Can you fill out the 1040 form based on the information provided?

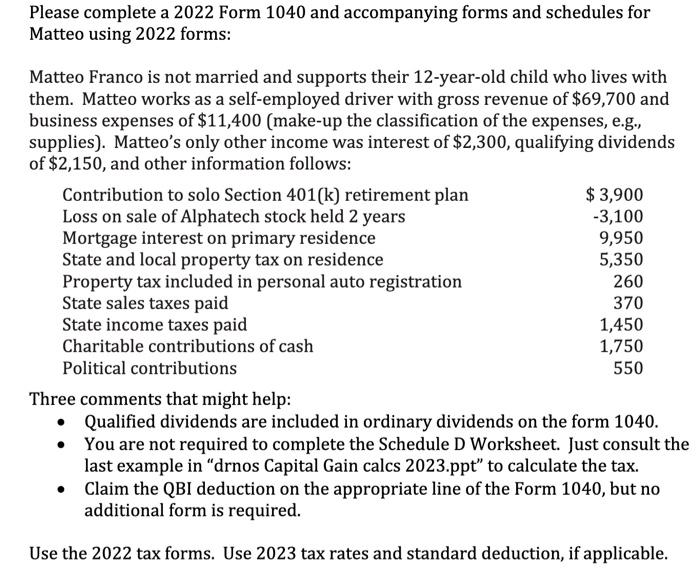

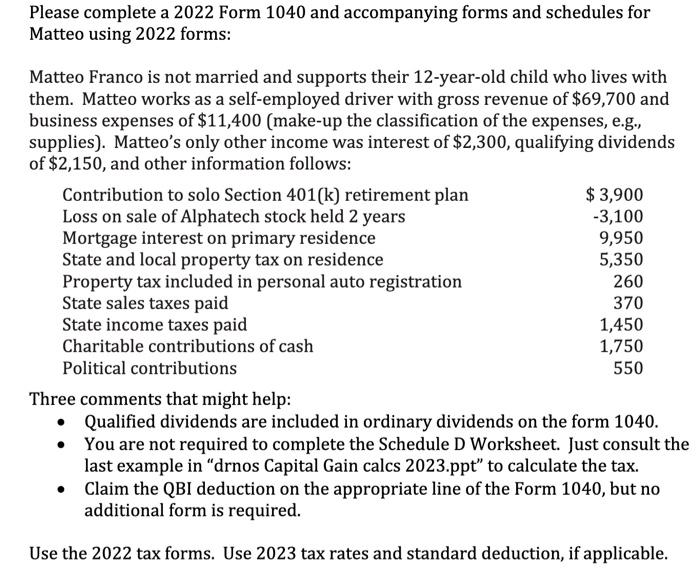

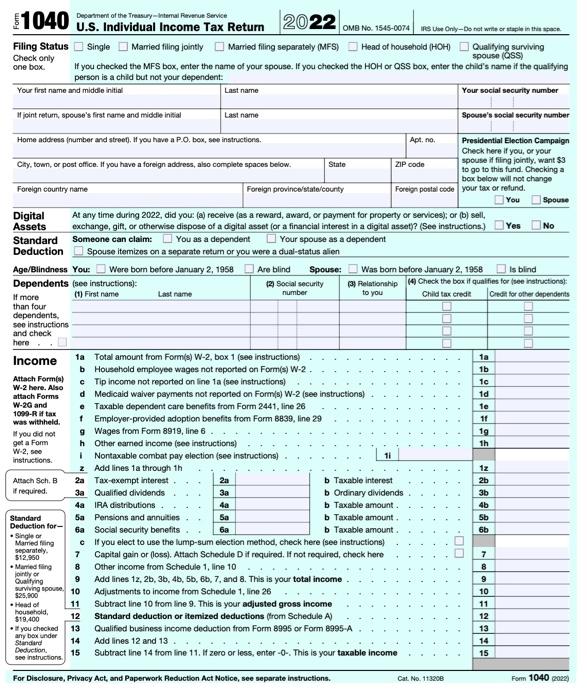

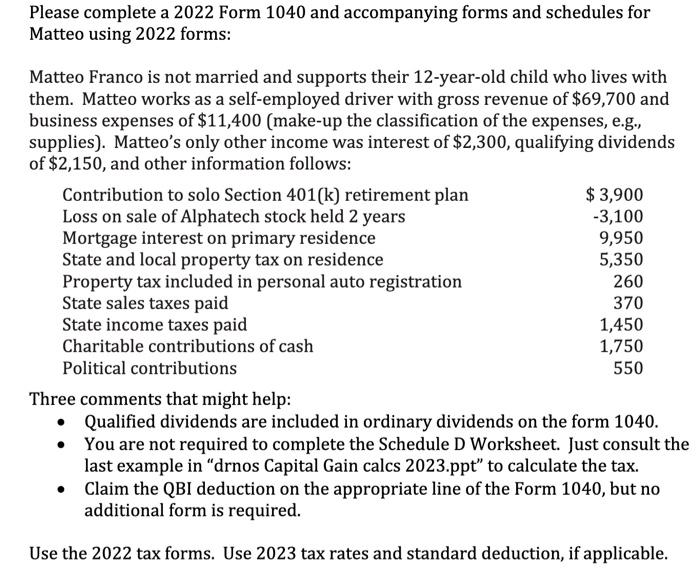

Please complete a 2022 Form 1040 and accompanying forms and schedules for Matteo using 2022 forms: Matteo Franco is not married and supports their 12-year-old child who lives with them. Matteo works as a self-employed driver with gross revenue of $69,700 and business expenses of $11,400 (make-up the classification of the expenses, e.g., supplies). Matteo's only other income was interest of $2,300, qualifying dividends of $ ? 150 and nther information followare. I nree comments tnat mignt nep: - Qualified dividends are included in ordinary dividends on the form 1040. - You are not required to complete the Schedule D Worksheet. Just consult the last example in "drnos Capital Gain calcs 2023.ppt" to calculate the tax. - Claim the QBI deduction on the appropriate line of the Form 1040, but no additional form is required. Use the 2022 tax forms. Use 2023 tax rates and standard deduction, if applicable. 1040 Degannent of the Traasury - Intemal Fervenue Service U.S. Individual Income Tax Return OME No. 1545-0074 ifs Ute Only-De not write or staple in thin taphee. Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying surviving Check only spouse (OSS) one box. If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QSS box, enter the child's name if the qualifying persen is a child but not your dependent: Please complete a 2022 Form 1040 and accompanying forms and schedules for Matteo using 2022 forms: Matteo Franco is not married and supports their 12-year-old child who lives with them. Matteo works as a self-employed driver with gross revenue of $69,700 and business expenses of $11,400 (make-up the classification of the expenses, e.g., supplies). Matteo's only other income was interest of $2,300, qualifying dividends of $ ? 150 and nther information followare. I nree comments tnat mignt nep: - Qualified dividends are included in ordinary dividends on the form 1040. - You are not required to complete the Schedule D Worksheet. Just consult the last example in "drnos Capital Gain calcs 2023.ppt" to calculate the tax. - Claim the QBI deduction on the appropriate line of the Form 1040, but no additional form is required. Use the 2022 tax forms. Use 2023 tax rates and standard deduction, if applicable. 1040 Degannent of the Traasury - Intemal Fervenue Service U.S. Individual Income Tax Return OME No. 1545-0074 ifs Ute Only-De not write or staple in thin taphee. Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying surviving Check only spouse (OSS) one box. If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QSS box, enter the child's name if the qualifying persen is a child but not your dependent