Answered step by step

Verified Expert Solution

Question

1 Approved Answer

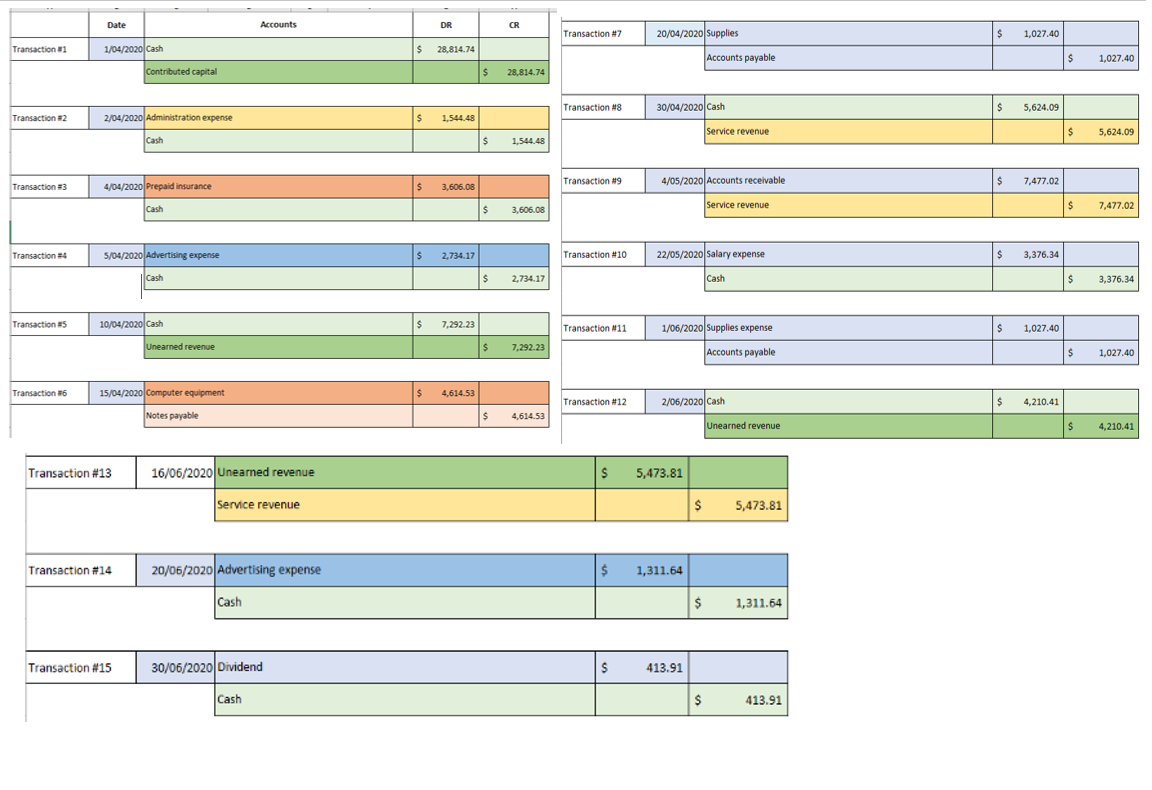

can you guys check through if I have the correct answer? Somehow when I did the post ledger the debit and credit did not match,

can you guys check through if I have the correct answer? Somehow when I did the post ledger the debit and credit did not match, I'm so confused and don't know what did I do wrong please help. this is a journal entry. thank you a lot

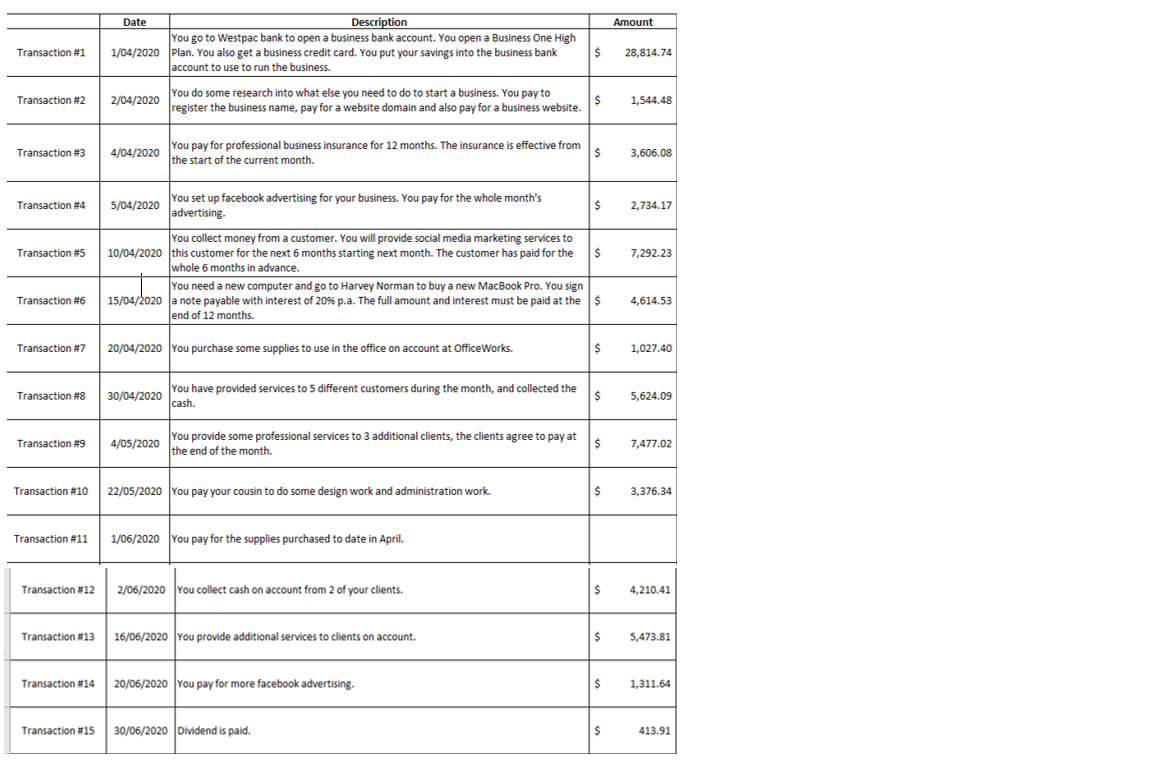

Amount Date Description You go to Westpac bank to open a business bank account. You open a Business One High 1/04/2020 Plan. You also get a business credit card. You put your savings into the business bank account to use to run the business. Transaction #1 $ 28,814.74 Transaction #2 2/04/2020 You do some research into what else you need to do to start a business. You pay to register the business name, pay for a website domain and also pay for a business website. $ 1,544.48 Transaction #3 4/04/2020 You pay for professional business insurance for 12 months. The insurance is effective from the start of the current month. $ 3,606.08 Transaction #4 5/04/2020 You set up facebook advertising for your business. You pay for the whole month's $ 2,734.17 advertising. Transaction #5 $ 7,292.23 You collect money from a customer. You will provide social media marketing services to 10/04/2020 this customer for the next 6 months starting next month. The customer has paid for the whole 6 months in advance. You need a new computer and go to Harvey Norman to buy a new MacBook Pro. You sign 15/04/2020 a note payable with interest of 20% p.a. The full amount and interest must be paid at the end of 12 months. Transaction #6 4,614.53 Transaction #7 20/04/2020 You purchase some supplies to use in the office on account at Office Works. $ 1,027.40 Transaction #8 30/04/2020 You have provided services to 5 different customers during the month, and collected the cash. $ 5,624.09 Transaction #9 4/05/2020 You provide some professional services to 3 additional clients, the clients agree to pay at the end of the month. $ 7,477.02 Transaction #10 22/05/2020 You pay your cousin to do some design work and administration work. $ 3,376.34 Transaction #11 1/06/2020 You pay for the supplies purchased to date in April Transaction #12 2/06/2020 You collect cash on account from 2 of your clients. $ 4,210.41 Transaction #13 16/06/2020 you provide additional services to clients on account. $ 5,473.81 Transaction #14 20/06/2020 You pay for more facebook advertising. $ 1,311.64 Transaction #15 30/06/2020 Dividend is paid. $ 413.91 Date Accounts DR CR Transaction #7 $ 1,027.40 Transaction 1 1/04/2020 Cash s 28,814.74 20/04/2020 Supplies Accounts payable $ 1,027.40 Contributed capital $ 28,814.74 Transaction M8 30/04/2020 Cash $ 5,624.09 Transaction #2 2/04/2020 Administration expense $ 1,544.48 Service revenue $ 5,624.09 Cash $ 1,544.48 4/04/2020 Prepaid insurance Transaction #9 4/05/2020 Accounts receivable 7,477.02 $ Transaction 3 $ 3,606.08 Cash $ 3,606.08 7,477.02 Service revenue $ Transaction 4 5/04/2020 Advertising expense $ 2.734.17 Transaction #10 22/05/2020 Salary expense $ 3,376.34 Cash $ 2,734.17 Cash $ 3,376.34 Transactions 10/04/2020 Cash $ 7.292.23 Transaction #11 1/06/2020 Supplies expense $ 1,027.40 Unearned revenue $ 7,292.23 Accounts payable $ 1,027.40 Transaction #6 15/04/2020 Computer equipment $ 4,614.53 Transaction #12 2/06/2020 Cash $ 4,210.41 Notes payable $ 4,614.53 Unearned revenue $ 4,210.41 Transaction #13 16/06/2020 Unearned revenue $ 5,473.81 Service revenue $ 5,473.81 Transaction #14 20/06/2020 Advertising expense $ 1,311.64 Cash $ 1,311.64 Transaction #15 30/06/2020 Dividend $ 413.91 Cash S 413.91Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started