can you explain how to get the answers ?

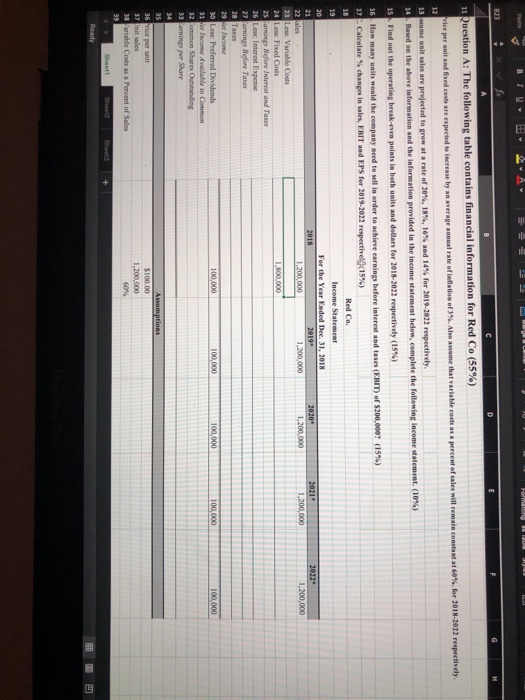

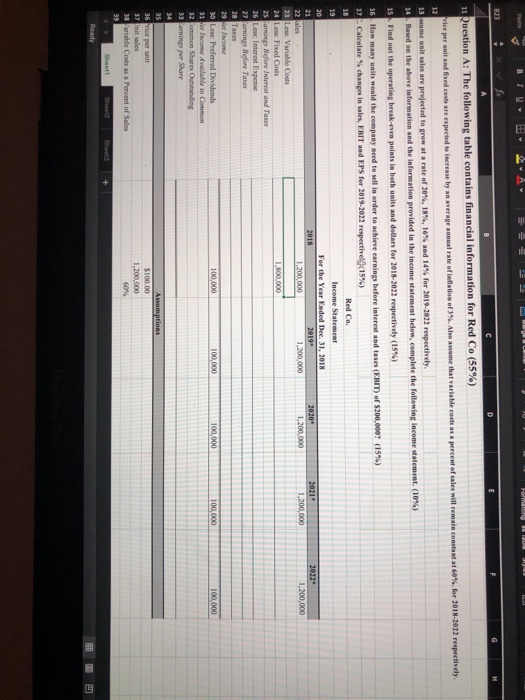

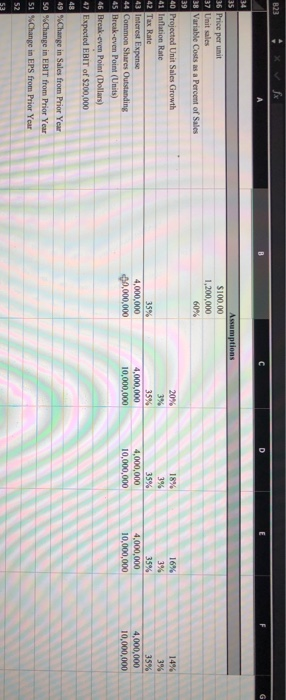

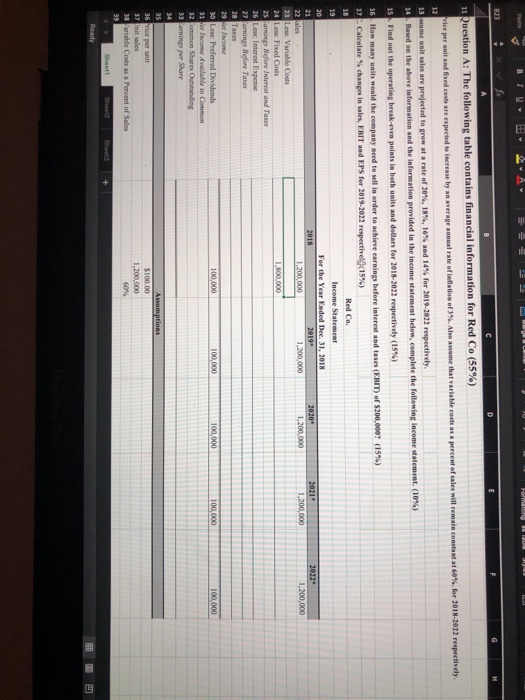

BILARI 11 Question A: The following table contains financial information for Red Co (55%) me that variable costs remain constant at 60% for 2018-2022 respectively. Price per unit and fised costs are expected to lacrease by an average annual rate of inflation of 3%. Also 13 wume unit sales are prejected to grow at a rate of 20%, 18%, 16% and 14% for 2019-2022 respectively. 14. Based on the above information and the information provided in the income statement below, complete the following income statement (10%) 15. Find out the operating break-even points in both units and dollars for 2018-2022 respectively (15%) 16 How many units would the company need to sell in order to achieve earnings before interest and taxes (EBIT) of $200,000? (15%) 17. Calculate changes in sales, EBIT and EPS for 2019-2022 respectiveX15%) Red Co. Income Statement For the Year Eaded Dec 31, 2018 2021 1.200,000 1,200,000 1,200,000 1,200,000 22 ales 23 Low Variable Costs 24 Less Fixed Costs 25 aming Nefore Interest and Tanes 26 Less: Interest Expense 27 arines Before Taxes 28 Taxes 29 encome 30 Less: Preferred Dividends 31 et Income Available to Coron 32ommon Shares Outstanding 33 amings per Share 100.000 100.000 100,000 36 Price per unit 37 nitales 38 ariable Costs as a Percent of Salles 1,200,000 Sheet Ready B23 * fx 36 Price per unit 37 Unit sales 38 Variable costs as a Percent of Sales Assumptions $100.00 1,200,000 60% 20% 1496 396 40 Projected Unit Sales Growth 41 Inflation Rate 42 Tax Rate 43 Interest Expense 44 Common Shares Outstanding 45 Break-even Point (Units) 46 Break-even Point (Dollars) 47 Expected EBIT of $200,000 35% 4,000,000 40,000,000 35% 4,000,000 10,000,000 3% 35% 4,000,000 10,000,000 16% 3% 35% 4,000,000 10,000,000 35% 4,000,000 10,000,000 49 Change in Sales from Prior Year 50 %Change in EBIT from Prior Year 51 XChange in EPS from Prior Year BILARI 11 Question A: The following table contains financial information for Red Co (55%) me that variable costs remain constant at 60% for 2018-2022 respectively. Price per unit and fised costs are expected to lacrease by an average annual rate of inflation of 3%. Also 13 wume unit sales are prejected to grow at a rate of 20%, 18%, 16% and 14% for 2019-2022 respectively. 14. Based on the above information and the information provided in the income statement below, complete the following income statement (10%) 15. Find out the operating break-even points in both units and dollars for 2018-2022 respectively (15%) 16 How many units would the company need to sell in order to achieve earnings before interest and taxes (EBIT) of $200,000? (15%) 17. Calculate changes in sales, EBIT and EPS for 2019-2022 respectiveX15%) Red Co. Income Statement For the Year Eaded Dec 31, 2018 2021 1.200,000 1,200,000 1,200,000 1,200,000 22 ales 23 Low Variable Costs 24 Less Fixed Costs 25 aming Nefore Interest and Tanes 26 Less: Interest Expense 27 arines Before Taxes 28 Taxes 29 encome 30 Less: Preferred Dividends 31 et Income Available to Coron 32ommon Shares Outstanding 33 amings per Share 100.000 100.000 100,000 36 Price per unit 37 nitales 38 ariable Costs as a Percent of Salles 1,200,000 Sheet Ready B23 * fx 36 Price per unit 37 Unit sales 38 Variable costs as a Percent of Sales Assumptions $100.00 1,200,000 60% 20% 1496 396 40 Projected Unit Sales Growth 41 Inflation Rate 42 Tax Rate 43 Interest Expense 44 Common Shares Outstanding 45 Break-even Point (Units) 46 Break-even Point (Dollars) 47 Expected EBIT of $200,000 35% 4,000,000 40,000,000 35% 4,000,000 10,000,000 3% 35% 4,000,000 10,000,000 16% 3% 35% 4,000,000 10,000,000 35% 4,000,000 10,000,000 49 Change in Sales from Prior Year 50 %Change in EBIT from Prior Year 51 XChange in EPS from Prior Year