Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you give the answers with basic formulas and steps to follow? Thanks! 1. Par=$10,000 a. For what price could you purchase the T-bill? b.

Can you give the answers with basic formulas and steps to follow? Thanks!

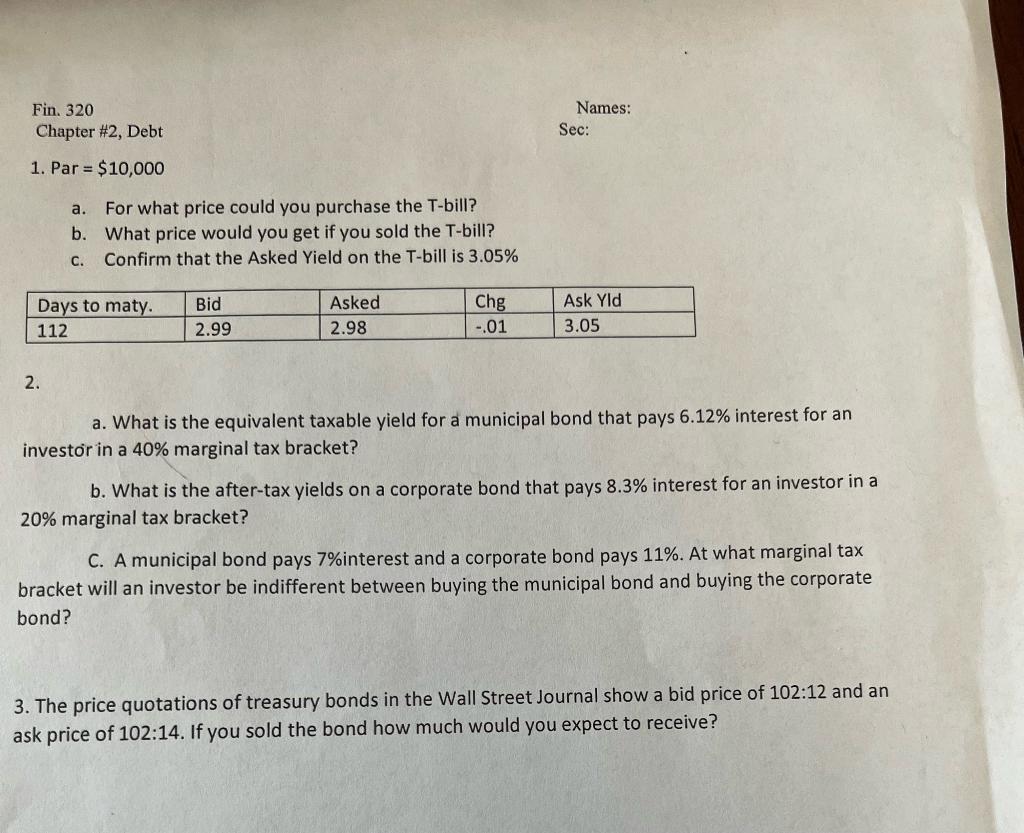

1. Par=$10,000 a. For what price could you purchase the T-bill? b. What price would you get if you sold the T-bill? c. Confirm that the Asked Yield on the T-bill is 3.05% 2. a. What is the equivalent taxable yield for a municipal bond that pays 6.12% interest for an investr in a 40% marginal tax bracket? b. What is the after-tax yields on a corporate bond that pays 8.3% interest for an investor in a 20% marginal tax bracket? C. A municipal bond pays 7% interest and a corporate bond pays 11%. At what marginal tax bracket will an investor be indifferent between buying the municipal bond and buying the corporate bond? 3. The price quotations of treasury bonds in the Wall Street Journal show a bid price of 102:12 and an ask price of 102:14. If you sold the bond how much would you expect to receiveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started