Question

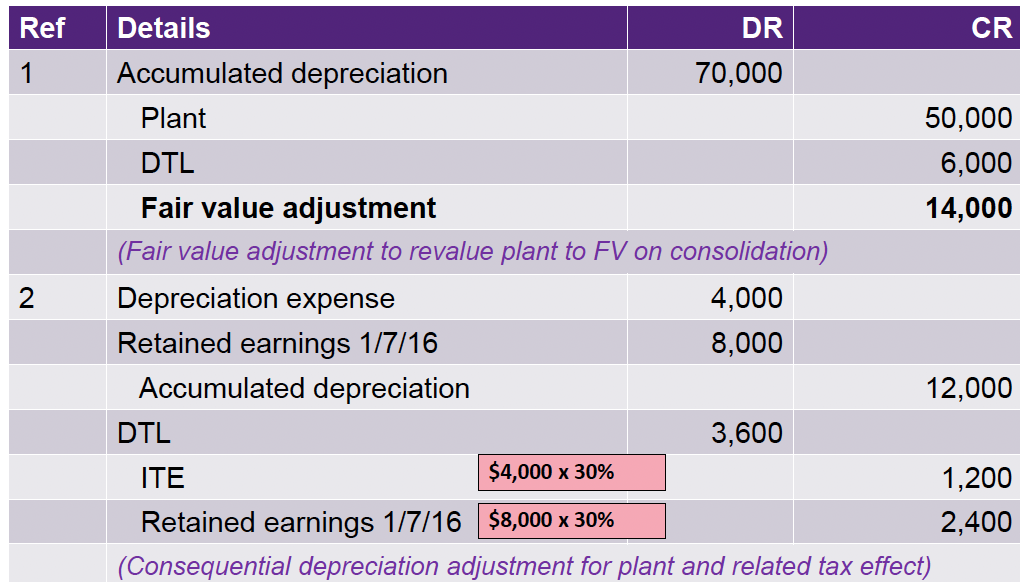

Can you explain to me how we get an accumulated dep of 70,000 and retain earnings for (1/7/2016)-8,000, if possible please explain all the calculations

Can you explain to me how we get an accumulated dep of 70,000 and retain earnings for (1/7/2016)-8,000, if possible please explain all the calculations in Ref 1 and 2 from the below question and answer.

Question:

P Ltd acquired a 60%interest in S Ltd on 1 July 2014 for $60,000

All assets are recorded at their fair values exceptfor an item of plant, which had a fair value of $200,000 and a carrying amount of $180,000 (original cost $250,000). The remaining useful life of the plant at the date of acquisition is 5 years

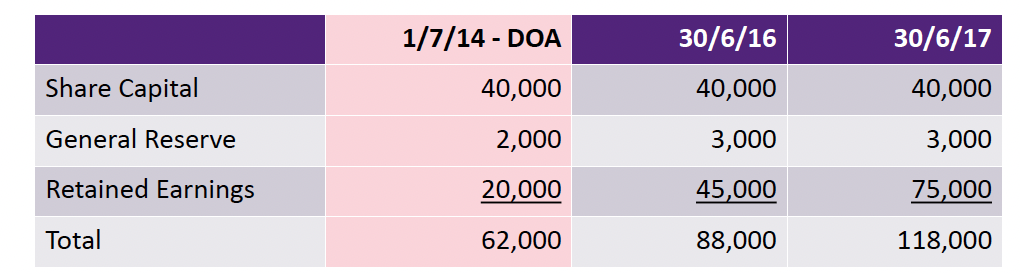

The relevant balance of shareholders equity of S Ltd comprised:

On 1 June 2016, S Ltd sold inventory to P Ltd for $100,000, at a profit before tax of $20,000.

All inventory is unsoldat 30 June 2016.

The inventory is sold to external parties by P Ltd on 15 July 2016. (Perpetual inventory system)

S Ltd paid a dividend of $10,000 on 1 January 2017.

S Ltd recorded a profit of $40,000 for the year ended 30 June 2017.

Required:

Prepare all consolidation journals required at 30 June 2017using the partial goodwill method.

Answer : On 1 June 2016, S Ltd sold inventory to P Ltd for $100,000, at a profit before tax of $20,000.

All inventory is unsoldat 30 June 2016.

The inventory is sold to external parties by P Ltd on 15 July 2016. (Perpetual inventory system)

S Ltd paid a dividend of $10,000 on 1 January 2017.

S Ltd recorded a profit of $40,000 for the year ended 30 June 2017.

Required:

On 1 June 2016, S Ltd sold inventory to P Ltd for $100,000, at a profit before tax of $20,000.

All inventory is unsoldat 30 June 2016.

The inventory is sold to external parties by P Ltd on 15 July 2016. (Perpetual inventory system)

S Ltd paid a dividend of $10,000 on 1 January 2017.

S Ltd recorded a profit of $40,000 for the year ended 30 June 2017.

Required:

Prepare all consolidation journals required at 30 June 2017using the partial goodwill method

Ans:

\begin{tabular}{|l|r|r|r|} \hline & 1/7/14 DOA & 30/6/16 & 30/6/17 \\ \hline Share Capital & 40,000 & 40,000 & 40,000 \\ \hline General Reserve & 2,000 & 3,000 & 3,000 \\ \hline Retained Earnings & 20,000 & 45,000 & 75,000 \\ \hline Total & 62,000 & 88,000 & 118,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started