can you do a finacial statment

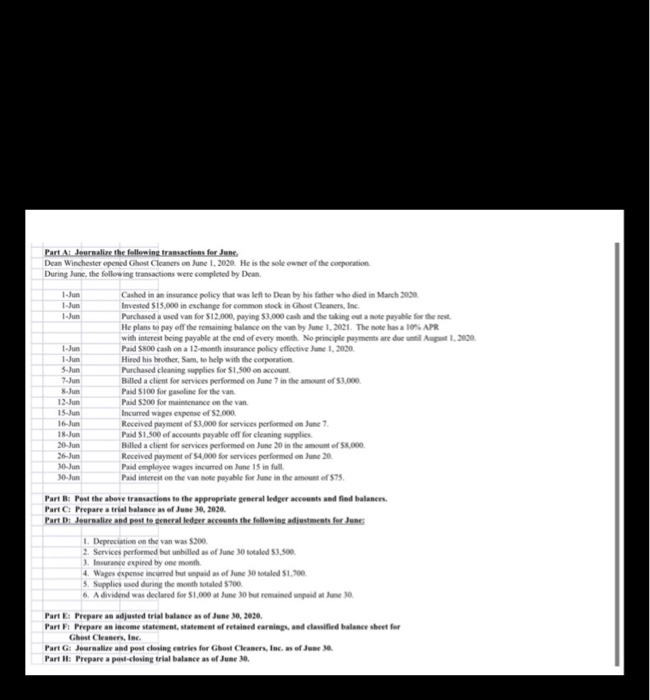

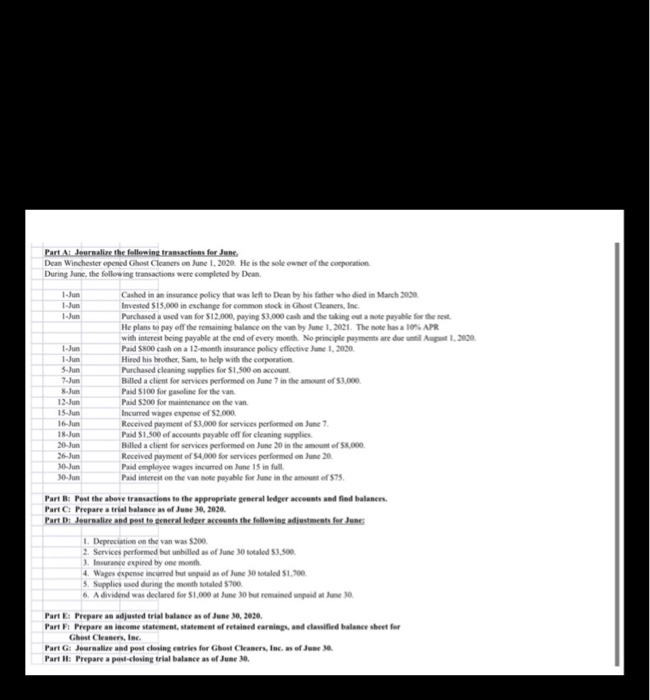

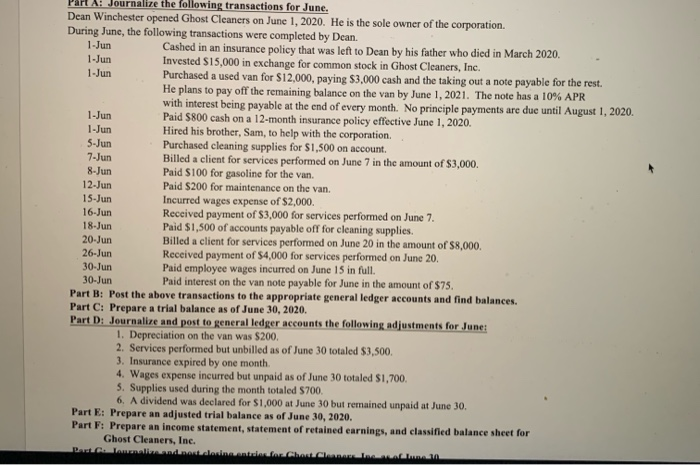

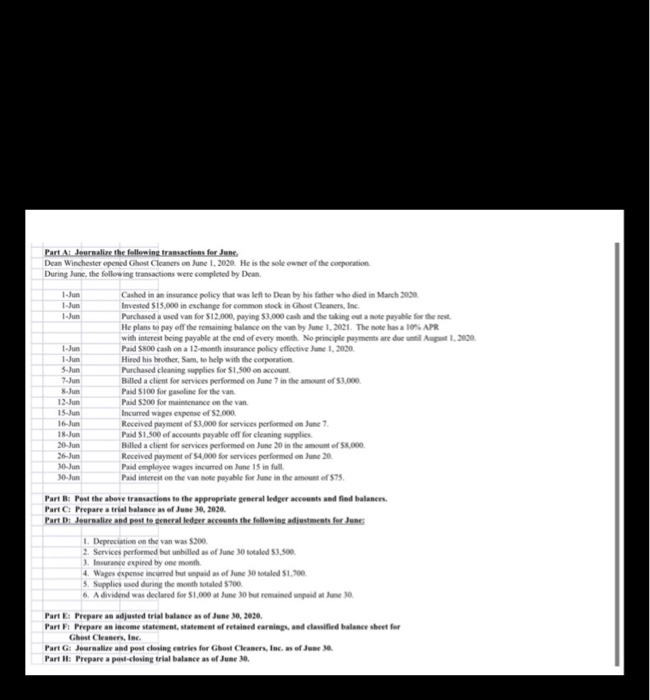

Part A: Journalize the following transactions for June Dean Winchester opened Ghost Cleaners on June 1.2020. He is the sole owner of the corporation During June, the following transactions were completed by Dean. Cashed in an insurance policy that was left to Dean by his father who died in March 2000 1-Jun Invested 15.000 in exchange for common stock in Ghost Cleaners, Inc. 1-Jun Purchased a used van for $12,000, paying $3.000 cash and the taking out a note payable for the rest He plans to pay off the remaining balance on the van by June 1, 2021. The ne has a 10. APR with interest being payable at the end of every month. No principle payments are due until August 1.3000 1-Jun Paid S800 cash on a 12-month insurance policy effective June 1, 2020 1-Jun Hired his brother. Sam, to help with the corporation S-Jun Purchased cleaning supplies for $1.500 on account 7-Jun Billed a client for services performed on June 7 in the amount of 53,000 8-Jun Paid S100 for gasoline for the van 12-Jun Paid $200 for maintenance on the van 15.Jun Incurred wages expense of $2,000 16-Jun Received payment of 53,000 for services performed on June 7 18.Jun Paid $1.500 of accounts payable off for cleaning supplies. 20-Jun Billed a client for services performed on June 20 in the amount of $8.000 26-Jun Received payment of S4,000 for services performed on June 20 30.Jun Paid employee wages incurred on June 15 in full 30-Jun Paid interest on the vannete payable for June in the amount of $75 Part B: Post the above transactions to the appropriate general ledger accounts and find balances. Part Ds Journalire and post to general ledger necounts the following adjustments for June 1. Depreciation on the van was $200 2. Services performed but unbilled as of June 30 totaled $3,500 3. Insurance expired by one month 4. Wages expense incurred but unpaid as of June 30 totaled 51.700 5. Supplies used during the month totaled 5700 6. A dividend was declared for $1,000 at June 30 but remained unpaid at June 30. Part I: Prepare an adjusted trial balance as of June 30, 2020 Part B. Prepare an income statement, statement of retained earnings, and classified balance sheet for Ghost Cleaners, Inc. Part G: Journalive and post closing entries for Ghost Cleaners, Inc. as of June 30. Part H: Prepare a post-closing trial balance as of June 30. 8:13 -- Part A: Journalize the following transactions for June. Dean Winchester opened Ghost Cleaners on June 1, 2020. He is the sole owner of the corporation During June, the following transactions were completed by Dean. 1-Jun Cashed in an insurance policy that was left to Dean by his father who died in March 2020. 1-Jun Invested $15,000 in exchange for common stock in Ghost Cleaners, Inc. 1-Jun Purchased a used van for $12,000, paying $3,000 cash and the taking out a note payable for the rest. He plans to pay off the remaining balance on the van by June 1, 2021. The note has a 10% APR with interest being payable at the end of every month. No principle payments are due until August 1, 2020. 1-Jun Paid $800 cash on a 12-month insurance policy effective June 1, 2020. 1-Jun Hired his brother, Sam, to help with the corporation 5-Jun Purchased cleaning supplies for $1,500 on account. 7-Jun Billed a client for services performed on June 7 in the amount of $3,000. 8-Jun Paid $100 for gasoline for the van. 12-Jun Paid $200 for maintenance on the van. 15-Jun Incurred wages expense of $2,000 16-Jun Received payment of $3,000 for services performed on June 7. 18-Jun Paid $1,500 of accounts payable off for cleaning supplies. 20-Jun Billed a client for services performed on June 20 in the amount of $8,000. 26-Jun Received payment of $4,000 for services performed on June 20. 30 Jun Paid employee wages incurred on June 15 in full. 30-Jun Paid interest on the van note payable for June in the amount of $75. Part B: Post the above transactions to the appropriate general ledger accounts and find balances. Part C: Prepare a trial balance as of June 30, 2020. Part D: Journalize and post to general ledger accounts the following adjustments for June: 1. Depreciation on the van was $200. 2. Services performed but unbilled as of June 30 totaled $3,500 3. Insurance expired by one month. 4. Wages expense incurred but unpaid as of June 30 totaled $1,700. 5. Supplies used during the month totaled $700. 6. A dividend was declared for $1,000 at June 30 but remained unpaid at June 30. Part E: Prepare an adjusted trial balance as of June 30, 2020. Part F: Prepare an income statement, statement of retained earnings, and classified balance sheet for Ghost Cleaners, Inc. Date Tamandar darimatedros Chart cm Part A: Journalize the following transactions for June Dean Winchester opened Ghost Cleaners on June 1.2020. He is the sole owner of the corporation During June, the following transactions were completed by Dean. Cashed in an insurance policy that was left to Dean by his father who died in March 2000 1-Jun Invested 15.000 in exchange for common stock in Ghost Cleaners, Inc. 1-Jun Purchased a used van for $12,000, paying $3.000 cash and the taking out a note payable for the rest He plans to pay off the remaining balance on the van by June 1, 2021. The ne has a 10. APR with interest being payable at the end of every month. No principle payments are due until August 1.3000 1-Jun Paid S800 cash on a 12-month insurance policy effective June 1, 2020 1-Jun Hired his brother. Sam, to help with the corporation S-Jun Purchased cleaning supplies for $1.500 on account 7-Jun Billed a client for services performed on June 7 in the amount of 53,000 8-Jun Paid S100 for gasoline for the van 12-Jun Paid $200 for maintenance on the van 15.Jun Incurred wages expense of $2,000 16-Jun Received payment of 53,000 for services performed on June 7 18.Jun Paid $1.500 of accounts payable off for cleaning supplies. 20-Jun Billed a client for services performed on June 20 in the amount of $8.000 26-Jun Received payment of S4,000 for services performed on June 20 30.Jun Paid employee wages incurred on June 15 in full 30-Jun Paid interest on the vannete payable for June in the amount of $75 Part B: Post the above transactions to the appropriate general ledger accounts and find balances. Part Ds Journalire and post to general ledger necounts the following adjustments for June 1. Depreciation on the van was $200 2. Services performed but unbilled as of June 30 totaled $3,500 3. Insurance expired by one month 4. Wages expense incurred but unpaid as of June 30 totaled 51.700 5. Supplies used during the month totaled 5700 6. A dividend was declared for $1,000 at June 30 but remained unpaid at June 30. Part I: Prepare an adjusted trial balance as of June 30, 2020 Part B. Prepare an income statement, statement of retained earnings, and classified balance sheet for Ghost Cleaners, Inc. Part G: Journalive and post closing entries for Ghost Cleaners, Inc. as of June 30. Part H: Prepare a post-closing trial balance as of June 30. 8:13 -- Part A: Journalize the following transactions for June. Dean Winchester opened Ghost Cleaners on June 1, 2020. He is the sole owner of the corporation During June, the following transactions were completed by Dean. 1-Jun Cashed in an insurance policy that was left to Dean by his father who died in March 2020. 1-Jun Invested $15,000 in exchange for common stock in Ghost Cleaners, Inc. 1-Jun Purchased a used van for $12,000, paying $3,000 cash and the taking out a note payable for the rest. He plans to pay off the remaining balance on the van by June 1, 2021. The note has a 10% APR with interest being payable at the end of every month. No principle payments are due until August 1, 2020. 1-Jun Paid $800 cash on a 12-month insurance policy effective June 1, 2020. 1-Jun Hired his brother, Sam, to help with the corporation 5-Jun Purchased cleaning supplies for $1,500 on account. 7-Jun Billed a client for services performed on June 7 in the amount of $3,000. 8-Jun Paid $100 for gasoline for the van. 12-Jun Paid $200 for maintenance on the van. 15-Jun Incurred wages expense of $2,000 16-Jun Received payment of $3,000 for services performed on June 7. 18-Jun Paid $1,500 of accounts payable off for cleaning supplies. 20-Jun Billed a client for services performed on June 20 in the amount of $8,000. 26-Jun Received payment of $4,000 for services performed on June 20. 30 Jun Paid employee wages incurred on June 15 in full. 30-Jun Paid interest on the van note payable for June in the amount of $75. Part B: Post the above transactions to the appropriate general ledger accounts and find balances. Part C: Prepare a trial balance as of June 30, 2020. Part D: Journalize and post to general ledger accounts the following adjustments for June: 1. Depreciation on the van was $200. 2. Services performed but unbilled as of June 30 totaled $3,500 3. Insurance expired by one month. 4. Wages expense incurred but unpaid as of June 30 totaled $1,700. 5. Supplies used during the month totaled $700. 6. A dividend was declared for $1,000 at June 30 but remained unpaid at June 30. Part E: Prepare an adjusted trial balance as of June 30, 2020. Part F: Prepare an income statement, statement of retained earnings, and classified balance sheet for Ghost Cleaners, Inc. Date Tamandar darimatedros Chart cm