Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you answer the question? Use the link below for help. https://www.canada.ca/en/revenue-agency/services/tax/individuals/frequently-asked-questions-individuals/adjustment-personal-income-tax-benefit-amounts.html It's February 28 and your parents, who are both over the age of

Can you answer the question? Use the link below for help.

https://www.canada.ca/en/revenue-agency/services/tax/individuals/frequently-asked-questions-individuals/adjustment-personal-income-tax-benefit-amounts.html

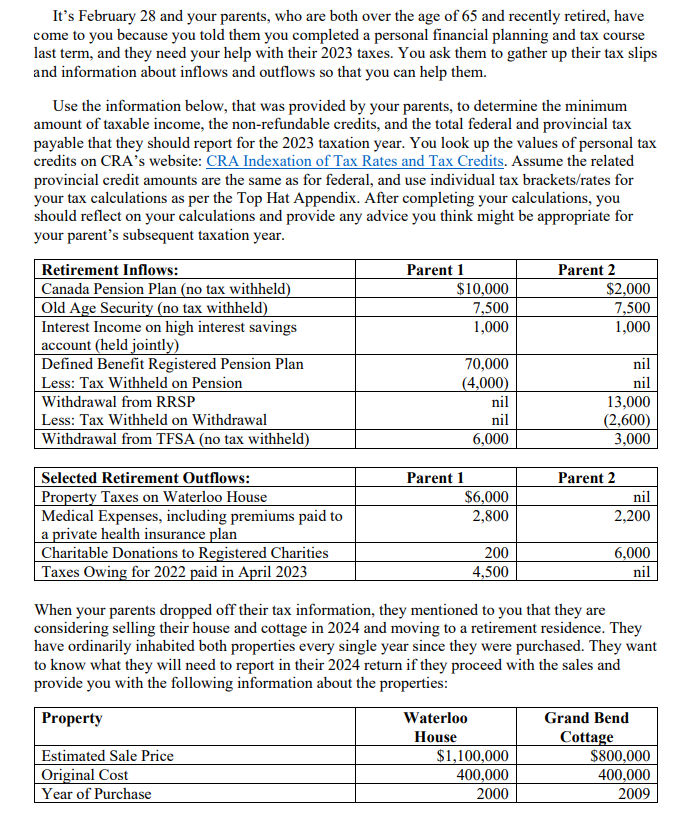

It's February 28 and your parents, who are both over the age of 65 and recently retired, have come to you because you told them you completed a personal financial planning and tax course last term, and they need your help with their 2023 taxes. You ask them to gather up their tax slips and information about inflows and outflows so that you can help them. Use the information below, that was provided by your parents, to determine the minimum amount of taxable income, the non-refundable credits, and the total federal and provincial tax payable that they should report for the 2023 taxation year. You look up the values of personal tax credits on CRA's website: CRA Indexation of Tax Rates and Tax Credits. Assume the related provincial credit amounts are the same as for federal, and use individual tax brackets/rates for your tax calculations as per the Top Hat Appendix. After completing your calculations, you should reflect on your calculations and provide any advice you think might be appropriate for your parent's subsequent taxation year. Retirement Inflows: Canada Pension Plan (no tax withheld) Old Age Security (no tax withheld) Interest Income on high interest savings account (held jointly) Defined Benefit Registered Pension Plan Less: Tax Withheld on Pension Withdrawal from RRSP Less: Tax Withheld on Withdrawal Withdrawal from TFSA (no tax withheld) Selected Retirement Outflows: Property Taxes on Waterloo House Medical Expenses, including premiums paid to a private health insurance plan Charitable Donations to Registered Charities Taxes Owing for 2022 paid in April 2023 Parent 1 $10,000 7,500 1,000 70,000 (4,000) Parent 1 nil nil 6,000 $6,000 2,800 Waterloo House 200 4,500 Parent 2 $1,100,000 400,000 2000 $2,000 7,500 1,000 13,000 (2,600) 3,000 Parent 2 nil nil nil 2,200 When your parents dropped off their tax information, they mentioned to you that they are considering selling their house and cottage in 2024 and moving to a retirement residence. They have ordinarily inhabited both properties every single year since they were purchased. They want to know what they will need to report in their 2024 return if they proceed with the sales and provide you with the following information about the properties: Property Estimated Sale Price Original Cost Year of Purchase 6,000 nil Grand Bend Cottage $800,000 400,000 2009

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To determine the minimum amount of taxable income nonrefundable credits and the total federal and provincial tax payable for your parents for the 2023 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started