Answered step by step

Verified Expert Solution

Question

1 Approved Answer

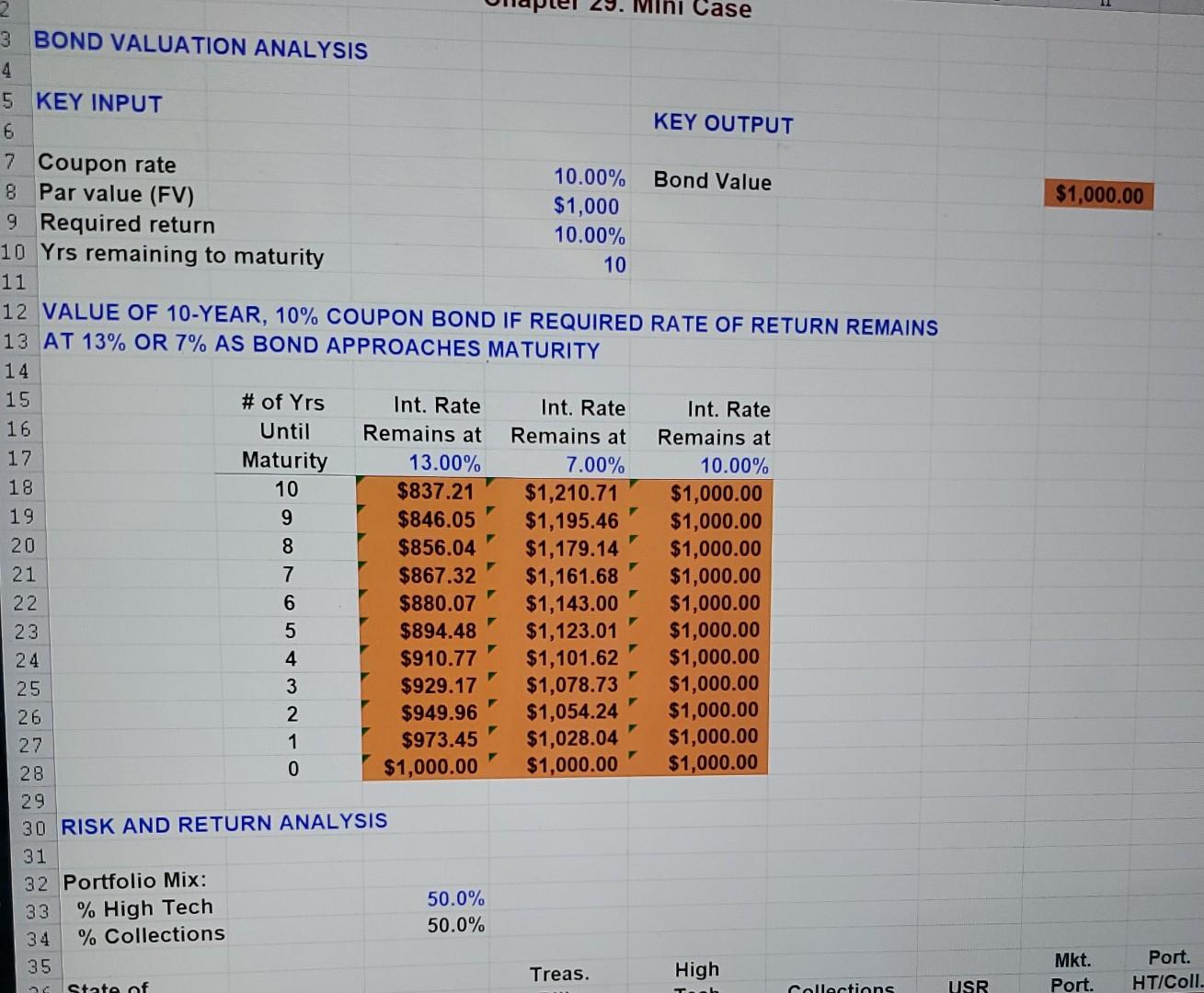

can you assist with the formulas for U.S Rubber Section and below? VALUE OF 10 -YEAR, 10% COUPON BOND IF REQUIRED RATE OF RETURN REMAINS

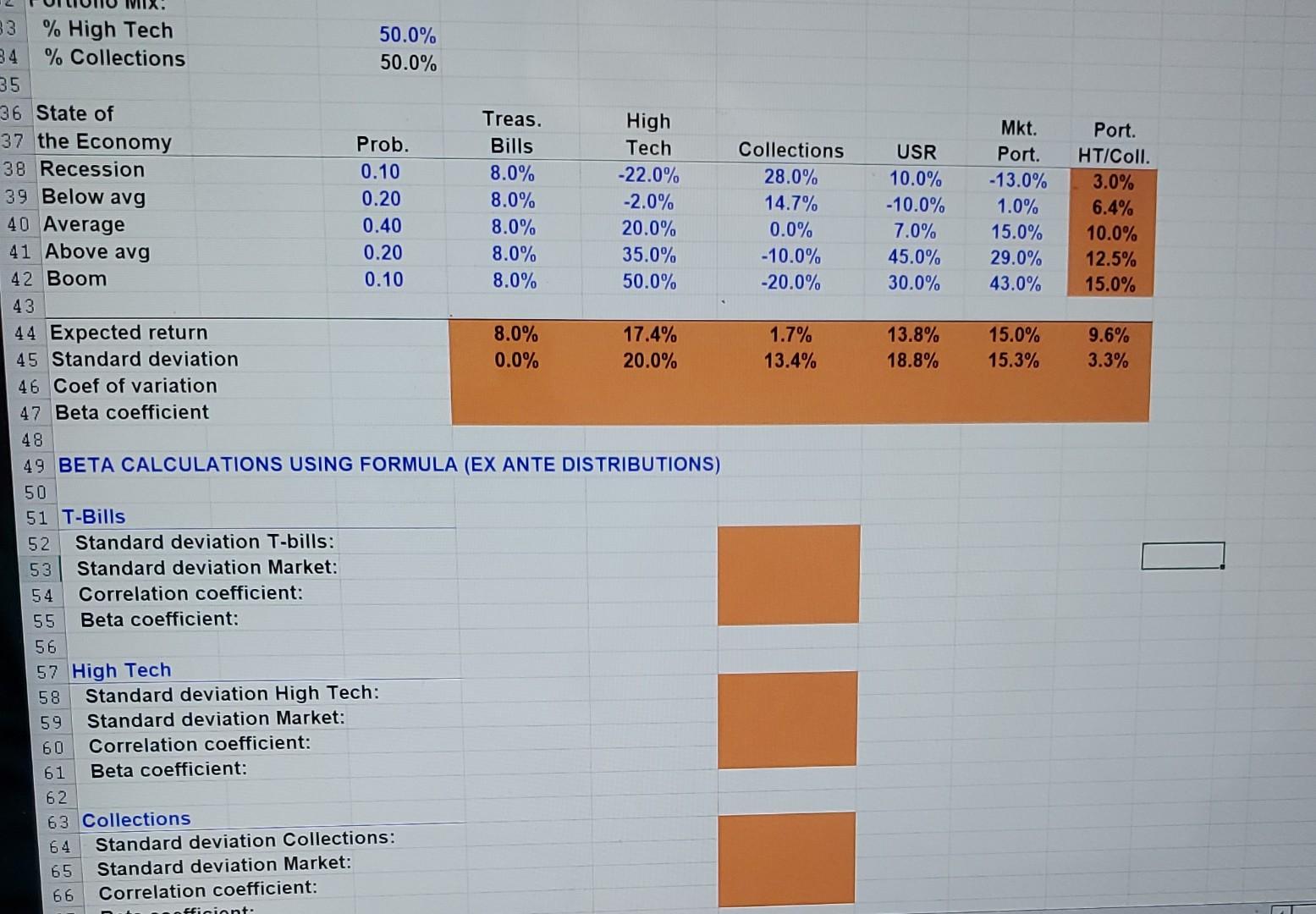

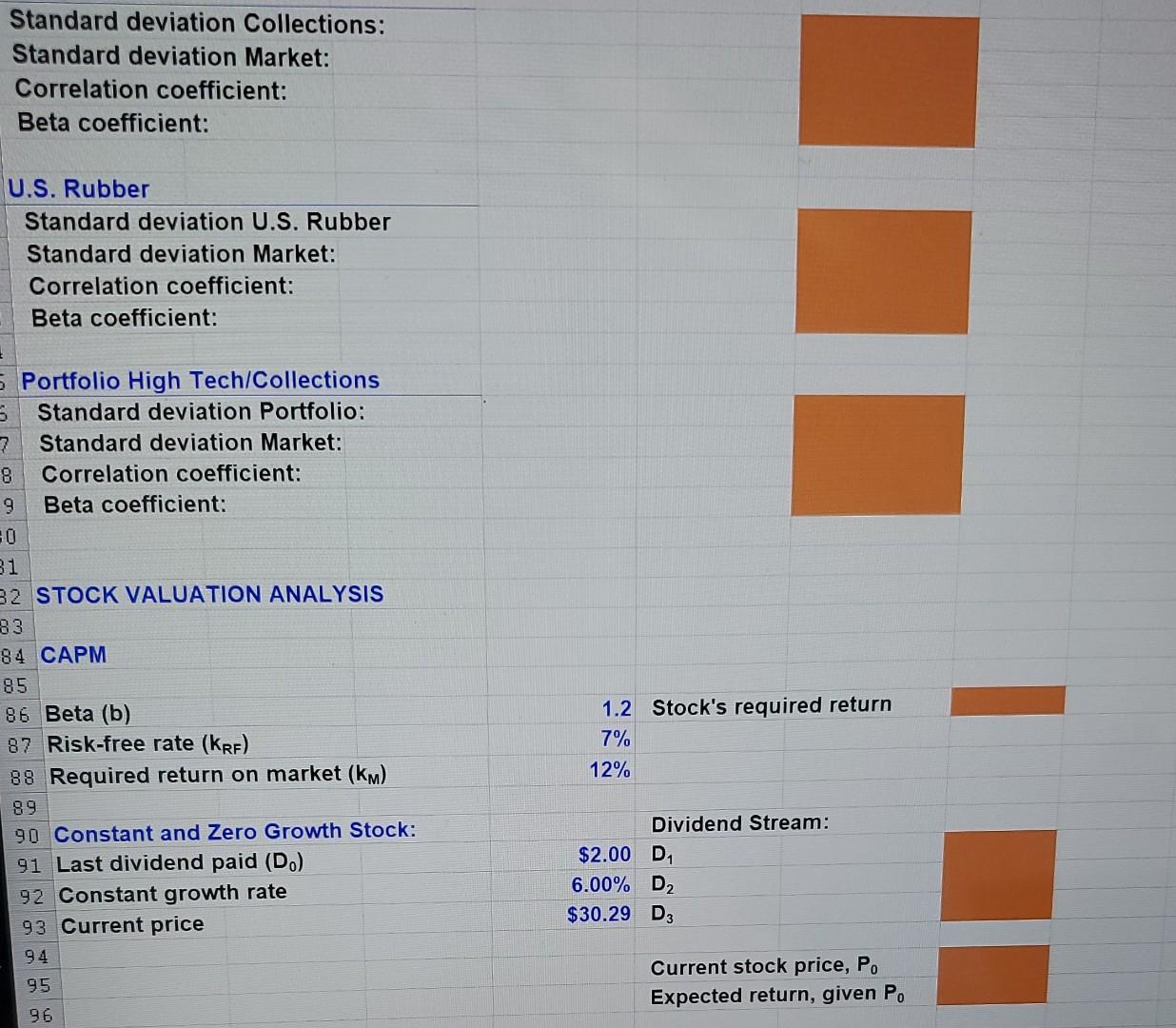

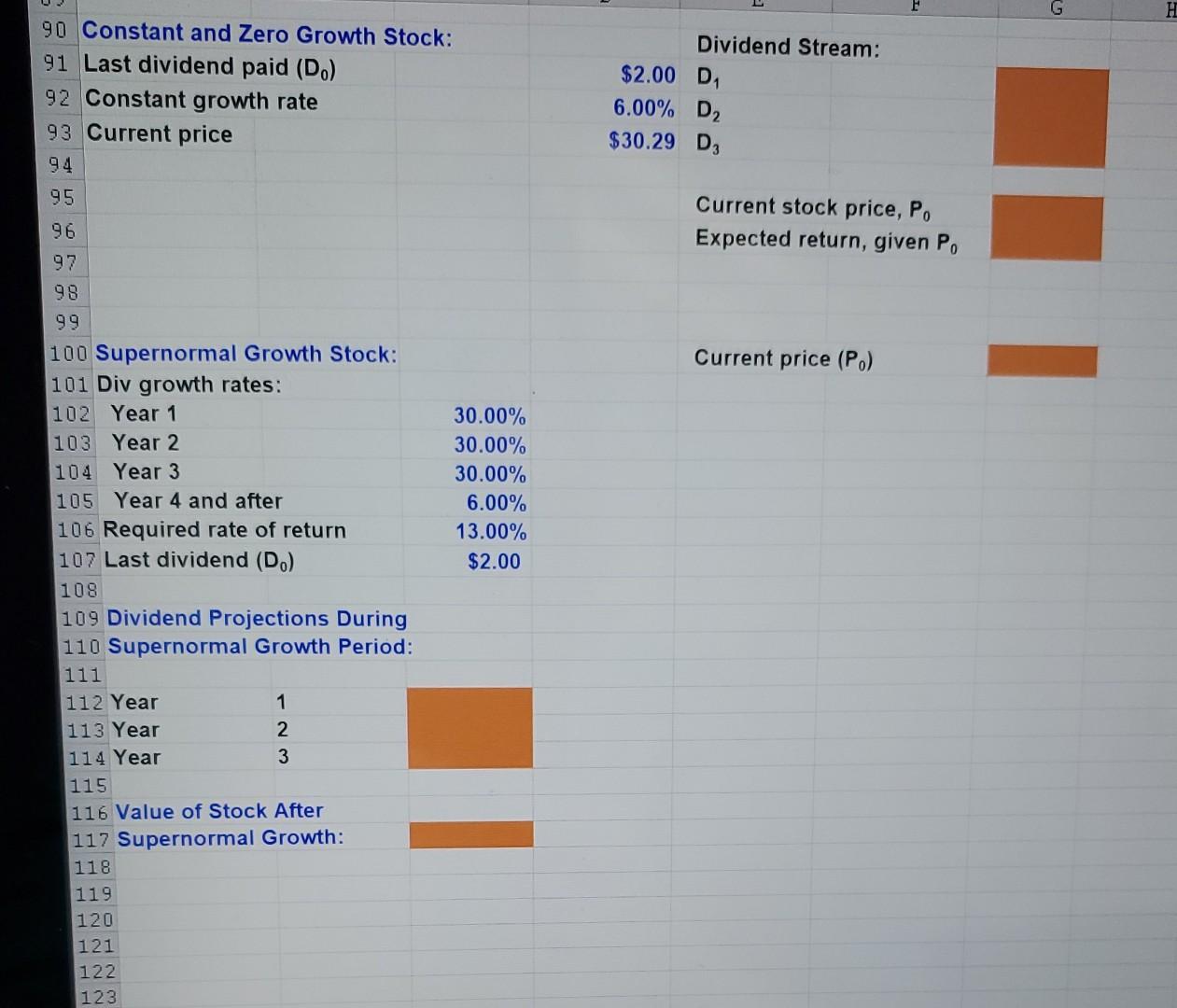

can you assist with the formulas for U.S Rubber Section and below?

VALUE OF 10 -YEAR, 10% COUPON BOND IF REQUIRED RATE OF RETURN REMAINS AT 13% OR 7% AS BOND APPROACHES MATURITY RISK AND RETURN ANALYSIS BETA CALCULATIONS USING FORMULA (EX ANTE DISTRIBUTIONS) Standard deviation Collections: Standard deviation Market: Correlation coefficient: Beta coefficient: U.S. Rubber Standard deviation U.S. Rubber Standard deviation Market: Correlation coefficient: Beta coefficient: Portfolio High Tech/Collections Standard deviation Portfolio: Standard deviation Market: Correlation coefficient: Beta coefficient: STOCK VALUATION ANALYSIS CAPM VALUE OF 10 -YEAR, 10% COUPON BOND IF REQUIRED RATE OF RETURN REMAINS AT 13% OR 7% AS BOND APPROACHES MATURITY RISK AND RETURN ANALYSIS BETA CALCULATIONS USING FORMULA (EX ANTE DISTRIBUTIONS) Standard deviation Collections: Standard deviation Market: Correlation coefficient: Beta coefficient: U.S. Rubber Standard deviation U.S. Rubber Standard deviation Market: Correlation coefficient: Beta coefficient: Portfolio High Tech/Collections Standard deviation Portfolio: Standard deviation Market: Correlation coefficient: Beta coefficient: STOCK VALUATION ANALYSIS CAPMStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started