Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you do 8b onwards(the EAR question) please? 8. If you have only 5750 on Janutury 1, 2002, what interes rate, cornponinded anmually, must yod

can you do 8b onwards(the EAR question) please?

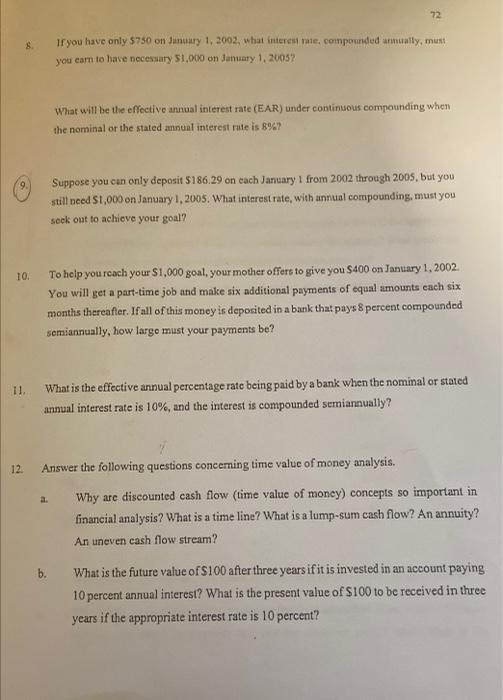

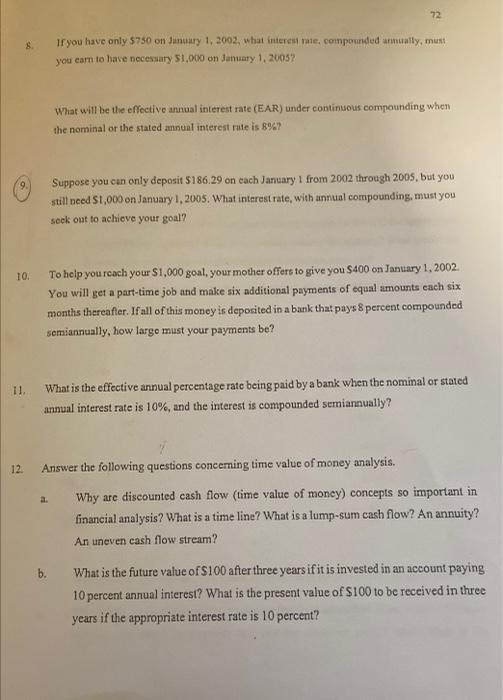

8. If you have only 5750 on Janutury 1, 2002, what interes rate, cornponinded anmually, must yod carm to have necesuary 51,000 on January 1,2005 ? What will be the effective annual interest rate (E.AR) under continuous compounding when the nominal or the stated amnual interest rate is 8% ? 9. Suppose you cen only deposit 5186.29 on each January 1 from 2002 through 2005, but you still need St, 000 on January 1, 2005. What interest rate, with annual compounding, must you seek ont to achicve your goal? 10. To help you reach your $1,000 goal, your mother offers to give you $400 on Jantary 1, 2002 You will get a part-time job and make six additional payments of equal amounts each six months thereafter. If all of this money is deponited in a bank that pays 8 percent compounded semiannually, how largo must your payments be? 11. What is the effective annual pereentage rate being paid by a bank when the nominal or stated annual interest rate is 10%, and the interest is compounded semiannually? 12. Answer the following questions conceming time value of money analysis. a. Why are discounted cash flow (time value of moncy) concepts so important in financial analysis? What is a time line? What is a lump-sum cash flow? An annuity? An uneven eash flow stream? b. What is the future value of $100 after three years if it is invested in an account paying 10 percent annual interest? What is the present value of $100 to be received in three years if the appropriate interest rate is 10 percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started