Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you do the write up anylsis of this company of this projected anylsis throughout the year of 2 0 1 9 ?to year of

Can you do the write up anylsis of this company of this projected anylsis throughout the year of ?to year of ?just two paragraph

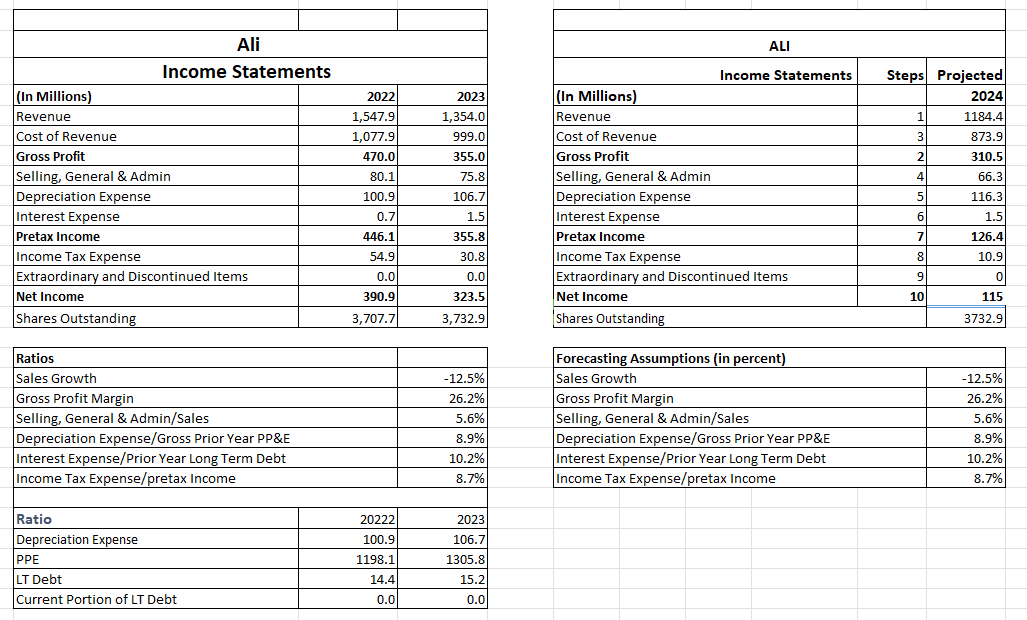

(In Millions) Revenue Cost of Revenue Gross Profit Selling, General & Admin Depreciation Expense Income Statements Interest Expense Pretax Income Income Tax Expense Extraordinary and Discontinued Items Net Income Shares Outstanding Ratios Sales Growth Gross Profit Margin Selling, General & Admin/Sales Ali Ratio Depreciation Expense Depreciation Expense/Gross Prior Year PP&E Interest Expense/Prior Year Long Term Debt Income Tax Expense/pretax Income PPE LT Debt Current Portion of LT Debt 2022 1,547.9 1,077.9 470.0 80.1 100.9 0.7 446.1 54.9 0.0 390.9 3,707.7 20222 100.9 1198.1 14.4 0.0 2023 1,354.0 999.0 355.0 75.8 106.7 1.5 355.8 30.8 0.0 323.5 3,732.9 -12.5% 26.2% 5.6% 8.9% 10.2% 8.7% 2023 106.7 1305.8 15.2 0.0 (In Millions) Revenue Cost of Revenue Gross Profit Selling, General & Admin Depreciation Expense ALI Income Statements Interest Expense Pretax Income Income Tax Expense Extraordinary and Discontinued Items Net Income Shares Outstanding Forecasting Assumptions (in percent) Sales Growth Gross Profit Margin Selling, General & Admin/Sales Depreciation Expense/Gross Prior Year PP&E Interest Expense/Prior Year Long Term Debt Income Tax Expense/pretax Income Steps Projected 2024 1184.4 873.9 310.5 66.3 116.3 1.5 126.4 10.9 0 115 3732.9 1 3 2 4 5 6 7 8 9 10 -12.5% 26.2% 5.6% 8.9% 10.2% 8.7%

Step by Step Solution

★★★★★

3.20 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Analysis of Ali Corporation 20192024 Ali Corporations projected income statements from 2019 to 2024 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started