Answered step by step

Verified Expert Solution

Question

1 Approved Answer

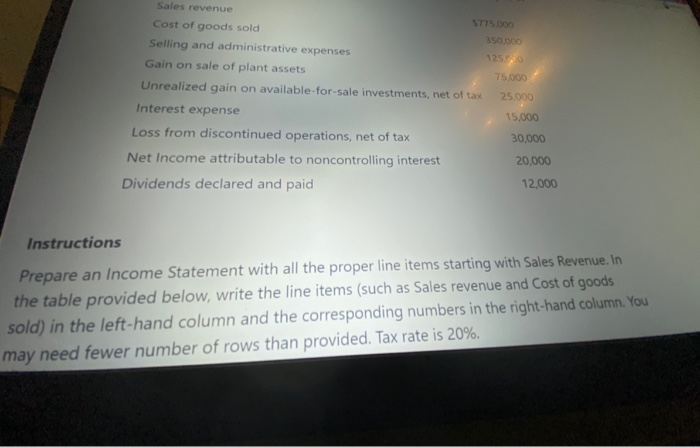

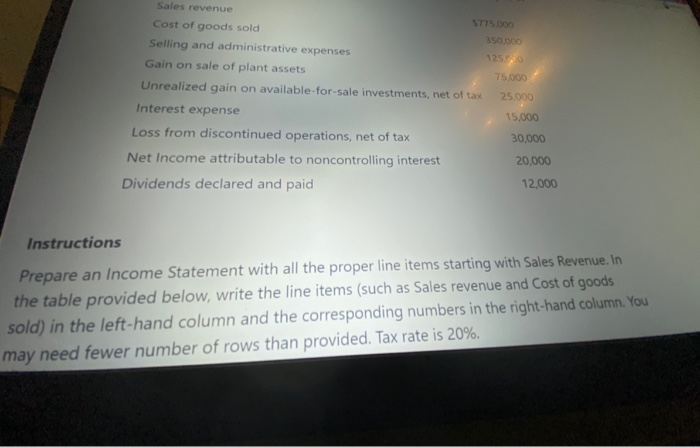

can you guys please help me with these Sales revenue S775.000 Cost of goods sold 350.000 Selling and administrative expenses 125 Gain on sale of

can you guys please help me with these

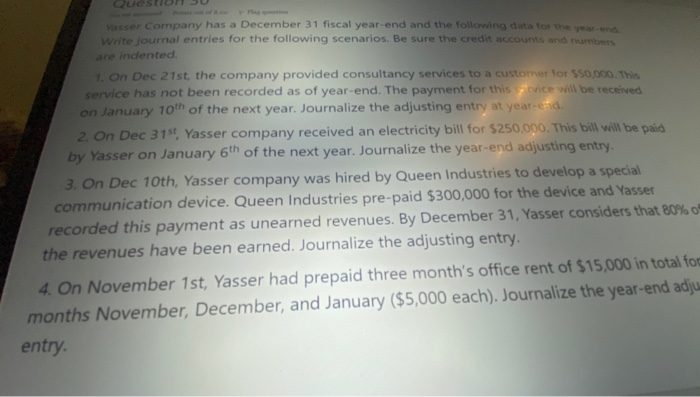

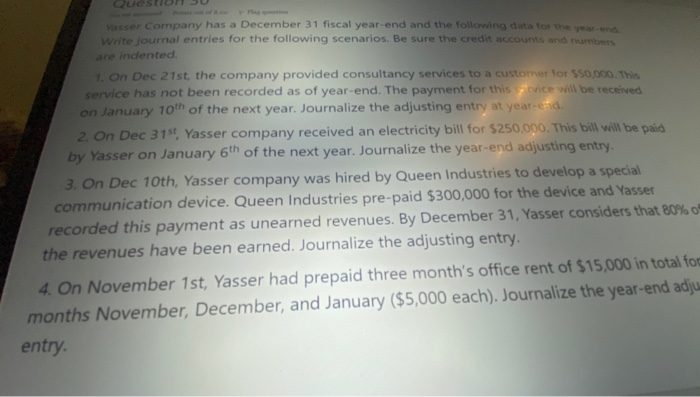

Sales revenue S775.000 Cost of goods sold 350.000 Selling and administrative expenses 125 Gain on sale of plant assets 75.000 Unrealized gain on available-for-sale investments, net of tax 25,000 Interest expense 15,000 Loss from discontinued operations, net of tax 30,000 20,000 Net Income attributable to noncontrolling interest 12,000 Dividends declared and paid Instructions Prepare an Income Statement with all the proper line items starting with Sales Revenue. In the table provided below, write the line items (such as Sales revenue and Cost of goods sold) in the left-hand column and the corresponding numbers in the right-hand column. You may need fewer number of rows than provided. Tax rate is 20%. Yasser Company has a December 31 fiscal year-end and the following data for the year Write journal entries for the following scenarios. Be sure the credit accounts and numbers are indented 1. On Dec 21st, the company provided consultancy services to a customer for $50,000. This service has not been recorded as of year-end. The payment for this vice will be received on January 10th of the next year. Journalize the adjusting entry at year-end 2. On Dec 315! Yasser company received an electricity bill for $250,000. This bill will be paid by Yasser on January 6th of the next year. Journalize the year-end adjusting entry. 3. On Dec 10th, Yasser company was hired by Queen Industries to develop a special communication device. Queen Industries pre-paid $300,000 for the device and Yasser recorded this payment as unearned revenues. By December 31, Yasser considers that 80% 0% the revenues have been earned. Journalize the adjusting entry. 4. On November 1st, Yasser had prepaid three month's office rent of $15,000 in total for months November, December, and January ($5,000 each). Journalize the year-end adju entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started