Answered step by step

Verified Expert Solution

Question

1 Approved Answer

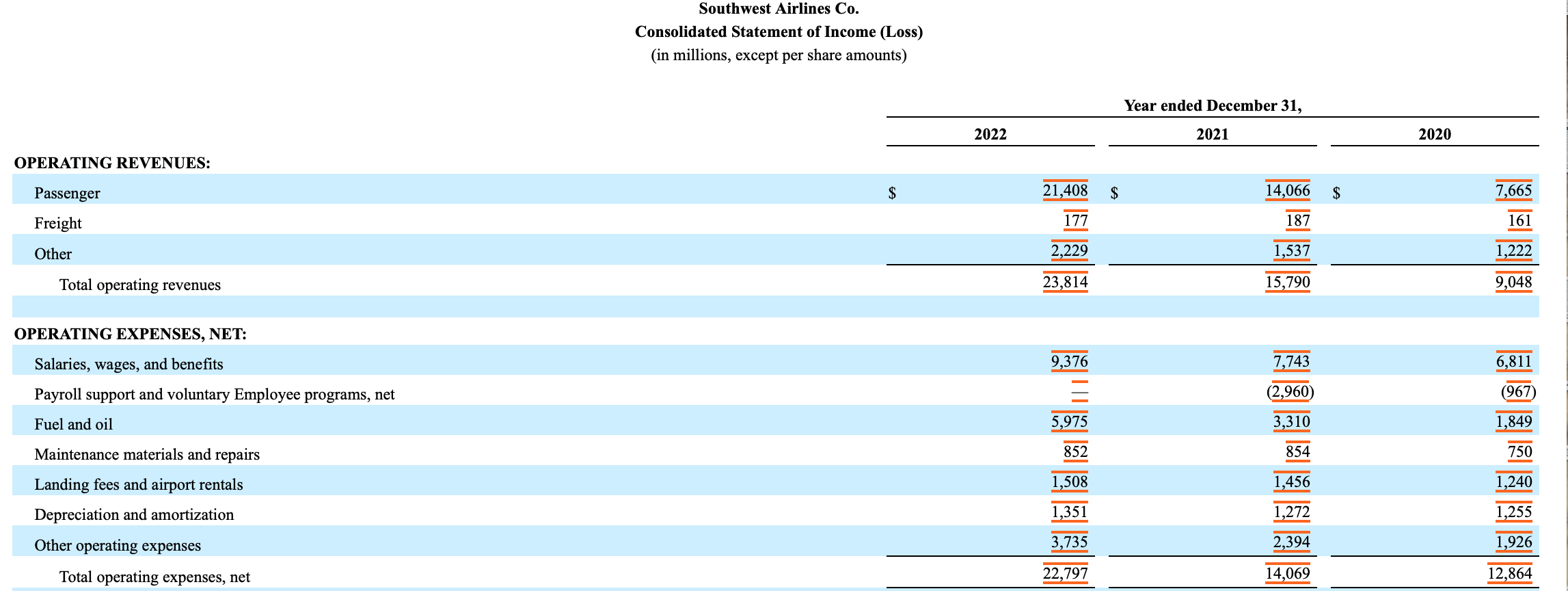

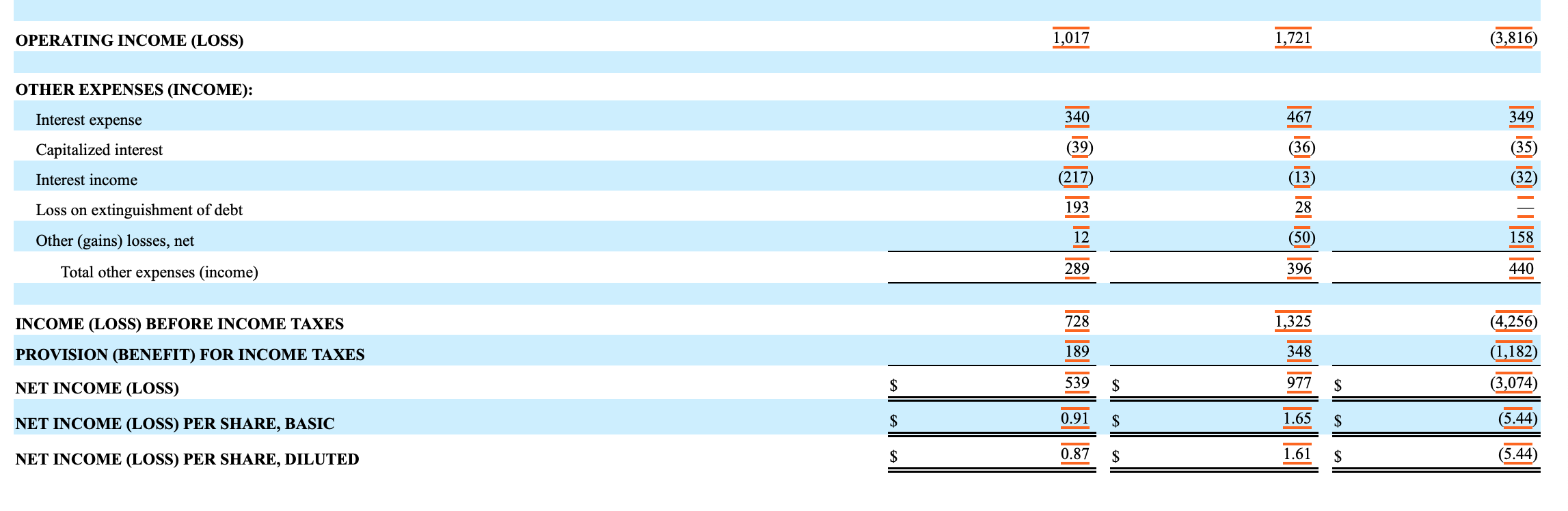

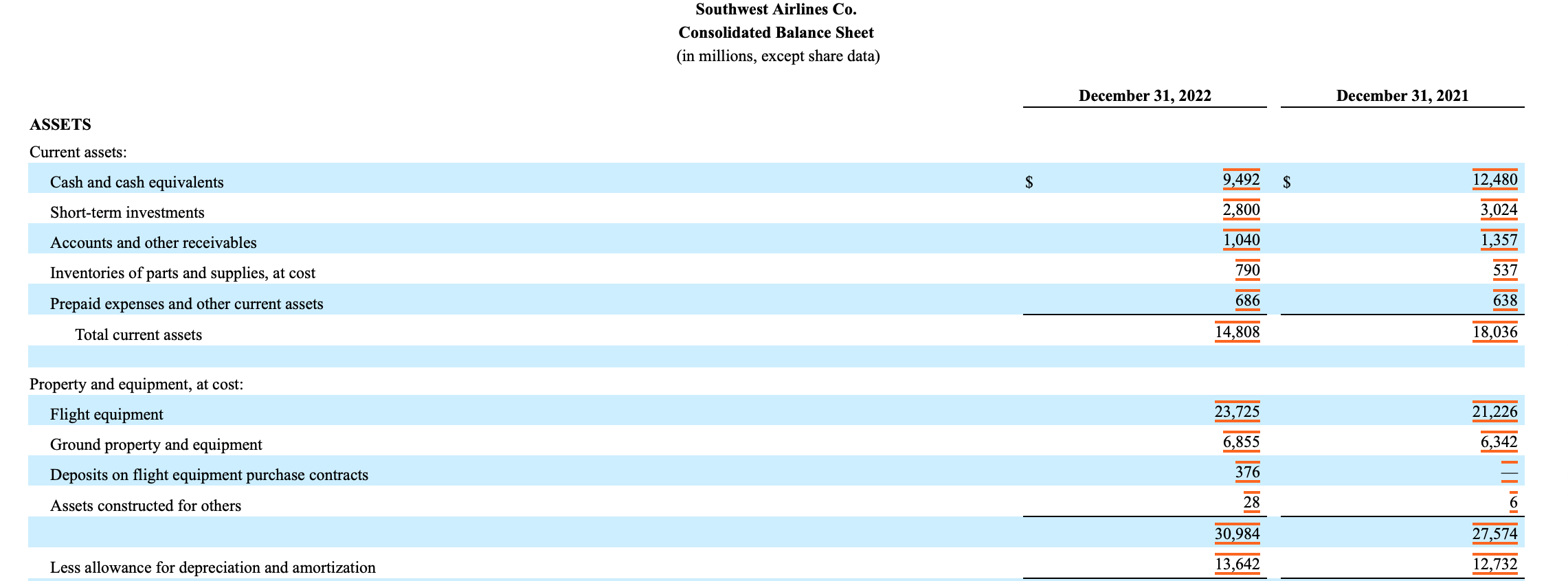

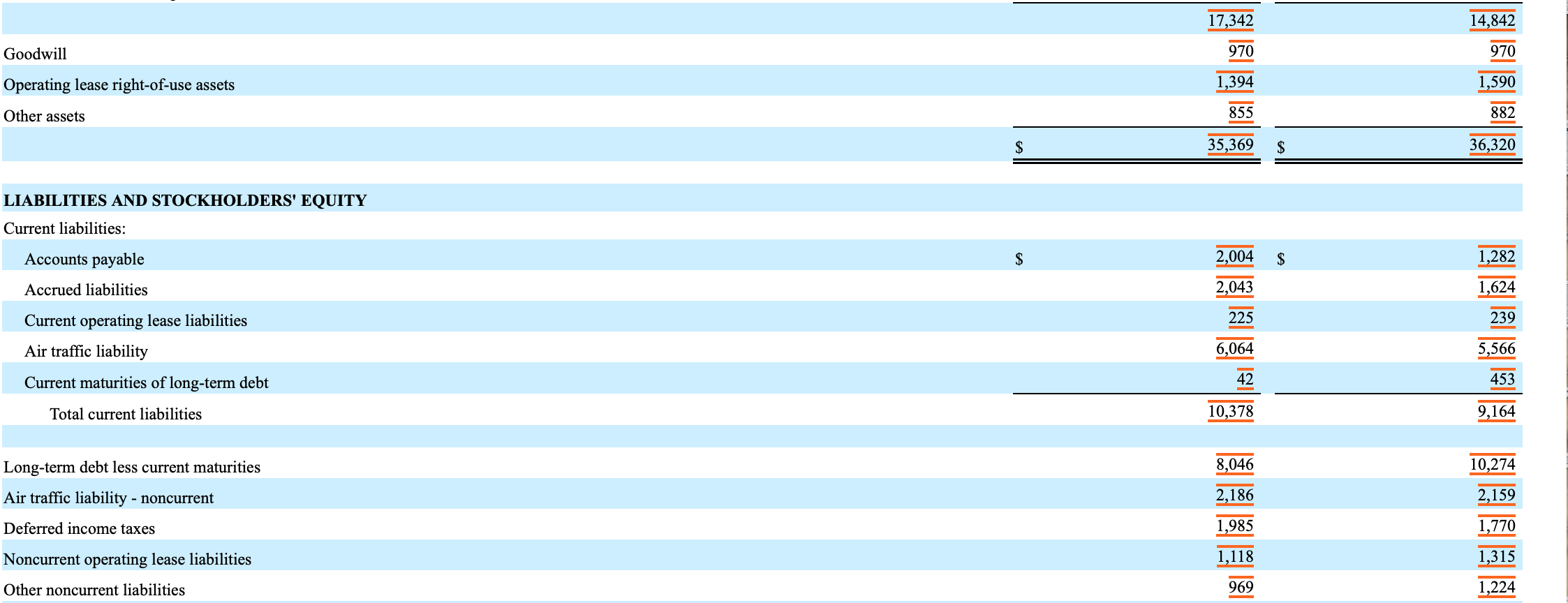

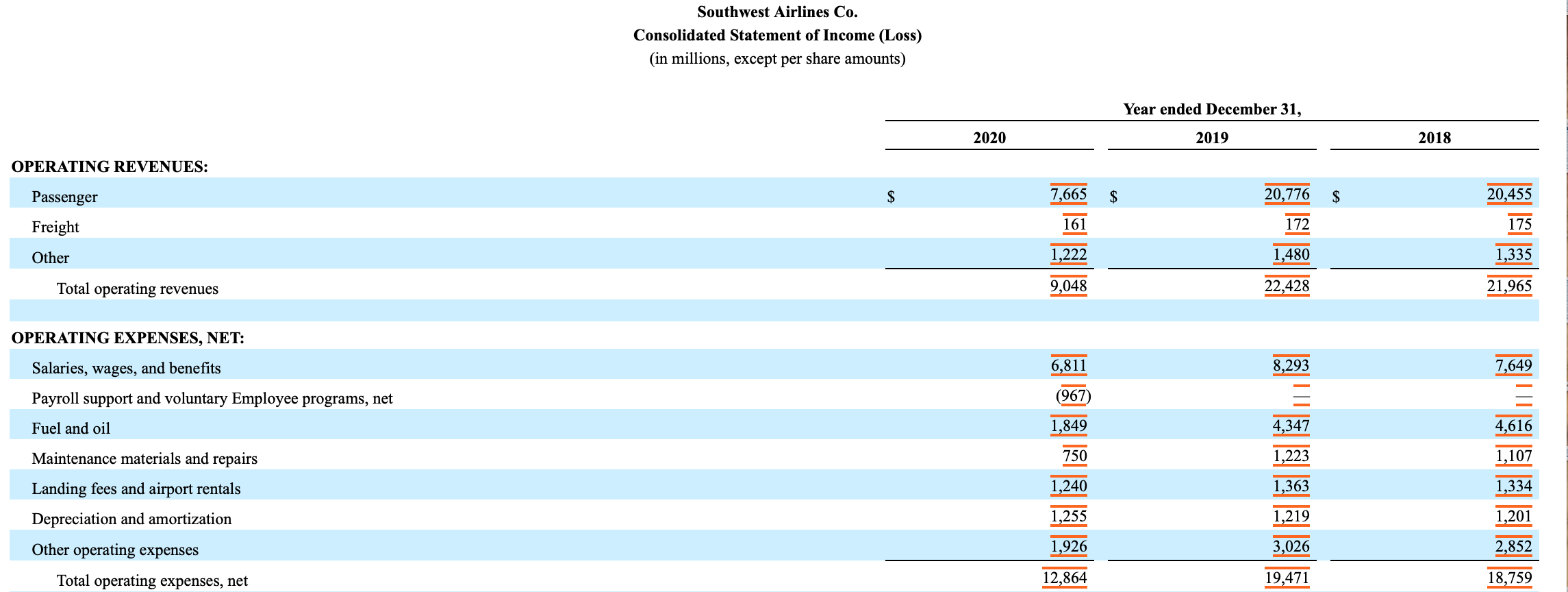

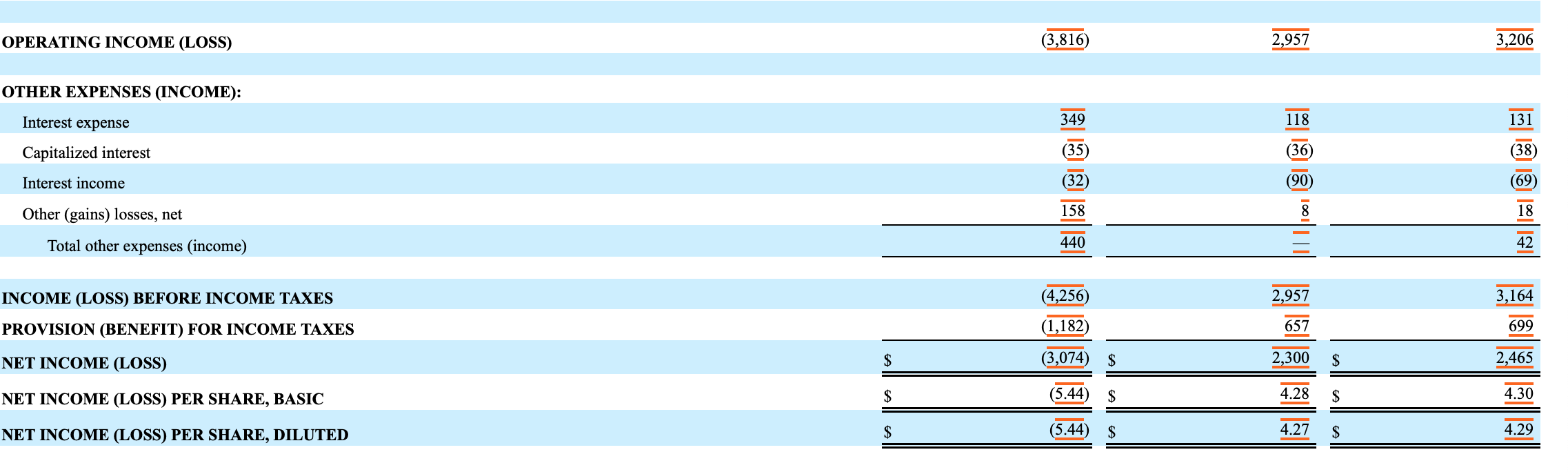

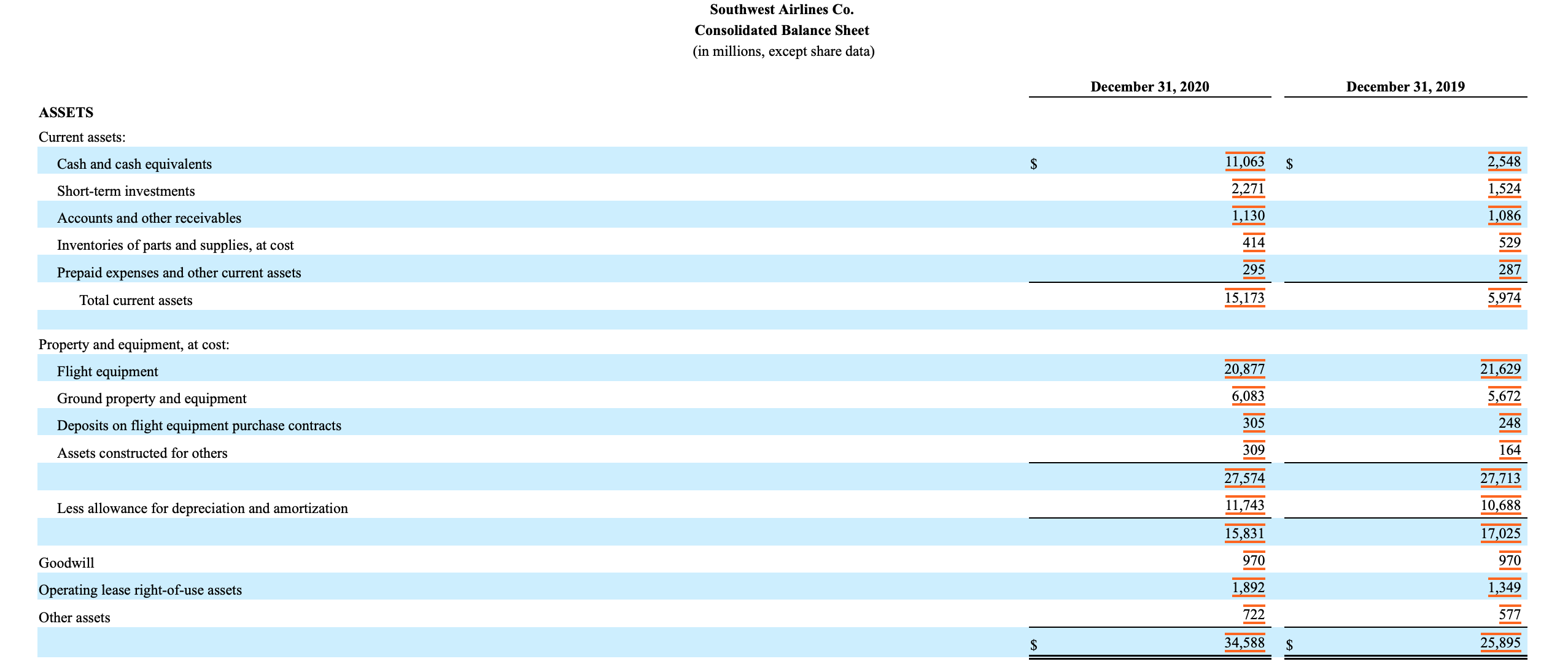

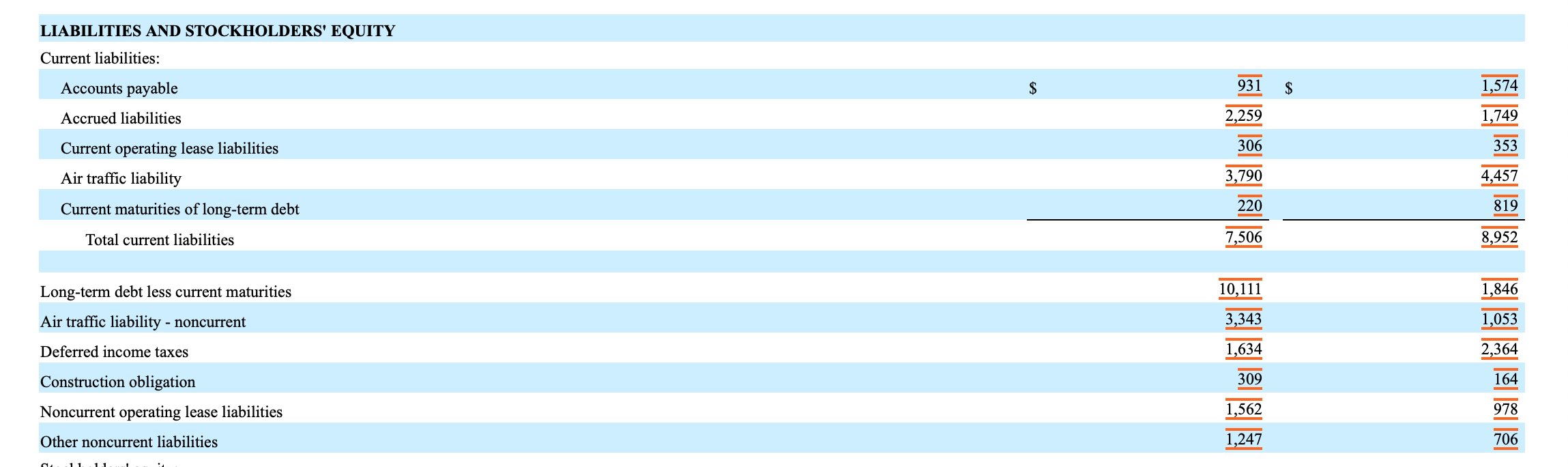

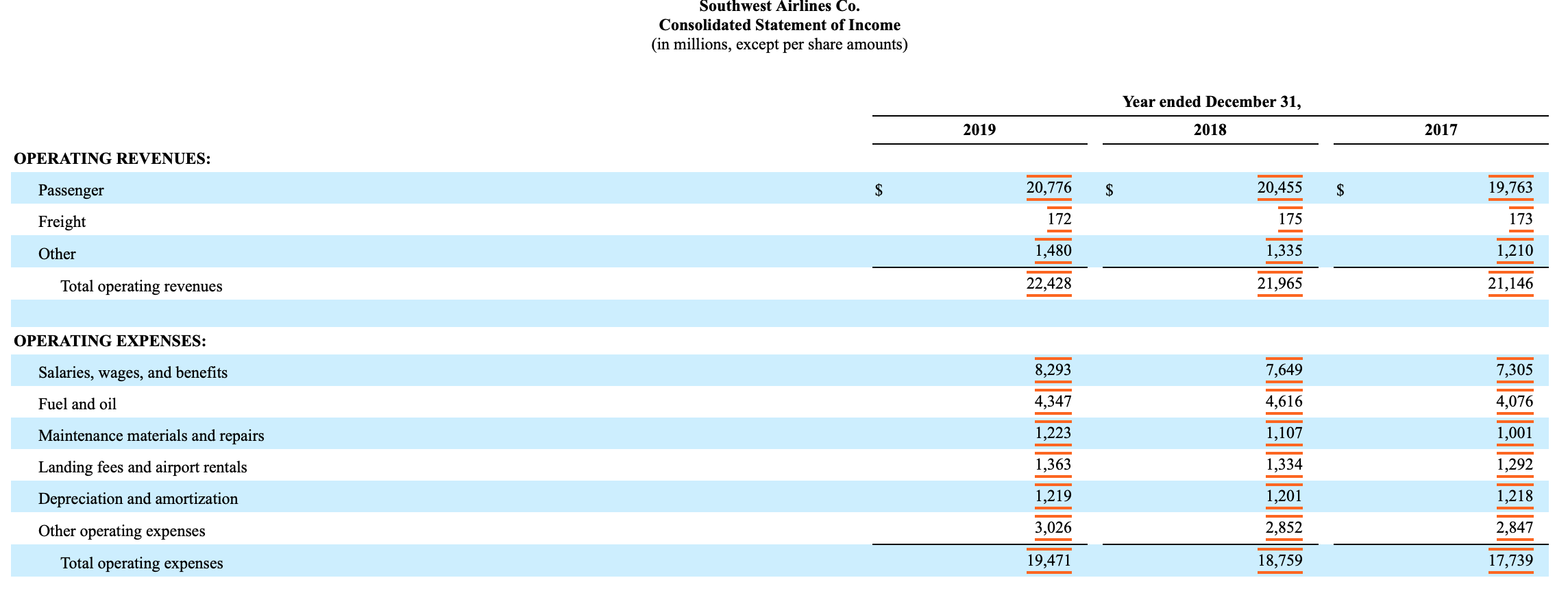

Can you do the Ratio analysis for the ratios shown below? Use the data below provided from the financial statements of Southwest Airlines. Only for

Can you do the Ratio analysis for the ratios shown below? Use the data below provided from the financial statements of Southwest Airlines. Only for each of the past 3 years.

a. Profitability ratios

b. Liquidity ratios

c. Leverage ratios

d. Activity ratios

e. Price-to-earnings ratio

f. The changes between years are included in the calculations.

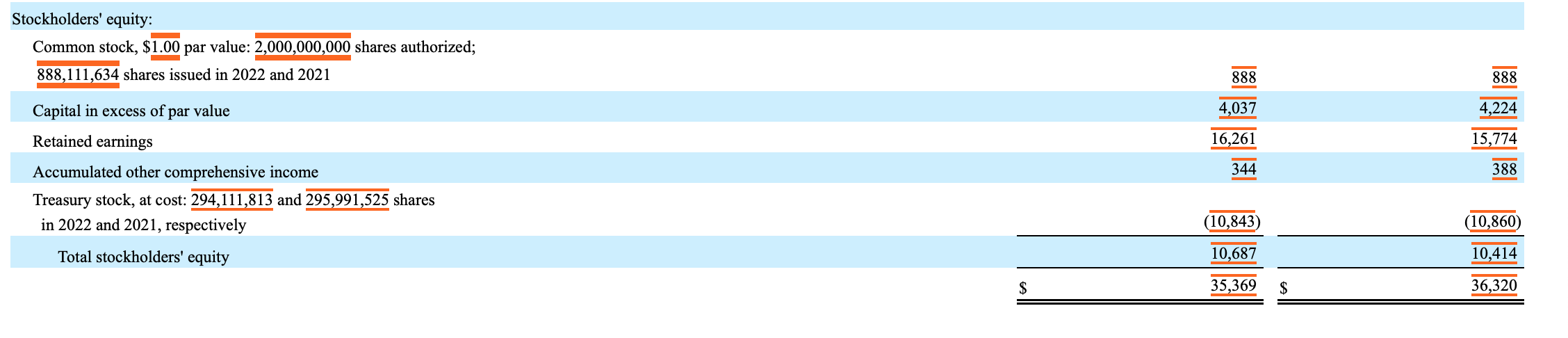

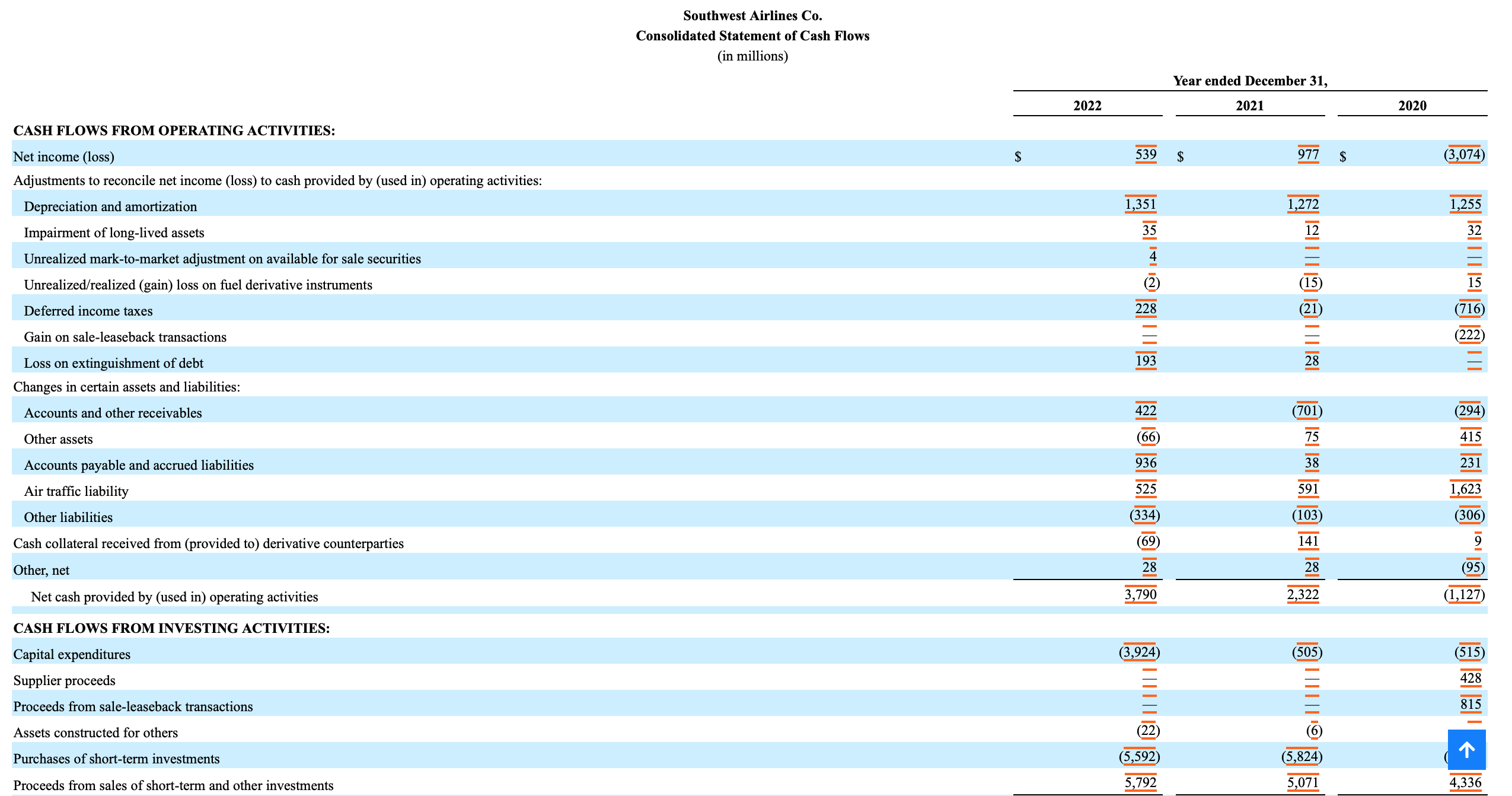

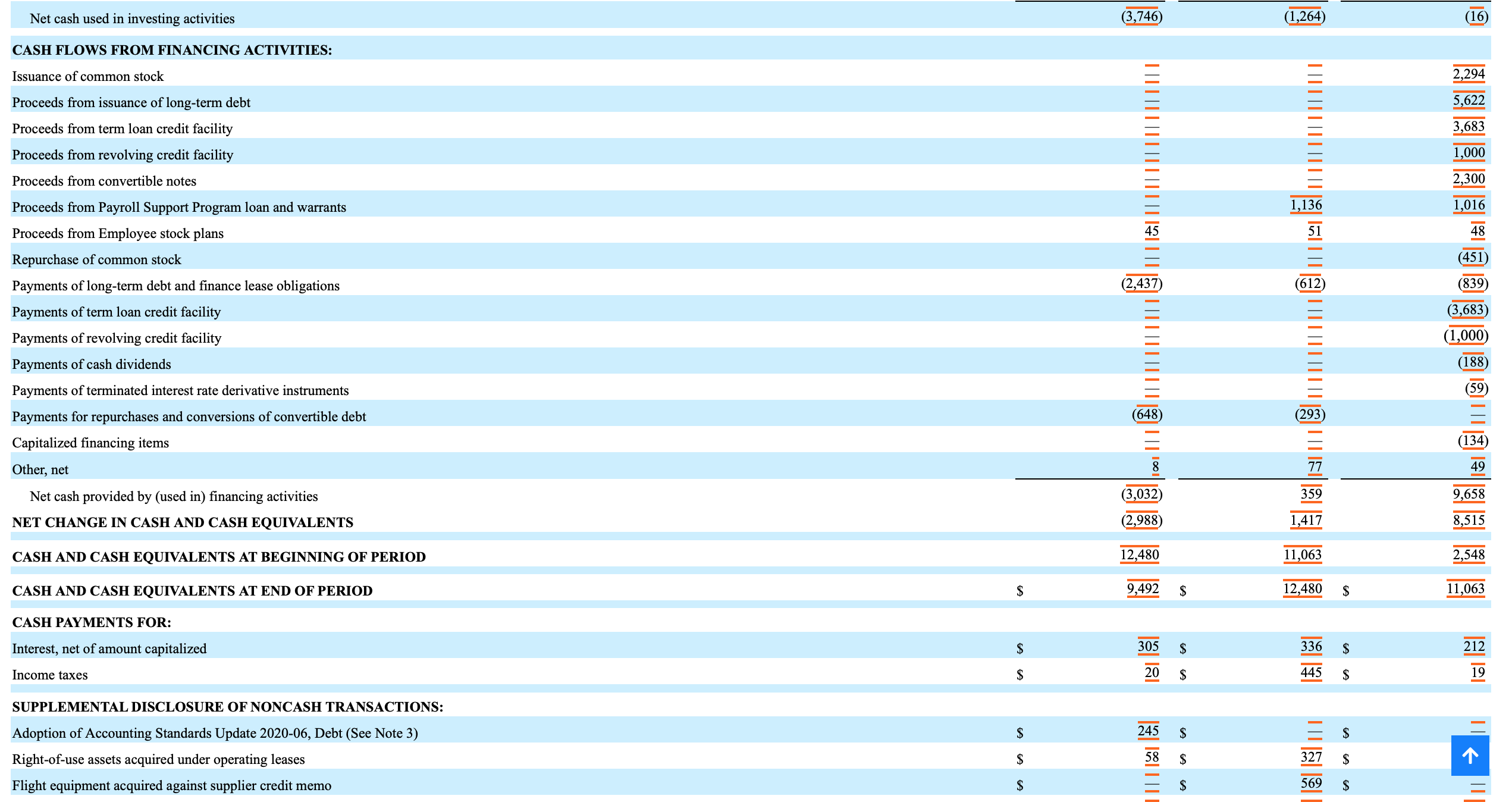

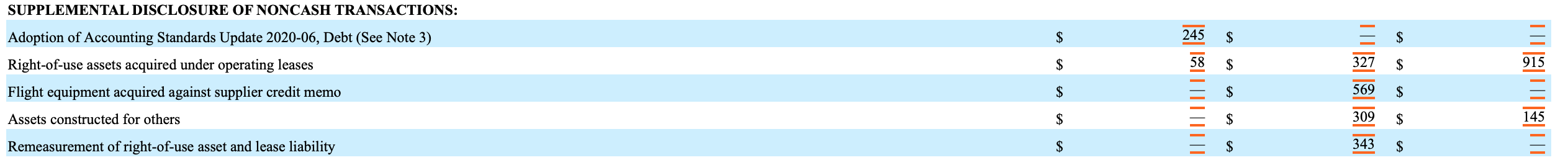

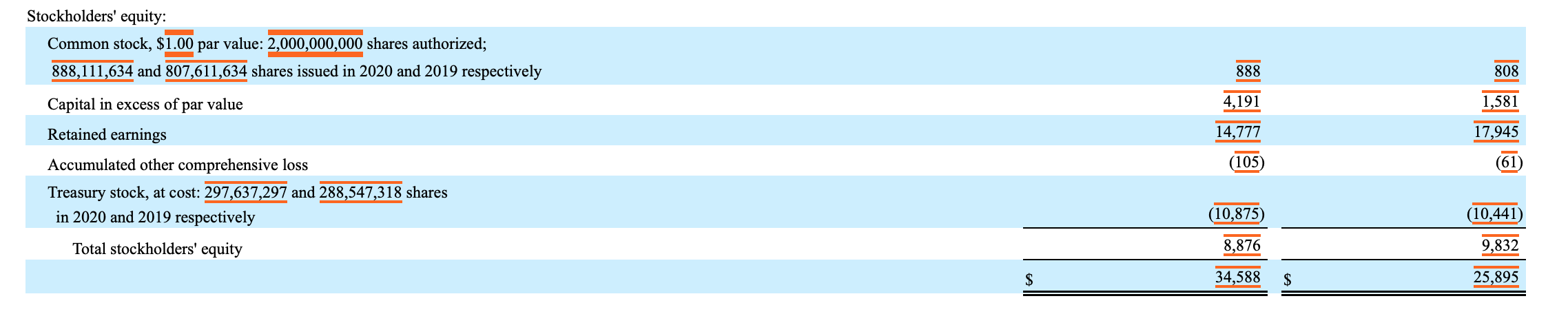

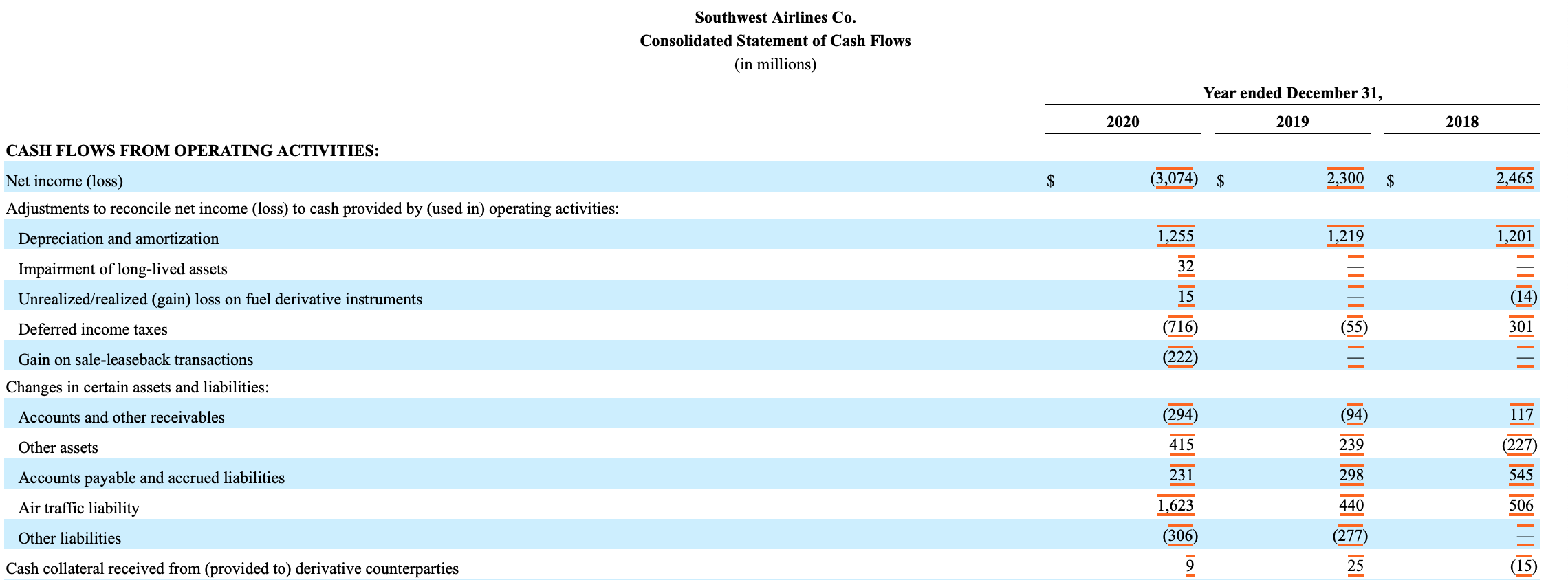

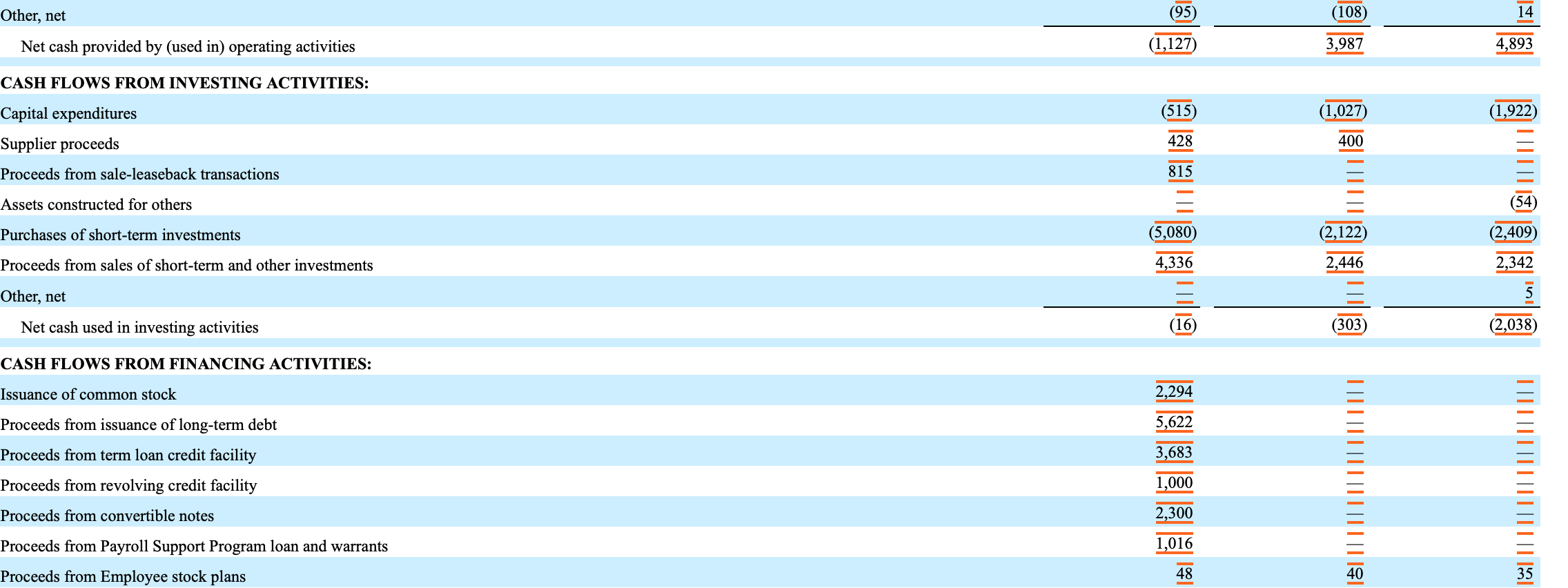

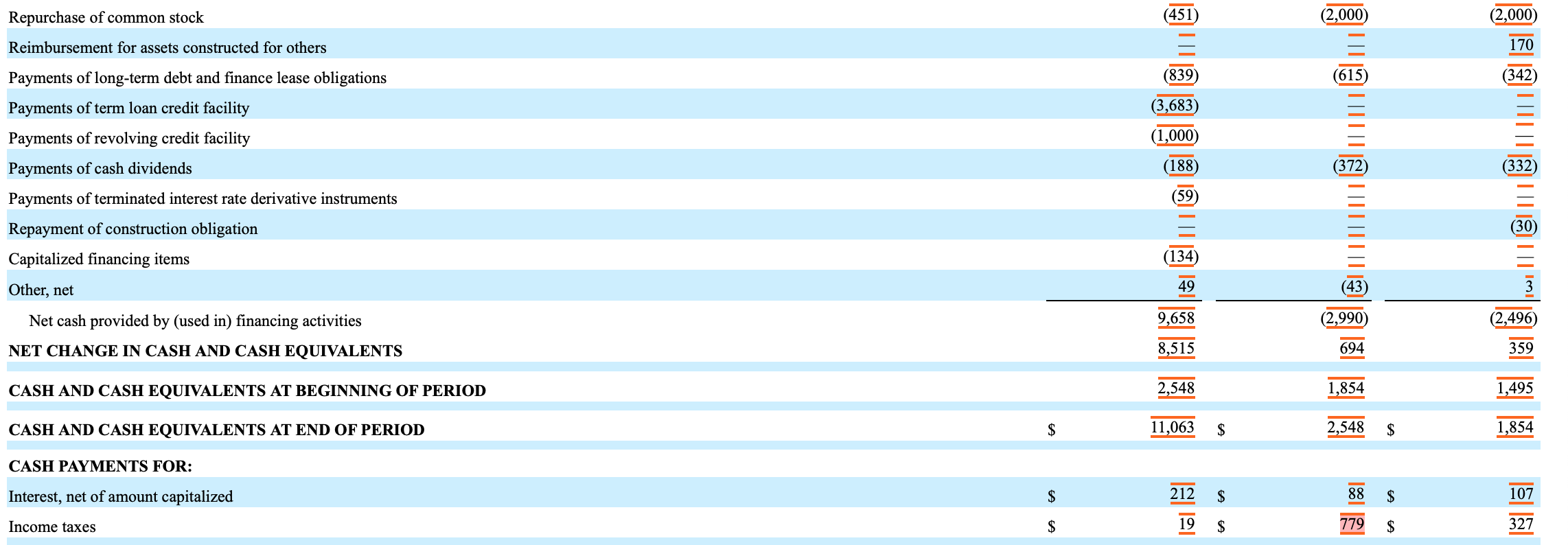

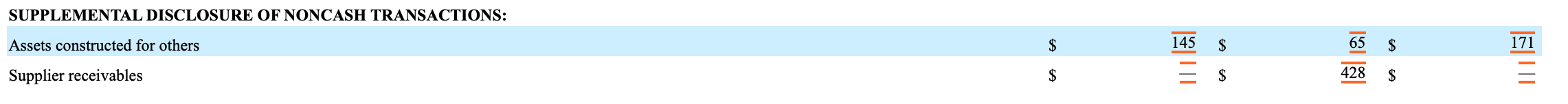

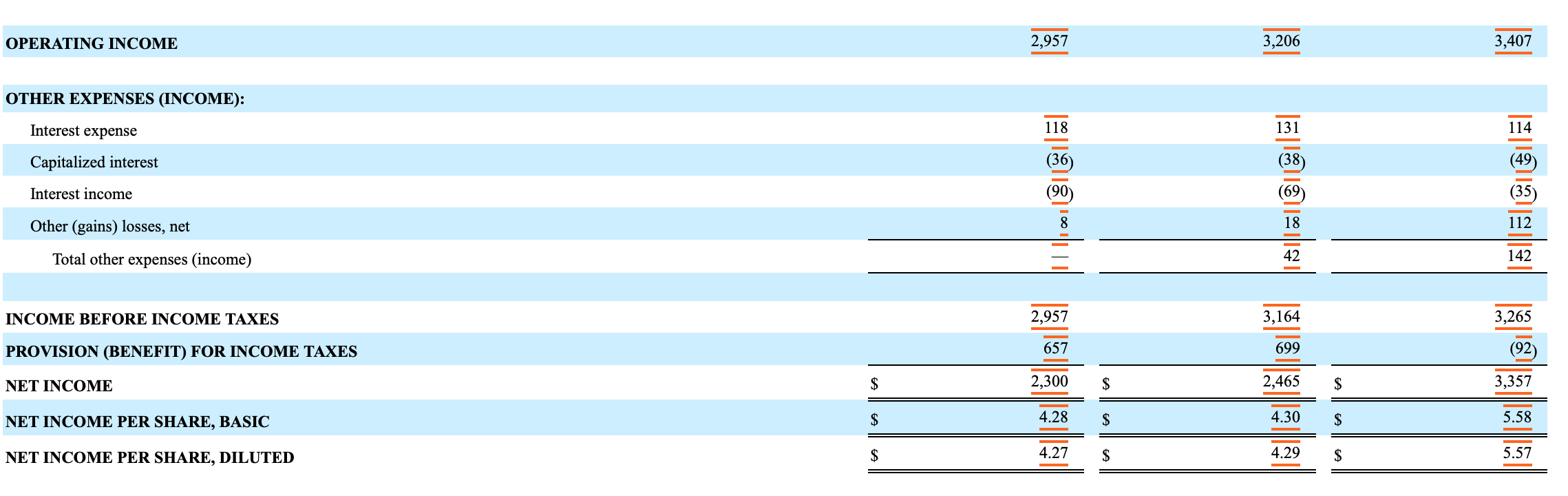

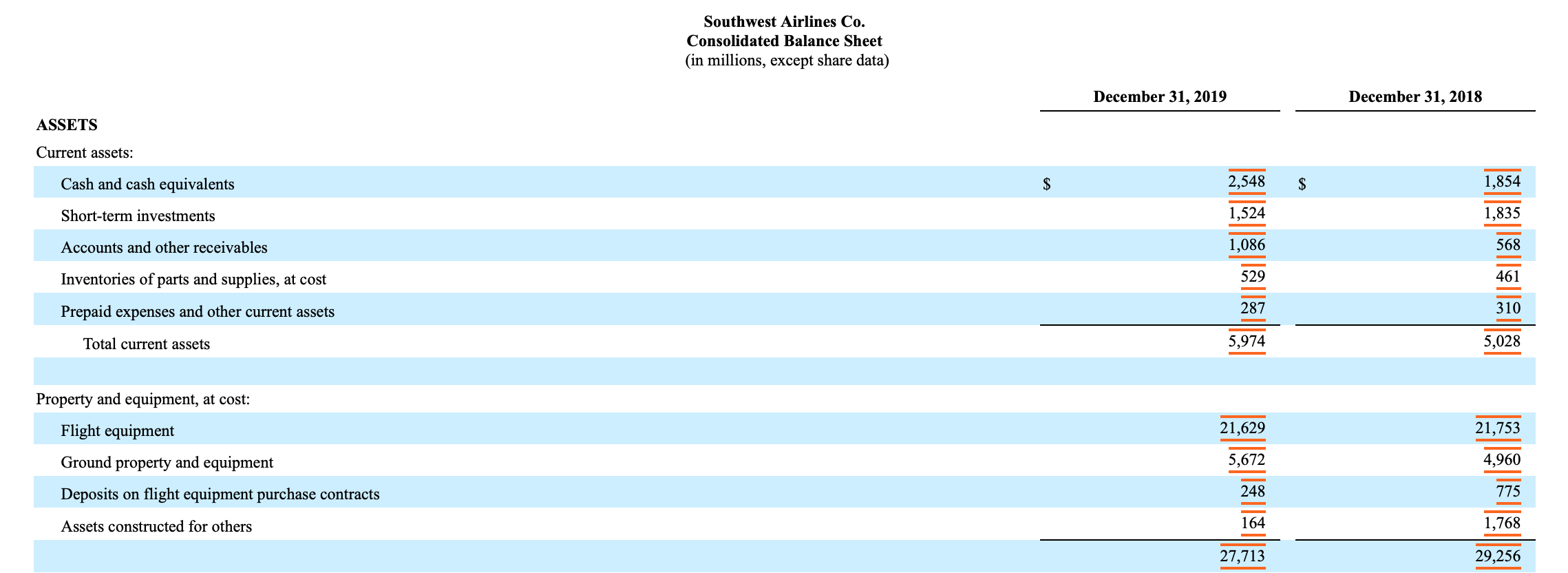

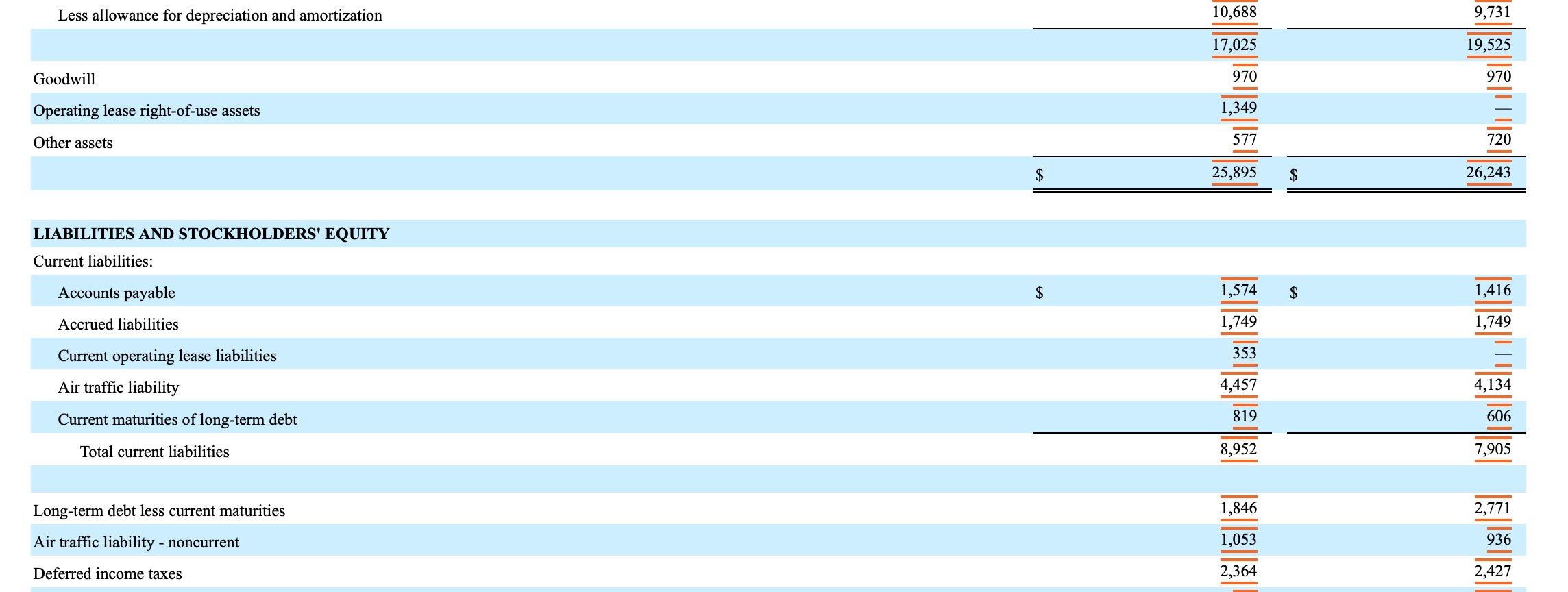

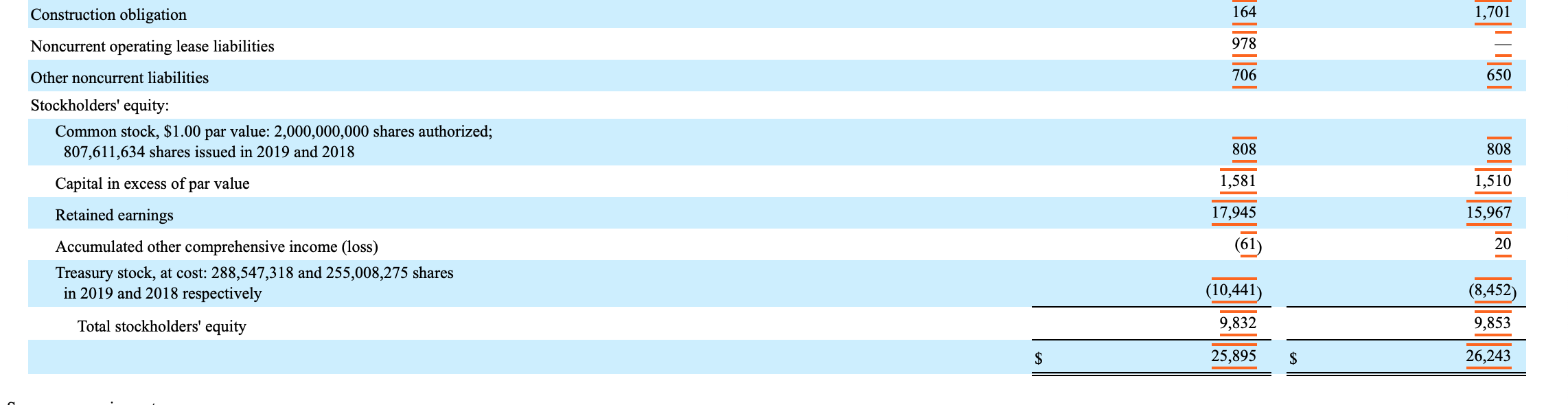

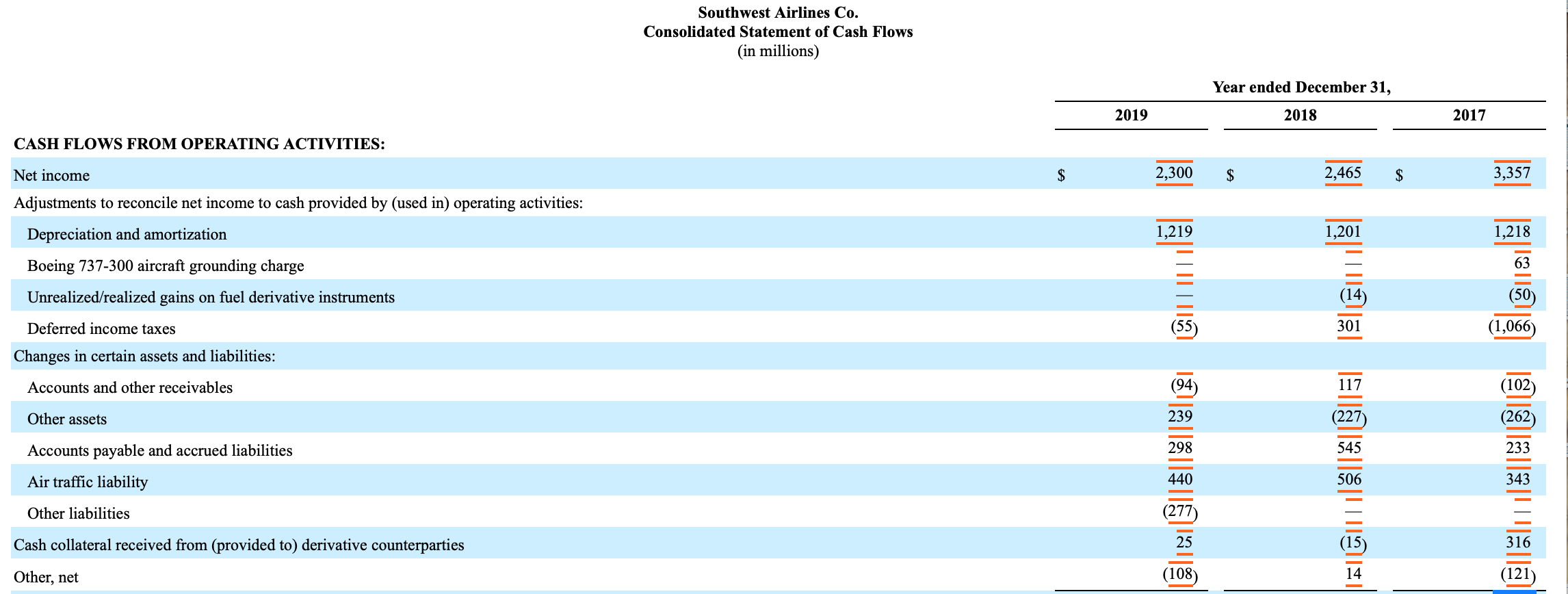

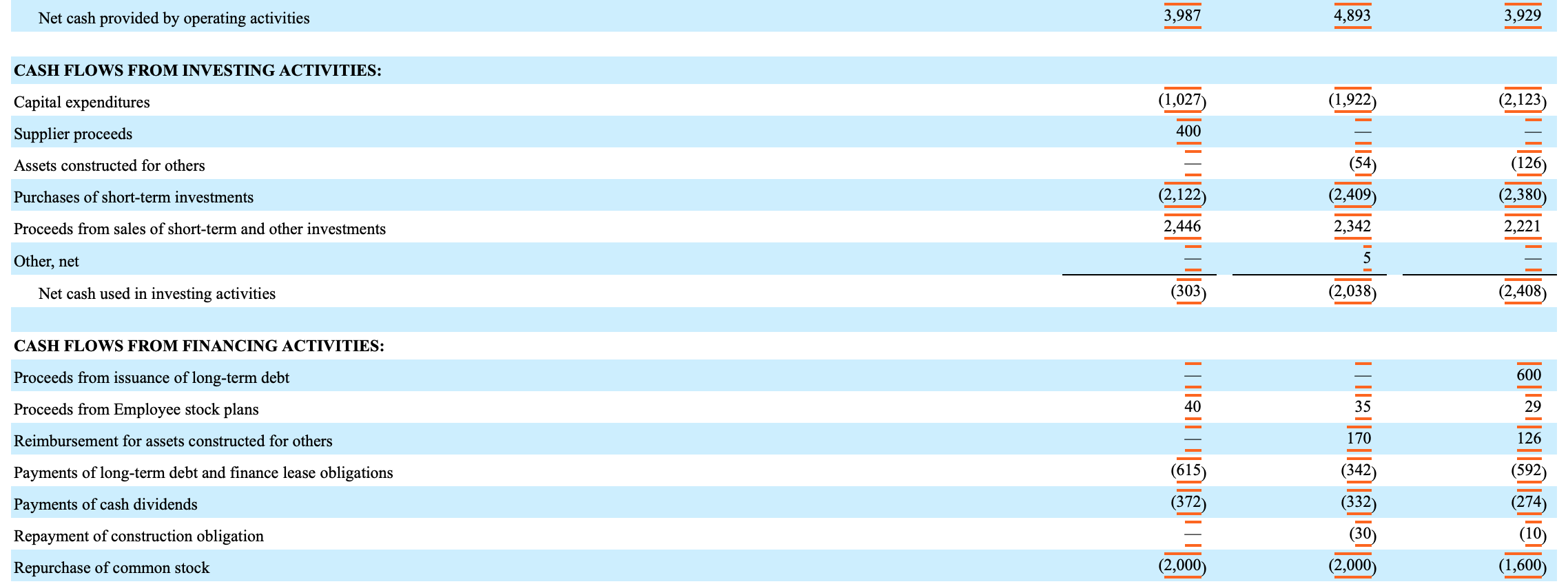

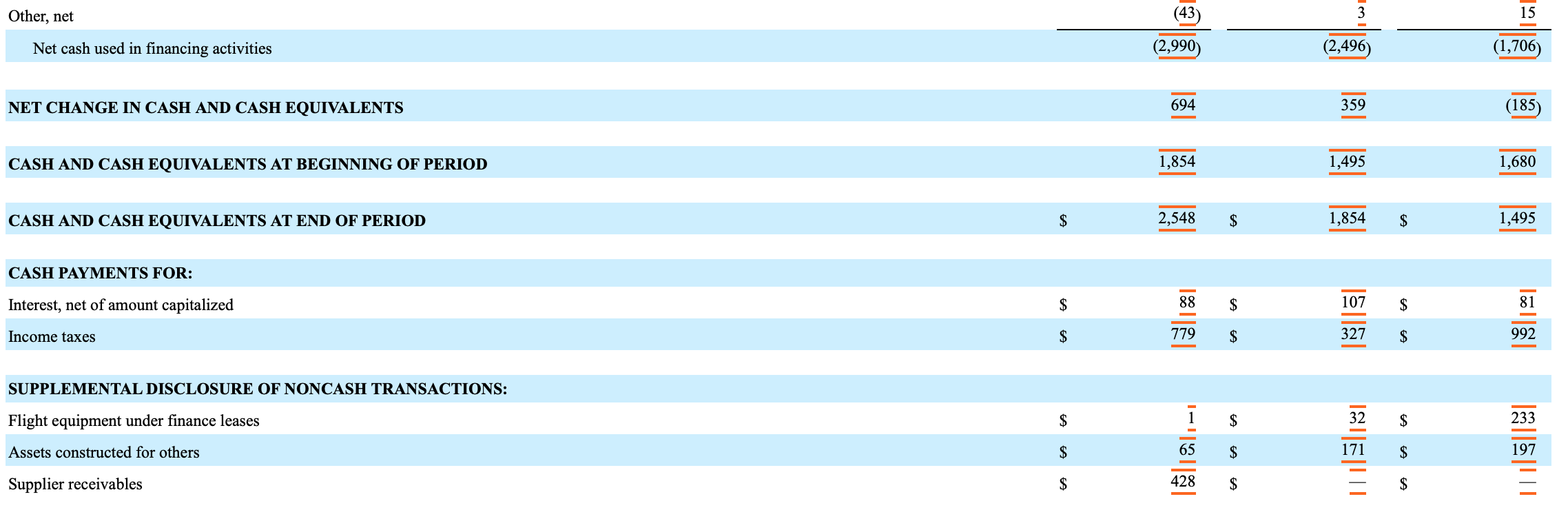

Goodwill Operating lease right-of-use assets Other assets \begin{tabular}{|c|c|c|c|} \hline & 17,342 & & 14,842 \\ \hline & 970 & & 970 \\ \hline & 1,394 & & 1,590 \\ \hline & 855 & & 882 \\ \hline$ & 35,369 & $ & 36,320 \\ \hline \end{tabular} LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Current operating lease liabilities Air traffic liability Current maturities of long-term debt Total current liabilities Long-term debt less current maturities Air traffic liability - noncurrent Deferred income taxes Noncurrent operating lease liabilities Other noncurrent liabilities OPERATING INCOME (LOSS) (3,816) 2,957 3,206 OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) INCOME (LOSS) BEFORE INCOME TAXES PROVISION (BENEFIT) FOR INCOME TAXES NET INCOME (LOSS) NET INCOME (LOSS) PER SHARE, BASIC NET INCOME (LOSS) PER SHARE, DILUTED \begin{tabular}{|c|c|c|c|c|c|} \hline & 349 & & 118 & & 131 \\ \hline & (35) & & (36) & & (38) \\ \hline & (32) & & (90) & & (69) \\ \hline & 158 & & 8 & & 18 \\ \hline & 440 & & = & & 42 \\ \hline & (4,256) & & 2,957 & & 3,164 \\ \hline & (1,182) & & 657 & & 699 \\ \hline$ & (3,074) & $ & 2,300 & $ & 2,465 \\ \hline$ & (5.44) & $ & 4.28 & $ & 4.30 \\ \hline$ & (5.44) & $ & 4.27 & $ & 4.29 \\ \hline \end{tabular} Snuthwest Airlines Co. OPERATING INCOME OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) INCOME BEFORE INCOME TAXES PROVISION (BENEFIT) FOR INCOME TAXES NET INCOME NET INCOME PER SHARE, BASIC NET INCOME PER SHARE, DILUTED 2,957 3,206 \begin{tabular}{l} 118 \\ (36) \\ (90) \\ 8 \\ E \\ \hline \end{tabular} 2,957 \begin{tabular}{|c|c|} \hline \multicolumn{2}{|r|}{118} \\ \hline & (36) \\ \hline & (90) \\ \hline & 8 \\ \hline & \\ \hline & 2,957 \\ \hline & 657 \\ \hline$ & 2,300 \\ \hline$ & 4.28 \\ \hline$ & 4.27 \\ \hline \end{tabular} \begin{tabular}{l} 131 \\ (38) \\ (69) \\ 18 \\ 42 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline & 3,164 \\ \hline & 699 \\ \hline$ & 2,465 \\ \hline$ & 4.30 \\ \hline$ & 4.29 \\ \hline \end{tabular} 3,407 \begin{tabular}{|c|c|c|c|} \hline & 131 & & 114 \\ \hline & (38) & & (49) \\ \hline & (69) & & (35) \\ \hline & 18 & & 112 \\ \hline & 42 & & 142 \\ \hline & 3,164 & & 3,265 \\ \hline & 699 & & (92) \\ \hline$ & 2,465 & $ & 3,357 \\ \hline$ & 4.30 & $ & 5.58 \\ \hline$ & 4.29 & $ & 5.57 \\ \hline \end{tabular} SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Assets constructed for others Supplier receivables Southwest Airlines Co. Consolidated Statement of Income (in millions, except per share amounts) Cowtbernat A iwlinger Co Southwest Airlines Co. Consolidated Balance Sheet (in millions, except share data) December 31, 2022 December 31, 2021 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, at cost Prepaid expenses and other current assets Total current assets Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others Less allowance for depreciation and amortization Southwest Airlines Co. Consolidated Balance Sheet (in millions, except share data) December 31, 2020 December 31, 2019 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, at cost Prepaid expenses and other current assets Total current assets Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others Less allowance for depreciation and amortization Goodwill Operating lease right-of-use assets Other assets Construction obligation Noncurrent operating lease liabilities Other noncurrent liabilities Stockholders' equity: Common stock, $1.00 par value: 2,000,000,000 shares authorized; 807,611,634 shares issued in 2019 and 2018 Capital in excess of par value Retained earnings Accumulated other comprehensive income (loss) Treasury stock, at cost: 288,547,318 and 255,008,275 shares in 2019 and 2018 respectively Total stockholders' equity \begin{tabular}{|c|c|c|c|} \hline \multicolumn{2}{|r|}{164} & & 1,701 \\ \hline & 978 & & \\ \hline & 706 & & 650 \\ \hline & 808 & & 808 \\ \hline & 1,581 & & 1,510 \\ \hline & 17,945 & & 15,967 \\ \hline & (61) & & 20 \\ \hline & ((10,441) & & (8,452) \\ \hline & 9,832 & & 9,853 \\ \hline$ & 25,895 & $ & 26,243 \\ \hline \end{tabular} Southwest Airlines Co. Consolidated Statement of Income (Loss) (in millions, except per share amounts) Stockholders' equity: Common stock, $1.00 par value: 2,000,000,000 shares authorized; 888,111,634 shares issued in 2022 and 2021 Capital in excess of par value Retained earnings Accumulated other comprehensive income 4,03788834416,261(10,843)10,68735,369 Treasury stock, at cost: 294,111,813 and 295,991,525 shares in 2022 and 2021, respectively Total stockholders' equity Other, net Net cash provided by (used in) operating activities (1,127)(95)3,987(108)4,89314 CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures Supplier proceeds Proceeds from sale-leaseback transactions Assets constructed for others Purchases of short-term investments Proceeds from sales of short-term and other investments Other, net Net cash used in investing activities \begin{tabular}{|c|c|c|} \hline(515) & (1,027) & (1,922) \\ \hline428 & 400 & \\ \hline 815 & & = \\ \hline & & (54) \\ \hline(5,080) & (2,122) & (2,409) \\ \hline4,336 & 2,446 & 2,342 \\ \hline & = & 5 \\ \hline(16) & (303) & (2,038) \\ \hline \end{tabular} CASH FLOWS FROM FINANCING ACTIVITIES: Issuance of common stock Proceeds from issuance of long-term debt Proceeds from term loan credit facility Proceeds from revolving credit facility Proceeds from convertible notes Proceeds from Payroll Support Program loan and warrants Proceeds from Employee stock plans Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures Supplier proceeds Assets constructed for others Purchases of short-term investments Proceeds from sales of short-term and other investments Other, net Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issuance of long-term debt Proceeds from Employee stock plans Reimbursement for assets constructed for others Payments of long-term debt and finance lease obligations Payments of cash dividends Repayment of construction obligation Repurchase of common stock \begin{tabular}{|c|c|c|} \hline & z & 600 \\ \hline 40 & 35 & 29 \\ \hline & 170 & 126 \\ \hline(615) & (342) & (592) \\ \hline (372) & (332) & (274) \\ \hline- & (30) & (10) \\ \hline(2,000) & (2,000) & (1,600) \\ \hline \end{tabular} Southwest Airlines Co. Consolidated Statement of Income (Loss) \begin{tabular}{|c|c|c|c|c|c|c|} \hline Repurchase of common stock & & (451) & & (2,000) & & (2,000) \\ \hline Reimbursement for assets constructed for others & & & & & & 170 \\ \hline Payments of long-term debt and finance lease obligations & & (839) & & (615) & & (342) \\ \hline Payments of term loan credit facility & & (3,683) & & & & \\ \hline Payments of revolving credit facility & & (1,000) & & & & E \\ \hline Payments of cash dividends & & (188) & & (372) & & (332) \\ \hline Payments of terminated interest rate derivative instruments & & (59) & & & & = \\ \hline Repayment of construction obligation & & = & & & & (30) \\ \hline Capitalized financing items & & (134) & & & & \\ \hline Other, net & & 49 & & (43) & & 3 \\ \hline Net cash provided by (used in) financing activities & & 9,658 & & (2,990) & & (2,496) \\ \hline NET CHANGE IN CASH AND CASH EQUIVALENTS & & 8,515 & & 694 & & 359 \\ \hline CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD & & 2,548 & & 1,854 & & 1,495 \\ \hline CASH AND CASH EQUIVALENTS AT END OF PERIOD & $ & 11,063 & $ & 2,548 & $ & 1,854 \\ \hline CASH PAYMENTS FOR: & & & & & & \\ \hline Interest, net of amount capitalized & $ & 212 & $ & 88 & $ & 107 \\ \hline Income taxes & $ & 19 & $ & 779 & $ & 327 \\ \hline \end{tabular} Net cash used in investing activities (3,746) (16) CASH FLOWS FROM FINANCING ACTIVITIES: Issuance of common stock Proceeds from issuance of long-term debt Proceeds from term loan credit facility Proceeds from revolving credit facility Proceeds from convertible notes Proceeds from Payroll Support Program loan and warrants Proceeds from Employee stock plans Repurchase of common stock Payments of long-term debt and finance lease obligations Payments of term loan credit facility Payments of revolving credit facility Payments of cash dividends Payments of terminated interest rate derivative instruments Payments for repurchases and conversions of convertible debt Capitalized financing items Other, net Net cash provided by (used in) financing activities NET CHANGE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS AT END OF PERIOD CASH PAYMENTS FOR: Interest, net of amount capitalized Income taxes SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Adoption of Accounting Standards Update 2020-06, Debt (See Note 3) Right-of-use assets acquired under operating leases Flight equipment acquired against supplier credit memo OPERATING INCOME (LOSS) OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Loss on extinguishment of debt Other (gains) losses, net Total other expenses (income) INCOME (LOSS) BEFORE INCOME TAXES PROVISION (BENEFIT) FOR INCOME TAXES NET INCOME (LOSS) NET INCOME (LOSS) PER SHARE, BASIC NET INCOME (LOSS) PER SHARE, DILUTED 1,017 1,721 (3,816) 467 (13) (50)28 1,325 348 \begin{tabular}{ll} \hline & 977 \\ \hline \hline$ & 1.65 \\ \hline \hline & 1.61 \\ \hline \end{tabular} 349 (32) \begin{tabular}{|c|c|} \hline & 349 \\ \hline & (35) \\ \hline & (32) \\ \hline & \\ \hline & 158 \\ \hline & 440 \\ \hline & (4,256) \\ \hline & (1,182) \\ \hline$ & (3,074) \\ \hline$ & (5.44) \\ \hline s & (5.44) \\ \hline \end{tabular} LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Current operating lease liabilities Air traffic liability Current maturities of long-term debt Total current liabilities Long-term debt less current maturities Air traffic liability - noncurrent Deferred income taxes Construction obligation Noncurrent operating lease liabilities Other noncurrent liabilities SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Adoption of Accounting Standards Update 2020-06, Debt (See Note 3) Right-of-use assets acquired under operating leases Flight equipment acquired against supplier credit memo Assets constructed for others Remeasurement of right-of-use asset and lease liability Stockholders' equity: Common stock, $1.00 par value: 2,000,000,000 shares authorized; 888,111,634 and 807,611,634 shares issued in 2020 and 2019 respectively Capital in excess of par value Retained earnings Accumulated other comprehensive loss Treasury stock, at cost: 297,637,297 and 288,547,318 shares in 2020 and 2019 respectively Total stockholders' equity Southwest Airlines Co. Consolidated Balance Sheet (in millions, except share data) ASSETS December 31, 2019 December 31, 2018 Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, at cost Prepaid expenses and other current assets Total current assets Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others \begin{tabular}{|c|c|c|c|} \hline \multirow[t]{6}{*}{$} & 2,548 & $ & 1,854 \\ \hline & 1,524 & & 1,835 \\ \hline & 1,086 & & 568 \\ \hline & 529 & & 461 \\ \hline & 287 & & 310 \\ \hline & 5,974 & & 5,028 \\ \hline \end{tabular} Less allowance for depreciation and amortization Goodwill Operating lease right-of-use assets Other assets \begin{tabular}{|c|c|c|c|} \hline & 10,688 & & 9,731 \\ \hline & 17,025 & & 19,525 \\ \hline & 970 & & 970 \\ \hline & 1,349 & & \\ \hline & 577 & & 720 \\ \hline$ & 25,895 & $ & 26,243 \\ \hline \end{tabular} LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Current operating lease liabilities Air traffic liability Current maturities of long-term debt Total current liabilities Long-term debt less current maturities Air traffic liability - noncurrent Deferred income taxes \begin{tabular}{|c|c|c|c|} \hline$ & 1,574 & $ & 1,416 \\ \hline & 1,749 & & 1,749 \\ \hline & 353 & & \\ \hline & 4,457 & & 4,134 \\ \hline & 819 & & 606 \\ \hline & 8,952 & & 7,905 \\ \hline & 1,846 & & 2,771 \\ \hline & 1,053 & & 936 \\ \hline & 2,364 & & 2,427 \\ \hline \end{tabular} Other, net Net cash used in financing activities NET CHANGE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS AT END OF PERIOD CASH PAYMENTS FOR: Interest, net of amount capitalized Income taxes SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Flight equipment under finance leases Assets constructed for others Supplier receivables \begin{tabular}{|c|c|c|c|c|c|} \hline & (43) & & 3 & & 15 \\ \hline & (2,990) & & (2,496) & & (1,706) \\ \hline & 694 & & 359 & & (185) \\ \hline & 1,854 & & 1,495 & & 1,680 \\ \hline$ & 2,548 & $ & 1,854 & $ & 1,495 \\ \hline \end{tabular} Goodwill Operating lease right-of-use assets Other assets \begin{tabular}{|c|c|c|c|} \hline & 17,342 & & 14,842 \\ \hline & 970 & & 970 \\ \hline & 1,394 & & 1,590 \\ \hline & 855 & & 882 \\ \hline$ & 35,369 & $ & 36,320 \\ \hline \end{tabular} LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Current operating lease liabilities Air traffic liability Current maturities of long-term debt Total current liabilities Long-term debt less current maturities Air traffic liability - noncurrent Deferred income taxes Noncurrent operating lease liabilities Other noncurrent liabilities OPERATING INCOME (LOSS) (3,816) 2,957 3,206 OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) INCOME (LOSS) BEFORE INCOME TAXES PROVISION (BENEFIT) FOR INCOME TAXES NET INCOME (LOSS) NET INCOME (LOSS) PER SHARE, BASIC NET INCOME (LOSS) PER SHARE, DILUTED \begin{tabular}{|c|c|c|c|c|c|} \hline & 349 & & 118 & & 131 \\ \hline & (35) & & (36) & & (38) \\ \hline & (32) & & (90) & & (69) \\ \hline & 158 & & 8 & & 18 \\ \hline & 440 & & = & & 42 \\ \hline & (4,256) & & 2,957 & & 3,164 \\ \hline & (1,182) & & 657 & & 699 \\ \hline$ & (3,074) & $ & 2,300 & $ & 2,465 \\ \hline$ & (5.44) & $ & 4.28 & $ & 4.30 \\ \hline$ & (5.44) & $ & 4.27 & $ & 4.29 \\ \hline \end{tabular} Snuthwest Airlines Co. OPERATING INCOME OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) INCOME BEFORE INCOME TAXES PROVISION (BENEFIT) FOR INCOME TAXES NET INCOME NET INCOME PER SHARE, BASIC NET INCOME PER SHARE, DILUTED 2,957 3,206 \begin{tabular}{l} 118 \\ (36) \\ (90) \\ 8 \\ E \\ \hline \end{tabular} 2,957 \begin{tabular}{|c|c|} \hline \multicolumn{2}{|r|}{118} \\ \hline & (36) \\ \hline & (90) \\ \hline & 8 \\ \hline & \\ \hline & 2,957 \\ \hline & 657 \\ \hline$ & 2,300 \\ \hline$ & 4.28 \\ \hline$ & 4.27 \\ \hline \end{tabular} \begin{tabular}{l} 131 \\ (38) \\ (69) \\ 18 \\ 42 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline & 3,164 \\ \hline & 699 \\ \hline$ & 2,465 \\ \hline$ & 4.30 \\ \hline$ & 4.29 \\ \hline \end{tabular} 3,407 \begin{tabular}{|c|c|c|c|} \hline & 131 & & 114 \\ \hline & (38) & & (49) \\ \hline & (69) & & (35) \\ \hline & 18 & & 112 \\ \hline & 42 & & 142 \\ \hline & 3,164 & & 3,265 \\ \hline & 699 & & (92) \\ \hline$ & 2,465 & $ & 3,357 \\ \hline$ & 4.30 & $ & 5.58 \\ \hline$ & 4.29 & $ & 5.57 \\ \hline \end{tabular} SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Assets constructed for others Supplier receivables Southwest Airlines Co. Consolidated Statement of Income (in millions, except per share amounts) Cowtbernat A iwlinger Co Southwest Airlines Co. Consolidated Balance Sheet (in millions, except share data) December 31, 2022 December 31, 2021 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, at cost Prepaid expenses and other current assets Total current assets Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others Less allowance for depreciation and amortization Southwest Airlines Co. Consolidated Balance Sheet (in millions, except share data) December 31, 2020 December 31, 2019 ASSETS Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, at cost Prepaid expenses and other current assets Total current assets Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others Less allowance for depreciation and amortization Goodwill Operating lease right-of-use assets Other assets Construction obligation Noncurrent operating lease liabilities Other noncurrent liabilities Stockholders' equity: Common stock, $1.00 par value: 2,000,000,000 shares authorized; 807,611,634 shares issued in 2019 and 2018 Capital in excess of par value Retained earnings Accumulated other comprehensive income (loss) Treasury stock, at cost: 288,547,318 and 255,008,275 shares in 2019 and 2018 respectively Total stockholders' equity \begin{tabular}{|c|c|c|c|} \hline \multicolumn{2}{|r|}{164} & & 1,701 \\ \hline & 978 & & \\ \hline & 706 & & 650 \\ \hline & 808 & & 808 \\ \hline & 1,581 & & 1,510 \\ \hline & 17,945 & & 15,967 \\ \hline & (61) & & 20 \\ \hline & ((10,441) & & (8,452) \\ \hline & 9,832 & & 9,853 \\ \hline$ & 25,895 & $ & 26,243 \\ \hline \end{tabular} Southwest Airlines Co. Consolidated Statement of Income (Loss) (in millions, except per share amounts) Stockholders' equity: Common stock, $1.00 par value: 2,000,000,000 shares authorized; 888,111,634 shares issued in 2022 and 2021 Capital in excess of par value Retained earnings Accumulated other comprehensive income 4,03788834416,261(10,843)10,68735,369 Treasury stock, at cost: 294,111,813 and 295,991,525 shares in 2022 and 2021, respectively Total stockholders' equity Other, net Net cash provided by (used in) operating activities (1,127)(95)3,987(108)4,89314 CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures Supplier proceeds Proceeds from sale-leaseback transactions Assets constructed for others Purchases of short-term investments Proceeds from sales of short-term and other investments Other, net Net cash used in investing activities \begin{tabular}{|c|c|c|} \hline(515) & (1,027) & (1,922) \\ \hline428 & 400 & \\ \hline 815 & & = \\ \hline & & (54) \\ \hline(5,080) & (2,122) & (2,409) \\ \hline4,336 & 2,446 & 2,342 \\ \hline & = & 5 \\ \hline(16) & (303) & (2,038) \\ \hline \end{tabular} CASH FLOWS FROM FINANCING ACTIVITIES: Issuance of common stock Proceeds from issuance of long-term debt Proceeds from term loan credit facility Proceeds from revolving credit facility Proceeds from convertible notes Proceeds from Payroll Support Program loan and warrants Proceeds from Employee stock plans Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures Supplier proceeds Assets constructed for others Purchases of short-term investments Proceeds from sales of short-term and other investments Other, net Net cash used in investing activities CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from issuance of long-term debt Proceeds from Employee stock plans Reimbursement for assets constructed for others Payments of long-term debt and finance lease obligations Payments of cash dividends Repayment of construction obligation Repurchase of common stock \begin{tabular}{|c|c|c|} \hline & z & 600 \\ \hline 40 & 35 & 29 \\ \hline & 170 & 126 \\ \hline(615) & (342) & (592) \\ \hline (372) & (332) & (274) \\ \hline- & (30) & (10) \\ \hline(2,000) & (2,000) & (1,600) \\ \hline \end{tabular} Southwest Airlines Co. Consolidated Statement of Income (Loss) \begin{tabular}{|c|c|c|c|c|c|c|} \hline Repurchase of common stock & & (451) & & (2,000) & & (2,000) \\ \hline Reimbursement for assets constructed for others & & & & & & 170 \\ \hline Payments of long-term debt and finance lease obligations & & (839) & & (615) & & (342) \\ \hline Payments of term loan credit facility & & (3,683) & & & & \\ \hline Payments of revolving credit facility & & (1,000) & & & & E \\ \hline Payments of cash dividends & & (188) & & (372) & & (332) \\ \hline Payments of terminated interest rate derivative instruments & & (59) & & & & = \\ \hline Repayment of construction obligation & & = & & & & (30) \\ \hline Capitalized financing items & & (134) & & & & \\ \hline Other, net & & 49 & & (43) & & 3 \\ \hline Net cash provided by (used in) financing activities & & 9,658 & & (2,990) & & (2,496) \\ \hline NET CHANGE IN CASH AND CASH EQUIVALENTS & & 8,515 & & 694 & & 359 \\ \hline CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD & & 2,548 & & 1,854 & & 1,495 \\ \hline CASH AND CASH EQUIVALENTS AT END OF PERIOD & $ & 11,063 & $ & 2,548 & $ & 1,854 \\ \hline CASH PAYMENTS FOR: & & & & & & \\ \hline Interest, net of amount capitalized & $ & 212 & $ & 88 & $ & 107 \\ \hline Income taxes & $ & 19 & $ & 779 & $ & 327 \\ \hline \end{tabular} Net cash used in investing activities (3,746) (16) CASH FLOWS FROM FINANCING ACTIVITIES: Issuance of common stock Proceeds from issuance of long-term debt Proceeds from term loan credit facility Proceeds from revolving credit facility Proceeds from convertible notes Proceeds from Payroll Support Program loan and warrants Proceeds from Employee stock plans Repurchase of common stock Payments of long-term debt and finance lease obligations Payments of term loan credit facility Payments of revolving credit facility Payments of cash dividends Payments of terminated interest rate derivative instruments Payments for repurchases and conversions of convertible debt Capitalized financing items Other, net Net cash provided by (used in) financing activities NET CHANGE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS AT END OF PERIOD CASH PAYMENTS FOR: Interest, net of amount capitalized Income taxes SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Adoption of Accounting Standards Update 2020-06, Debt (See Note 3) Right-of-use assets acquired under operating leases Flight equipment acquired against supplier credit memo OPERATING INCOME (LOSS) OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Loss on extinguishment of debt Other (gains) losses, net Total other expenses (income) INCOME (LOSS) BEFORE INCOME TAXES PROVISION (BENEFIT) FOR INCOME TAXES NET INCOME (LOSS) NET INCOME (LOSS) PER SHARE, BASIC NET INCOME (LOSS) PER SHARE, DILUTED 1,017 1,721 (3,816) 467 (13) (50)28 1,325 348 \begin{tabular}{ll} \hline & 977 \\ \hline \hline$ & 1.65 \\ \hline \hline & 1.61 \\ \hline \end{tabular} 349 (32) \begin{tabular}{|c|c|} \hline & 349 \\ \hline & (35) \\ \hline & (32) \\ \hline & \\ \hline & 158 \\ \hline & 440 \\ \hline & (4,256) \\ \hline & (1,182) \\ \hline$ & (3,074) \\ \hline$ & (5.44) \\ \hline s & (5.44) \\ \hline \end{tabular} LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Current operating lease liabilities Air traffic liability Current maturities of long-term debt Total current liabilities Long-term debt less current maturities Air traffic liability - noncurrent Deferred income taxes Construction obligation Noncurrent operating lease liabilities Other noncurrent liabilities SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Adoption of Accounting Standards Update 2020-06, Debt (See Note 3) Right-of-use assets acquired under operating leases Flight equipment acquired against supplier credit memo Assets constructed for others Remeasurement of right-of-use asset and lease liability Stockholders' equity: Common stock, $1.00 par value: 2,000,000,000 shares authorized; 888,111,634 and 807,611,634 shares issued in 2020 and 2019 respectively Capital in excess of par value Retained earnings Accumulated other comprehensive loss Treasury stock, at cost: 297,637,297 and 288,547,318 shares in 2020 and 2019 respectively Total stockholders' equity Southwest Airlines Co. Consolidated Balance Sheet (in millions, except share data) ASSETS December 31, 2019 December 31, 2018 Current assets: Cash and cash equivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, at cost Prepaid expenses and other current assets Total current assets Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others \begin{tabular}{|c|c|c|c|} \hline \multirow[t]{6}{*}{$} & 2,548 & $ & 1,854 \\ \hline & 1,524 & & 1,835 \\ \hline & 1,086 & & 568 \\ \hline & 529 & & 461 \\ \hline & 287 & & 310 \\ \hline & 5,974 & & 5,028 \\ \hline \end{tabular} Less allowance for depreciation and amortization Goodwill Operating lease right-of-use assets Other assets \begin{tabular}{|c|c|c|c|} \hline & 10,688 & & 9,731 \\ \hline & 17,025 & & 19,525 \\ \hline & 970 & & 970 \\ \hline & 1,349 & & \\ \hline & 577 & & 720 \\ \hline$ & 25,895 & $ & 26,243 \\ \hline \end{tabular} LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Current operating lease liabilities Air traffic liability Current maturities of long-term debt Total current liabilities Long-term debt less current maturities Air traffic liability - noncurrent Deferred income taxes \begin{tabular}{|c|c|c|c|} \hline$ & 1,574 & $ & 1,416 \\ \hline & 1,749 & & 1,749 \\ \hline & 353 & & \\ \hline & 4,457 & & 4,134 \\ \hline & 819 & & 606 \\ \hline & 8,952 & & 7,905 \\ \hline & 1,846 & & 2,771 \\ \hline & 1,053 & & 936 \\ \hline & 2,364 & & 2,427 \\ \hline \end{tabular} Other, net Net cash used in financing activities NET CHANGE IN CASH AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD CASH AND CASH EQUIVALENTS AT END OF PERIOD CASH PAYMENTS FOR: Interest, net of amount capitalized Income taxes SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS: Flight equipment under finance leases Assets constructed for others Supplier receivables \begin{tabular}{|c|c|c|c|c|c|} \hline & (43) & & 3 & & 15 \\ \hline & (2,990) & & (2,496) & & (1,706) \\ \hline & 694 & & 359 & & (185) \\ \hline & 1,854 & & 1,495 & & 1,680 \\ \hline$ & 2,548 & $ & 1,854 & $ & 1,495 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started