Can you Explain this paper for simple explanation?

About Transfer Pricing in Managarial Economics.

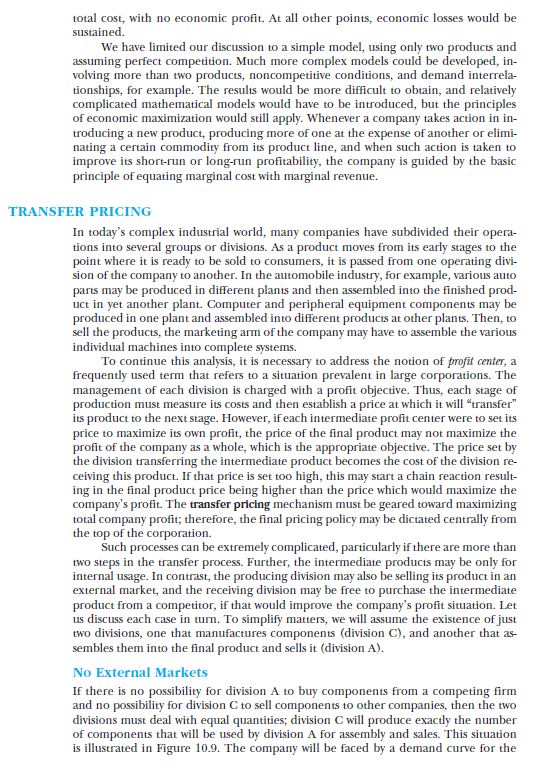

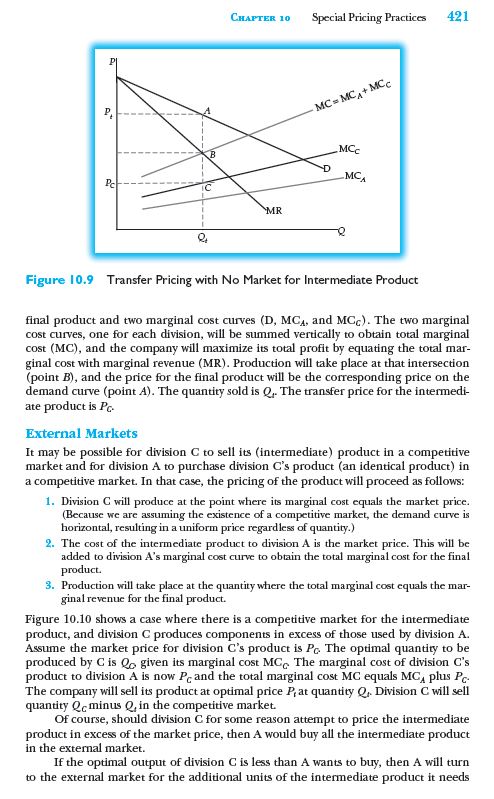

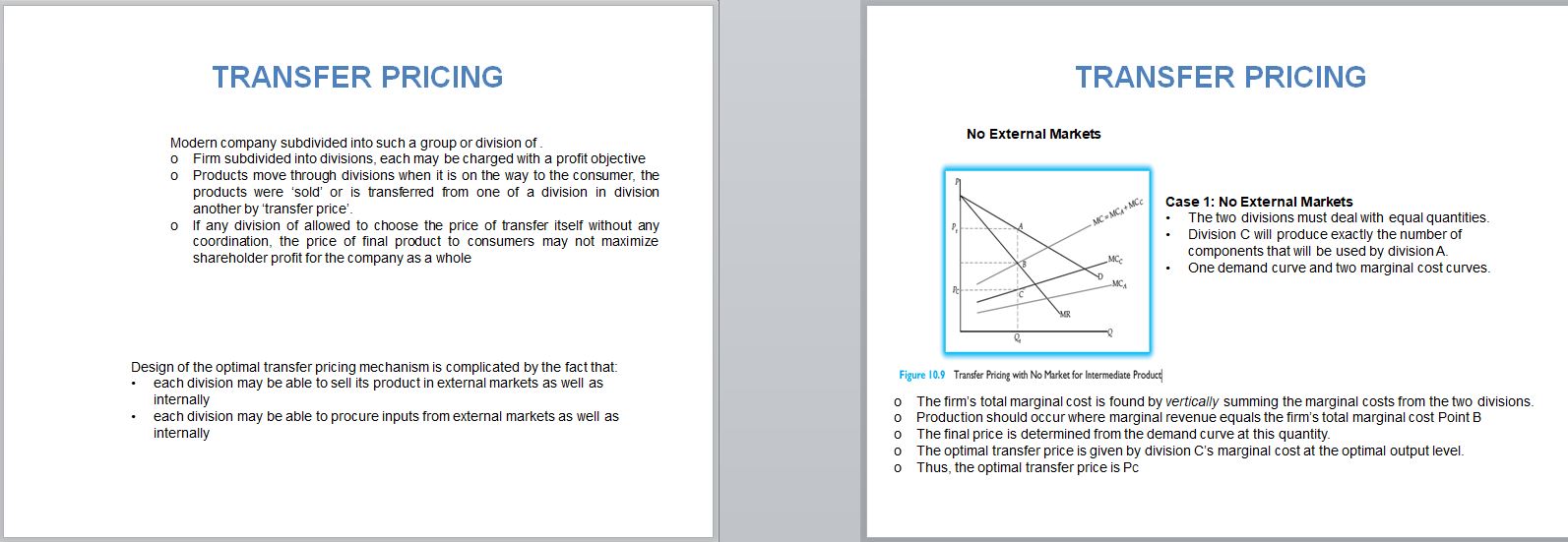

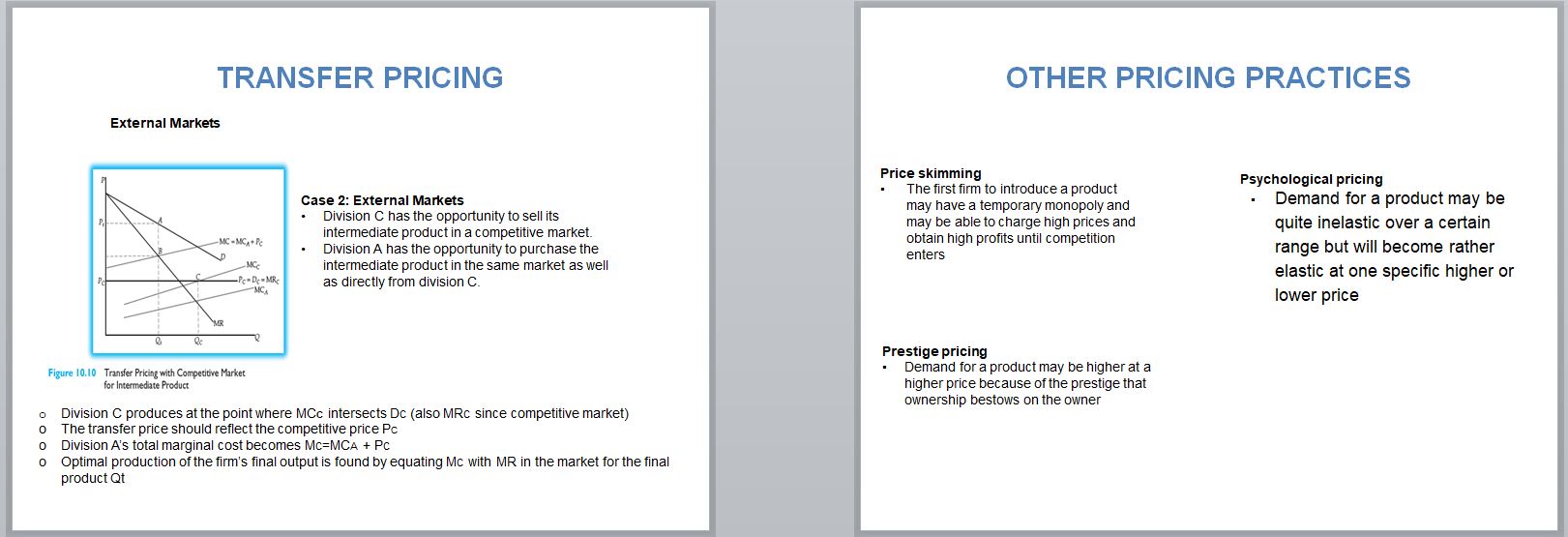

total cost. with no economic prot. At all other points, economic losses would be sus-Ined. We have limited our discussion to a simple model, using only two products and assuming perfect competition. Much more complex models could be developed, in volving more than two products, noncompetitive conditions, and demand interrela tionships, for example. The resqu would be more difcult to obtain, and relatively complicated mathematical models would have to be introduced, but. the prindples ofeconomlc maximization would still apply. Whenever a company takes action in in troducing a new product, producing more ofone at the expense ofattother or elimi nating a cenain commodity from its product line, and when such action is taken to improve its shortrun or long-run protability, the company is guided by the basic principle oi'equating marginal costwith marginal revenue. MS FER PRICING In today's complex indmtrial world, many companies have subdivided their opera tions into several groups or divisions. As a product moves from its early stages to the point where it is ready to be sold to consumers, it is passed from one operating divi sion oi'the company to another. in the automobile industry, forexarnple, various auto parts may be produced in di'erent plants and then assembled into the nished prod- uct in yet another plant. Computer and peripheral equipment components may be produced in one plant and assembled into diiierent products at otherplants. Then, to sell the products, the marketingarm oft'he company may have ID assemble the variotn individual machines into complete systems. To continue this analysis, ll is necessary to address the notion ofprqfil mitt; a frequently used term that refers to a situation prevalent in large corporations. The managementofeach division is charged with a prot objective. Thus, each stage of production must measure its costs and then establish a price atwhich it will \"transfer\" its productto the next stage. However, ii'each intermediate protcenuerwere to setits prioe to maximize its own profit, the price of the nal product may not maximise the prot of the company as a whole, which is the appropriate objective. The price set by the division transferring the intermediate product becomes the cost of the division re ceiving this product. If that price is set too high, this may start a chain reaction result ing in the nal product price being higher than the price which would maximize the company's prot The transfer pl'ldng mechanism must be geared toward maximizing total company prot; therei'ote, the nal pricing policymay be dictated centrally from the top oi'the corporation. Such processes can be extremely complicated, particularly ifthere are more than two steps in the transfer proceu. Further. the intermediate products may be only [or internal tinge. In contrast, the producing division mayaJso be selling its product in an external market, and the receiving division may be free to purchase the intermediate product from a competitor, ifthatwould improve the company's prot situation. Let usdiscuss each case in turn. To simplify matters, we will assume the existence ofjust two divisions, one that manufactures components (division C}, and another that as sembles them into the nal product and sells it (division A). No External Markets If there b no possibility for division A to buy components from a competing firm and no possibility for division I: to sell components to other companies. then the two divisions must deal with equal quantities; division C will produce exactly the number of oomponents that will be used by division A {or assembly and sales. This situation is illustrated in Figure 10.9. The company will be faced by a demand cune for the CHAPTER 10 Special Pricing Practices 421 MC = MCA + MCC P MCC MCA C `MR Figure 10.9 Transfer Pricing with No Market for Intermediate Product final product and two marginal cost curves (D, MC,, and MCc). The two marginal cost curves, one for each division, will be summed vertically to obtain total marginal cost (MC), and the company will maximize its total profit by equating the total mar- ginal cost with marginal revenue (MR). Production will take place at that intersection (point B), and the price for the final product will be the corresponding price on the demand curve (point A). The quantity sold is Q.. The transfer price for the intermedi- ate product is Pc External Markets It may be possible for division C to sell its (intermediate) product in a competitive market and for division A to purchase division C's product (an identical product) in a competitive market. In that case, the pricing of the product will proceed as follows: 1. Division C will produce at the point where its marginal cost equals the market price. (Because we are assuming the existence of a competitive market, the demand curve is horizontal, resulting in a uniform price regardless of quantity.) 2. The cost of the intermediate product to division A is the market price. This will be added to division A's marginal cost curve to obtain the total marginal cost for the final product. 3. Production will take place at the quantity where the total marginal cost equals the mar- ginal revenue for the final product. Figure 10.10 shows a case where there is a competitive market for the intermediate product, and division G produces components in excess of those used by division A. Assume the market price for division C's product is Po The optimal quantity to be produced by C is Q given its marginal cost MC. The marginal cost of division C's product to division A is now Pc and the total marginal cost MC equals MC, plus Pc. The company will sell its product at optimal price Pat quantity Q. Division C will sell quantity Q- minus Q, in the competitive market. Of course, should division C for some reason attempt to price the intermediate product in excess of the market price, then A would buy all the intermediate product in the external market. If the optimal output of division C is less than A wants to buy, then A will turn to the external market for the additional units of the intermediate product it needsP. MC = MCA+ Pc B D MCC Pc = DC = MR -MC `MR Qc Figure 10.10 Transfer Pricing with Competitive Market for Intermediate Product to maximize company profits. The graph for this situation would be quite similar to Figure 10.10, and we leave it to the reader to illustrate this particular situation. In this section, we discuss transfer pricing among different divisions of a com- pany when all the divisions are located in the same country. When different parts of a corporation are located in different countries and products are shipped across borders, the situation becomes even more complex. We discuss this subject in detail in Chapter 13. OTHER PRICING PRACTICES Price skimming occurs when a firm is the first to introduce a product. It may have a virtual monopoly, and often will be able to charge high prices and obtain substantial profits before competition enters. In penetradon pricing a company sets a relatively low price in order to obtain market share. Limit pricing exists when a monopolist sets a price below the monopoly price (where MR = MC) to discourage potential competitors from entering the market and competing. At the lower price, the monopolist's profit will be below its maximum. Of course, limit pricing may be based on the monopolist's expectation that its cost will decrease because of the existence of a learning curve, so that ultimately the limit price will become the profit maximizing price. Another special pricing practice is predatory pricing, where a company prices below its marginal cost to cause competitors to exit the market. After the competitors have left the market the company will raise its prices. However, this practice is not seen very often in the United States because it is illegal under the Sherman Antitrust Act. Also, it may create considerable losses to the monopolist and may not be worthwhile in the long run. Further, after the monopolist raises prices a new competitive threat may appear. Thus the company may have to lower prices again and incur new losses. With prestige pricing, demand for a product may be higher at a higher price because of the prestige that ownership bestows on the buyer. Psychological pricing takes advantage of the fact that the demand for a particular product may be quite inelastic over a certain range but will become rather elastic at