Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you answer these question, without using the refrained earning and doing the calculations accurately? Like in previous answers I asked the calculations were not

Can you answer these question, without using the refrained earning and doing the calculations accurately? Like in previous answers I asked the calculations were not accurate however you hav eto balanace the Assets= l+e

Please provide all the calculations for explanation purposes.

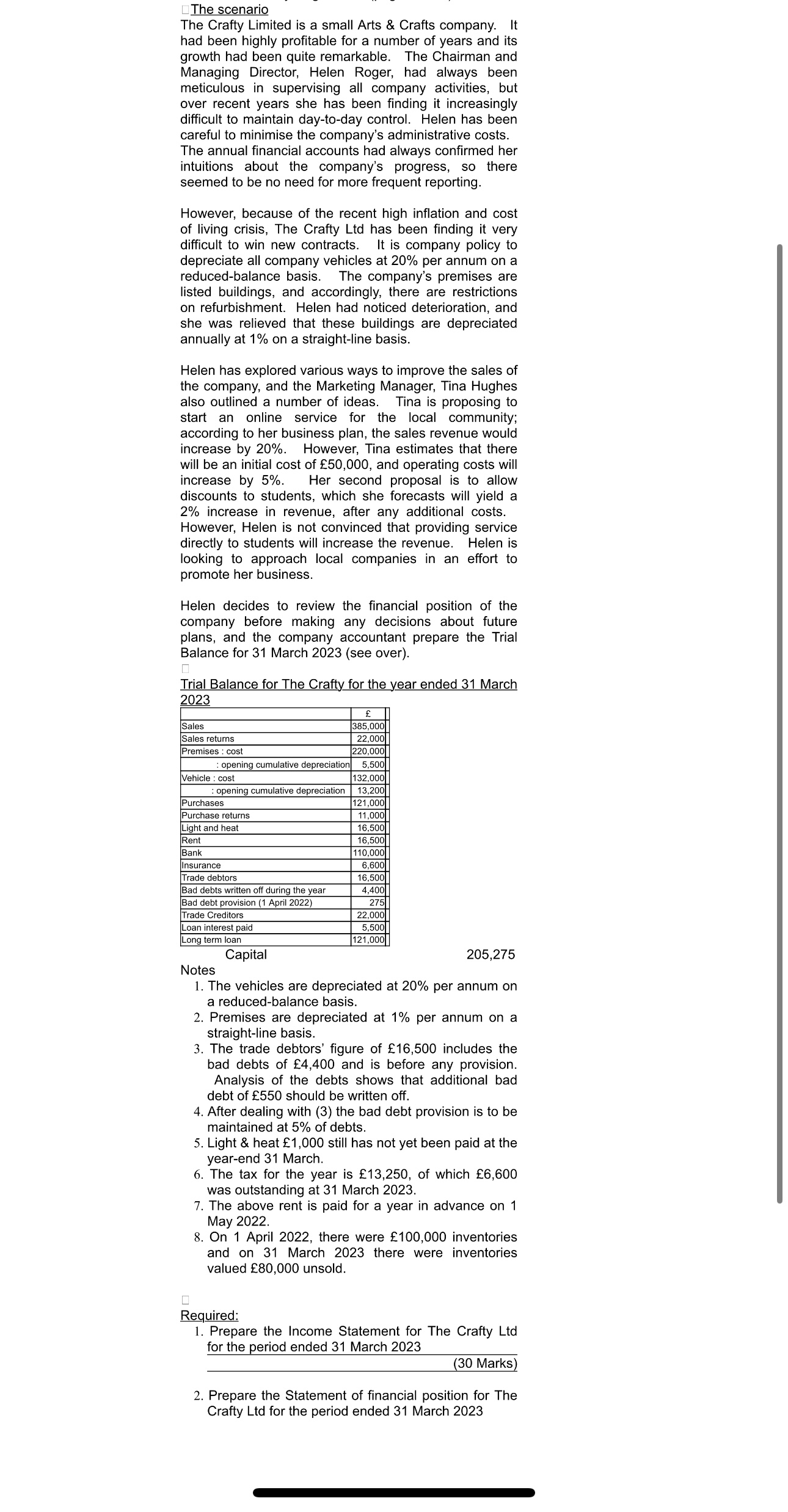

The Crafty Limited is a small Arts \& Crafts company. It had been highly profitable for a number of years and its growth had been quite remarkable. The Chairman and Managing Director, Helen Roger, had always been meticulous in supervising all company activities, but over recent years she has been finding it increasingly difficult to maintain day-to-day control. Helen has been careful to minimise the company's administrative costs. The annual financial accounts had always confirmed her intuitions about the company's progress, so there seemed to be no need for more frequent reporting. However, because of the recent high inflation and cost of living crisis, The Crafty Ltd has been finding it very difficult to win new contracts. It is company policy to depreciate all company vehicles at 20% per annum on a reduced-balance basis. The company's premises are listed buildings, and accordingly, there are restrictions on refurbishment. Helen had noticed deterioration, and she was relieved that these buildings are depreciated annually at 1% on a straight-line basis. Helen has explored various ways to improve the sales of the company, and the Marketing Manager, Tina Hughes also outlined a number of ideas. Tina is proposing to start an online service for the local community; according to her business plan, the sales revenue would increase by 20%. However, Tina estimates that there will be an initial cost of 50,000, and operating costs will increase by 5%. Her second proposal is to allow discounts to students, which she forecasts will yield a 2% increase in revenue, after any additional costs However, Helen is not convinced that providing service directly to students will increase the revenue. Helen is looking to approach local companies in an effort to promote her business. Helen decides to review the financial position of the company before making any decisions about future plans, and the company accountant prepare the Trial Balance for 31 March 2023 (see over). Trial Balance for The Crafty for the year ended 31 March n2 Notes 205,275 1. The vehicles are depreciated at 20% per annum on a reduced-balance basis. 2. Premises are depreciated at 1% per annum on a straight-line basis. 3. The trade debtors' figure of 16,500 includes the bad debts of 4,400 and is before any provision. Analysis of the debts shows that additional bad debt of 550 should be written off. 4. After dealing with (3) the bad debt provision is to be maintained at 5% of debts. 5. Light \& heat 1,000 still has not yet been paid at the year-end 31 March. 6. The tax for the year is 13,250, of which 6,600 was outstanding at 31 March 2023. 7. The above rent is paid for a year in advance on 1 May 2022. 8. On 1 April 2022, there were 100,000 inventories and on 31 March 2023 there were inventories valued 80,000 unsold. Required: 1. Prepare the Income Statement for The Crafty Ltd for the period ended 31 March 2023 (30 Marks) 2. Prepare the Statement of financial position for The Crafty Ltd for the period ended 31 March 2023Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started