Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you breifly explain Q. 2 and Q.4 with your own sight? Thank you!! You re a supervisor in the treasury department of Big Corp.

Can you breifly explain Q. 2 and Q.4 with your own sight? Thank you!!

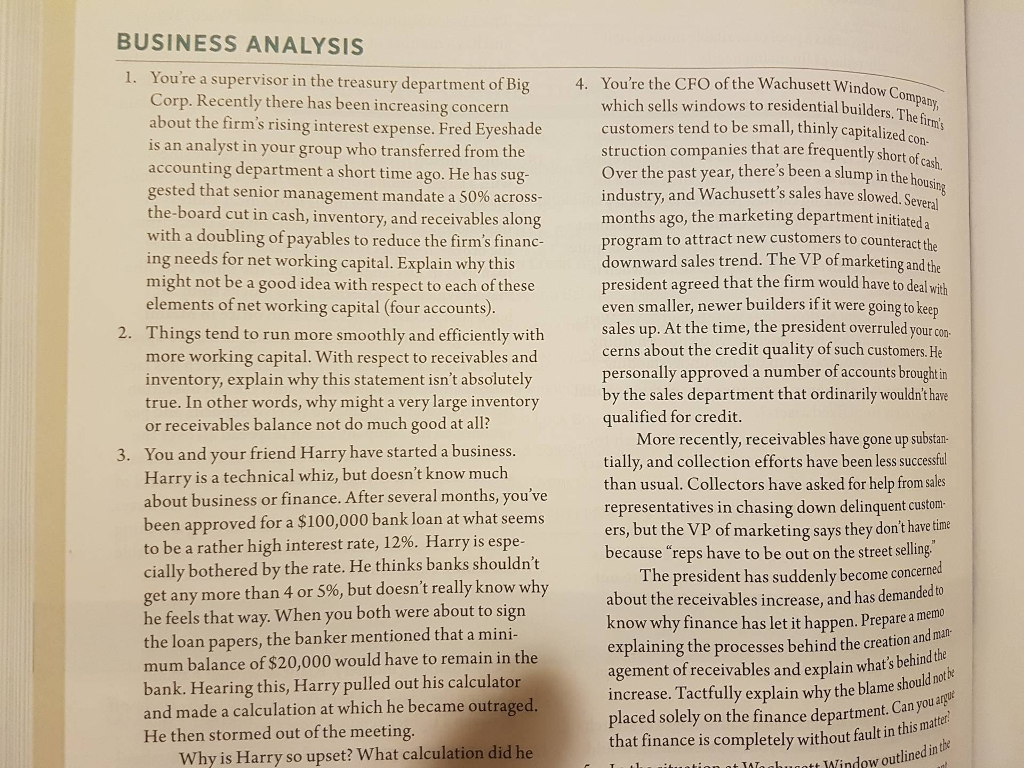

You re a supervisor in the treasury department of Big Corp. Recently there has been increasing concern about the firm's rising interest expense. Fred Eyeshade is an analyst in your group who transferred from the accounting department a short time ago. He has suggested that senior management mandate a 50% across-the-board cut in cash, inventory, and receivables along with a doubling of payables to reduce the firm's financing needs for net working capital. Explain why this might not be a good idea with respect to each of these elements of net working capital (four accounts). Things tend to run more smoothly and efficiently with more working capital. With respect to receivables and inventory, explain why this statement isn't absolutely true. In other words, why might a very large inventory or receivables balance not do much good at all? You're the CFO of the Wachusett Window Company, which sells windows to residential builders. The firm's customers tend to be small, thinly capitalized construction companies that are frequently short of cash. Over the past year, there's been a slump in the housing industry, and Wachusett's sales have slowed. Several months ago, the marketing department initiated a program to attract new customers to counteract the downward sales trend. The VP of marketing and the president agreed that the firm would have to deal with even smaller, newer builders if it were going to keep sales up. At the time, the president overruled your concerns about the credit quality of such customers. He personally approved a number of accounts brought in by the sales department that ordinarily wouldn't have qualified for credit. More recently, receivables have gone up substantially, and collection efforts have been less successful than usual. Collectors have asked for help from sales representatives in chasing down delinquent customers, but the VP of marketing says they don't have time because "reps have to be out on the street selling". The president has suddenly become concerned about the receivables increase, and has demanded to know why finance has let it happen. Prepare a memo explaining the processes behind the creation and management of receivables and explain what's behind the increase. Tactfully explain why the blame should not be placed solely on the finance department. Can you argue that finance is completely without fault in this matterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started