Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you guys show me how to do this question step-by-step? Thank you! B2. You've been provided with the following data, covering one year, concerning

Can you guys show me how to do this question step-by-step? Thank you!

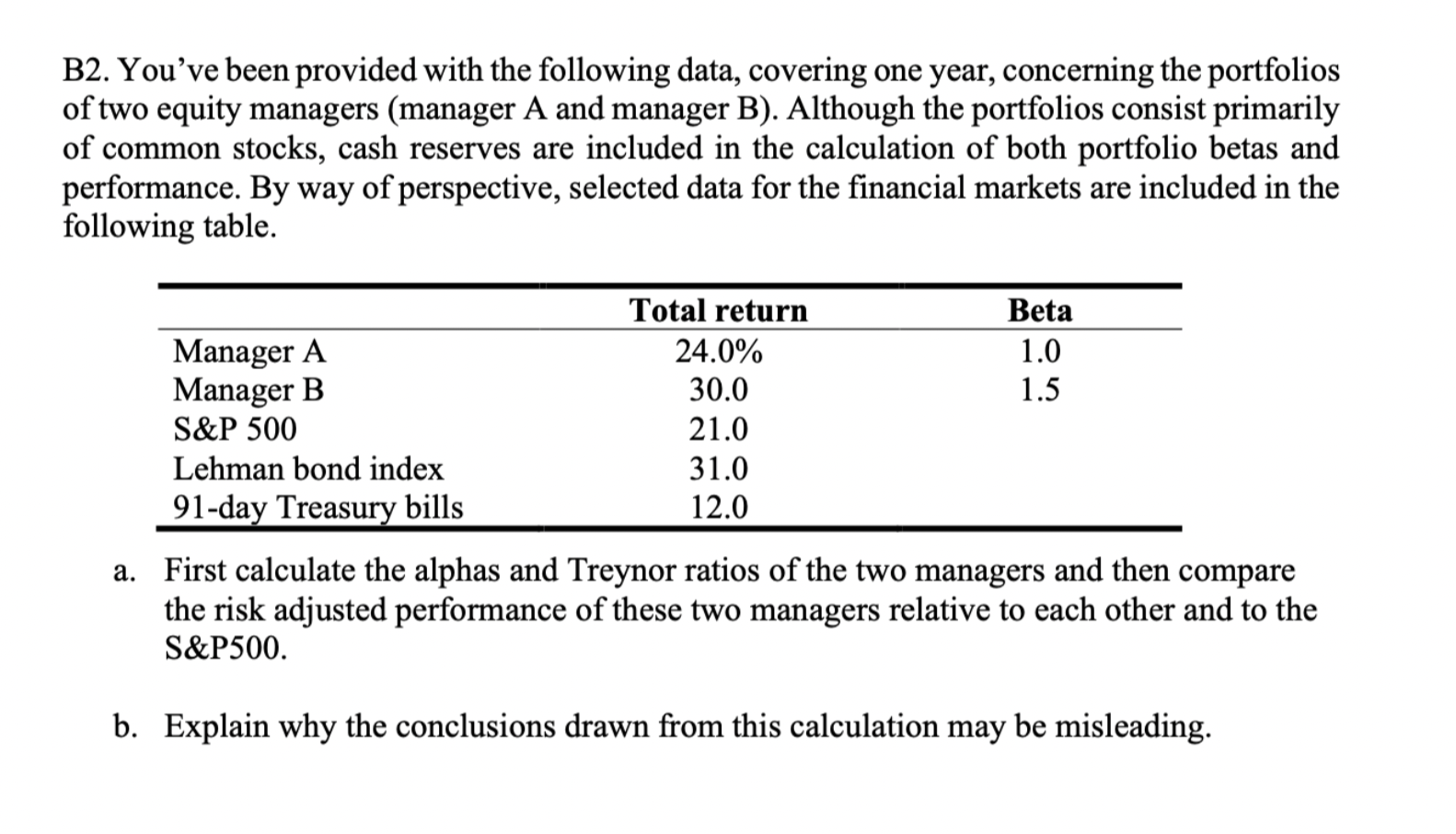

B2. You've been provided with the following data, covering one year, concerning the portfolios of two equity managers (manager A and manager B). Although the portfolios consist primarily of common stocks, cash reserves are included in the calculation of both portfolio betas and performance. By way of perspective, selected data for the financial markets are included in the following table. Total return Beta Manager A 24.0% 1.0 Manager B 30.0 1.5 S&P 500 21.0 Lehman bond index 31.0 91-day Treasury bills 12.0 a. First calculate the alphas and Treynor ratios of the two managers and then compare the risk adjusted performance of these two managers relative to each other and to the S&P500. b. Explain why the conclusions drawn from this calculation may be misleadingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started