Answered step by step

Verified Expert Solution

Question

1 Approved Answer

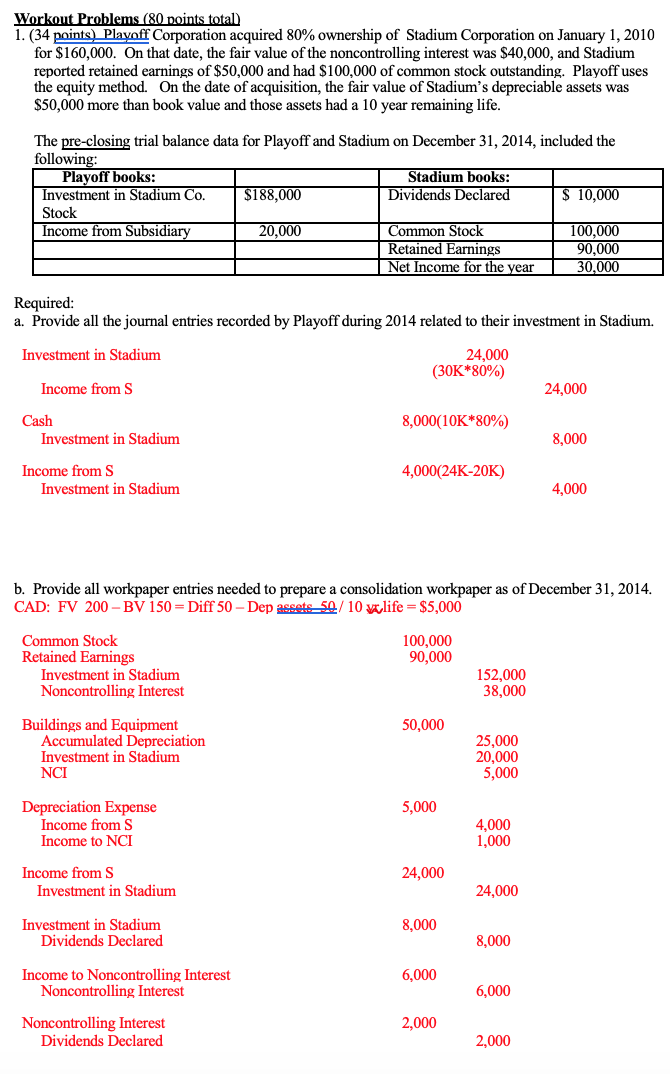

Can you explain to me how you get the numbers in red? Workout Problems (80 points total) 1. (34 points) Playoff Corporation acquired 80% ownership

Can you explain to me how you get the numbers in red?

Workout Problems (80 points total) 1. (34 points) Playoff Corporation acquired 80% ownership of Stadium Corporation on January 1, 2010 for $160,000. On that date, the fair value of the noncontrolling interest was $40,000, and Stadium reported retained earnings of $50,000 and had $100,000 of common stock outstanding. Playoff uses the equity method. On the date of acquisition, the fair value of Stadium's depreciable assets was $50,000 more than book value and those assets had a 10 year remaining life. The pre-closing trial balance data for Playoff and Stadium on December 31, 2014, included the following: Playoff books: Stadium books: Investment in Stadium Co. $188,000 Dividends Declared $ 10,000 Stock Income from Subsidiary 20,000 Common Stock 100,000 Retained Earnings 90,000 Net Income for the year 30,000 Required: a. Provide all the journal entries recorded by Playoff during 2014 related to their investment in Stadium. Investment in Stadium 24,000 (30K*80%) Income from S 24,000 Cash Investment in Stadium 8,000(10K*80%) 8,000 Income from S Investment in Stadium 4,000(24K-20K) 4,000 b. Provide all workpaper entries needed to prepare a consolidation workpaper as of December 31, 2014. CAD: FV 200 - BV 150 = Diff 50 - Dep assets 50/10 y life = $5,000 100,000 90,000 Common Stock Retained Earnings Investment in Stadium Noncontrolling Interest 152,000 38,000 50,000 Buildings and Equipment Accumulated Depreciation Investment in Stadium NCI 25,000 20,000 5,000 5,000 Depreciation Expense Income from S Income to NCI 4,000 1,000 24,000 Income from S Investment in Stadium 24,000 8,000 Investment in Stadium Dividends Declared 8,000 6,000 Income to Noncontrolling Interest Noncontrolling Interest 6,000 Noncontrolling Interest Dividends Declared 2,000 2,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started