Answered step by step

Verified Expert Solution

Question

1 Approved Answer

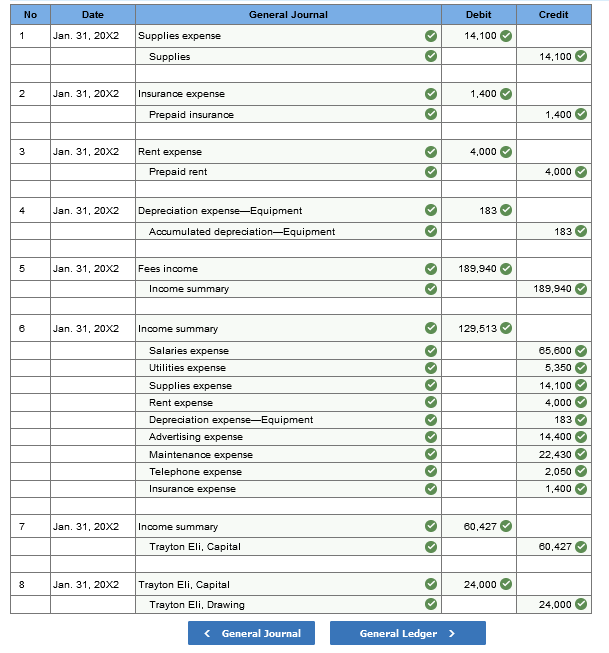

Can you find what I am missing from this? It says the answer is not complete. No Date General Journal Debit Credit 1 Jan. 31,

Can you find what I am missing from this? It says the answer is not complete.

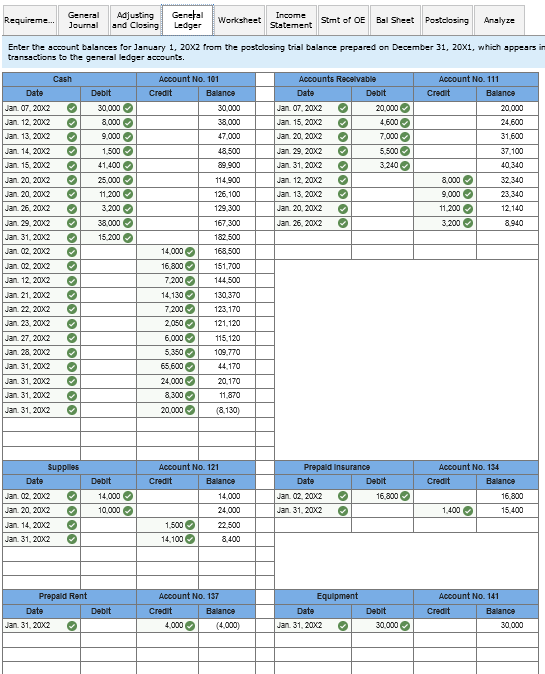

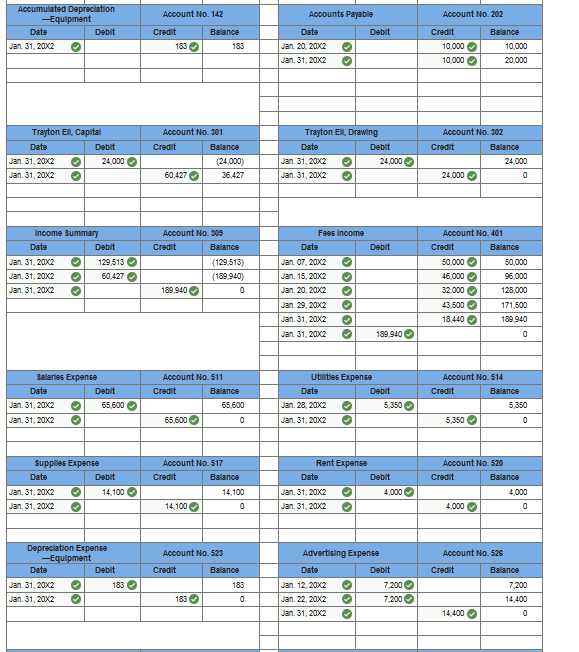

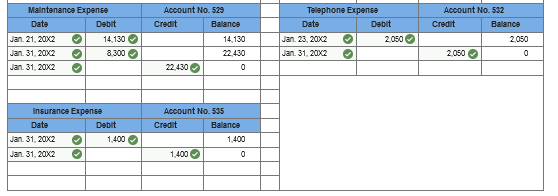

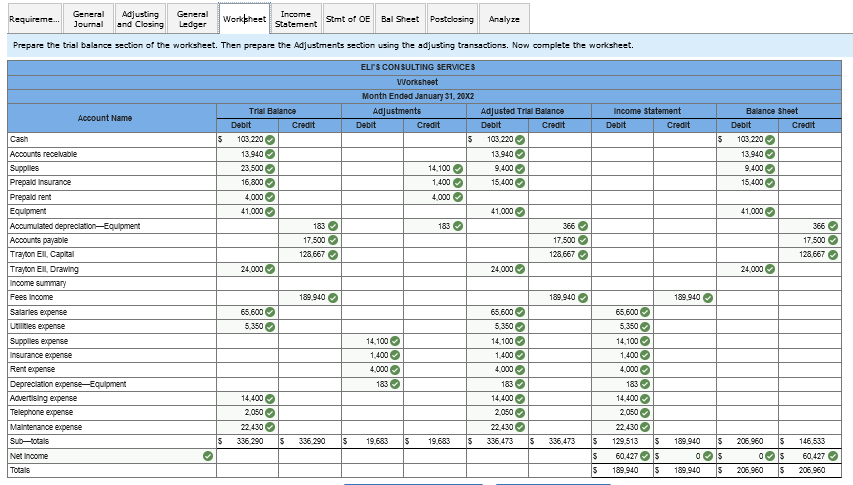

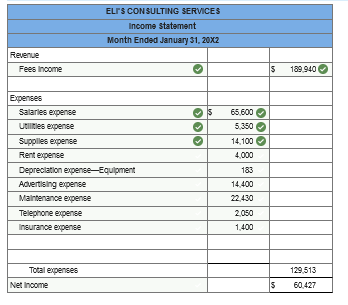

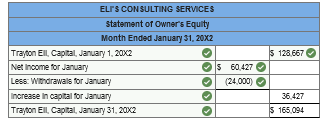

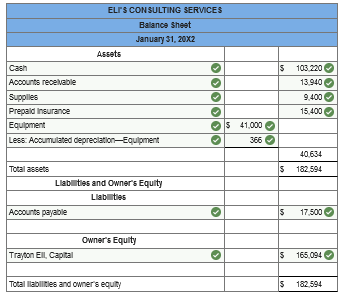

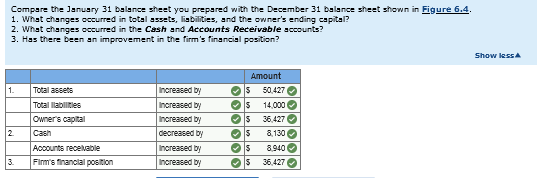

No Date General Journal Debit Credit 1 Jan. 31, 20X2 Supplies expense 14,100 Supplies 14,100 2 Jan. 31, 20X2 Insurance expense 1.400 Prepaid insurance 1,400 3 Jan. 31, 20X2 4,000 Rent expense Prepaid rent >> 4,000 4 > Jan. 31, 20X2 183 Depreciation expense-Equipment Accumulated depreciation-Equipment 18 5 Jan. 31. 20X2 Fees income > 189,940 Income summary 189,940 6 Jan. 31, 20X2 Income summary 129,513 OOO Salaries expense Utilities expense Supplies expense Rent expense Depreciation expense-Equipment Advertising expense Maintenance expense Telephone expense Insurance expense 65,600 5,350 14,100 4.000 183 14,400 22,430 2,050 1,400 7 Jan. 31, 20X2 Income summary 60,427 Trayton Eli, Capital 60,427 8 Jan. 31, 20X2 Trayton Eli, Capital 24,000 Trayton Eli, Drawing 24,000 (General Journal General Ledger > Requireme... General Journal Adjusting and Closing General Ledger Worksheet Income Statement Stmt of OE Bel Sheet Postclosing Analyze Enter the account balances for January 1, 20x2 from the postclosing trial balance prepared on December 31, 20x1, which appears in transactions to the general ledger accounts. Debit 30.000 8.000 9.000 OOOOOO 1.500 Accounts Receivable Date Debit Jan. 07. 20X2 20.000 Jan 15, 20X2 4.600 Jan 20, 20X2 7.000 Jan. 29, 20X2 5.500 Jan 31, 20X2 3240 Jan. 12. 20x2 Jan 13, 20X2 Jan 20, 20X2 Jan. 26. 20X2 Account No. 111 Credit Balance 20.000 24.600 31.600 37.100 40 340 8.000 32 340 9,000 23 340 11 200 12.140 3200 8.940 41.400 OOOOOOOOO Cash Date Jan. 07. 20X2 Jan. 12. 20X2 Jan 13, 20X2 Jan 14, 20x2 Jan 15, 20X2 Jan 20, 20X2 Jan 20, 20X2 Jan 26, 20X2 Jan. 29, 20X2 Jan 31, 20x2 Jan. 02. 20X2 Jan. 02. 20X2 Jan. 12. 20X2 Jan 21, 20X2 Jan 22, 20X2 Jan 23, 20X2 Jan 27, 20X2 Jan 28, 20X2 Jan. 31. 20X2 Jan 31, 20X2 Jan 31, 20X2 Jan 31, 20X2 25.000 11.200 3.200 38.000 15 200 OOOOO Account No. 101 Credit Balance 30.000 38.000 47.000 48.500 89.900 114.900 126.100 129 300 167 300 182.500 14.000 168,500 16.800 151.700 7.200 144.500 14,130 130 370 7200 123, 170 2.050 121,120 6.000 115.120 5,350 109.770 65.600 44,170 24.000 20170 8.300 11.870 20.000 (8.130) 0 Debit Supplies Date Jan 02 20X2 Jan 20, 20X2 Jan 14, 20x2 Jan 31, 20X2 Prepaid Insurance Date Debit Jan. 02. 20x2 16.800 Jan 31, 20X2 Account No. 134 Credit Balance 16.800 1.400 15.400 14.000 10.000 Account No. 121 Credit Balance 14.000 24.000 1,500 22.500 14.100 8.400 OO OO OOOO Prepaid Rent Date Debit Jan 31, 20X2 Account No. 137 Credit Balance 4.000 (4.000) Equipment Date Jan 31, 20X2 Debit 30.000 Account No. 141 Credit Balance 30 000 o Accumulated Depreciation -Equipment Date Debit Jan 31, 20X2 Account No. 142 Credit Balance 183 183 Accounts Payable Date Debit Jan. 20. 20X2 Jan. 31, 20X2 Account No. 202 Credit Balance 10,000 10.000 10,000 20,000 Trayton El Capital Date Debit Jan 31, 20X2 24,000 Jan. 31, 20X2 Account No. 301 Credit Balance (24.000) 60.427 36.427 Trayton Ell, Drawing Date Debit Jan 31, 20X2 24.000 Jan 31, 20X2 Account No. 302 Credit Balance 24.000 24.000 Income Summary Date Debit Jan 31, 20X2 129,513 Jan. 31, 20X2 60.427 Jan. 31, 20X2 lololo Account No. 309 Credit Balance (129,513) (189.940) 189.940 0 16 000 Fees Income Date Debit Jan. 07. 20X2 Jan 15, 20X2 Jan 20, 20X2 Jan. 29, 20X2 Jan. 31, 20X2 Jan 31, 20X2 189.940 OOOOOO Account No. 401 Credit Balance 50,000 50,000 96 000 32,000 128.000 43.500 171.500 18.440 189.940 0 Salaries Expense Date Debit Jan. 31, 20X2 65,600 Jan. 31, 20X2 Account No. 511 Credit Balance 65.600 olo Utilities Expense Date Debit Jan. 28, 20X2 5.350 Jan. 31. 20x2 Account No. 514 Credit Balance 5.350 5,350 0 OO 65,600 0 Credit Supplies Expense Date Debit Jan 31, 20X2 14.100 Jan. 31, 20X2 Account No. 517 Credit Balance 14,100 14,100 0 Rent Expense Date Debit Jan. 31. 20X2 4.000 Jan. 31. 20X2 lolo Account No. 520 Balance 4.000 4.000 0 OO Account No. 523 Account No. 526 Depreciation Expense -Equipment Date Debit Jan. 31, 20X2 183 Jan. 31, 20X2 Credit Balance Credit Balance 183 Advertising Expense Date Debit Jan. 12. 20X2 7 200 Jan. 22. 20X2 7.200 Jan 31, 20x2 7 200 OO 183 0 Solo 14.400 0 14.400 Maintenance Expense Date Debit Jan 21, 20X2 14.130 Jan 31, 20X2 8,300 Jan 31, 20X2 Account No. 529 Credit Balance 14.130 22.430 22.430 0 Telephone Expense Date Debit Jan 23, 20X2 2.050 Jan 31, 20X2 Account No. 532 Credit Balance 2050 OOO ol 2,050 0 Insurance Expense Date Debit Jan 31, 20X2 1.400 Jan 31, 20X2 Account No. 595 Credit Balance 1.400 1.400 0 OO Requireme... General Journal Adjusting and Closing General Ledger Workbheet Income Statement Stmt of OE Bel Sheet Postclosing Analyze Prepare the trial balance section of the worksheet. Then prepare the Adjustments section using the adjusting transactions. Now complete the worksheet. ELIS CONSULTING SERVICES Worksheet Month Ended January 31, 20X2 Adjustments Debit Credit $ Account Name Adjusted Trial Balance Debit Credit 103220 Income Statement Debit Credit Balance Sheet Debit Credit 103 220 Cash s IS 13940 13 940 14,100 1.400 4.000 9.400 15.400 Trial Balance Debit Credit 103 220 13.940 23.500 16.800 4.000 41.000 183 17.500 128.667 24.000 9.400 15.400 41.000 41.000 183 366 17,500 128,667 366 17 500 128.667 24.000 24.000 189 940 > 189940 199 940 Accounts receivable Supplies Prepaid insurance Prepaid rent Equipment Accumulated depreciation Equipment Accounts payable Trayton Ell, Capital Trayton Ell, Drawing Income summary Fees Income Salaries expense Utilities expense Supplles expense Insurance expense Rent expense Depreciation expense-Equipment Advertising expense Telephone expense Maintenance expense Sub-otals Net Income Totals 65.600 5,350 14.100 1,400 4.000 183 65.600 5,350 14,100 1,400 4.000 183 14.400 2.050 22.430 336.473 65.600 5,350 14.100 1,400 4.000 183 14.400 2,050 22.430 129,513 60.427 189.940 14.400 2.050 22.430 336.290 S S 336.290 S 19.683 S 19.683 S S 336.473 $ $ 189 940 IS IS IS S S s IS 206.960 0 206.960 S $ 146.533 60.427 206.960 S 189.940 ELIS CONSULTING SERVICES Income Statement Month Ended January 31, 20X2 Revenue Fees Income $ 189 940 DIC Expenses Salaries expense Utilities expense Supplies expense Rent expense Depreciation expense - Equipment Advertising expense Maintenance expense Telephone expense Insurance expense 65.600 5.350 14.100 4.000 183 14.400 22.430 2.050 1.400 Total expenses Net Income 129513 60.427 A $ 128.667 ELIS CONSULTING SERVICES Statement of Owner's Equity Month Ended January 31, 20X2 Trayton Ell, Capital, January 1, 20X2 Net Income for January $ 60.427 Less: Windrawals for January (24.000) Increase in capital for January Trayton Ell, Capital, January 31, 20X2 36,427 $ 165,094 ELIS CONSULTING SERVICES Balance Sheet January 31, 20X2 Assets Cash Accounts receivable Supplies Prepaid Insurance Equipment $ 41.000 Less: Accumulated depreciation Equipment 366 $ 103 220 13.940 9.400 15.400 40.634 $ 182 594 Total assets Llabies and Owner's Equity Llabilities Accounts payable $ 17,500 Owner's Equity Trayton Ell, Capital $ 165,094 Total alles and owner's equity $ 182.594 Credit ELIS CONSULTING SERVICES Postclosing Trial Balance December 31, 20X2 Account Name Debit Cash $ 103 220 Accounts receivable 13.940 Supplies 9.400 Prepaid Insurance 15.400 Equipment 41.000 Accumulated depreciation Equipment Accounts payable Trayton Ell, Capital 366 17,500 165,094 Totals S 182.960 S 182.960 Compare the January 31 balance sheet you prepared with the December 31 balance sheet shown in Figure 6.4. 1. What changes occurred in total assets, liabilities, and the owner's ending capital? 2. What changes occurred in the Cash and Accounts Receivable accounts? 3. Has there been an improvement in the firm's financial position? Show less 1. Total assets Increased by Increased by Increased by decreased by Increased by Increased by Total abilities Owner's capital Cash Accounts receivable Firm's financial position Amount S 50.427 S 14.000 S 36.427 S 8.130 S 8940 S 36.427 2 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started