Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you explain how we managed to solve this question (answer attached)? and what is the equation used? and what for? like explain it for

can you explain how we managed to solve this question (answer attached)? and what is the equation used? and what for? like explain it for someone ghat wants to solve this and doesnt know much about it .

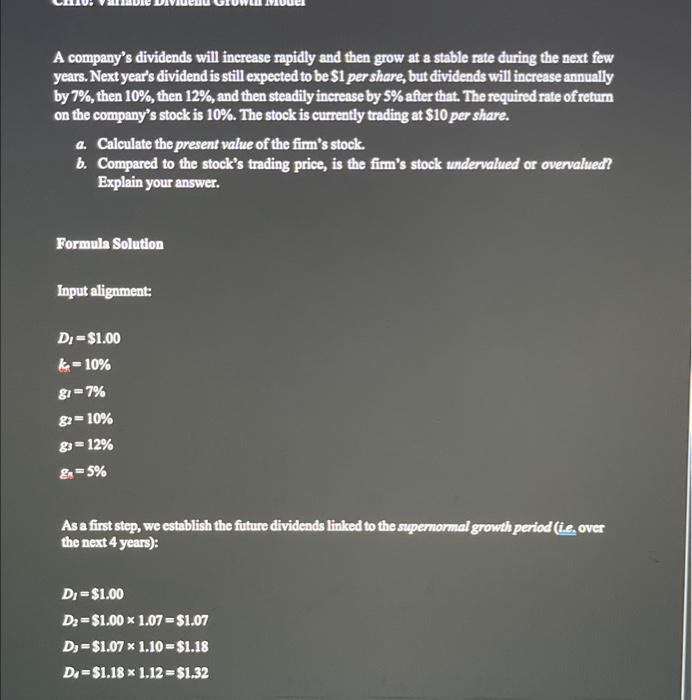

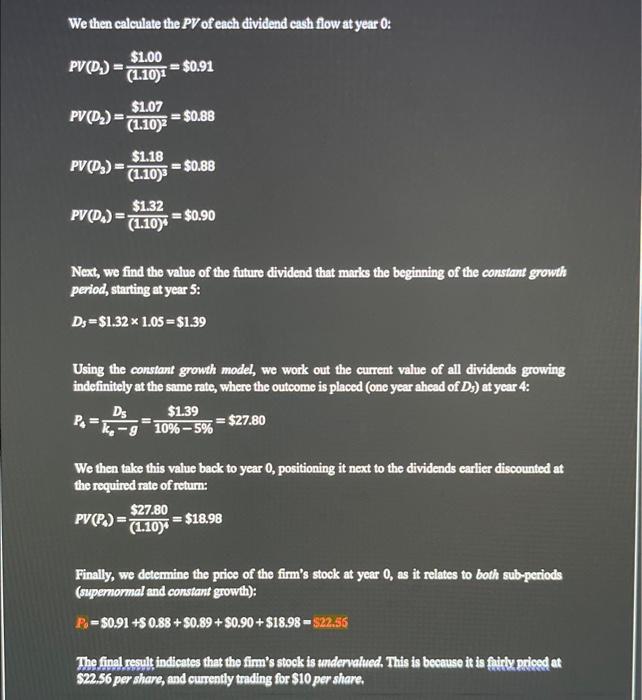

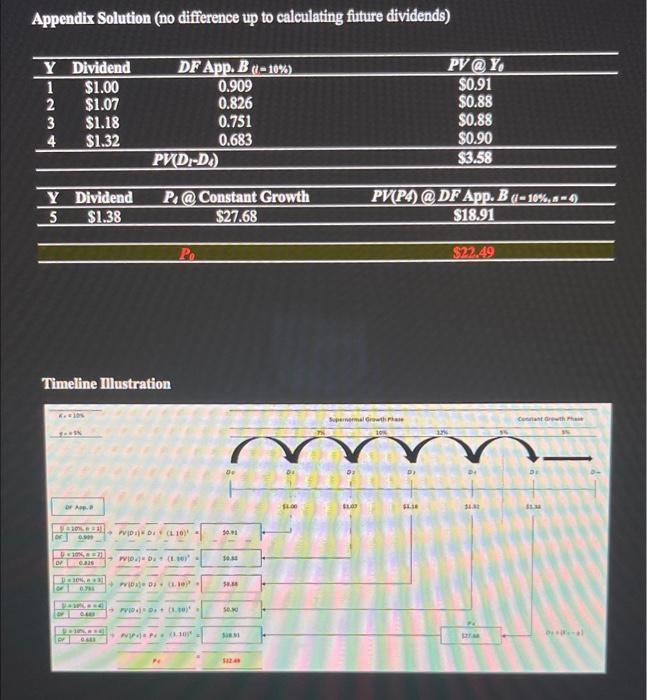

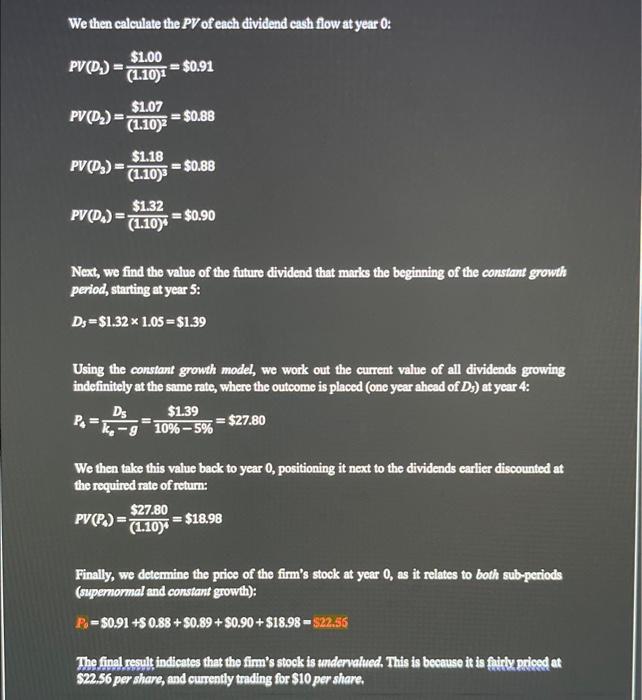

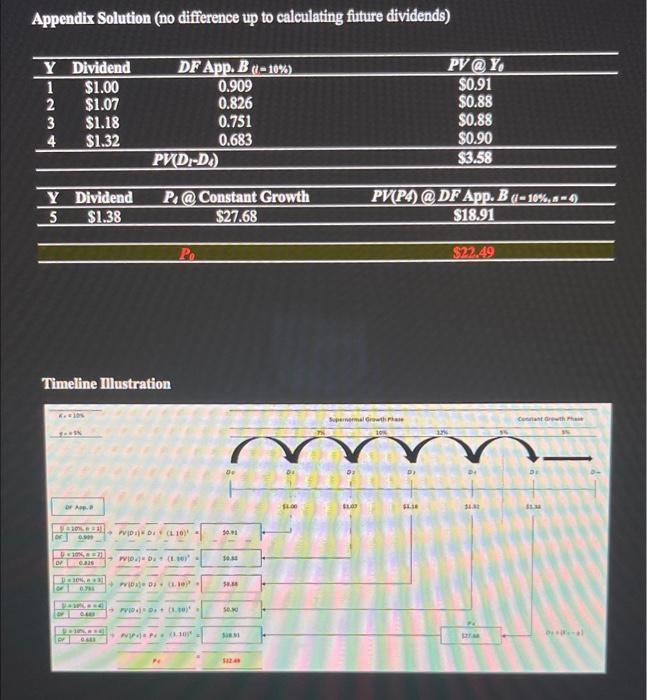

A company's dividends will increase rapidly and then grow at a stable rate during the next few years. Next year's dividend is still expected to be $1 per share, but dividends will increase annually by 7%, then 10%, then 12%, and then steadily increase by 5% after that. The required rate of return on the company's stock is 10%. The stock is currently trading at $10 per share. a. Calculate the present value of the firm's stock. b. Compared to the stock's trading price, is the firm's stock undervalued or overvalued? Explain your answer. Formula Solution Input alignment: D1=51.00kn=10%g1=7%g2=10%g3=12%gn=5% As a first step, we establish the future dividends linked to the supernormal growth period (ie., over the next 4 years): D1=$1.00D2=$1.001.07=$1.07D3=$1.071.10=$1.18D1=$1.181.12=$1.32 We then calculate the PV of each dividend cash flow at year 0 : PV(D2)=(1.10)1$1.00=$0.91PV(D2)=(1.10)2$1.07=$0.88PV(D3)=(1.10)3$1.18=$0.88PV(D4)=(1.10)4$1.32=$0.90 Next, we find the value of the future dividend that marks the beginning of the constant growth period, starting at year 5 : Ds=$1.321.05=$1.39 Using the constant growhh model, we work out the current value of all dividends growing indefinitely at the same rate, where the outcome is placed (one year ahead of D5 ) at year 4 : P4=kegD5=10%5%$1.39=$27.80 We then take this value back to year 0 , positioning it next to the dividends carlier discounted at the required rate of return: PV(P4)=(1.10)4$27.80=$18.98 Finally, we determine the price of the firm's stock at year 0 , as it relates to both sub-periods (supernormal and constant growth): P0=$0.91+$0.88+$0.89+$0.90+$18.98=522.56 The final result indicates that the fim's stock is undenvalued. This is because it is furlly priced at S22,56 per share, and currently trading for $10 per share. Appendix Solution (no difference up to calculating future dividends) Timeline Illustration

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started