Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you give an explain to why, i would like to understand the material better. Please 6. For every dollar of operating income paid out

can you give an explain to why, i would like to understand the material better. Please

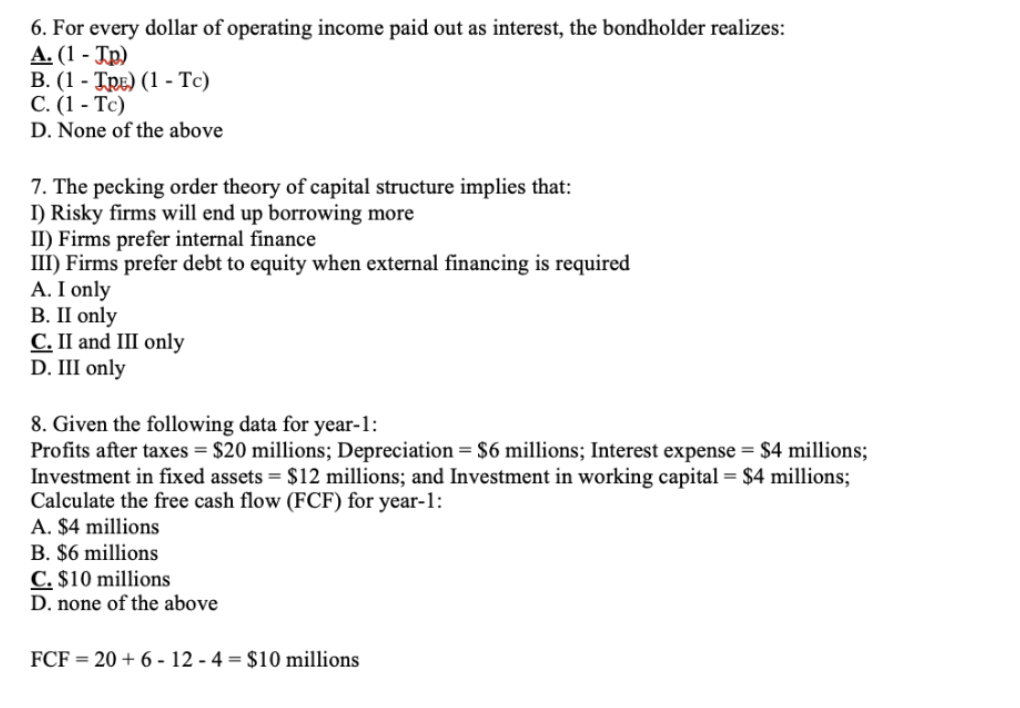

6. For every dollar of operating income paid out as interest, the bondholder realizes: A. (1Tp) B. (1Tp)(1Tc) C. (1Tc) D. None of the above 7. The pecking order theory of capital structure implies that: I) Risky firms will end up borrowing more II) Firms prefer internal finance III) Firms prefer debt to equity when external financing is required A. I only B. II only C. II and III only D. III only 8. Given the following data for year-1: Profits after taxes =$20 millions; Depreciation =$6 millions; Interest expense =$4 millions; Investment in fixed assets =$12 millions; and Investment in working capital =$4 millions; Calculate the free cash flow (FCF) for year-1: A. $4 millions B. $6 millions C. $10 millions D. none of the above FCF=20+6124=$10 millionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started