can you answer this please? with an explanation

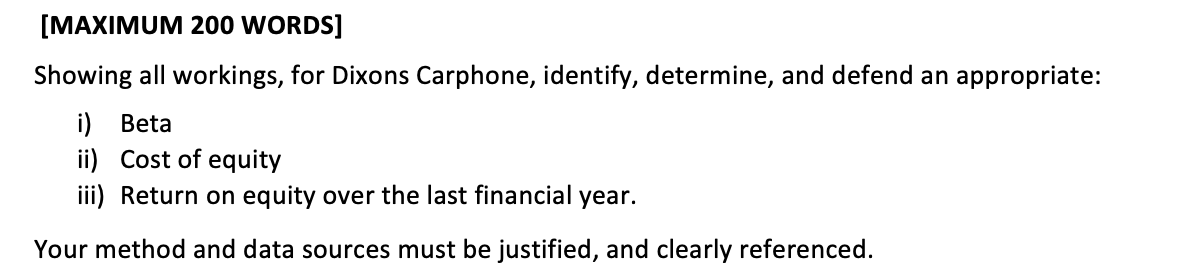

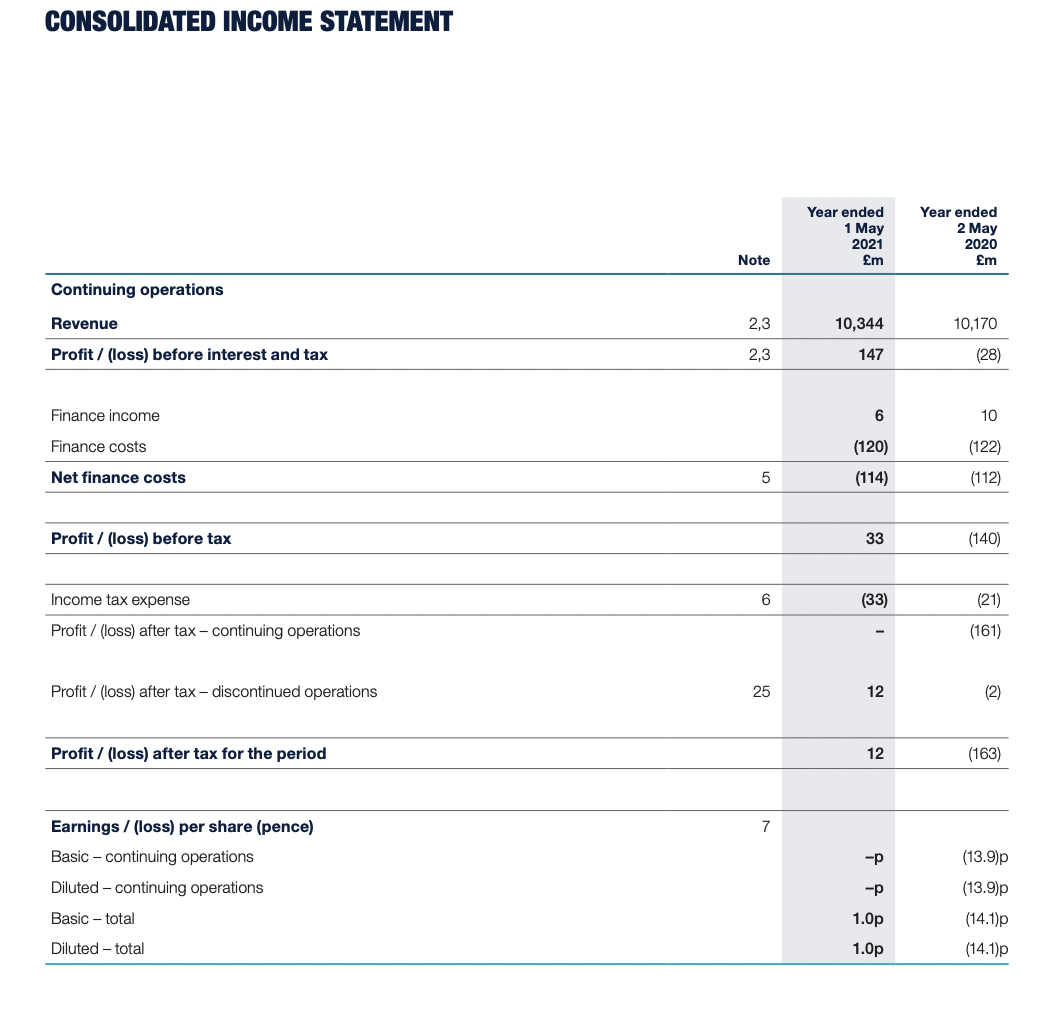

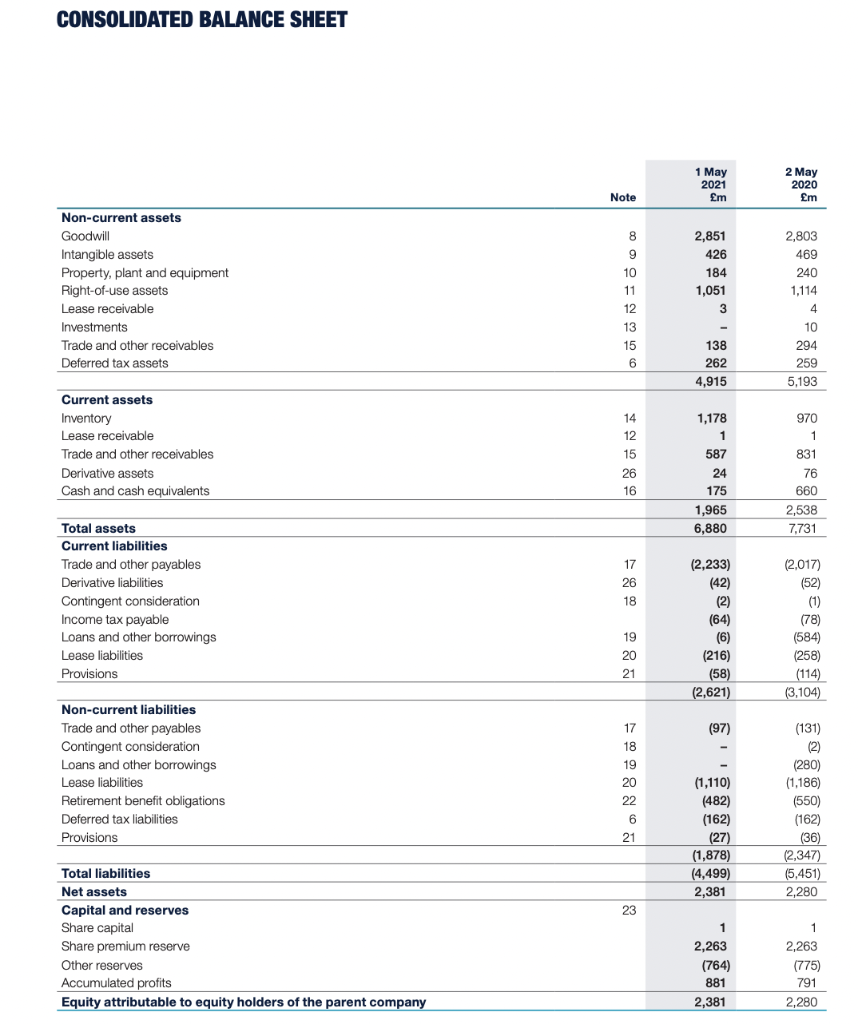

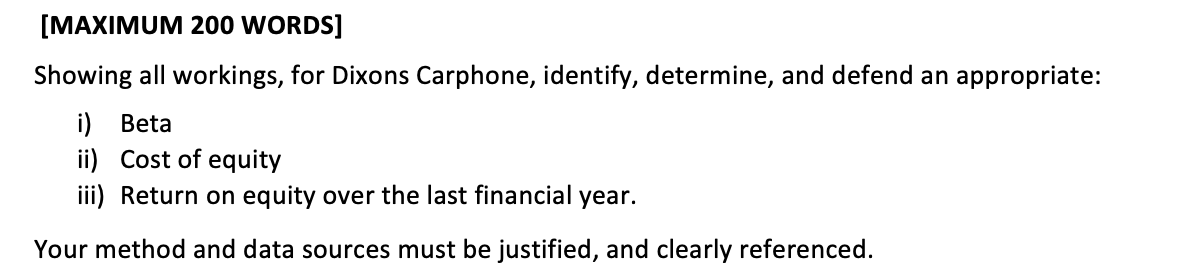

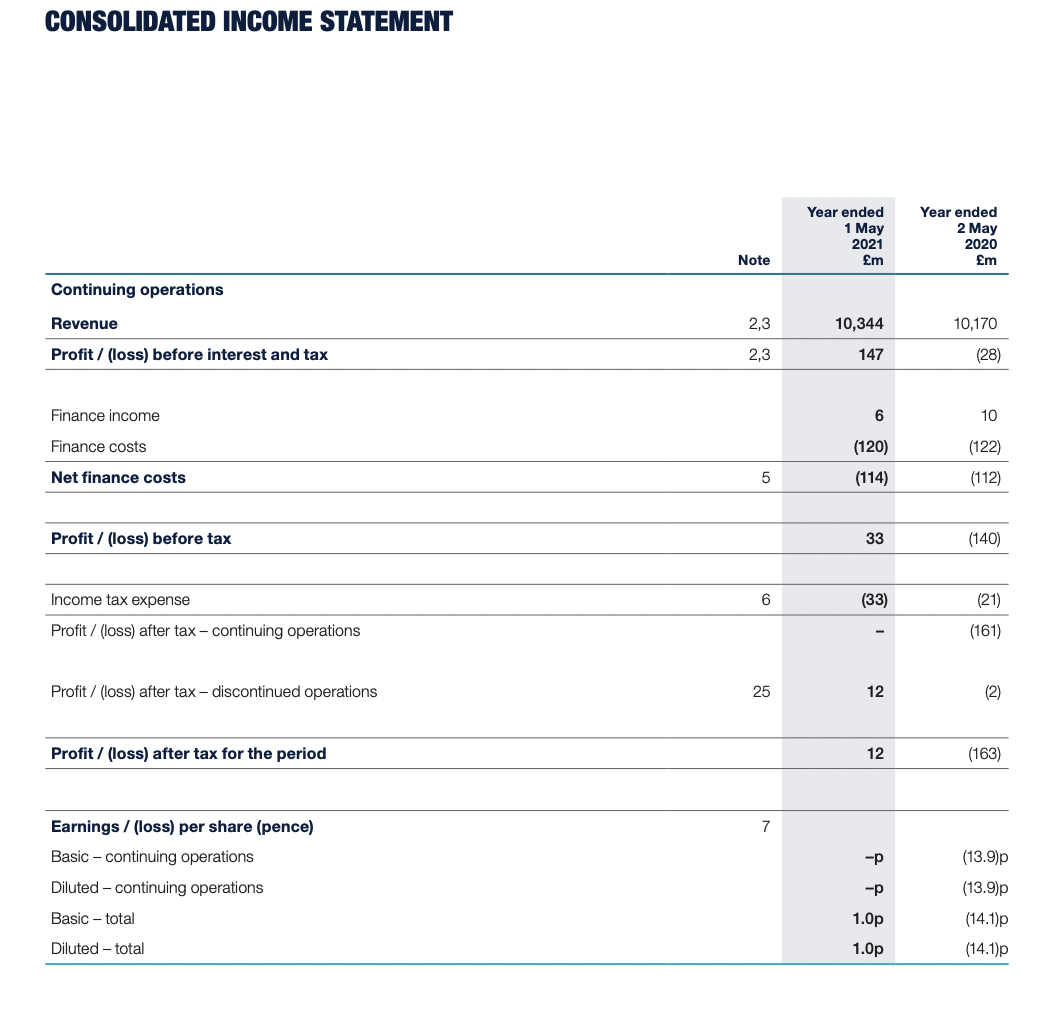

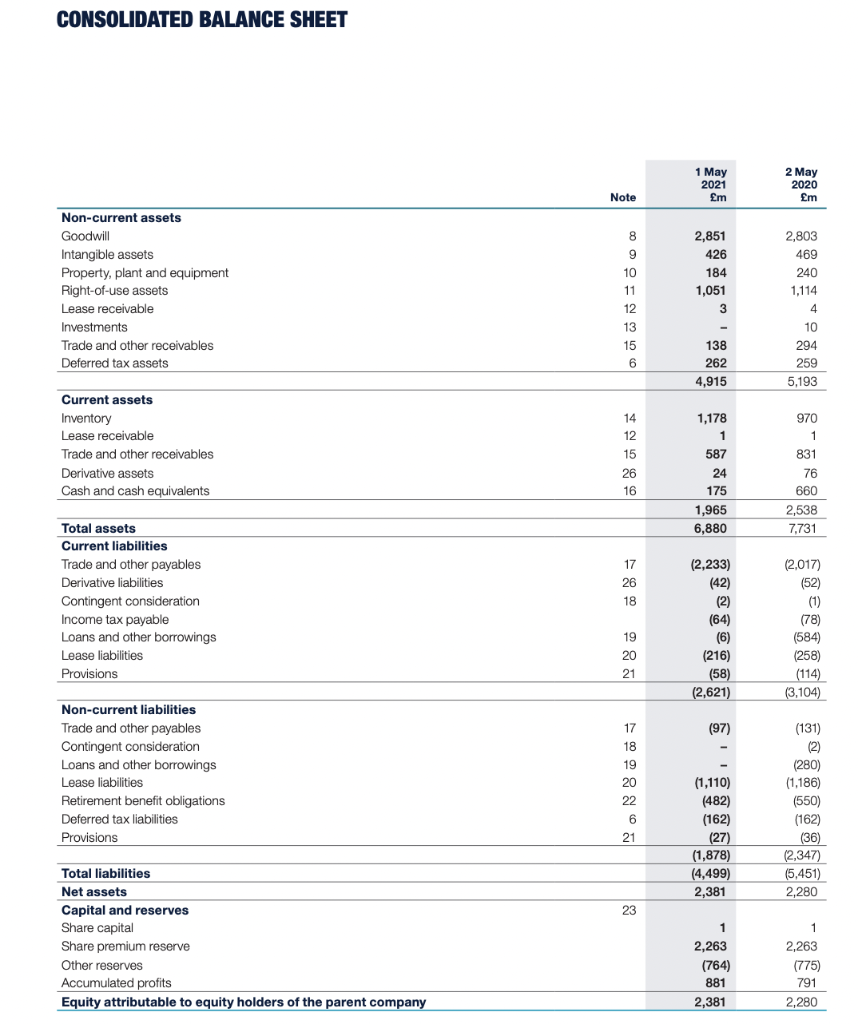

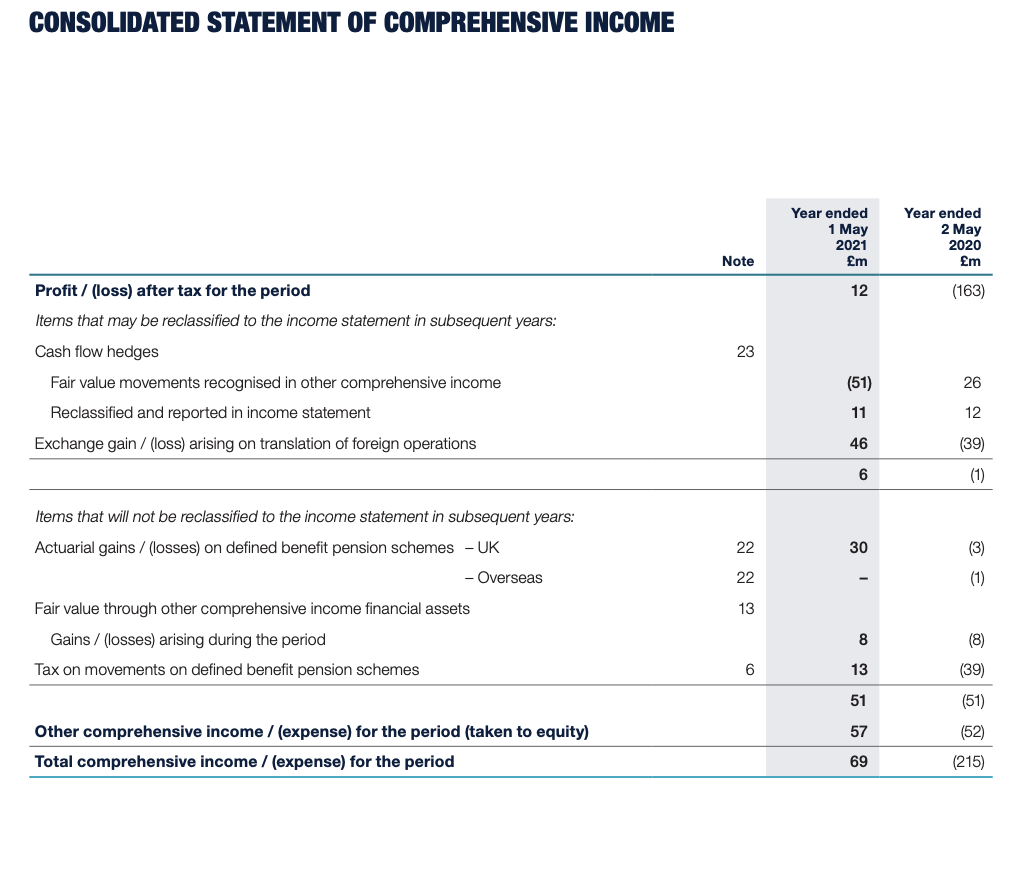

[MAXIMUM 200 WORDS] Showing all workings, for Dixons Carphone, identify, determine, and defend an appropriate: i) Beta ii) Cost of equity iii) Return on equity over the last financial year. Your method and data sources must be justified, and clearly referenced. CONSOLIDATED INCOME STATEMENT Year ended 1 May 2021 m Year ended 2 May 2020 m Note Continuing operations Revenue 2,3 10,344 10,170 Profit / (loss) before interest and tax 2,3 147 (28) Finance income 6 10 Finance costs (120) (122) (112) Net finance costs 5 (114) Profit/ (loss) before tax 33 (140) Income tax expense 6 (33) (21) Profit/ (loss) after tax - continuing operations (161) Profit/ (loss) after tax - discontinued operations 25 12 (2) Profit/ (loss) after tax for the period 12 (163) Earnings /(loss) per share (pence) Basic - continuing operations Diluted - continuing operations (13.9) PP Basic - total 1.0p (13.9)p (14.1)p (14.1)p Diluted - total 1.0p CONSOLIDATED BALANCE SHEET 1 May 2021 2 May 2020 Em Note m 8 Non-current assets Goodwill Intangible assets Property, plant and equipment Right-of-use assets Lease receivable Investments Trade and other receivables Deferred tax assets 2,851 426 184 1,051 3 3 2,803 469 240 1,114 9 10 11 12 13 15 4 138 10 294 259 5,193 6 262 4,915 14 12 Current assets Inventory Lease receivable Trade and other receivables Derivative assets Cash and cash equivalents 15 26 1,178 1 587 24 175 1,965 6,880 970 1 831 76 660 2,538 7,731 16 Total assets Current liabilities Trade and other payables Derivative liabilities Contingent consideration Income tax payable Loans and other borrowings Lease liabilities Provisions 17 26 18 (2,233) (42) (2) ( (64) (6) (216) (58) (2,621) (2,017) (52) (1) ( (78) (584) (258) (114) (3,104) 19 20 21 (97) Non-current liabilities Trade and other payables Contingent consideration Loans and other borrowings Lease liabilities Retirement benefit obligations Deferred tax liabilities Provisions 17 18 19 20 22 (131) ( (2) (280) (1,186) (550) (162) (36) (2,347) (5,451) 2,280 (1,110) (482) (162) (27) (1,878) (4,499) 2,381 6 21 23 Total liabilities Net assets Capital and reserves Share capital Share premium reserve Other reserves Accumulated profits Equity attributable to equity holders of the parent company 1 2,263 (764) 881 2,381 1 2,263 (775) 791 2,280 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Year ended 1 May 2021 m Year ended 2 May 2020 m Note 12 (163) 23 Profit/ (loss) after tax for the period Items that may be reclassified to the income statement in subsequent years: Cash flow hedges Fair value movements recognised in other comprehensive income Reclassified and reported in income statement Exchange gain / (loss) arising on translation of foreign operations (51) 26 11 12 46 (39) 6 (1) Items that will not be reclassified to the income statement in subsequent years: Actuarial gains / (losses) on defined benefit pension schemes - UK - Overseas 22 30 (3) 22 (1) 13 Fair value through other comprehensive income financial assets Gains/(losses) arising during the period Tax on movements on defined benefit pension schemes 8 (8) 6 6 13 (39) 51 (51) 57 Other comprehensive income / (expense) for the period (taken to equity) Total comprehensive income / (expense) for the period (52) (215) 69 [MAXIMUM 200 WORDS] Showing all workings, for Dixons Carphone, identify, determine, and defend an appropriate: i) Beta ii) Cost of equity iii) Return on equity over the last financial year. Your method and data sources must be justified, and clearly referenced. CONSOLIDATED INCOME STATEMENT Year ended 1 May 2021 m Year ended 2 May 2020 m Note Continuing operations Revenue 2,3 10,344 10,170 Profit / (loss) before interest and tax 2,3 147 (28) Finance income 6 10 Finance costs (120) (122) (112) Net finance costs 5 (114) Profit/ (loss) before tax 33 (140) Income tax expense 6 (33) (21) Profit/ (loss) after tax - continuing operations (161) Profit/ (loss) after tax - discontinued operations 25 12 (2) Profit/ (loss) after tax for the period 12 (163) Earnings /(loss) per share (pence) Basic - continuing operations Diluted - continuing operations (13.9) PP Basic - total 1.0p (13.9)p (14.1)p (14.1)p Diluted - total 1.0p CONSOLIDATED BALANCE SHEET 1 May 2021 2 May 2020 Em Note m 8 Non-current assets Goodwill Intangible assets Property, plant and equipment Right-of-use assets Lease receivable Investments Trade and other receivables Deferred tax assets 2,851 426 184 1,051 3 3 2,803 469 240 1,114 9 10 11 12 13 15 4 138 10 294 259 5,193 6 262 4,915 14 12 Current assets Inventory Lease receivable Trade and other receivables Derivative assets Cash and cash equivalents 15 26 1,178 1 587 24 175 1,965 6,880 970 1 831 76 660 2,538 7,731 16 Total assets Current liabilities Trade and other payables Derivative liabilities Contingent consideration Income tax payable Loans and other borrowings Lease liabilities Provisions 17 26 18 (2,233) (42) (2) ( (64) (6) (216) (58) (2,621) (2,017) (52) (1) ( (78) (584) (258) (114) (3,104) 19 20 21 (97) Non-current liabilities Trade and other payables Contingent consideration Loans and other borrowings Lease liabilities Retirement benefit obligations Deferred tax liabilities Provisions 17 18 19 20 22 (131) ( (2) (280) (1,186) (550) (162) (36) (2,347) (5,451) 2,280 (1,110) (482) (162) (27) (1,878) (4,499) 2,381 6 21 23 Total liabilities Net assets Capital and reserves Share capital Share premium reserve Other reserves Accumulated profits Equity attributable to equity holders of the parent company 1 2,263 (764) 881 2,381 1 2,263 (775) 791 2,280 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Year ended 1 May 2021 m Year ended 2 May 2020 m Note 12 (163) 23 Profit/ (loss) after tax for the period Items that may be reclassified to the income statement in subsequent years: Cash flow hedges Fair value movements recognised in other comprehensive income Reclassified and reported in income statement Exchange gain / (loss) arising on translation of foreign operations (51) 26 11 12 46 (39) 6 (1) Items that will not be reclassified to the income statement in subsequent years: Actuarial gains / (losses) on defined benefit pension schemes - UK - Overseas 22 30 (3) 22 (1) 13 Fair value through other comprehensive income financial assets Gains/(losses) arising during the period Tax on movements on defined benefit pension schemes 8 (8) 6 6 13 (39) 51 (51) 57 Other comprehensive income / (expense) for the period (taken to equity) Total comprehensive income / (expense) for the period (52) (215) 69