Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you fill in the table below of the question I shared? More Info Near the end of the year, Pizza Appeal offered to buy

Can you fill in the table below of the question I shared?

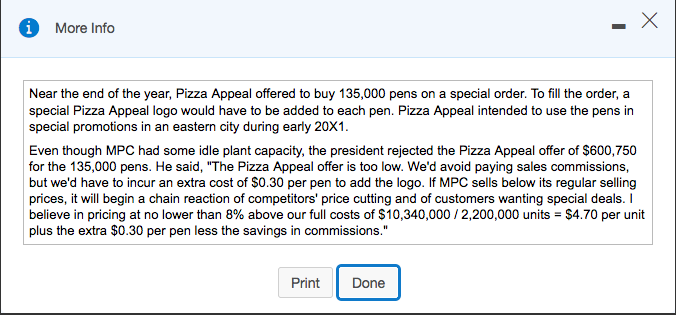

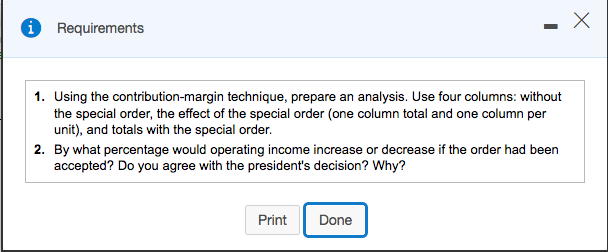

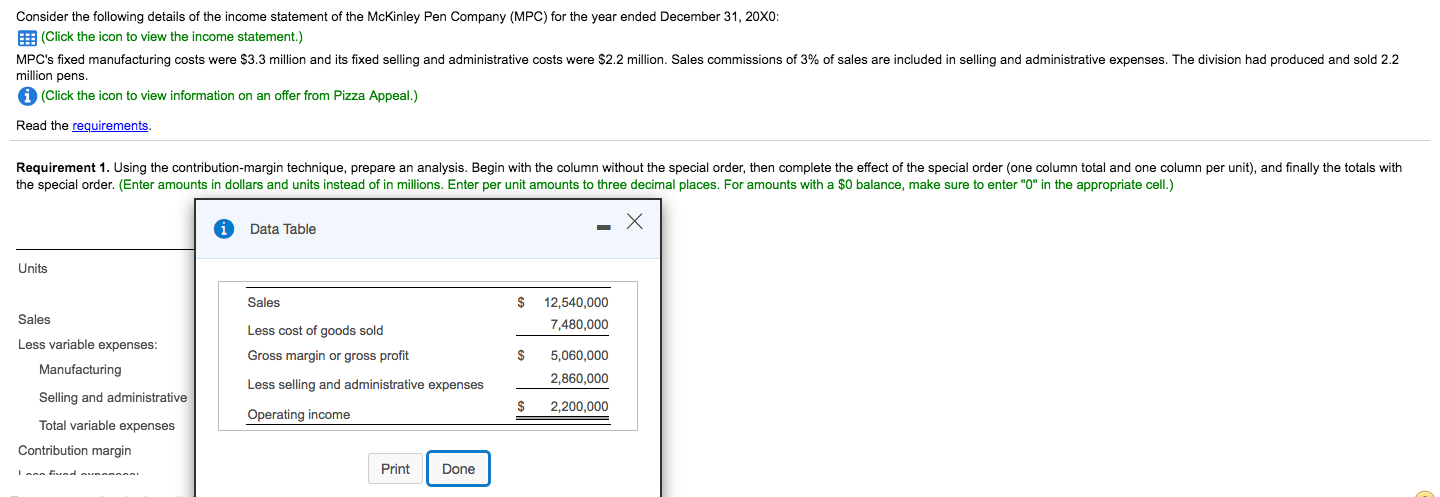

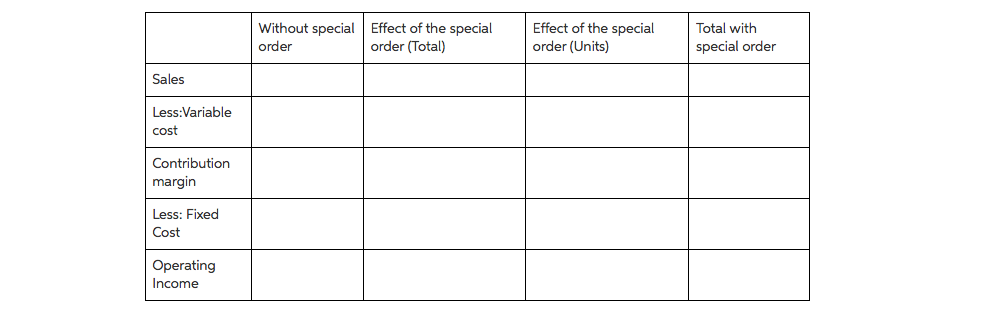

More Info Near the end of the year, Pizza Appeal offered to buy 135,000 pens on a special order. To fill the order, a special Pizza Appeal logo would have to be added to each pen. Pizza Appeal intended to use the pens in special promotions in an eastern city during early 20X1. Even though MPC had some idle plant capacity, the president rejected the Pizza Appeal offer of $600,750 for the 135,000 pens. He said, "The Pizza Appeal offer is too low. We'd avoid paying sales commissions, but we'd have to incur an extra cost of $0.30 per pen to add the logo. If MPC sells below its regular selling prices, it will begin a chain reaction of competitors' price cutting and of customers wanting special deals. I believe in pricing at no lower than 8% above our full costs of $10,340,000 / 2,200,000 units = $4.70 per unit plus the extra $0.30 per pen less the savings in commissions." Print Done i Requirements X 1. Using the contribution-margin technique, prepare an analysis. Use four columns without the special order, the effect of the special order (one column total and one column per unit), and totals with the special order. 2. By what percentage would operating income increase or decrease if the order had been accepted? Do you agree with the president's decision? Why? Print Done Consider the following details of the income statement of the McKinley Pen Company (MPC) for the year ended December 31, 20XO: E (Click the icon to view the income statement.) MPC's fixed manufacturing costs were $3.3 million and its fixed selling and administrative costs were $2.2 million. Sales commissions of 3% of sales are included in selling and administrative expenses. The division had produced and sold 2.2 million pens. (Click the icon to view information on an offer from Pizza Appeal.) Read the requirements Requirement 1. Using the contribution-margin technique, prepare an analysis. Begin with the column without the special order, then complete the effect of the special order (one column total and one column per unit), and finally the totals with the special order. (Enter amounts in dollars and units instead of in millions. Enter per unit amounts to three decimal places. For amounts with a $0 balance, make sure to enter "0" in the appropriate cell.) Data Table Units Sales $ Sales 12,540,000 7,480,000 Less variable expenses: Manufacturing Less cost of goods sold Gross margin or gross profit Less selling and administrative expenses $ 5,060,000 2,860,000 Selling and administrative $ 2,200,000 Operating income Total variable expenses Contribution margin Print Done Without special Effect of the special order order (Total) Effect of the special order (Units) Total with special order Sales Less:Variable cost Contribution margin Less: Fixed Cost Operating IncomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started