Answered step by step

Verified Expert Solution

Question

1 Approved Answer

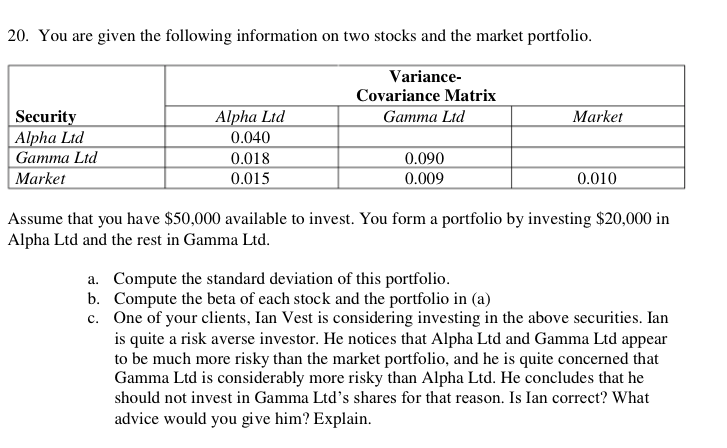

Can you explain part c please. Thanks 20. You are given the following information on two stocks and the market portfolio. Variance- Covariance Matrix Gamma

Can you explain part c please.

Thanks

20. You are given the following information on two stocks and the market portfolio. Variance- Covariance Matrix Gamma Ltd Market Security Alpha Ltd Gamma Ltd Market Alpha Ltd 0.040 0.018 0.015 0.090 0.009 0.010 Assume that you have $50,000 available to invest. You form a portfolio by investing $20,000 in Alpha Ltd and the rest in Gamma Ltd. a. Compute the standard deviation of this portfolio. b. Compute the beta of each stock and the portfolio in (a) c. One of your clients, Ian Vest is considering investing in the above securities. Ian is quite a risk averse investor. He notices that Alpha Ltd and Gamma Ltd appear to be much more risky than the market portfolio, and he is quite concerned that Gamma Ltd is considerably more risky than Alpha Ltd. He concludes that he should not invest in Gamma Ltd's shares for that reason. Is Ian correct? What advice would you give him? ExplainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started