Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you explain question A in details thank you Zear Company produces an electronic processor and sells it wholesale to manufacturing and retail outlets at

Can you explain question A in details thank you

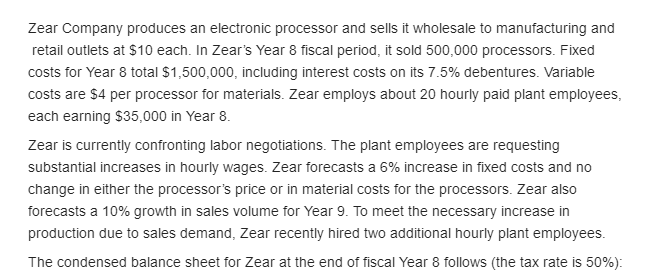

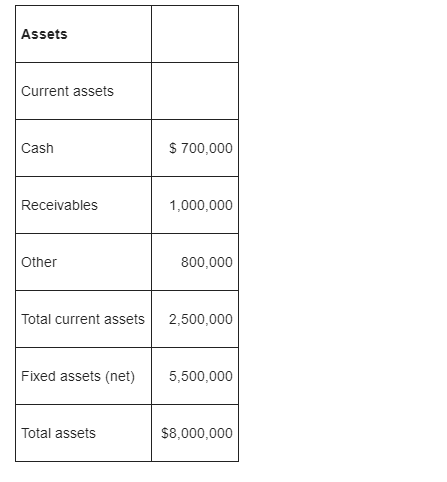

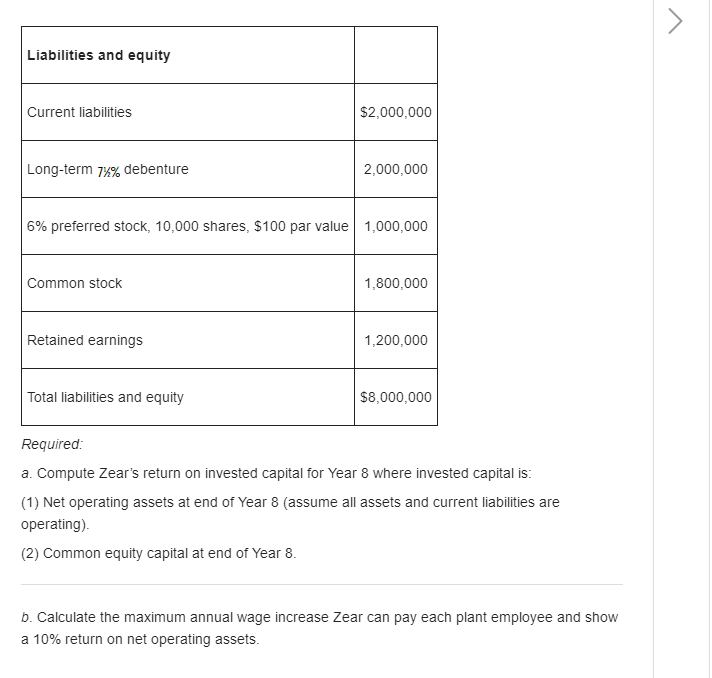

Zear Company produces an electronic processor and sells it wholesale to manufacturing and retail outlets at $10 each. In Zear's Year 8 fiscal period, it sold 500,000 processors. Fixed costs for Year 8 total $1,500,000, including interest costs on its 7.5% debentures. Variable costs are $4 per processor for materials. Zear employs about 20 hourly paid plant employees, each earning $35,000 in Year 8. Zear is currently confronting labor negotiations. The plant employees are requesting substantial increases in hourly wages. Zear forecasts a 6% increase in fixed costs and no change in either the processor's price or in material costs for the processors. Zear also forecasts a 10% growth in sales volume for Year 9. To meet the necessary increase in production due to sales demand, Zear recently hired two additional hourly plant employees. The condensed balance sheet for Zear at the end of fiscal Year 8 follows (the tax rate is 50%): Assets Current assets Cash $ 700,000 Receivables 1,000,000 Other 800,000 Total current assets 2,500,000 Fixed assets (net) 5,500,000 Total assets $8,000,000 Liabilities and equity Current liabilities $2,000,000 Long-term 7% debenture 2,000,000 6% preferred stock, 10,000 shares, $100 par value 1,000,000 Common stock 1,800,000 Retained earnings 1,200,000 Total liabilities and equity $8,000,000 Required: a. Compute Zear's return on invested capital for Year 8 where invested capital is: (1) Net operating assets at end of Year 8 (assume all assets and current liabilities are operating) (2) Common equity capital at end of Year 8. b. Calculate the maximum annual wage increase Zear can pay each plant employee and show a 10% return on net operating assetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started