Answered step by step

Verified Expert Solution

Question

1 Approved Answer

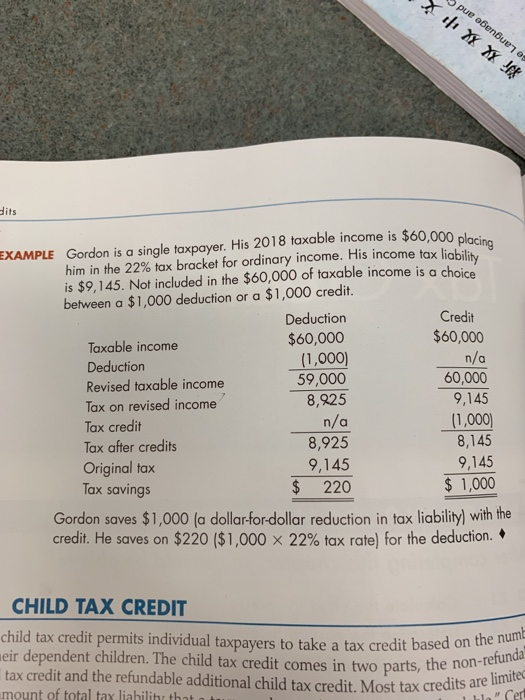

can you explain how does the number come. such as tax on revised income $8925 dits EXAMPLE Gordon is a single taxpayer. His 2018 taxable

can you explain how does the number come. such as tax on revised income $8925

dits EXAMPLE Gordon is a single taxpayer. His 2018 taxable income is $60,000 ploc is $9,145. Not included in the $60,000 of taxable income is a choice between a $1,000 deduction or a $1,000 credit. him in the 22% tax bracket for ordinary income. His income tax liability Credit Deduction $60,000 1,000] 59,000 8,925 $60,000 Taxable income Deduction Revised taxable income Tax on revised income Tax credit Tax after credits Original tax Tax savings 60,000 9,145 (1,000 8,145 8,925 9,145 $220 9,145 $1,000 Gordon saves $1,000 (a dollarfordollar reduction in tax liability) with the credit. He saves on $220 ($1,000 22% tax rate) for the deduction. . CHILD TAX CREDIT child tax credit permits individual taxpayers to take a tax credit base eir dependent children. The child tax credit comes in two parts, thenot limite tax credit and the refundable additional child tax credit. Most tax cres Cer mount of total tax liabilit, that Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started