Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you explain your reasoning for each letter, please? 12. The following data present key ratios for six well-known U.S. corpora- tions: Apple, Boeing, Citigroup,

Can you explain your reasoning for each letter, please?

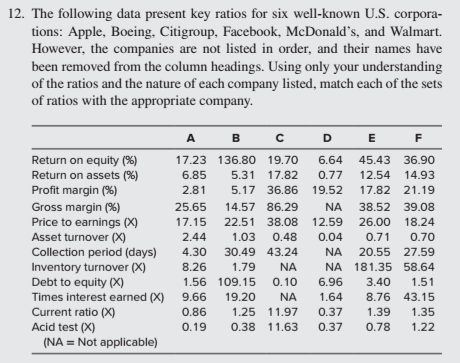

12. The following data present key ratios for six well-known U.S. corpora- tions: Apple, Boeing, Citigroup, Facebook, McDonald's, and Walmart. However, the companies are not listed in order, and their names have been removed from the column headings. Using only your understanding of the ratios and the nature of each company listed, match each of the sets of ratios with the appropriate company. Return on equity (%) Return on assets (%) Profit margin (%) Gross margin (%) Price to earnings (X) Asset turnover (X) Collection period (days) Inventory turnover (X) Debt to equity (X) Times interest earned (X) Current ratio (%) Acid test (X) (NA = Not applicable) A B C D E 17.23 136.80 19.70 6.64 45.43 36.90 6.85 5.31 17.82 0.77 12.54 14.93 2.81 5.17 36.86 19.52 17.82 21.19 25.65 14.57 86.29 NA 38.52 39.08 17.15 22.51 38.08 12.59 26.00 18.24 2.44 1.03 0.48 0.04 0.71 0.70 4.30 30.49 43.24 NA 20.55 27.59 8.26 1.79 NA NA 181.35 58.64 1.56 109.15 0.10 6.96 3.40 1.51 9.66 19.20 NA 1.64 8.76 43.15 0.86 1.25 11.97 0.37 1.39 1.35 0.19 0.38 11.63 0.37 0.78 1.22Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started