exercises - International Finance - Monday, 23rd January 2023 - 4 exs - B 1. Katy Brits specializes in

Can you answer question 3 please

Exercises - International Finance - Monday, 23rd January 2023 - 4 exs - B 1. Katy Brits specializes in cross-rate arbitrage. She notices the following quotes: BidAskNY:0.99001.0300$/Lon:1.07001.1000$/Fkf:1.15001.1700/ 3 Calculate cross rates and what steps would she take to make an arbitrage profit (if possible), and calculate the profits if she has 1,000,000 available for this purpose. 2. Suppose that the treasurer of IBM can borrow $10,000,000 or its gbp equivalent, and observes the following quotes: the 90-days interest rate is 7.00 \% per annum in the United States and 9.00% per annum in United Kingdom. Currently, the spot exchange rate is $1.12 per gbp and the 90 -days forward exchange rate is $1.10 per gbp. Treasurer calculates possible future Spot exchange rate (in 90 days) considering PPP with expected inflation rates of 4.00 \% per annum in the United States and 6.00% per annum in United Kingdom. Calculate (if exists) Covered Interest Arbitrage and Uncovered Interest Arbitrage. Explain differences between CIA and UIA. 3. Money and foreign Exchange Markets in Frankfurt and New York are very efficient. Using the following Market information, answer the following questions: Spot Exchange rate: 1.1200$/ One year interest rate in New York: 3.25% One year interest rate in Frankfurt: 2.15% Expected inflation rate in Frankfurt: 1.15% a) What do the financial Markets suggest for inflation in the US next year? b) Estimate Today's one year forward Exchange rate between the dollar and the euro. c) Calculate real interest rate in both countries d) Calculate Expected Spot Exchange rate in one yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started